IG Spread Betting Expert Review: The Original & Still One Of The Best

Account: IG Spread Betting

Description: IG won “best spread betting broker” in our 2023 and 2022 awards as it continues to be the best spread betting platform. As well as inventing the concept of financial spread betting in 1974, IG also offers access to the most markets, with the most liquidity and are the biggest spread betting broker valued at over £3.7bn.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

Is IG a good spread betting platform?

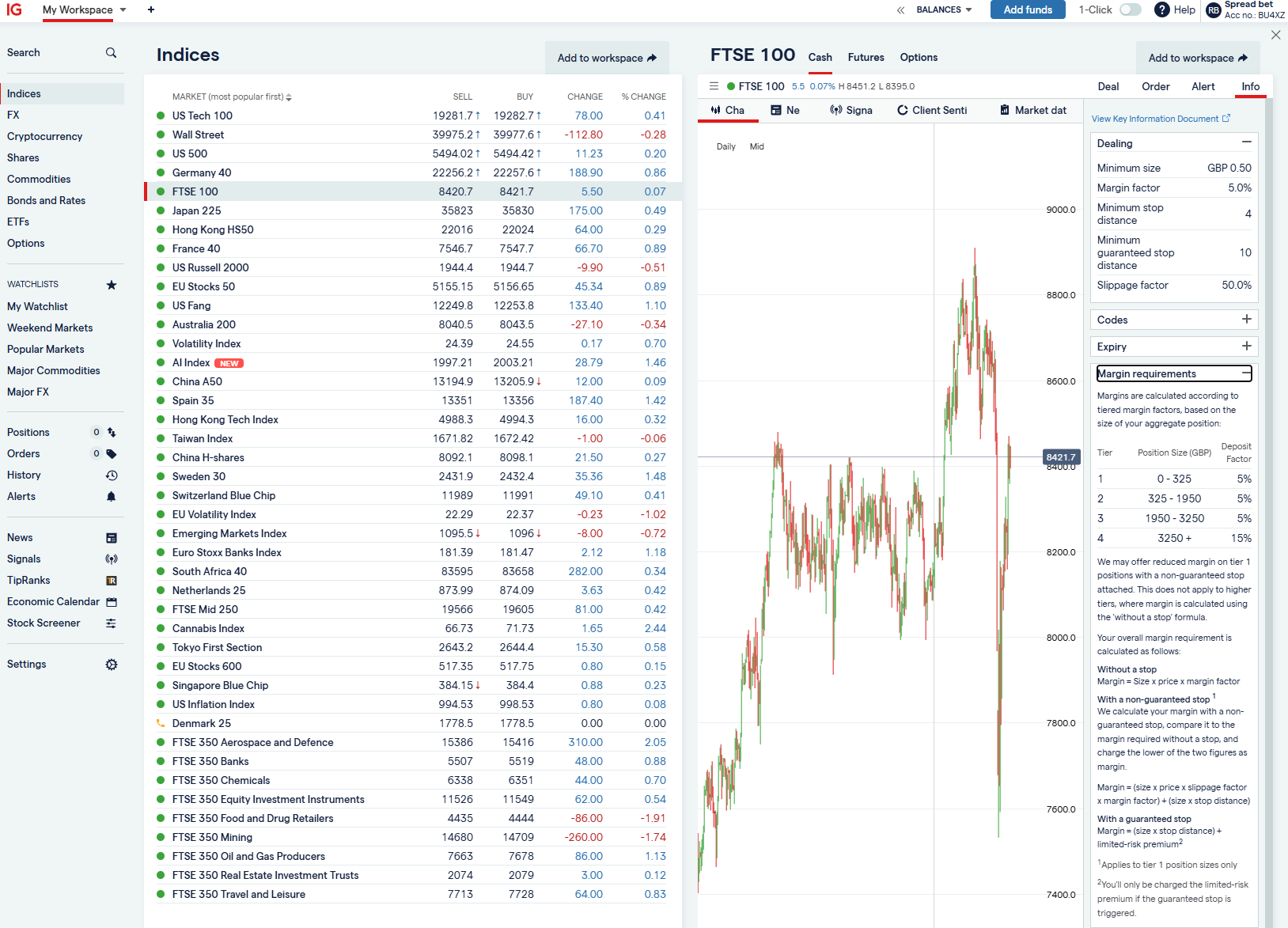

Yes, IG by far has the most comprehensive market access for any spread betting broker. You can trade around 17,000 markets, which is significantly more than the 12,000 or so offered by City Index and CMC Markets. The majority of the extra markets are made up fo smaller cap shares and exotic fx pairs, commodities and indices meaning that there are more opportunities vailable.

However, one downside is that even through IG charges competitive commission (included in the spread) for for spread betting, in some markets brokers like Pepperstone or Spreadex can be cheaper.

IG won “best spread betting broker” in our 2023 and 2022 awards as it continues to be the best spread betting platform. As well as inventing the concept of financial spread betting in 1974, IG also offers access to the most markets, with the most liquidity and are, (by market cap as of April ’22) the biggest spread betting broker valued at over £3.5bn.

Overall, IG is the best spread betting broker is suitable for beginners through to professional high volume and high-frequency traders.

With IG you can spread bet on over 17,000 markets (an industry-leading amount), including 51 forex pairs, 38 commodities, 34 indices and over 10,000 UK and international stocks.

A few key features that make IG’s spread betting platform stand out are the ability to bet on smaller-cap shares, trade IPOs pre-market via their “grey market” and their liquidity. IG’s liquidity can actually be better than the underlying exchange, so you can place and get filled in large orders using IG’s internal liquidity when there might not be the volume on the exchange order book.

Even though IG internalises order flow they do not profit from client losses, instead hedging or matching order flow and operating symmetrical tolerance levels. This means that you also benefit from positive slippage, so if you place a spread bet limit order and the market moves in your favour before it is executed you get a better fill.

When I compared pricing against other spread betting brokers IG spreads are always competitive and often market-leading, especially in the major instruments, but where IG wins business is its ability to continually innovate and add value to its spread betting platform. There are trading signals from Autochartist and PIAfirst, but IG takes it a step further by making executing these signals easier and integrating dealing tickets. IG has a good post-trade analytics feature that can show you where you are profitable or not and they create a huge amount of analysis and research around what their clients are trading based on platform analytics.

Pros

- Huge range of markets to spread bet on

- Good liquidity for large spread bet positions

- Spread betting on smaller-cap stocks

Cons

- £250 minimum deposit

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

4.3

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.