CMC Invest General Investment Account Expert Review

Provider: CMC Invest General Investment Account

Verdict: The GIA from CMC Invest lets you invest in major UK shares, US stocks and ETFs without having to pay commission when you deal. The app is free to use when investing in a general investment account, however, you can upgrade to a Plus account which includes a flexible stocks and shares ISA, access to UK mid-cap shares and a USD wallet.

Capital at risk

Is the CMC Invest general investment account any good?

If you are just starting out investing, then CMC Invest is a good GIA for some longer-term investments. But, if you are an established and experienced CMC Markets customer you may find the CMC Invest offering too basic. Better options for sophisticated investors would be Saxo, or Interactive Brokers.

Special Offer: If you upgrade to the CMC Invest premium plan, it will be free for 12 months, and then £25 a month, which includes an ISA, SIPP and access to more markets like small cap stocks.

Investments: Shares & ETFs

Minimum deposit: £0

Account types: GIA, ISA

Account charge: £0 – £25 per month

Dealing fee: £0

Fees: General investment accounts are commission and fee free. ISA accounts cost £10 a month and are included in the Plus plan. For US shares there is a 0.5% conversion fee.

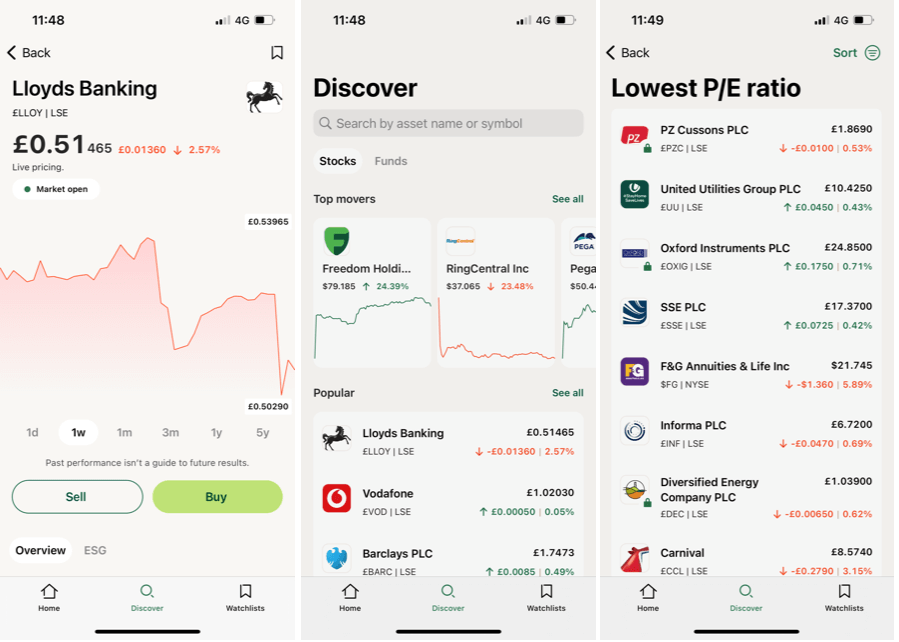

Investing Platform: CMC Invest’s app gives you access to major stocks, and has a screener to help search for potential investments.

Pros

- Zero commission

- No custody fee for GIAs

- Low FX conversion fee of 0.5%

Cons

- No fractional shares

- No limit or stop orders

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.4- Expert opinion: CMC Invest reviewed & rated