-

Richard Berry

Richard Berry

- Updated

In this guide, we will explain the best ways to send money to Canada using currency brokers for large amounts and money transfer apps for smaller amounts. Use our comparison of what we think are the best accounts for sending money to Canada to compare how many currencies they offer, what the minimum and maximum transfer sizes are, or if they offer currency forwards and currency options. You can also see how established a company is by comparing when they were founded, how many customers they have and how much money they transfer abroad.

Best ways to send money to Canada from the UK

- Use a currency broker like OFX for large CAD money transfers

- Use a money transfer app like Wise for smaller CAD money transfers

- Never use your bank for CAD money transfers as it is very expensive unless you are with a new fintech bank like Revolut that has discounted exchange rates

| Currency Broker | Number of Currencies | Min Transfer | Forward Contracts | Same Day | Customer Reviews | Get Quote |

|---|---|---|---|---|---|---|

| 40 | £100 | 24 months | ✔️ | 4.9

(Based on 2,604 reviews)

| Request Quote |

| 40 | £100 | 12 months | ✔️ | 4.8

(Based on 912 reviews)

| Request Quote |

| 55+ | £250 | 12 months | ✔️ | 4.4

(Based on 49 reviews)

| Request Quote |

| 30+ | £3,000 | 24 months | ✔️ | 4.7

(Based on 91 reviews)

| Request Quote |

Compare exchange rates for sending money to Canada

Use our Canadian Dollar exchange rate comparison tool to request quotes from multiple providers and see how you could save up to 4% on large CAD currency transfers versus using your bank when you send money to Canada.

Please note: The rates displayed in this currency conversion quote tool are supplied to us directly from the currency brokers as a percentage mark-up. Please ensure you read our guide to getting the best exchange rates guide.

Is Now The Best Time To Buy Canadian Dollars From Pounds?

The pound-to-Canadian dollar forecast is an indication of where technical and fundamental analysts think the GBPCAD price may be in the future. You can use these exchange rate forecasts to help you decide if now is the right time to buy Canadian Dollars, or if you should wait until the price improves.

- Bank of Canada one of the first central banks to cut rates this cycle

- GBPCAD weakens into 1.750

- Current trend favours a further zig-zag rally into 1.780-1.780

How has the Pound performed against the Canadian Dollar recently?

GBP has had a decent run against the Canadian Dollar of late.

From the 1.700 support (C$1.7 to change one Pound Sterling), the FX rate rallied to multi-year highs at 1.752 this week. This leg up extends GBP’s recovery advance from the low 1.400s by 3,000bps (see below). In other words, the weakness embedded in GBPCAD since 2022 is erased.

One factor causing traders to stick to long GBP bets is the differential monetary policies between the two countries. Remember, FX is all about relative trends. On June 5, the Bank of Canada lowered the policy rate by 25 bps to 4.75 percent. This adjustment was somewhat unexpected and traders immediately sold more Canadian Dollars.

In particular, the market took heart from this outlook from the Bank of Canada: “With continued evidence that underlying inflation is easing, Governing Council agreed that monetary policy no longer needs to be as restrictive.” In other words, investors are anticipating further rate cuts ahead, perhaps ahead of the UK and in larger magnitude, too.

Technically, having cleared the overhead range resistance at 1.730 the rate now looks to 1.780 as the next major target. The pattern of rising lows further support this modestly bullish stance.

Is it a good time to buy US Dollars with pounds?

The past few weeks saw Sterling strengthen against the Canadian Dollar.

The question now is whether GBP can continue its current good form. On the chart, resistance only emerges at the high side of the 1.750-1.800 band.

If you do need Canadian dollars now, you may wish to take advance of GBP’s current strength to buy some. I would, however, eye to complete most CAD purchases near 1.780. That area is a major resistance and at this point few are expecting the multi-year ceiling to give way. Take advantage of GBP rallies to buy more Canadian Dollars.

Will the pound get stronger against the CAD in the second half of 2024?

Despite the low ratings of the current UK government, the market remains bullish of GBP against that of CAD.

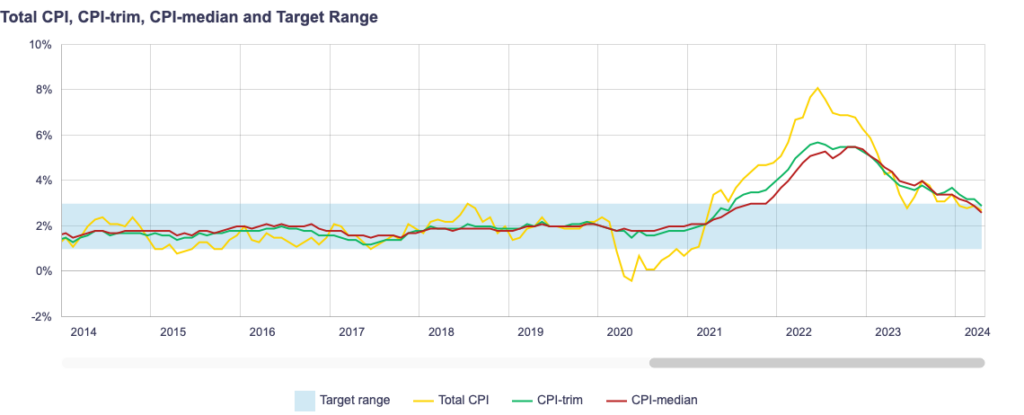

Inflation, which is falling sharply in Canada, could be one reason why this trend is in favour of GBP. Most price measures are now heading into a range acceptable to the Canadian central bank (see below). As price inflation cools, the bank may want to target growth. “At 1.7%,”observed the BoC governor Tiff Macklem, “growth was lower than projected in the April report,” A dovish monetary policy is now firmly on the table.

This means the CAD may continue to weaken in the coming weeks.

But is this a strong view? Well, perhaps only up to a certain point. Central banks herd too, especially amongst the advance nations. Economic synchronicity is the base impact that hit all G7 countries. It is hard for one advance country to be in a recession while another is booming. You can witness this herding effect right now. Just this week, the European Central Bank followed the lead of BoC and dropped 25 bps in the main policy rate. Not a coincident.

The Bank of England is thus expected to do so very soon. Hence, it is unlikely that GBP will get too much stronger against the CAD in 2024 as their monetary policies dictate that they cut rates at the same time.

One contrary factor against this opinion is a major crash in commodity prices. The Canadian Dollar is often viewed as a proxy for the commodity market since the country exports a vast quantities of the raw material. Should commodities like oil go into a tailspin, this may result in a further selling of the C$.

Source: Bank of Canada (April 24)

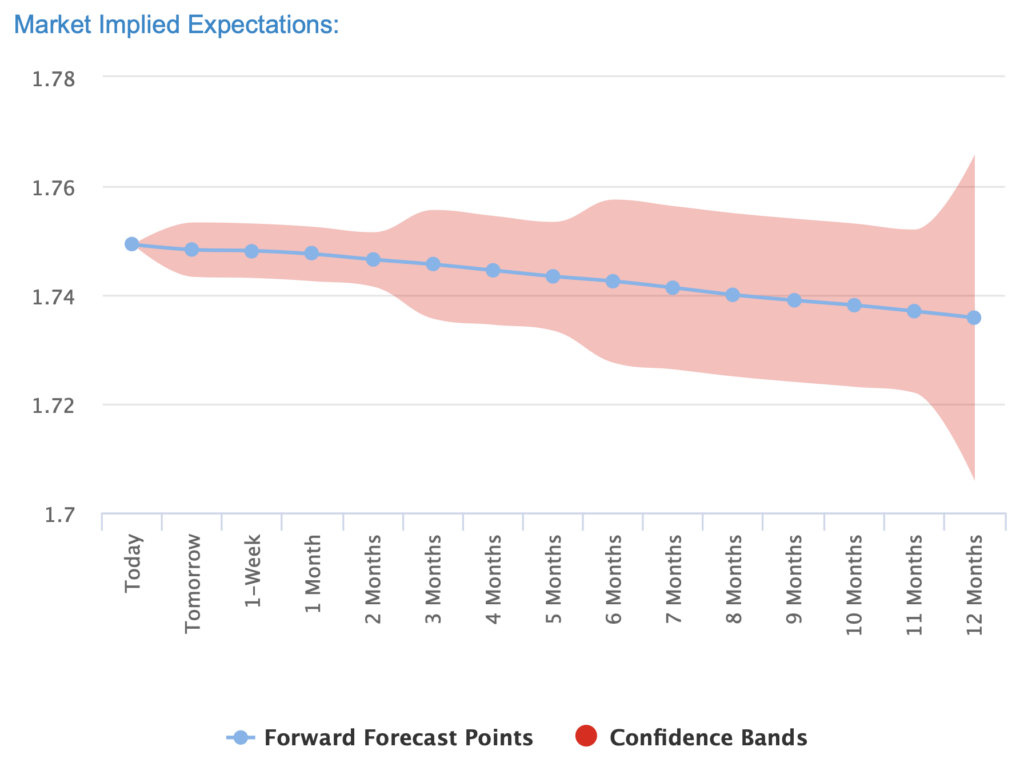

What is the GBPCAD forecast in weeks, months, and years?

In light of the above-mentioned economic trends, the market consensus is that GBPCAD will not continue to advance much from here.

If anything, many are expecting GBPCAD to pull back into the range at around 1.740-1.760 in the next 2-3 months (see below).

However, these are just expectations, which can change quickly given a new set of economic data. Therefore I expect GBPCAD to range higher with a lot of backing and filling at around 1.750.

Where is the best place for buying large amounts of Canadian Dollars from Pounds

There are two different ways people buy Canadian Dollars from Pounds

- Through a currency broker like Currencies Direct, OFX or Global Reach– when transferring money abroad

- Through a forex broker like CMC Markets, City Index or IG – when speculating on the price of currency

You can use our comparison table of currency brokers to see how many currencies they offer, what the minimum CAD transfer is and if they offer forwards and currency options as well as when they were established. You can either visit each currency broker individually or use our currency quote comparison tool to request multiple exchange rates.

Or, if you are more interested in trading GBPCAD , you can compare forex brokers here.

What is the live GBPCAD exchange rate?

The current GBPCAD exchange rate is 1.86838 which is a change of -0.56% from the previous days closing price. Over a week GBPCAD is -0.56%, compared to it’s change over a month of 1.28% and one year of 4.31%.

GBPCAD exchange rate data is updated every 15 minutes.

Sending money to Canada FAQ:

The best way to send money to Canada is to use a currency broker.

As well as getting the best exchange rates, if you send money to Canada with a currency broker you also get:

- Expert help and advice to reduce your risk and exposure

- Dedicated account managers every step of the way

- Convert funds online and platform access 24/7

- Same day and forward currency exchange contracts

- Zero service charge, commission or transfer fees

- Transfer money direct to single or multiple beneficiary accounts

When you convert and transfer Canadian Dollars (CAD) with a currency broker your fixed exchange should be a maximum of 0.5% from the mid-market for currency transfers. To put this in perspective, banks traditionally charge 3-5% which means that if you are sending £100,000 worth of Canadian Dollars (CAD) you could save up to £4,500 with a currency broker versus the banks.

Request a quote to see how much you can save – you’ll find a better Canadian Dollar (CAD) exchange rate than by using your bank.

Our comparison tables and Candian Dollar (CAD) exchange rate quote request forms will help you find the best Candian Dollar exchange rate. Our exchange rate comparison tables highlight the key features of currency transfer providers whereas Candian Dollar exchange rate quote request forms will make currency brokers compete for your business by offering the best exchange rate.

Here are a few tips on getting the best Canadian Dollar (CAD) exchange rate:

- Always compare (read our guide to comparing exchange rates here)

- Never go with your bank

- Understand the fees

- Use a currency forward to lock in the current exchange rate

If you think the CAD exchange rate is going to go in your favour you should wait. Or, if you are worried the rate will move against you, it is possible to lock in the current rate for up to a year in advance with a currency forward.

Yes, you can send money using PayPal, but it is very expensive. If you are only planning on sending a small amount of money to Canada a money transfer app is much cheaper.

With a currency broker, you can send an unlimited amount of money to Canada. Money transfer apps are good for sending under £10,000. Banks are the worst way to send money to Canada because of the high fees.

The three main ways to send money to Canada are:

- Large amounts – currency brokers like Key Currency, Global Reach and OFX

- Medium amounts money transfer apps Like Wise and XE

- Small and cash amounts – wire transfer providers like Western Union (WU)

Yes, the best way to get the currency exchange rate if you want to send money to Canada is to use a currency forward where you buy the currency now by putting down a small deposit and pay the balance when you make the transfer.

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the CAD money transfer providers via a non-affiliate link, you can view them directly here: