CFD trading and Spread Betting broker CMC Markets announced full-year figures on Thursday for the period ending the 31st of March 2020, and they made for impressive reading.

Net operating income for the group reached 252.0 million up from just £130.80 in full-year 2019 and CMC’s pretax profits jumped to £98.70 million compared to just £6.30 million for the prior year.

How much is a client worth to CMC Markets?

Earnings per share grew 15 fold to 30.1p up from 2.0p in 2019. Whilst the number of active CFD traders at CMC Markets rose by almost 4,000 to 57,202.

Each of those clients was worth some £3,750 in revenues up by +180% from the comparable revenue figures in 2019

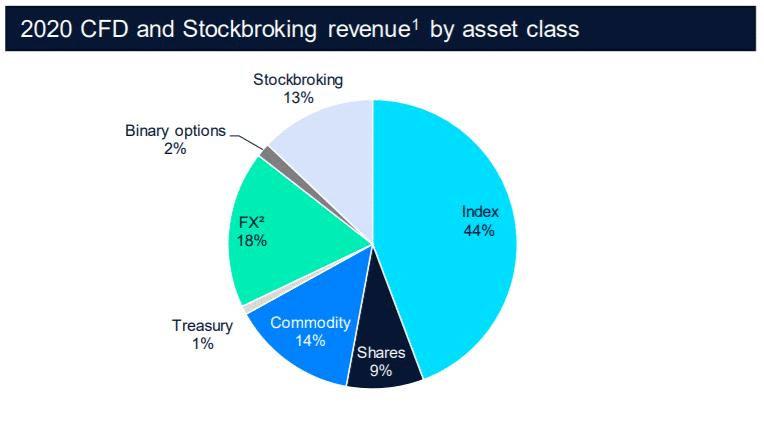

As with rivals CMC Markets generated those bumper revenues we find the following breakdown.

Index trading accounted for +44% with CFDs on individual share account for a further +9.0% of revenues

Away from equity markets FX accounted for +18.0%, a smaller share of revenues than perhaps one would have anticipated. Whilst the group’s Stockbroking business a large part of which is made up by a JV /white label arrangement with ANZ bank accounted. for +13.0% of 2020 income.

CMC management declared a dividend of 12.18 pence bringing the total dividend 15.03p for the year

CMC Markets performance during the Coronavirus pandemic

They acknowledged that recent events had boosted both profitability, client trading activity and numbers. However, they believe, that CMC Markets will be well poised to continue to deliver, as business becomes normalised.

They pointed to the group’s investment in technology and infrastructure and to the development of its institutional B2B offerings. Adding that CMC also benefited from strong client retention among its individual customers.

CMC Markets CEO Peter Cruddas who retains a substantial equity stake in the company said that

“The significant performance improvement in 2020 is a result of the Group’s unwavering focus on our strategic initiatives. This has delivered increased diversification of Group revenues, improved CFD client income retention and an increased number of active clients. The growing contribution of B2B revenues is also particularly pleasing and will continue to be an important part of our strategy going forward.”

CMC Market’s stock price rallied by +60 pence on Thursday to close at 259p versus Wednesday’s 199.2p

The shares were modestly better on Friday afternoon as well. Thursday’s move was accompanied by a large rise in the trading volumes of CMC shares suggesting that the markets share the managements optimistic outlook.

It seems to us that much will depend on how the group can grow and leverage its B2B operations and whether it can capitalise on its growing business in both physical stocks and equity CFD products. That’s for the future, however, but right now CMC Market’s shareholders and other stakeholders must feel pretty pleased with themselves.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com