Interactive Brokers has unveiled a new Investment Themes feature designed to help investors cut through market noise and uncover investable opportunities.

Investment Themes are available across IBKR’s trading platforms, the new tool simplifies stock research by helping users explore companies linked to real-world trends, from “Generative AI” to “Nuclear Energy” without needing to know a single ticker symbol.

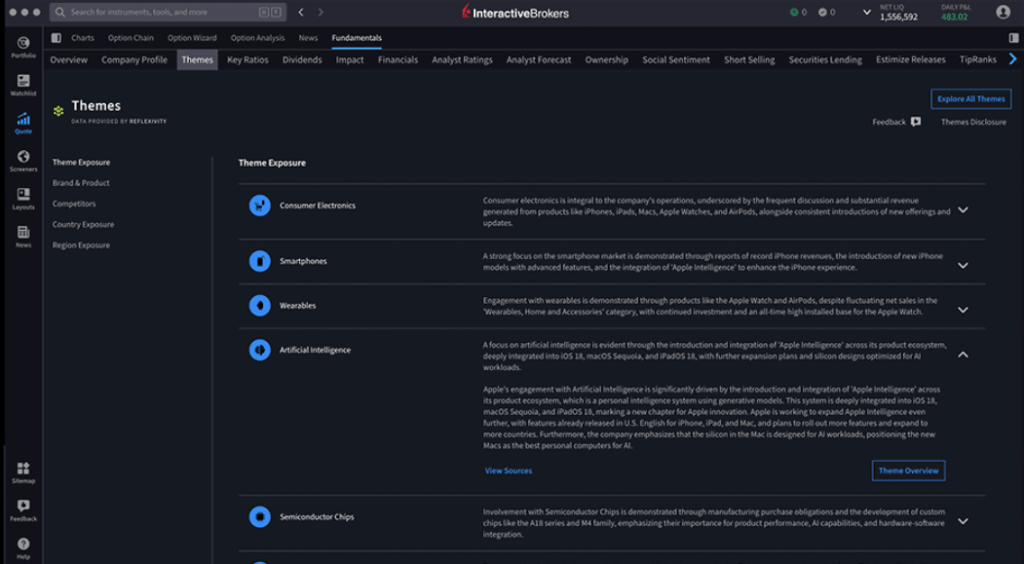

Powered by AI-driven insights from Reflexivity, Investment Themes allows users to begin with a big-picture idea and instantly identify related public companies in the S&P 1500. The tool connects products, competitors, and geographies, giving investors an interactive and intuitive way to explore a theme’s entire landscape.

“Investment Themes will help our clients turn raw relationship data into a narrative that they can trade on,” said Steve Sanders, EVP of Marketing and Product Development at Interactive Brokers. “It’s about turning curiosity into conviction more efficiently.”

Reflexivity’s proprietary knowledge graph maps the relationships between companies, offering a dynamic view of how business drivers are connected, including product overlaps, regional exposure, and strategic importance.

The tool currently includes around 500 market themes, each scored on factors such as revenue exposure and capital allocation. Investors can now see how deeply a company is involved in a given trend, compare it to rivals, and better understand potential risks or synergies.

It also integrates directly with IBKR’s *Fundamentals Explorer*, offering a new “Investment Themes” tab on every S\&P 1500 company profile. This tab shows related trends, competitors, and global revenue breakdowns, helping investors discover opportunities or avoid overconcentration.

Available at no extra cost to clients, Investment Themes is live in beta across Trader Workstation, IBKR Mobile, and IBKR Desktop, with a full release coming soon.

Interactive Brokers, as far as I’m concerned, has always tried to educate their clients, as in the words of their founder Thomas Peterffy, “an educated client is a profitable client,” and a profitable client is a long-term, happy, commission-paying client.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.