-

Checked By

Richard Berry

Checked By

Richard Berry

- Updated

UAE CFD brokers let you speculate on stocks, indices, commodities and FX pairs going up or down with leverage. CFD trading has become very popular in Dubai and the UAE in recent years as many well-known CFD brokers have established a presence in the UAE.

| Name | Logo | CFD Markets | Min Deposit | GMG Rating | Customer Reviews | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

CFD Markets 5,000 |

Min Deposit $100 |

GMG Rating |

Customer Reviews 4.2

(Based on 19 reviews)

|

Visit Platform 74%-76% of retail CFD accounts lose money. |

Account Types:

|

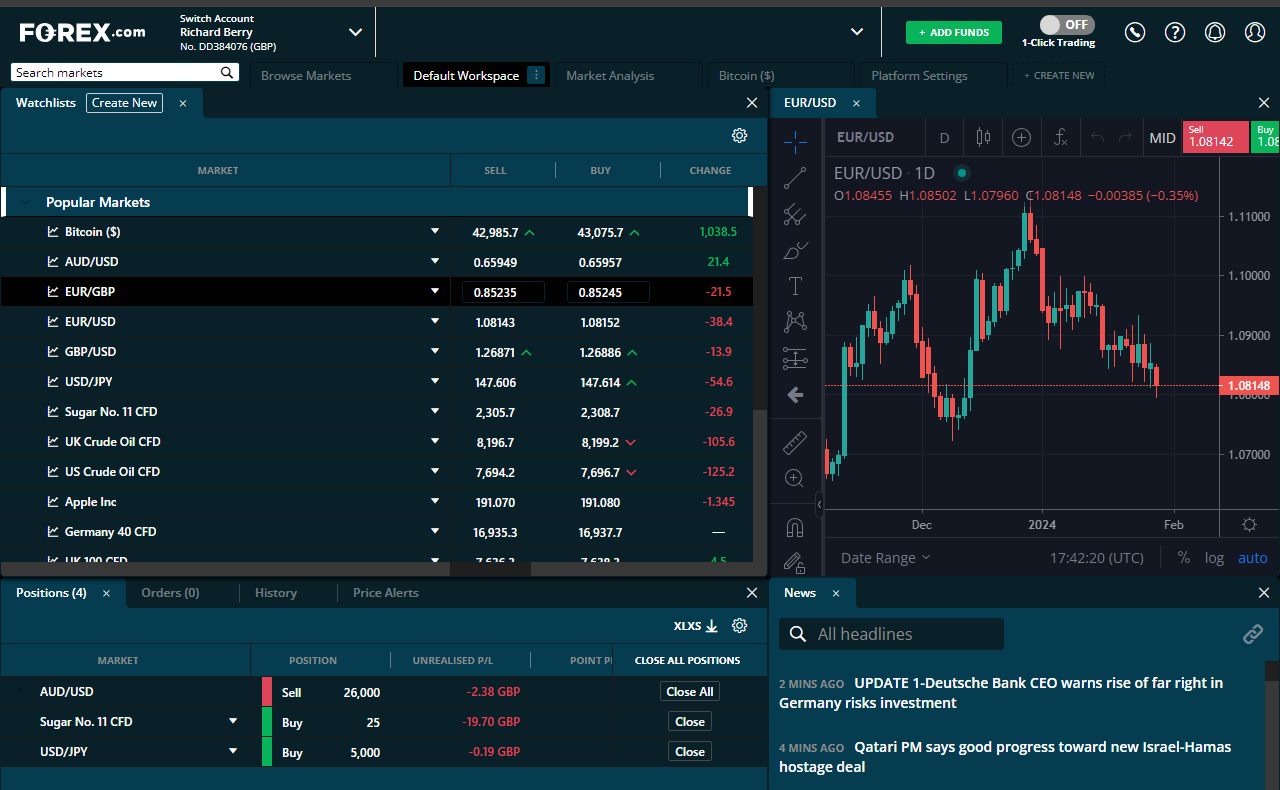

FOREX.com: Best UAE CFD broker for trading signals Account: FOREX.com UAE CFD Trading Description: Forex.com is a global provider of CFDs and other trading instruments. CFD traders in Dubai can access a wide range of CFDs on various asset classes, including stocks, indices, commodities and forex. Forex.com provides competitive pricing, tight spreads, and a user-friendly trading platform for executing CFD trades. But what makes Forex.com stand out are the trading signals and performance analytics that can help CFD trading become more profitable. Is Forex.com a good CFD trading platfom in the UAE? Overall, an excellent CFD trading platform with lots of markets 25 commodities, with spreads as low as 0.8 for gold trading and 0.3 for crude oil. If you are a forex trader, then Forex.com’s trading signals, platform and trading performance data make it one of the best platforms for currency trading. Is Forex.com CFD trading OTC or DMA in the UAE? You can trade real CFDs in the UAE with forex.com as they are regulated by the DFSA and have a local office in Dubai. Forex.com is owned by NASDAQ listed StoneX and is one of the largest forex brokers in the world. Forex.com is properly regulated by the DFSA Reference Number: F000542 and have a local UAE office with their parent companies (StoneX): Office 48D Almas Tower Jumeirah Lakes Towers PO Box 125942 Dubai, UAE

Pros

Cons

Overall5 |

||

|

CFD Markets 1,200 |

Min Deposit $1 |

GMG Rating |

Customer Reviews 4.6

(Based on 86 reviews)

|

Visit Platform 72% of retail investor accounts lose money |

Account Types:

|

Pepperstone: Best UAE CFD broker for MT4 Account: Pepperstone UAE CFD Trading Description: In 2020 Pepperstone obtained a Dubai Financial Services Authority (DFSA) license to expand its CFD brokers services in the Middle East and Dubai. Set up by industry vet Tarik Chebib in 2021, who has prior experience setting up similar CFD trading services operations in the region, it is one of the largest CFD brokers globally led by Alexander Kolpokchi. Can you trade CFDs with Pepperstone legally in the UAE? Yes, is it legal to trade CFDs with Pepperstone in the UAE as they are regulated by the DFSA and have a local office in Dubai. Pepperstone focus on MT4 and automated trading strategies and cater to high-net-worth individuals (HNWIs) in the Gulf states and the wider Middle East, who want to trade CFD on popular local markets like Oil and Gold as well as the most popular international indic DFSA Reference Number: F004356 UAE Address: Pepperstone Financial Services (DIFC) Limited – Office 1502, Al Fattan Currency House, Tower 2 – Dubai – United Arab Emirates

Pros

Cons

Overall4.5 |

||

|

CFD Markets 4,500 |

Min Deposit $20 |

GMG Rating |

Customer Reviews 4.8

(Based on 1,811 reviews)

|

Visit Platform CFDs trading carries risk. Capital.com is regulated by the Securities and Commodities Authority. |

Account Types:

|

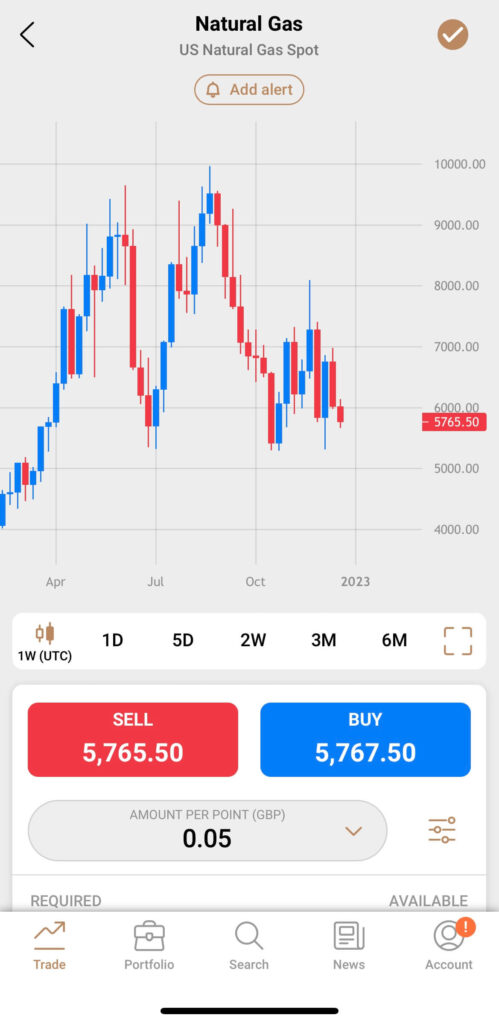

Capital.com Voted Best Trading Account In 2025 Provider: Capital.com Verdict: Capital.com won the People’s Choice vote for “Best Trading Account” in the 2025 Good Money Guide Awards and “Best Trading App” in our 2023 awards as they have one of the most intuitive apps for trading the most popular markets globally. Capital.com was founded in 2016 and is a CFD trading platform broker with offices in the UK and around the world. Since then, they have grown to offer over 3,000 tradable assets to 100,000 monthly active clients. Is Capital.com any good for trading?

What makes Capital.com different? Thumbs up, literally Do you know what one of the most impressive thing about Capital.com is? They put the buy and sell buttons at the bottom of the app. I don’t mean that in a facetious way, it’s genuinely a brilliant feature. This may not sound like much but it’s a good example of how Capital.com has integrated decades of analytics, experience, feedback and customer data into creating a very easy-to-use intuitive trading app from scratch. When Capital.com first became authorised by the FCA back in 2018, I visited their offices in London to have a chat about what they offer. The two main things we discussed were button placement and AI. Trading App But anyway, if you’ve updated your iPhone to the latest iOS you’ll notice that Apple has started moving things to the bottom of the screen, the search bar for instance. This is because, phones are getting bigger, and your thumb can’t reach the top of the screen if you are holding it with one hand. This is something that Capital.com figured out would make trading easier 5 years ago. I’ve just been through a bunch of other trading apps on my phone and still, amazingly enough, none of the other brokers have done this yet.

Capital.com was also the first to integrate artificial intelligence to help you improve your trading, they say, based on the Martingale theory. When I spoke to Chris Demetriou, the head of sales in the UK, he said that the system should give you prompts based on your previous trades. So for example, if you are about to do a trade that is similar to ones you have constantly lost on before, you should get a “are you sure you want to do this” notification. Leverage Control Everybody knows, that one of the main reasons people lose money when trading is overleverage. This could be either from not having enough free cash on account to give your position breathing space, or simply putting on trades that are too risky. One really good feature is that you can change your leverage based on asset class. The default leverage is the max that retail traders in the UK are permitted, but you can change this to 1:1 so you need to fully pay up for positions. A sensible thing to do if you are just getting started, which can help reduce excessive losses. As your experience grows you can increase your leverage accordingly. Hedging You can also set the platform to put on hedging positions, so you can be long and short the same thing at the same time. Why you ask? Well, it can help you run longer-term positions and short-term hedges. This in fact is the very point of CFDs. They were originally hedging tools, and still a good way to protect your long-term investment portfolio against short-term market corrections without having to close off your positions. Customer Support Customer support is pretty good too, you can get in touch via the chat widget on the platform, whatsapp or telegram. When I tested it I got a response within a minute and the issue I had was dealt with quickly (uploading ID to verify my account if you must know). TradingView You can’t trade from the charts, but when you have open positions they are overlayed along with your stops and limits, which you can move by dragging and dropping. But, if charting is your thing, you can join the other 78,000 Capital.com customers using and trading from TradingView. Proprietory Tech One thing I quite like though is that instead of relying on third-party software, the Capital.com trading platform is built in-house, and if you want something you can ask for it. For example, previously on the app you could see where an asset is as a percentage relative to the daily range. But, a customer asked, if you could see it in points too. So, that was quickly integrated so that you can now toggle between percentages and points. A small thing, but indicative of a broker that can do things and does do things, rather than just logging a helpdesk ticket. Refinitiv There are no trading signals on the platform or app, but you do get access to Refinitiv reports on US stocks, which give you a good overview of historic and potential future financial health. A good feature for those looking at slightly longer-term positions. Overnight funding Talking of long positions, or longer long positions, Capital.com also display quite clearly what your overnight financing rates are going to be on a daily basis. I’m sure this is a regulatory obligation anyway, but it’s done in a way that you can actually see what the price is, rather than an opaque formula. It gives a bit more transparency about how much a position is going to cost you. Investmate If you are new to trading, they have a stand-alone app called Investmate, which puts you through a series of bitesize courses that explain the financial markets. Capital.com also own currency.com if you fancy a punt on crypto, and shares.com so we can expect to see more comprehensive physical investing options soon. Pros

Cons

Overall4.5 |

||

|

CFD Markets 17,000 |

Min Deposit $250 |

GMG Rating |

Customer Reviews 3.9

(Based on 678 reviews)

|

Visit Platform 67% of retail investor accounts lose money |

Account Types:

|

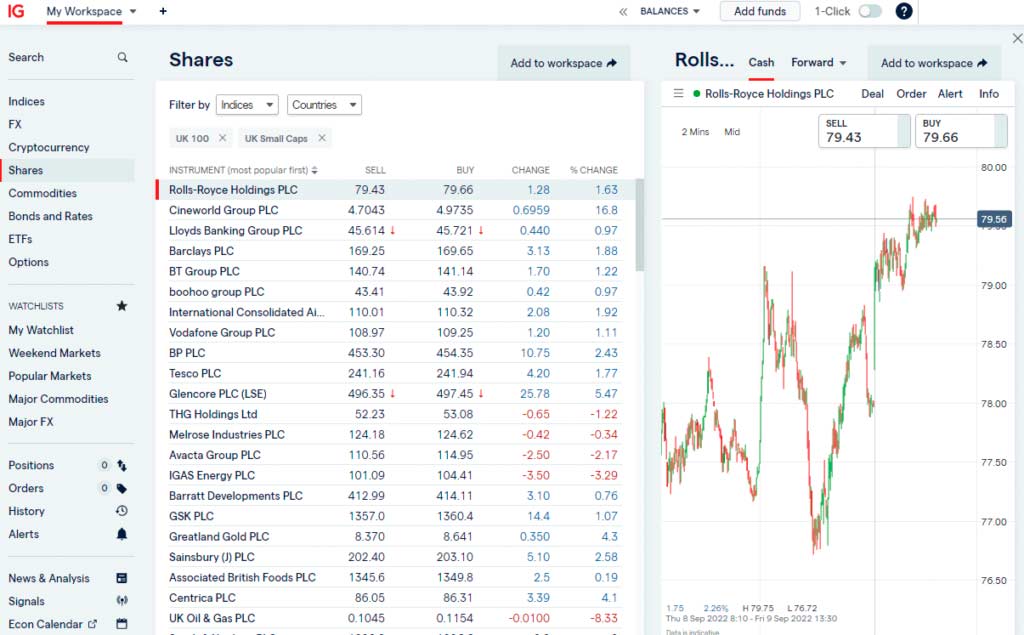

IG: Best UAE CFD broker for liquidity for high net worth traders in Dubai Account: IG UAE CFD Trading Description: IG, a global provider of CFD trading services, opened an office in Dubai in 2008. This expansion allowed IG to establish a physical presence in the region and cater to the needs of traders and investors in Dubai and the wider Middle East. With the Dubai office, IG can provide local support to CFD traders, personalized service, and tailored contracts-for-difference trading solutions to clients in the region. Is CFD trading with IG allowed in the UAE? Yes, you can trade CFDs in the UAE with IG as they are regulated by the DFSA and have a local office in Dubai. DFSA Reference Number: F001780 Overall, IG is a good CFD broker for UAE traders who want deep liquidity on a wide range of markets. Plus their expansion into the UAE demonstrated IG’s commitment to serving the growing demand for online trading services in Dubai and further solidified its position as a leading broker in the industry. IG UAE Address: IG Limited – Level 27, Currency House – Tower 2, Dubai International Financial Centre, Dubai, 506968, United Arab Emirates

Pros

Cons

Overall4.7 |

||

|

CFD Markets 12,000 |

Min Deposit $1 |

GMG Rating |

Customer Reviews 3.7

(Based on 149 reviews)

|

Visit Platform 67% of retail investor accounts lose money |

Account Types:

|

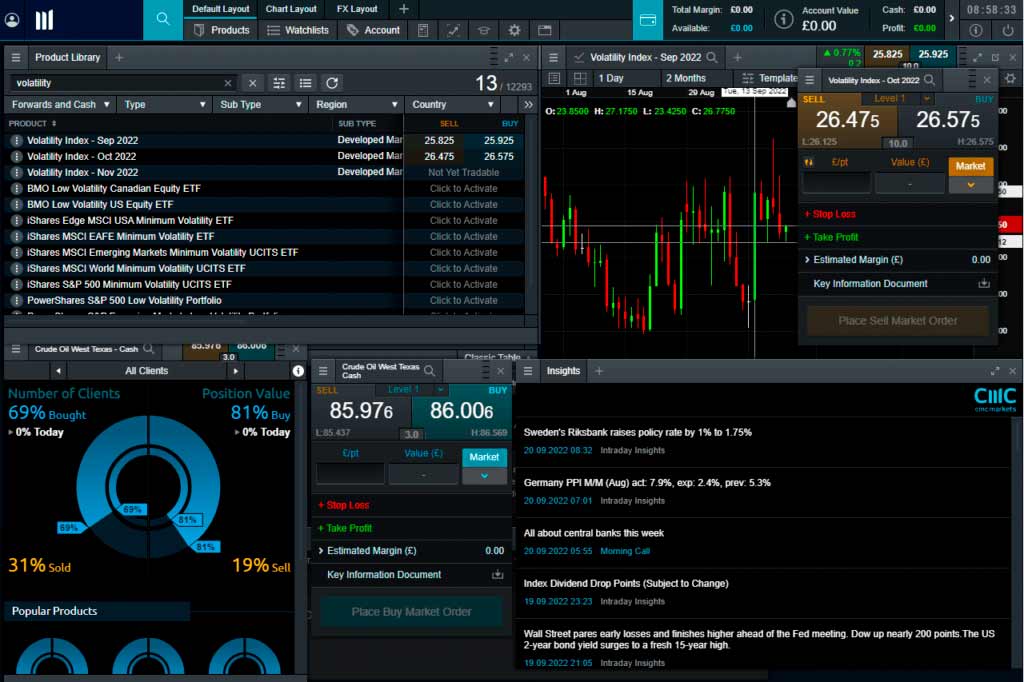

CMC Markets: Best UAE CFD broker platform for active traders Account: CMC Markets UAE CFD Trading Description: CMC Markets started offering CFDs (Contracts for Difference) in the United Arab Emirates (UAE) in 2019. This allowed traders in the UAE to access a wide range of CFD products, including indices, commodities, forex, and more, through CMC Markets’ online trading platform. Is CFD trading allowed with CMC Markets in the UAE? Yes, it is fine to trade CFDs in the UAE with CMC Markets as they have a local office in Dubai and are regulated by the DFSA. DFSA Reference Number: F002740 CMC is a good CFD broker for traders who want a sophisticated and fast trading platform with unique sentiment trading tools. CMC Markets Connect, established its physical presence in the UAE in 2019 and rebranded in January 2021. With the expanded office, CMC Markets aims to continue building its reputation in the Middle East and support its existing clients in the region. Richard Elston, the Group Head of Institutional at CMC Markets Connect, expressed confidence in the new office, highlighting the UAE’s growth as a global financial hub. CMC Markets UAE Address: CMC Markets Middle East Limited. Unit 2903, Level 29, ICD Brookfield Place, DIFC, PO Box 507183, Dubai, UAE

Pros

Cons

Overall4.7 |

||

|

CFD Markets 9,000 |

Min Deposit $1 |

GMG Rating |

Customer Reviews 3.6

(Based on 74 reviews)

|

Visit Platform 62% of retail investor accounts lose money |

Account Types:

|

Saxo Markets: Best UAE CFD broker for direct market access Account: Saxo UAE CFD Trading Description: Saxo Bank offers CFD trading in Dubai where traders can access over 8,800 instruments, including single stocks, indices, forex, commodities, options, and bonds. Saxo’s CFD trading platform provides ultra-competitive pricing with tight spreads and low commissions. Is Saxo regulated for CFD trading in the UAE? Yes, you can trade CFDs with Saxo in the UAE as they are regulated by the DFSA and have a physical office in Dubai. In fact, Saxo markets offer one of the best CFD trading platforms in Dubai for small and large customers on their robust SaxoTradeGo trading platform. the key advantage of trading CFDs with Saxo is that you get DMA access and can place CFD orders directly on the exchange order book for better pricing. SaxoTraderGO, offers charting with 50+ technical indicators, integrated Trade Signals, and innovative risk-management features. Key to Saxo’s UAE offering is that Saxo Bank has a strong reputation with over 30 years of experience, serving 1,000,000 satisfied customers. Saxo DFSA Reference Number: F001014 UAE Address: Saxo Bank (Dubai) Ltd. Boulevard Plaza – Tower 1 30th floor, office 3002 Dubai Downtown, Burj Khalifa area Dubai, UAE

Pros

Cons

Overall4.8 |

- Over 30,000 votes and reviews in the annual Good Money Guide awards

- Our team’s experiences testing the UAE CFD trading platforms with real money

- In-depth comparison of the features that make these Dubai CFD brokers the best

- Exclusive interviews with the CFD brokers CEOs and senior management

- Find out more about our review process in the How We Test Providers page.

UAE CFD Broker FAQs:

Here are the answers to the most commonly asked questions by people searching for the best CFD brokers in Dubai and UAE.

Yes, Dubai & The UAE has been trying to establish itself as a financial trading centre for much of the last decade and has now succeeded, with the majority of global CFD brokers having offies in Dubai. In fact, some UK-based CFD trading platforms, such as capital.com, have moved entirely from the UK to the UAE.

The principal regulator is the DFSA, the Dubai Financial Services Authority which regulates financial businesses, based in Dubai’s special economic zone.

Which is centred around the Dubai International Finacial Centre or DIFC. This special economic zone consists of 272 acres of commercial real estate, which houses hundreds of financial institutions, that operate under a tax and business-friendly regime.

More than 25,000 finance professionals work within the DIFC for over 2500 companies, details about those companies can be checked on the DIFC public register which can be found on their website.

The DFSA oversees the special economic zone and the businesses within it, including asset managers, insurers, banks and credit service providers, brokers, fund managers and custodians.

The DFSA enforces anti-money laundering regulations and has the power to investigate the activities of companies on the DIFC register.

No. DFSA regulated brokers can no longer offer volume-based rebates to their retail customers.

Yes. The regulator has also introduced negative balance protection for the retail clients, of the CFD brokers it regulates, limiting a client’s maximum loss to the balance of funds on their account

And at the same time, the DFSA has imposed an automatic close out rule whereby open positions are closed if a client’s equity falls below 50% of their margin requirement.

In December 2021 the DFSA introduced new rules for retail clients who trade CFDs through brokers under its oversight.

In common with other regulators, the DFSA has mandated the maximum, margin levels that can be applied to retail CFD trading accounts.

As a result, margin rates have more than doubled for retail clients trading vai Dubai based brokers.

However, these new margin restrictions are still more generous than those allowed by either the UK’s FCA or the European Union’s ESMA.

Under the DFSA rules, clients can access margins of 50:1 on Indices and FX majors, and some commodities such as gold and oil, whilst other commodities are margined at 20 to 1.

CFDs on individual shares are leveraged at 10 to 1, whilst cryptocurrencies can be traded on margins of 20% or a ratio of 5 to 1.

Nor can retail customers offset margins for long and short positions in the same asset, instead, they must now margin each position separately. Client money is held in a segregated client bank account under the DFSA’s client money rules.

City Index and XTB have the lowest spreads for trading Oil whilst IG and CMC Markets have the lowest spreads for trading Gold.

IG offers the most markets to UAE traders, with over 17,000 tradable instruments. Followed closely by City Index’s 12,000, although City Index also has some excellent added value trader tools like performance analytics.

Saxo Markets offers the most account types for trading in Dubai and Abu Dhabi, including direct market access futures and options.

Yes. We have extensively tested each of the brokers in this list, interviewed the CEOs and analysed the key data points that make trading platforms stand out. You ca see what others think of them and read our full reviews of the individual trading platforms here

- City Index review

- IG review

- CMC Markets review

- Pepperstone review

- Saxo Markets review

- Interactive Brokers review

- Spreadex review

- Markets.com review

- XTB review

- eToro review

- Plus500 review

- Capital.com review

If you would like to see what we think of each trading platform for specific products you can read our CFD broker reviews, or our forex trading platform reviews.

It is possible to be classified as a professional client of a Dubai based broker.

Though to qualify for that designation you will need to meet some quite stringent criteria, including having a portfolio with an unencumbered value of US $1.0 million or greater.

You should be able to demonstrate that you have made 40 or more significant leveraged trades over the last year.

Each of these trades should have had a minimum notional value of US $50,000.

Alternatively, you will need to have worked in a relevant professional position in a DFSA regulated firm, within the DIFC. Or, at an overseas firm regulated by an equivalent body, such as the FCA or ESMA etc, and have done so within the last two years.

Professional clients in Dubai are not subject to the DFSA margin restrictions however and they can receive volume-related rebates on their trading activities.

The principal stock exchange in the UAE is the ADX which is based in Abu Dhabi, the Emirates capital.

ADX was founded in November 2000 and is now the second-largest stock market in the Arab region, and offers trading in stocks, bonds, ETFs, and other instruments approved by the UAE Securities and Commodities Authority.

The exchange operates a main market for blue-chip stocks, alongside a growth section and a newly established derivatives market, that currently trades equity futures.

Index futures and other derivatives are due to be introduced as this section of the ADX exchange expands.

Non UAE residents can open a trading account with a regulated broker in the UAE, however, those brokers are not allowed to openly solicit business from UK nationals.

Capital.com has a user friendly and intuitive trading platform and app, that gives access to the most popular financial markets with competitive spreads with the ability to reduce risk by decreasing your leverage. Trading via the app has always been capital.com’s forte, and in 202, it won our award for “best trading app” not in part due to the fact that the company CTO has extensive experience in building engaging apps like Candy Crush.

Capital.com has a user friendly and intuitive trading platform and app, that gives access to the most popular financial markets with competitive spreads with the ability to reduce risk by decreasing your leverage. Trading via the app has always been capital.com’s forte, and in 202, it won our award for “best trading app” not in part due to the fact that the company CTO has extensive experience in building engaging apps like Candy Crush.