-

Checked By

Richard Berry

Checked By

Richard Berry

- Updated

| Name | Logo | Forex Pairs | Min Deposit | GMG Rating | Customer Reviews | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

Forex Pairs 80 |

Min Deposit $100 |

GMG Rating |

Customer Reviews 4.2

(Based on 19 reviews)

|

Visit Platform 74% of retail CFD accounts lose money. |

Account Types:

|

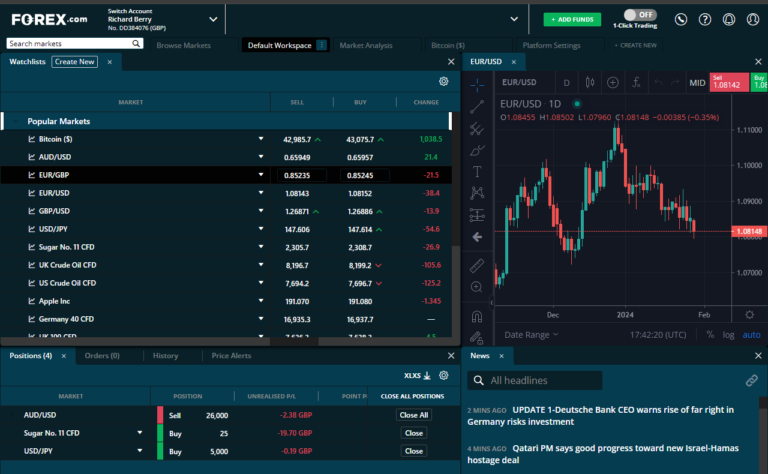

FOREX.com UAE Forex Trading: A dedicated forex platform for UAE traders Account: FOREX.com UAE Forex Trading Description: FOREX.com has excellent forex trading signals including Performance Analytics to help UAE traders improve strategy. They offer a robust forex trading platform with lots of forex pairs, 25 commodities, indices and spreads as low as 0.8 for gold trading and 0.3 for crude oil. Is FOREX.com currency trading legal in the UAE? Yes it is legal to trade FX on FOREX.com in the UAE as they are regulated by the DFSA and have a local office in Dubai. FOREX.com has excellent forex trading signals including Performance Analytics to help UAE traders improve strategy. They offer a robust forex trading platform with lots of forex pairs, 25 commodities, indices and spreads as low as 0.8 for gold trading and 0.3 for crude oil. For UAE forex traders, Forex.com’s trading signals, platform and trading performance data make it one of the best platforms for currency trading.

Pros

Cons

Overall5 |

||

|

Forex Pairs 100 |

Min Deposit $1 |

GMG Rating |

Customer Reviews 4.6

(Based on 86 reviews)

|

Visit Platform 71.9% of retail investor accounts lose money |

Account Types:

|

Pepperstone UAE Forex Trading: Tight FX pricing and automated trading Account: Pepperstone UAE Forex Trading Description: Pepperstone has a very comprehensive package of automated forex trading tools on MT4, MT5, cTrader and TradingView. Pepperstone were founded in 2010 in Australia and have since then grown to be a global brokerage with offices in Dubai and around 400,000 active clients. Is Pepperstone legal in the UAE for forex trading? Yes, it is legal for Pepperstone to offer forex trading in the UAE as they are regulated by the DFSA and have a local office in Dubai. Pepperstone is a good choice for UAE traders who want to automate their forex trading strategies through MT4. As far as MT4 brokers they are one of the biggest and best and offer a very good set of “expert indicators” on the currency markets.

Pros

Cons

Overall4.8 |

||

|

Forex Pairs 51 |

Min Deposit $250 |

GMG Rating |

Customer Reviews 3.9

(Based on 678 reviews)

|

Visit Platform 68% of retail investor accounts lose money |

Account Types:

|

IG: Best UAE forex broker for OTC liquidityAccount: IG UAE Forex Trading Description: IG is one of the largest global forex brokers operating in the UAE with a vast selection of markets to trade with great liquidity. Can you trade forex with IG in the UAE? Yes, you can trade forex in the UAE with IG as they are regulated by the DFSA and have a local office in Dubai. IG is a good choice as IG stands out through deep liquidity, high market range and excellent added value such as trading tools and analysis.

Pros

Cons

Overall4 |

||

|

Forex Pairs 2,000+ |

Min Deposit $50 |

GMG Rating |

Customer Reviews 3.7

(Based on 146 reviews)

|

Visit Platform 76% of retail investor accounts lose money |

Account Types:

|

Plus500 Expert Review 2026: A user-friendly platform with access to global markets Provider: Plus500 Verdict: Plus500 is one of the largest online trading platforms and operates in more than 50 countries worldwide. Founded in 2008, it has more than 26 million customers today.

Plus500 is headquartered in Israel, however, it’s listed in the UK on the London Stock Exchange (it’s a member of the FTSE 250 index). Here in Britain, its platform is operated by Plus500UK Ltd, which has offices in London.

In the UK, you can only trade CFDs with Plus500. CFDs are financial instruments that allow you to profit from the price movements of a security without owning the underlying security itself. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Is Plus500 a good broker? Yes, Plus500’s trading platform has evolved nicely over the years from a simple interface to an intuitive execution venue for CFDs on the major markets and stocks. Opening a Plus500 account is really simple:

Pricing: It’s dynamic so moves with the market for minimum spreads. Plus500 does not charge any trading commissions when you place a CFD trade. However, there are some fees you need to be aware of including:

Withdrawals are free of charge no matter how many you make per month. Deposits are also free of charge. Market Access: Very good, Plus500 are always first to try new asset classes With Plus500, you can trade CFDs on a range of assets and instruments including:

Overall, there are over 2,800 assets you can trade with CFDs. The maximum amount of leverage you can use with Plus500 varies depending on the asset class as shown in the table below. If you are trading forex, you can potentially borrow up to 30 times your own money. For shares, you can only borrow up to five times your own capital. Plus500 margin rates:

Platform & Apps: Basic execution, but it does the job well Plus500 trading apps and platform also offers several tools to help traders manage risk including:

Customer Service: Plus500 doesn’t have a phone option, but its live chat is sufficient Plus500’s customer service options are limited to online chat, email and WhatsApp. So, you can’t contact the company by telephone. However, don’t let that put you off. We contacted the company via online chat and were very impressed with the service and support offered. It’s worth noting that support is available 24/7. This is a big plus – some other CFD providers only provide support during the week. If you are a larger or professional trader you can get access to Plus500’s Premium Service Package which includes:

The premium service is invitation only. To become a premium customer, you must have a real-money trading account. However, if you want better margin rates but are not interested in the premium package you can upgrade to a professional account. The Plus500 professional account is an account designed for professional traders. With this account, you have access to higher levels of leverage (e.g. 1:20 for shares). To be eligible for a professional account, you must meet two of the following three criteria:

Research & Analysis: Some sentiment, but limited education and analysis. Plus500 offers a range of additional features designed to help traders make money, including:

Pros

Cons

Overall4.6 |

||

|

Forex Pairs 338 |

Min Deposit $1 |

GMG Rating |

Customer Reviews 3.7

(Based on 149 reviews)

|

Visit Platform 64% of retail investor accounts lose money |

Account Types:

|

CMC Markets UAE Forex Trading: Excellent sentiment tools for active UAE traders Account: CMC Markets UAE Forex Trading Description: CMC Markets offers good FX sentiment tools and over 388 forex pairs to trade. The broker has over 300,000 active clients trading online and is operated from 13 global offices (including Dubai), with headquarters in The City of London. Can you trust CMC Markets for forex trading in the UAE? Yes, it is fine to trade forex in the UAE with CMC Markets as they have a local office in Dubai and are regulated by the DFSA. CMC Markets is one of the best UAE trading platforms for high-frequency and active FX traders. It’s a good choice for those who want to trade currency on tight spreads, with a platform built on exceptional tech.

Pros

Cons

Overall4 |

||

|

Forex Pairs 84 |

Min Deposit $1 |

GMG Rating |

Customer Reviews 3.6

(Based on 74 reviews)

|

Visit Platform 62% of retail investor accounts lose money |

Account Types:

|

Saxo UAE Forex Trading Review: A professional mix of OTC and DMA forex trading Account: Saxo UAE Forex Trading Description: Saxo is one of the few UAE forex brokers that provides OTC & DMA (direct market access currency futures) forex trading as well as access to the gold and oil exchanges. Is Saxo regulated for forex trading in the UAE? Yes, you can trade forex with Saxo in the UAE as they are regulated for FX CFDs and DMA currency futures trading. Saxo has a local forex trading office in Dubai and is regulated by the DFSA. What makes Saxo Markets one of the best forex trading platforms in the UAE is the ability to trade OTC FX as well as on-exchange currency futures and options. However, one disadvantage is you cannot work automated trading strategies as they do not offer MT4 trading in the UAE. Saxo is a good choice for more sophisticated UAE traders. The platform, analysis, and direct market access may be too complicated for beginners. But, for experienced traders its coverage, commissions and research are unrivalled.

Pros

Cons

Overall4.3 |

||

|

Forex Pairs 95 |

Min Deposit $20 |

GMG Rating |

Customer Reviews 4.8

(Based on 1,812 reviews)

|

Visit Platform CFDs trading carries risk. Capital.com is regulated by the Securities and Commodities Authority. |

Account Types:

|

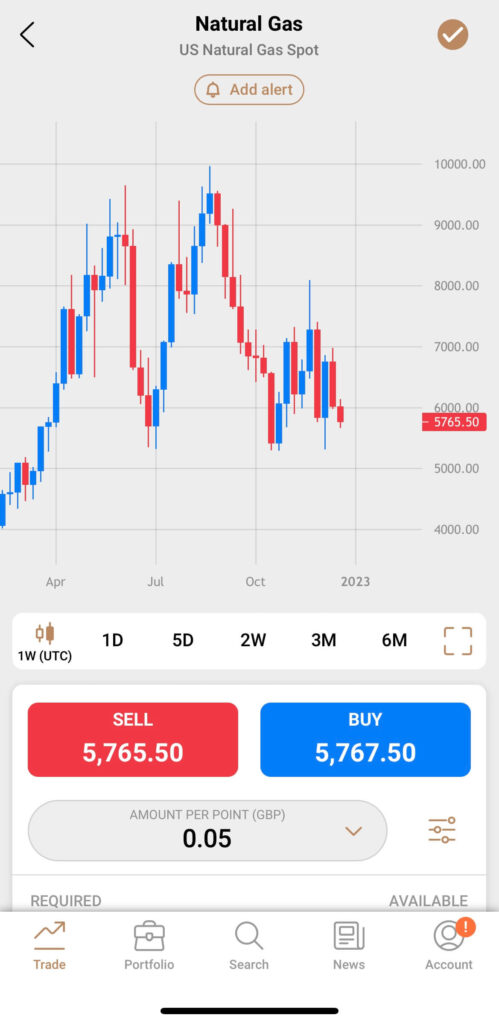

Capital.com Voted Best Trading Account In 2025 Provider: Capital.com Verdict: Capital.com won the People’s Choice vote for “Best Trading Account” in the 2025 Good Money Guide Awards and “Best Trading App” in our 2023 awards as they have one of the most intuitive apps for trading the most popular markets globally. Capital.com was founded in 2016 and is a CFD trading platform broker with offices in the UK and around the world. Since then, they have grown to offer over 3,000 tradable assets to 100,000 monthly active clients. Is Capital.com any good for trading?

What makes Capital.com different? Thumbs up, literally Do you know what one of the most impressive thing about Capital.com is? They put the buy and sell buttons at the bottom of the app. I don’t mean that in a facetious way, it’s genuinely a brilliant feature. This may not sound like much but it’s a good example of how Capital.com has integrated decades of analytics, experience, feedback and customer data into creating a very easy-to-use intuitive trading app from scratch. When Capital.com first became authorised by the FCA back in 2018, I visited their offices in London to have a chat about what they offer. The two main things we discussed were button placement and AI. Trading App But anyway, if you’ve updated your iPhone to the latest iOS you’ll notice that Apple has started moving things to the bottom of the screen, the search bar for instance. This is because, phones are getting bigger, and your thumb can’t reach the top of the screen if you are holding it with one hand. This is something that Capital.com figured out would make trading easier 5 years ago. I’ve just been through a bunch of other trading apps on my phone and still, amazingly enough, none of the other brokers have done this yet.

Capital.com was also the first to integrate artificial intelligence to help you improve your trading, they say, based on the Martingale theory. When I spoke to Chris Demetriou, the head of sales in the UK, he said that the system should give you prompts based on your previous trades. So for example, if you are about to do a trade that is similar to ones you have constantly lost on before, you should get a “are you sure you want to do this” notification. Leverage Control Everybody knows, that one of the main reasons people lose money when trading is overleverage. This could be either from not having enough free cash on account to give your position breathing space, or simply putting on trades that are too risky. One really good feature is that you can change your leverage based on asset class. The default leverage is the max that retail traders in the UK are permitted, but you can change this to 1:1 so you need to fully pay up for positions. A sensible thing to do if you are just getting started, which can help reduce excessive losses. As your experience grows you can increase your leverage accordingly. Hedging You can also set the platform to put on hedging positions, so you can be long and short the same thing at the same time. Why you ask? Well, it can help you run longer-term positions and short-term hedges. This in fact is the very point of CFDs. They were originally hedging tools, and still a good way to protect your long-term investment portfolio against short-term market corrections without having to close off your positions. Customer Support Customer support is pretty good too, you can get in touch via the chat widget on the platform, whatsapp or telegram. When I tested it I got a response within a minute and the issue I had was dealt with quickly (uploading ID to verify my account if you must know). TradingView You can’t trade from the charts, but when you have open positions they are overlayed along with your stops and limits, which you can move by dragging and dropping. But, if charting is your thing, you can join the other 78,000 Capital.com customers using and trading from TradingView. Proprietory Tech One thing I quite like though is that instead of relying on third-party software, the Capital.com trading platform is built in-house, and if you want something you can ask for it. For example, previously on the app you could see where an asset is as a percentage relative to the daily range. But, a customer asked, if you could see it in points too. So, that was quickly integrated so that you can now toggle between percentages and points. A small thing, but indicative of a broker that can do things and does do things, rather than just logging a helpdesk ticket. Refinitiv There are no trading signals on the platform or app, but you do get access to Refinitiv reports on US stocks, which give you a good overview of historic and potential future financial health. A good feature for those looking at slightly longer-term positions. Overnight funding Talking of long positions, or longer long positions, Capital.com also display quite clearly what your overnight financing rates are going to be on a daily basis. I’m sure this is a regulatory obligation anyway, but it’s done in a way that you can actually see what the price is, rather than an opaque formula. It gives a bit more transparency about how much a position is going to cost you. Investmate If you are new to trading, they have a stand-alone app called Investmate, which puts you through a series of bitesize courses that explain the financial markets. Capital.com also own currency.com if you fancy a punt on crypto, and shares.com so we can expect to see more comprehensive physical investing options soon. Pros

Cons

Overall4.5 |

- Over 30,000 votes and reviews in the annual Good Money Guide awards

- Our team’s experiences testing the UAE Forex trading platforms with real money

- In-depth comparison of the features that make these Dubai forex brokers the best

- Exclusive interviews with the Forex brokers CEOs and senior management

- Find out more about our review process in the How We Test Providers page.

UAE Forex Broker FAQs:

Here are the answers to the most commonly asked questions by people searching for the best FOREX brokers in Dubai and UAE.

As an emerging trading hub with a large ex-pat community, you would expect to be able to open and trade in a wide variety of underlying currencies in the UAE and indeed you can.

Though it will be worth checking specific details about trading account denominations with your chosen broker.

As an example IG‘s Dubai operation allows you to deposit in US dollars, British pounds, Euros, United Arab Emirates dirham’s (AED) and Saudi riyals (SAR).

However, trading accounts at IG Dubai can only be denominated in US dollars, Euros or sterling.

The most popular markets within the UAE are oil and gold, both are commodities that have been intrinsically linked to the growth of the region. That affinity is reflected in the larger leverage for retail clients, afforded to gold and oil by the DFSA.

CFDs on equity indices and FX majors are also widely traded in Dubai, which of course sits at a crossroads thats midway between European and Asian timezones, being four hours ahead of GMT and four hours behind Hong Kong, Singapore and Shanghai.

Yes. We have extensively tested each of the forex brokers in this list, interviewed the CEOs and analysed the key data points that make trading platforms stand out. You can see what others think of them and read our full reviews of the individual trading platforms here

- City Index review

- IG review

- CMC Markets review

- Pepperstone review

- Saxo Markets review

- Interactive Brokers review

- Spreadex review

- Markets.com review

- XTB review

- eToro review

- Plus500 review

- Capital.com review

If you would like to see what we think of each trading platform for specific products, you can read our forex trading platform reviews.

Yes, forex brokers that have local offices in the UAE are regulated by the Dubai Financial Services Authority (DFSA).

Capital.com has a user friendly and intuitive trading platform and app, that gives access to the most popular financial markets with competitive spreads with the ability to reduce risk by decreasing your leverage. Trading via the app has always been

Capital.com has a user friendly and intuitive trading platform and app, that gives access to the most popular financial markets with competitive spreads with the ability to reduce risk by decreasing your leverage. Trading via the app has always been