It’s been a difficult couple of days for equity investors, particularly if you are exposed to technology stocks and given the weighting of the Mag 7, on a global basis, that’s pretty much everybody.

In times like this, I find it useful to look at things from a top-down perspective; tables like those shown below are helpful in this regard.

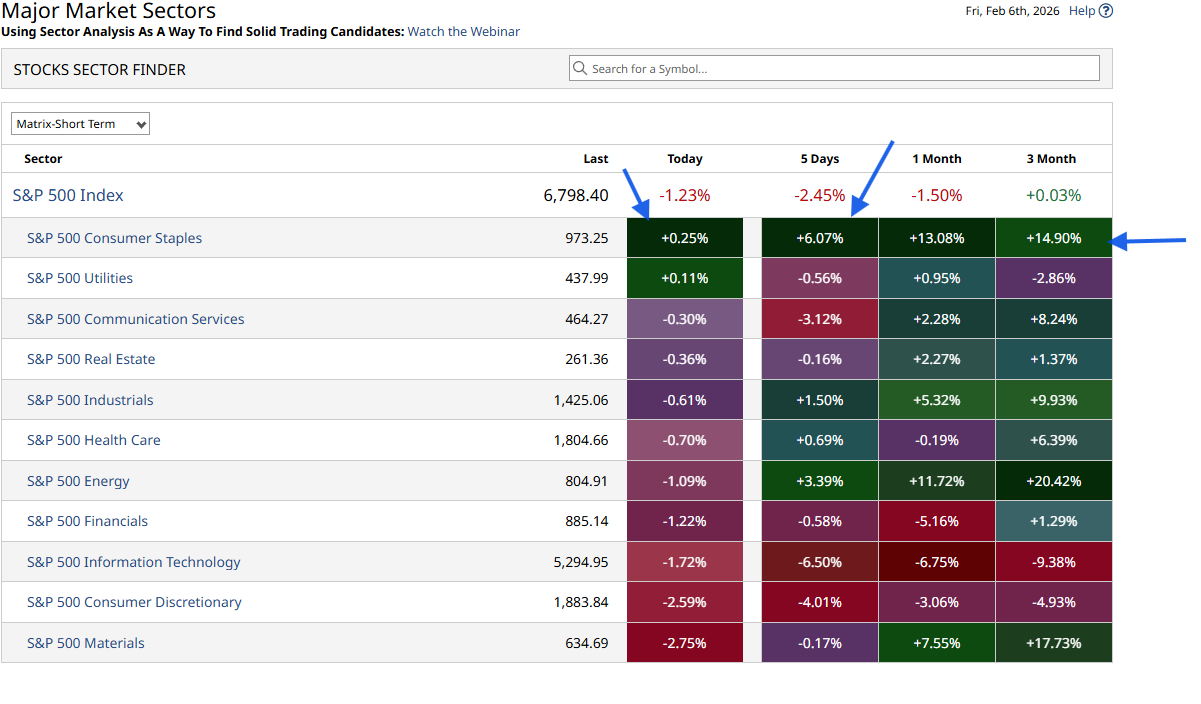

The first table shows us the performance of S&P 500 sectors over intervals out to the last 3-months.

What’s clear from this is that the rally in Consumer Staple’s hasn’t happened over night, but rather over the last quarter- clearly the signs were there, if you new where to look.

I note though that the upside move came to halt yesterday, has the sector had its moment(um) in the sun?

That’s something to look at in today’s session, and the weekly close for both the sector and constituent stocks could be very instructive.

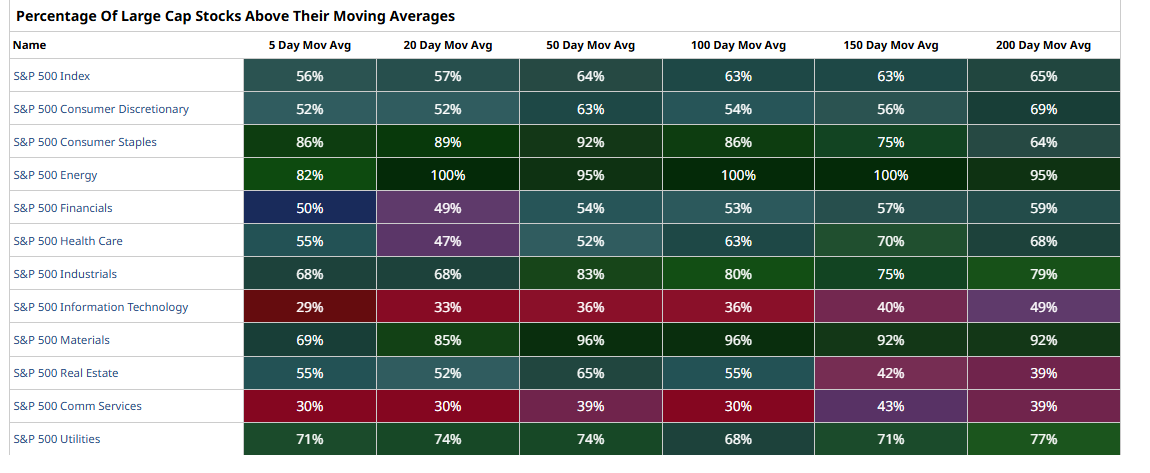

The second table looks at breadth in the market in this case measured by the percentage of stocks in S&P sectors, that are trading above or below key Moving Averages.

Given the ” blood letting in recent days, I am surprised to see that the respective percentages in Comms Services and Information Technology, aren’t lower than they are.

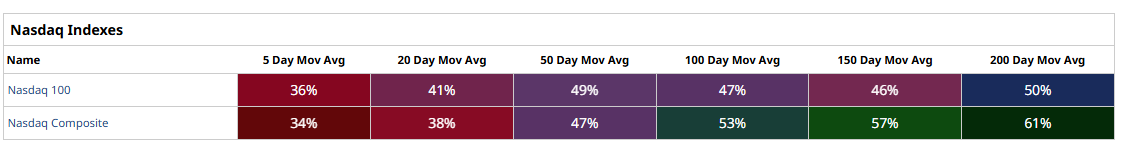

I have added the data for the Nasdaq 100 and Composite indices for context, see table three.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

To contact Darren, please see his Invesdaq profile.