The current Royal Mail (LON:IDS) international distribution services share price is 359p (as of 16:35 30-May-2025) which is a change of 0.2 or 0.06% from the last closing price of 359 with 31,396,662 shares traded giving Royal Mail a market capitalisation of £3,463,051,497. The most recent daily high has been 359.4 and daily low 359. The Royal Mail share price 52 week high has been 368 and the 52 week low 313.2. Based on the most recent Royal Mail share price opening of 359, the current Royal Mail EPS (earnings per share) are 0.26 and the PE (price earnings ratio) is 13.65.

How to buy shares in Royal Mail (LON:IDS)

To buy shares in Royal Mail you need to invest in international distribution services (LON:IDS), and need a trading or share dealing account. Follow these three steps if you want to buy shares in Royal Mail:

- Decide if you want to buy Royal Mail shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

Buying one LON:IDS share costs 359p. However, as well as the 359p cost of buying the shares you will also have to pay stamp duty, commission when you buy and sell shares and custody fees for holding your shares on your account. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

Royal Mail Share Price Chart

Royal Mail (LON:IDS) International Distribution Services share price analysis 7/12/22

Royal Mail shares (LON:IDS) face heavy short-selling pressure. Should you bet against them and buy International Distribution Services PLC?

Royal Mail was once a venerable brand. But now, it is just a corporate name. As a matter of fact, in October 2022 the company’s stock name changed to International Distribution Services plc (LON:IDS). Whenever a corporate name change happens, watch out.

Is Royal Mail (LON:IDS) a good investment in the long term?

Right now, no. The company is currently buffeted mercilessly by a number of factors – factors that could yet drag on for months. Yes, IDS’s share price may have reflected some of these negative influences, but there are no major positive catalysts on the horizon that could spark a bullish re-rate of the company. Better staying in cash and wait, rather than holding Royal Mail shares and hope.

In 2013, the Royal Mail Group was privatised with great fanfare by the Department of Business. The government offloaded its 60% holding in the company at 330p per share. After a 9-year listing, IDS’s share price is a quarter cheaper at 225p.

Until the pandemic arrived in 2020, the parcel distribution company’s shares were crashing to new lows. But covid-19 injected a new lease of life into its business as physical interaction was minimised. People relied on the Royal Mail to distribute goods. The Royal Mail share price soared to 600p last year.

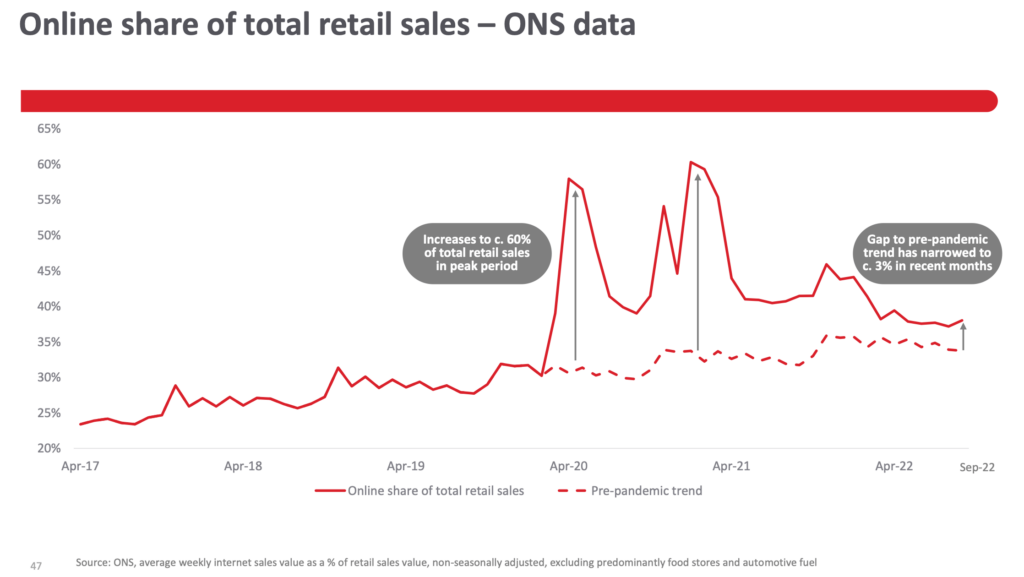

But that was then. Under their new name, LON:IDS’ rally had fizzled out and prices have collapsed 60% from that peak. With more industrial strikes on the way, a higher base cost and increased physical interaction, investors’ perception of the company has turned starkly negative. The online shopping boom could not last forever.

Source: IDS plc

Even the management is fairly downbeat these days, as summarised in its November result presentation: “We continue to expect a full year adjusted operating loss of around £350m – £450m, including the direct impact of 122 days of industrial action which have taken place or have been notified to us, but excluding any charges for redundancy costs.”

Is now a good time to buy Royal Mail shares (LON:IDS)?

Like most other shares, the best time to buy the Royal Mail is when it is extremely negative. But investors will promptly ask: How to tell when the stock is ‘extremely negative’? Like now?

Yes and no. Yes, sentiment of IDS is very poor. But the share price hasn’t dropped significantly over the past few weeks.

Remember, during Dec 2019 – Mar 2020 IDS’s shares price plunged from 240p to 120p. That’s a 50 percent drop. That slump pushed the share to technically oversold territory and prices soon rebounded afterwards.

If I pencil in a similar drop of 40-50%, it would take the share to 120-140p from the current level. At that bombed-out level, perhaps it may entice a lot more buying of the shares and stabilise prices.

Is the Royal Mail share price (LON:IDS) overvalued or undervalued at the moment?

The market sentiment on IDS shares is fairly unfavourable at the moment. It is not hard to see why. The IDS share price has dropped consistently for the past 12 months without much hesitation.

Technical support levels to watch are 200p followed by another at 160-175p. A break of these floor levels means that the stock could go on to challenge the all-time low at 120p.

Given this backdrop, are IDS shares under- or over-valued? At the rate prices are falling, it seems they are overvalued. The stock is fundamentally challenged on many fronts. Even the interim dividend was cancelled. (As an aside, it is worth pointing out that IDS’ dividend payments have been patchy since 2020)

Source: Hargreaves Lansdown

If we look at the Royal Mail’s financial results, revenue, profits and margins have all regressed in the first half. This negative trend is set to extend.

Source: IDS plc

Why has Royal Mail’s share price dropped recently?

There are a few reasons for the drop in IDS’s share prices of late, including:

- Lower number of parcel deliveries – made by the company. This impacted its top-line revenue.

- Industrial action – which may lead to an increase in the future cost base

- Higher energy and financial costs – due to the rise in transport costs and borrowing rates. As a result, financial losses are increasing faster than expected.

Taken together, IDS’s share price halved in the past year.

What is the Royal Mail’s share price prediction?

The City has become quite negative on the stock compared to a year ago.

Last December, there were no ‘Sell/Underperform’ ratings on the stock. Now there are 3. More brokers are putting out ‘Hold’ recommendations too (from 3 to 6). This means that the overall consensus on IDS is gloomy. The risk for the stock is therefore on the downside.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com