Gold Surges as Investors Flock to Safe-Haven Assets

Since so-called “Liberation Day” (April 2), financial markets have been rocked by unexpected economic and corporate distress. Tariffs are, for the lack of better words, economic “sands” that are poured into the gears of a smoothly functioning international trade system. They reduce the efficiency of the global trading pattern and, ultimately, lead to an economic slowdown and a compression of corporate margins.

Many corporate veterans are voicing their concerns. Jamie Dimon, the CEO of the world’s largest bank JP Morgan (JPM:US), warns of “considerable turbulence” if tariff plans go ahead.

These tariff wars are expected to impact the US deeply – 90% chance of a recession, as one economist estimates. Unsurprisingly, investors are rapidly losing confidence in the valuation of US equities. S&P, Nasdaq and Dow are firmly in correction territory. Foreign investors, too, are re-adjusting their Treasury holdings in the wake of the tariff war. The fact that the US dollar is also dropping as the outlook of US assets dims.

This means there is only one safe haven asset on the table: gold.

On April 22, for the first time ever, gold surged to a record $3,500 a troy ounce. Prices are soaring because investors are scrambling to hide in this safe haven. US assets? No thanks. The fact that the Fed’s independence is under threat only further fuels market jitteriness. However, gold’s climb is far too fast. A period of consolidation is not to be ruled out.

Is it a Good Time to Buy Gold?

Having hit new all-time highs, it is a good time to buy gold now? Gold is currently in an uncharted territory. When a financial instrument hit record highs, every holder is sitting on profits. Few are willing to sell. Plus, new price highs will attract momentum traders. The combination of high demand and low selling pressure will push prices higher.

Of course, there are risks to this bullish scenario. The White House may, after suffering intensifying political backlash, decide to reverse all its previous policies. This could lead to higher risk appetite and causes gold to lose its shine.

For new buyers, scaling into gold would be a better strategy rather than buying it all at one shot. After all, gold is a long-term investment.

In the US, the largest and oldest gold ETF is SPDR Gold (ticker: GLD). An equivalent in the UK is iShares Physical Gold (ticker: SGLN).

What about Silver?

One often overlooked precious metal is silver.

Frequently dubbed ‘poor man’s gold’, silver has been underperforming gold for some time. While gold had already overcame its 2011 resistance peak price a while back, Silver is still struggling to clear even $40. A long-term ratio chart of gold-vs-silver below shows how much silver is lagging.

But silver tends to catch up with gold eventually. The metal exhibits significant high-beta moves at the tail end of precious metal bull market. Prices spiked to $50 in the previous upswing.

Therefore, given the current silver price, there is plenty of upside scope to catch up with gold. Some exposure here in a portfolio are desired.

In the US, the largest silver ETF is iShares Silver (ticker: SLV). An equivalent in the UK is iShares Silver (ticker: SSLN).

What is the Gold Forecast in Months and Years?

Gold is a slow-moving asset. Unlike Nvidia or Broadcom, gold does not do 10x quickly. It is a relatively stable asset, albeit with occasional violent price moves due to speculative funds moving in and out quickly.

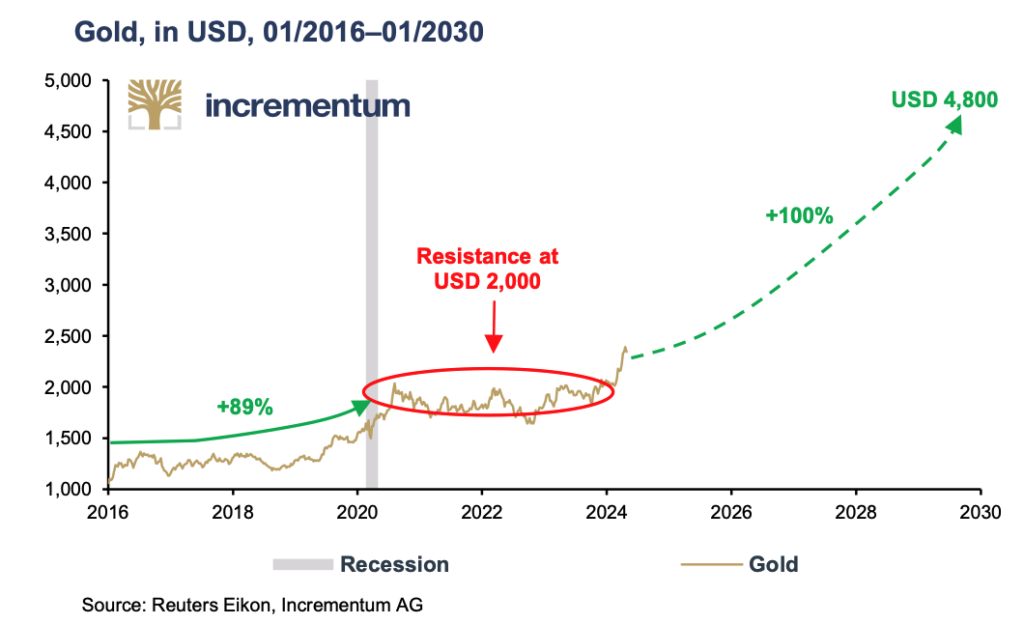

Given gold’s recent bullish price moves, its outlook is naturally positive. According to some long-term industry observers, gold may extend its bull run all the way to $4,000 by the end of the decade (see below).

But this could be an overly simplistic view of gold trend. Like most asset prices, gold will exhibit sharp corrections, unexpected pullbacks, and violent price swings along the way. The path towards $4,000 may take longer than expected. Therefore, suitable position sizes of gold within a diversified portfolio are advised.

Source: In Gold We Trust (Incrementum) (2024)

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.