BAE shares are trading at all-time highs so investors cannot be blamed for wanting to sell and lock in nearly 100% profits over the last five years. In this analysis I look at the rise of BAE Systems’ share price and if now is a good time to hold or buy more and keep riding bull run.

Buy when the cannons roar

Said Barron Rothschild…

War destroys, on a massive scale. A quick glance at the horrifying images from Ukraine tell you all you need to know about modern warfare. The high level of carnage requires a gigantic amount of weaponry. Tanks, guns, batteries, drones, firearms, assault vehicles – the whole lot.

War, therefore, is a ‘growth catalyst’ for weapons manufacturers. Decades ago, US President Eisenhower warned about the “military-industrial complex”. While this problem has abated somewhat in recent years, nonetheless war is good for companies that make weapons.

BAE System is one of these companies that supply a host of air, maritime and electronic military systems. Formed in 1999 through the merger of British Aerospace and Marconi System, BAE is currently the largest defence contractor in the UK and one of the biggest defence companies in the world. Last I checked, BAE’s market capitalisation is worth more than £32 billion – the 16th largest stock in the FTSE 100.

Government’s Golden Share

Despite being a publicly-listed company, the UK government retains a ‘golden share’ in BAE. This is to prevent a foreign takeover of a critical company.

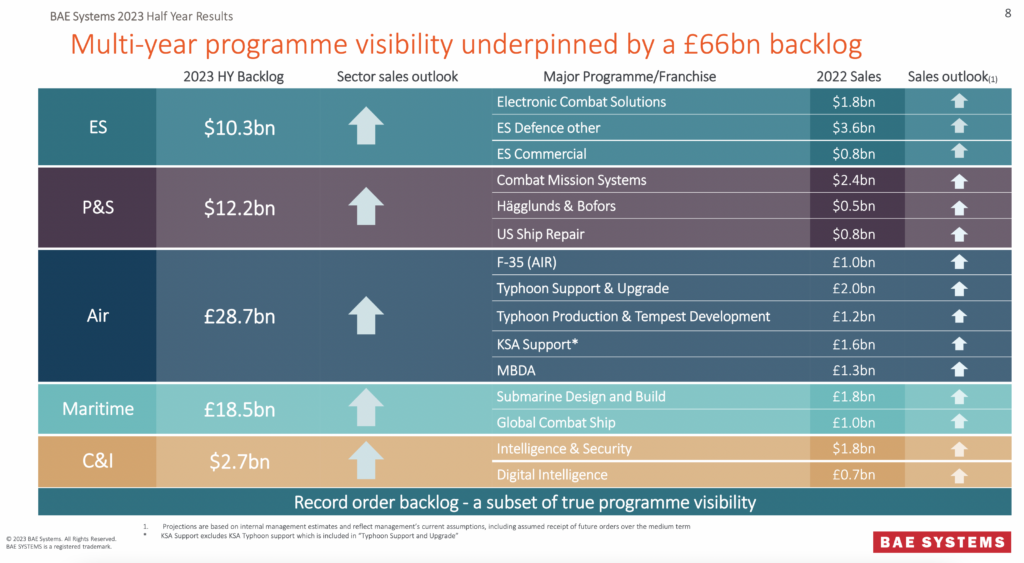

Revenue for the manufacturer is a strong £12 billion for 1H of 2023; free cash flow totalled £1 billion. BAE is a profitable firm with plenty of backlog on its order book.

According to BAE’s latest presentation note, it recorded a £66 billion backlog of orders that are spread among various departments in the future (see below). Last but not least, BAE is a partner in the joint-strike F35 fighter program.

Source: BAE System

Sell when you hear trumpets

Concluded Barron Rothschild…

Despite the bullish outlook on the defence sector, should investors offload some BAE shares?

Since the war in Ukraine began, shares in BAE have been rising nonstop. The upside breakout from 600p in March 2022 led to a multi-quarter uptrend. Month after month, the stock hit new all-time highs.

Moreover, prices have recently cleared the psychological 1,000p resistance (after three attempts). With no obvious technical resistance, this indicates that BAE’s rally may only stop at the next big round number level near 1,200p or 1,500p (see below).

Psychologically, I suspect investors here are happy with the way things are progressing for the company. Rising geopolitical tensions worldwide are causing big customers – that is, governments – to upgrade their weapon arsenal. Note this: middle-east customer clients account for 17% of BAE’s sales. The recent new conflict there will only fuel more orders.

Buy, sell or hold?

Should one, then, use this price strength to sell some shares?

The technical setup of BAE is bullish. But having risen so far for so long, yes, it may be prudent to book some profits. Just look at how Raytheon (RTX), BAE’s US counterpart, performed in recent months. Prices slumped by 30%.

And of course, tensions could wind down in 2024 – when all parties concerned decide that ‘jaw, jaw is better than war, war’.

On balance, I would still keep some shares in BAE though. Selling a positive momentum stock usually leads to deep regret when prices appreciate further. Trailing stop losses may be a good idea to help you stick with the trend and then jump off the bandwagon when prices start to sag.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please ask a question in our financial discussion forum.