Avacta Life Sciences Group Plc (www.avacta.com) is a small-cap biotech company. Two key divisions support the health company: Oncology drug development (Therapeutics) and Diagnostics. The latter is about expanding the in-vitro diagnostics business to support the medical profession; while the former is about leveraging its proprietary pre|CISION and Affirmer platforms to develop cancer therapies.

What makes Avacta Group PLC (AIM:AVCT) a good investment?

What is interesting about the AIM-listed biotech is that the management is growing both divisions. First, Avacta’s cancer drug development has entered into clinical trials. In particular, AVA6000, a tumour targeted form of Doxorubicin, is undergoing multiple clinical trials (since 2021). Phase 1 has been completed earlier this year.

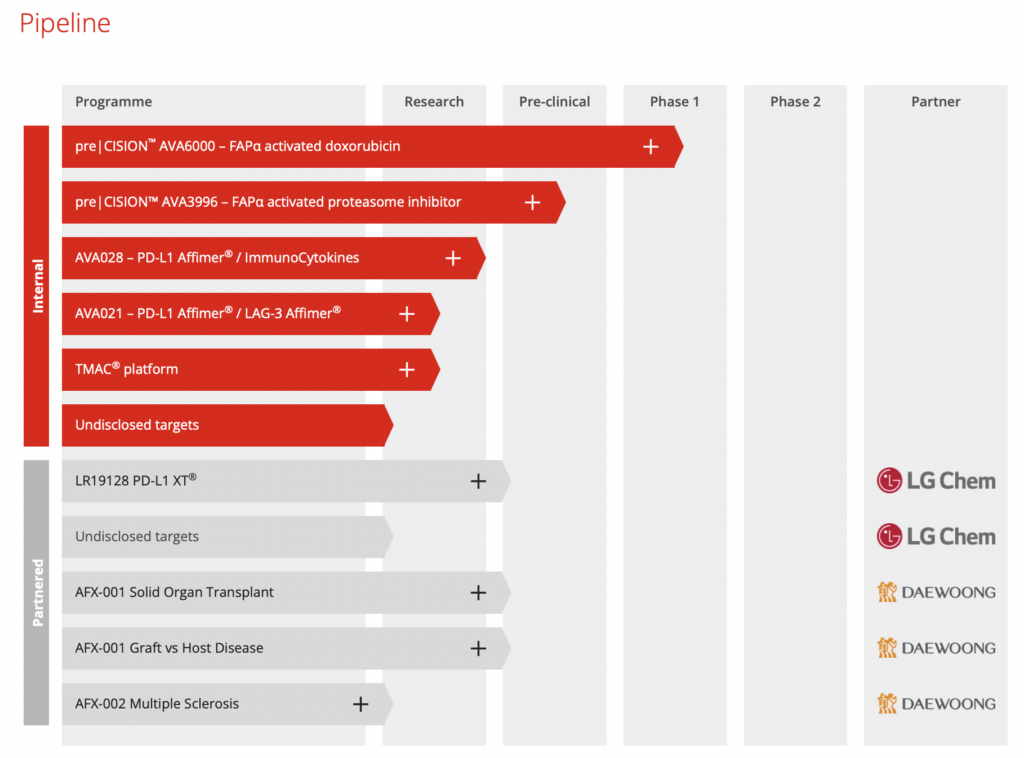

Avacta also have drug development partnerships with LG Chem and DaeWoong Pharmaceuticals; the latter using AVCT’s Affirmer technology.

In other words, the £340-million company has some interesting products in the pipeline that could be of interest to deep-pocketed Pharma/biotech company. A quick chart of Avacta’s clinical pipeline is most helpful at this point:

Source: Avacta plc

Drugs development aside, the biotech is pursuing M&A-led growth strategy in the diagnostic division.

About a year ago (Oct ’22), the company bolstered its balance sheets by £61 million through a combination of debt (convertible bonds) and new equity.

Part of this capital was employed to take over the UK-based IVD distributor LaunchDiagnostics (at a cost of £24 million). In the middle of the year, Avacta bought Coris BioConcept (for £7.4 million) to expand its full spectrum of IVD business.

Therefore, the company under the leadership of Alastair Smith is fast-growing biotech that may yield profitable results to long-term investors.

Pros and Cons of Investing in Avacta

The pre-product biotech sector is a notorious industry to invest in – primarily due to the sudden burst of volatility in its business. Should you, then, invest in the Avacta Group?

Here we list some of the pros and cons of buying AVCT shares:

- A promising biotech company with a focus on growth in cancer drugs development and diagnostics business

- Clinical trials in AVA6000 (and others) may pique the interest of major biotechs

- Partnerships with multiple pharmaceuticals

- There have been rumours of an Avacta takeover, so investors are “buying the rumour, selling the fact”

However, the downside risks for AVCT are clear:

- Results from its clinical trials may disappoint the market in the future

- Revenue remains minuscule (£9.7 million) compared to its market cap (£340 million). Operating losses for the year ending 2022 totalled £39.5 million.

- If an Avacta takeover does not emerge, the share price will fall

While the company has raised some capital last year, at this rate of losses we wouldn’t discount more capital raises over the medium term. This could dilute the equity further.

Technical and market outlook for Avacta Group

To profit from a stock, you need the market to agree with your bullish thesis. In other words, a stock might be worth £X in your book. But if the market does not agree with this optimistic scenario at all, you might find it hard to make money on the stock as its share price languishes.

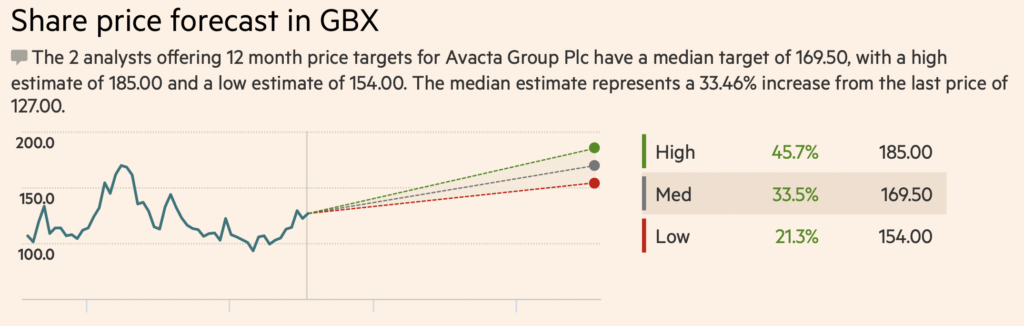

What is the market outlook for AVCT? According to some City forecasts, brokers are mostly bullish on the stock. The median estimate is about 170p. However the sample of analysts is low (2-3), which is normal for a small biotech company.

Major fund managers typically only allocate a small percentage of their funds in small-cap biotech companies due to risk. In Avacta’s case, just two institutional shareholders owned more than 3 percent of the company’s equity (Conifer Management 4.4% and Ballie Gifford 3.7%).

Source: Financial Times (paywall)

Turning to Avacta’s share price trend, it is noticeable that it is currently trading in a range (100p-140p).

Two excursions outside this band – one in early 2022 and another in 1Q 2023 – were quickly pulled back into this range. This makes its share price interesting because one may need to take a ‘contrarian’ view to buy this share. That is, you wait for a pullback into double digit to buy as, based on its recent trading pattern, prices are likely to bounce back up.

The alternative stance is to hold back until an upside breakout (around 145p) before commencing trading buys.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com