VinFast Auto (VFS) achieved a stunning valuation of $200 billion in August 2023 when its share price rocketed. After a 80% decline, it is time to buy this new wonder stock?

The Rise of VinFast Auto

The arrival of VinFast in Nasdaq last month shattered the boredom of a quiet August.

The tale began when VinFast Auto (VFS) listed in the US Nasdaq exchange via a blank-cheque company (commonly known as SPAC). To facilitate this IPO process, Vietnamese automaker migrated its registered headquarter to Singapore a few years back. While VinFast’s main market remains in Vietnam, VinFast has started selling EV cars in the US (vinfastauto.us). The listing was completed on 15 August. So far, so good.

On 28 August, VinFast achieved a milestone that many listed companies could only dream of. At the closing price of $82.35 a share, VFS’s valuation soared to a staggering $190 billion. Intraday peak market capitalisation saw VinFast zoom north of $200 billion – a valuation tag that make the six-year-old company worth as much as major Shell Plc (SHEL).

Last I checked, Shell the oil behemoth generated in the last quarter some $5 billion in profits. VinFast? A measly revenue of $83 million in the last three months; net loss totalled $598 million. Safe to say that you can not find a wider disparity in valuation and fundamentals anywhere else in the world. Jim Chanos promptly labelled VinFast a ‘$200-billion meme stock’.

Many are right to wonder: Has the Meme craze returned? More importantly, is this a one-off episode or there are more VinFasts in the pipeline?

Limited float of shares

What exactly caused VFS stock price to spike in the first place? A few reasons. First, the free float of VFS’s shares is extremely limited.

According to the VinFast’s SEC registration document, 99% of its stock is held by billionaire Pham Nhat Vuong (of VinGroup). Extreme price volatility is almost guaranteed when a listed company’s free float is this narrow.

Early stage

Second, VinFast is a young electric-vehicle maker (tick: right industry) based in Vietnam (tick: right country). The ongoing Green Revolution often propelled investors into these new energy/green industries because they are expected to grow faster. Many are fervently searching for the ‘next Tesla’. When a new EV turns up, hot money flocked into it.

Hot sector

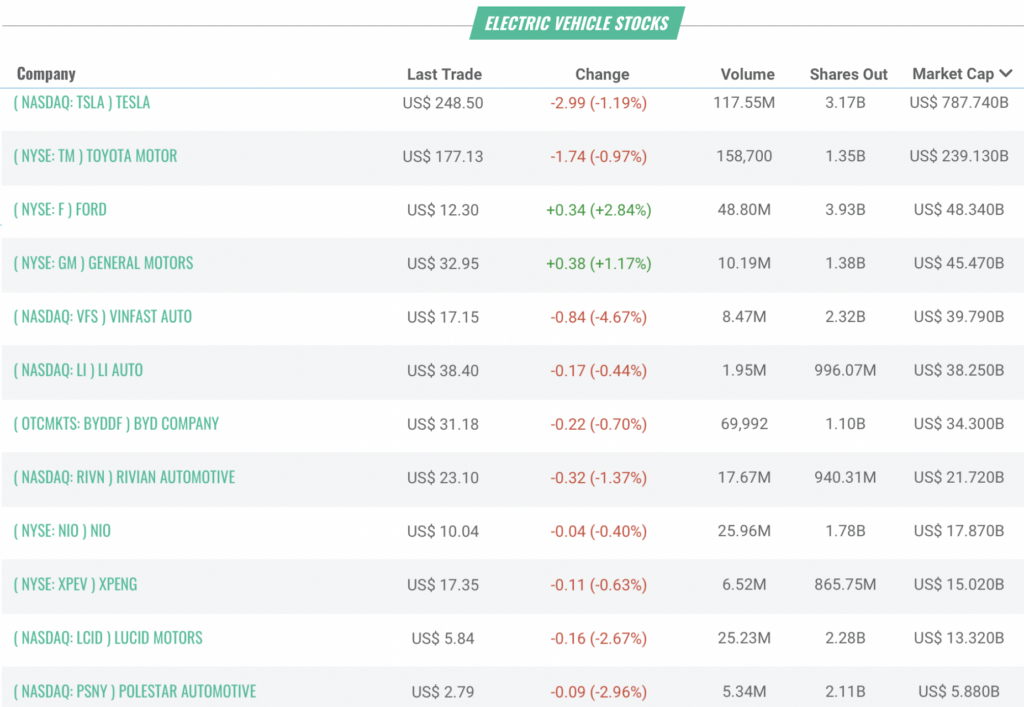

The last point is that the entire EV sector had a relatively good 2023. Tesla (TSLA) rebounded 200% from its 2022 lows; Chinese EVs stocks Li Auto (LI) and XPeng (XPEV) surged by more than 100%. Against this relative benign backdrop, investors are more than willing to bet on another emerging EV stock.

The (Predictable?) Fall

While a stock can defy gravity for a while, eventually the laws of physics reassert.

Since closing above $80 in late August, VinFast couldn’t hold onto its gains. On 29 August, share prices plunged by a stunning 45%. Then, the stock developed seven bearish candles in a row (see above).

Volatile

Prices closed last week at $17 – thus cementing a peak-to-low drawdown of 79%. Such wild drawdowns are not uncommon in the stock market. But VinFast’s pace is. In just fourteen trading sessions, VinFast rose 400% and then drop 80%. So much for the ‘efficient market hypothesis’.

The question now is whether VinFast will become the next Tesla. For now, that scenario appears a little far fetch. First of all, Tesla took nearly a decade, under the stewardship of Elon Musk, to reach $200 billion in market capitalisation. VinFast reached this in just two weeks post IPO. The market is pricing in a very optimistic view of VinFast’s business. Perhaps a tad too optimistic.

Competitive sector

Second, VinFast is operating in one of the most competitive industries in the world: Automobiles. Here scale, cash and new technologies are essential to success. Can VinFast design, make and sell cars fast enough to justify its wild valuation?

I’m not so sure.

Just a quick comparison. BYD’s market capitalisation is about double that of VinFast’s now: $95b vs $40b. But here is a telling stat, BYD sold 1.1 million EVs in 1H of 2023. VinFast sold just 22,ooo cars last year.

In a nutshell, the valuation thesis for VFS is still very bullish even after a 80% share price decline. In fact, VFS is still ‘priced for perfection’. Can VinFast maintain this elevated valuation? Certainly not without a huge dose of positive factors. Even then, I would not rule out further price drops when investors realise how much more capital VinFast needs to sell cars like BYD.

VinFast’s rise and fall shows you the danger of buying into a hype. When a ‘story’ is too good to be true, it often is. VFS’s steep decline may attract some brave traders search for a bounce; long-term oriented investors, however, should look elsewhere.

Source: Greenstocknews.com

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com