- Online streaming powerhouse Netflix reports better-than-expected 2022 results

- Founder-CEO Reed Hastings is leaving the company

- Netflix stock rebounds but still trades significantly below its all-time highs

Netflix (NASDAQ:NFLX) is a true disruptor in the entertainment and technology industry. It revolutionised how we watch movies forever. After growing relentlessly in the 2010s, during which shareholders reaped fantastic rewards, will this decade be more of the same even though CEO Hastings is stepping down?

If there is a ‘Stock of the Decade’ award for 2010-20, Netflix (NASDAQ:NFLX) would be a strong contender. The online streaming firm disrupted the entertainment and technology industry by toppling the former champion – Blockbuster (now bankrupt).

Wall Street loved stocks like these. Early on, Netflix was part of the elite tech stocks called ‘FAANG‘ – big technology giants that move industries and shape our lives. Investors who bought Netflix in the early days made a fortune.

Netflix’s share price soared from $7 in 2010 to $700 just ten years later – a 100-fold return. Very few stocks produced returns of that magnitude.

But is Netflix still a buy? Looking back, 2022 was an ‘annus horribilis’ for the company. Its lofty share prices went into a tailspin after results underperformed expectations. From $600 per share, it crashed to a low of $150 – a three-quarter drop.

While prices have started to recover (trading at around $310 in early January 23), it is still way below the pandemic highs.

Some say Netflix is no longer the ‘golden stock’ that it once was. The primary reason is that competition is heating up.

Big entertainment firms like Disney are now spending billions to take advantage of the growing streaming industry. And the advantageous impact of the pandemic is fading. We no longer ‘binge-watch’ Netflix movies. As such, Netflix’s global audience is not going to rise as fast as previously assumed. Lastly, the risk of a recession lurks in the background. This will squeeze spending on Netflix. Now, founder-CEO Reed Hastings is stepping down – a move that may create some turbulence at the top.

- Investing guide – How to invest in a recession

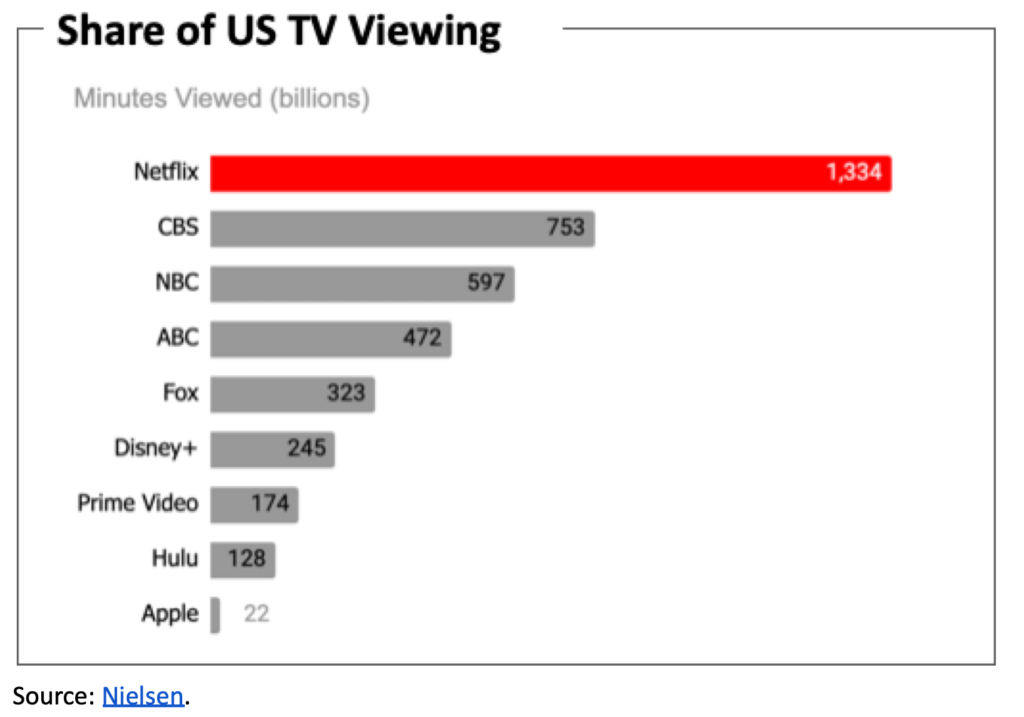

That said, Netflix will remain a powerhouse in the entertainment industry for the foreseeable future. Its share of the TV is No 1 (see below). The firm is continuing to make blockbuster programs (Squid Game – Netflix’s top-viewed program in 94 countries!). Yes, the stock has plunged, but it may rebound when the bullish sentiment returns.

Just this week, Netflix released 4Q results that are surprisingly better than the negative market expectations.

“In 2022,” the company announced “we finished with 231M paid memberships and generated $32B of revenue, $5.6B in operating income, $2.0B of net cash from operating activities and $1.6B of free cash flow (FCF). In 2023, we expect at least $3B of FCF, assuming no material swings in F/X.“

We are not going to write off Netflix just yet.

Source: Netflix

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com