-

Reviews By

Richard Berry

Reviews By

Richard Berry

- Updated

Money transfer apps are the quickest and cheapest way to send money abroad, with better exchange rates and less admin fees than banks.

| Name | Logo | Currencies | Min – Max | GMG Rating | User Reviews | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

Currencies 50 |

Min – Max $1 – $1m |

GMG Rating |

User Reviews 4.5

(Based on 217 reviews)

|

Account Types:

|

Wise won “Best Money Transfer App” in the 2024 Good Money Guide Awards because of its low costs, simple-to-use app, and range of currencies.

Wise Won Best Money Transfer App in the 2025 Good Money Guide Awards Provider: Wise Verdict: Wise is one of the best (and cheapest) money transfer apps for sending currency abroad since it pioneered peer-to-peer (P2P) low cost international payments. Wise helps people send money abroad for much less than it would cost to do it through a high street bank. It was launched as TransferWise in 2011 as a P2P currency network, but has since grown to provide money transfers to over 15 million customers sending more than £9 billion a month. Is Wise a Good Money Transfer App?

But in a nutshell… Should you use Wise? Yes. Is it cheap? Yes. Is it easy to use? Yes. Is it safe? Yes. Since Wise was founded back in 2011, I’ve followed its progress. There are many firms that shout loudly about wanting to disrupt an industry. But most of the time, it’s marketing hyperbole. However, in Wise’s case, it has disrupted how we send money around the world – by making it cheap and making it easy. The only reason not to use Wise is if you already bank with Starling, as the fees are pretty similar and you probably don’t want another app on your phone if you don’t need it. Truly DisruptiveA few years ago, before Wise was founded, I wanted to send €30 to a friend in Munich. It was an absolute nightmare. I was banking with NatWest, which wanted £20 as a minimum fee for sending the money to a European bank account. Next I tried PayPal – still expensive. So I withdrew €30 in cash from a Euro cash machine in London, put it in an envelope and sent it through the post. The only other option was the inconvenience of visiting a Western Union shop. Thankfully along came TransferWise. It was a boom time for money transfer apps but this one had the best story: it was circumventing “evil” banks by transferring money abroad using P2P networks. If you needed to transfer €30 to Germany, it matched you with someone in Germany who wanted to transfer €30 to England. No need to do any FX, and therefore less in fees to pay. It also had fantastic marketing – for example stripping off to the pants in front of the Bank of England to protest “rip-off” banking charges. It was a stroke of genius, really, as British people love seeing naked people, and hate banks. Of course liquidity gaps need to be filled when there isn’t someone on the other side of your transaction and TransferWise used firms like Currency Cloud (now owned by Visa) to ensure that customers always got the best price. Richard Branson was also an investor. So there you go. Over the years, Wise as grown by being easy to use and charging low fees. How Does Wise Work?Wise offers international money transfers and a multi-currency account with a pre-paid card. You can send 40+ currencies to 160+ countries, and hold 40+ currencies in a Wise account. You can pay into your Wise account by debit card, credit card or bank transfer. If you have funds in a multi-currency account, you can use those to fund a transfer when sending money abroad. And you can choose to lock in a rate for up to 48 hours. Wise says international transfers typically arrive in seconds. Wise matches up buyers and sellers of currency in different countries, rather than physically transferring money internationally. Wise Customer ServiceWe’ve marked Wise down a bit as it doesn’t provide a telephone number. This is fine for small transactions but if you’re sending a large amount of money abroad, you may be better off using a currency broker. Wise does offer a call back service for amounts over £80,000, though. With a broker, you can phone up an account executive or dedicated dealer, who can provide updates on your transfer or help out immediately with any issues. But all in all, Wise customer support, is fairly efficient. Is Wise Safe?Wise is about as safe as you can get for sending small amounts of money abroad. Wise is not a bank – it doesn’t have a banking licence in the UK but is authorised by the Financial Conduct Authority as an “e-money business”, which means funds are ring-fenced but not protected by the Financial Services Compensation Scheme (FSCS). Wise is listed on the LSE (LON:WISE) with at market cap of around £9.6 billion, as at January 2026. That is well up from where it was at its IPO, but even though lots of tech firms listed in 2021, it was a pretty bad time to come to market, and most have performed poorly since then because of overall market conditions and over ambitions venture capitalists wanting a return on their investments. So the stock markets also think Wise is pretty good. Since TransferWise launched, the group has grown to provide money transfers to over 15 million customers sending more than £12 billion a month. It’s a shame it is planning on ditching the London stock markets for the glamour of high valuations in the US. Using a listed app is helpful as you can see how it’s faring financially. If the Wise share price starts to go down, this could indicate potential financial problems and be a sign to switch to a different app. Apps & PlatformWise makes it incredibly easy to transfer money abroad – the app is really simple to use. If you have a large amount of money to send, you’re better off with a currency broker because they can help with market timing and lock in exchange rates with forward contracts and currency options. Plus if you ask nicely and are transferring enough money, a broker might undercut Wise’s exchange rates and fees. Remember, that in FX, everything is negotiable. Wise is also venturing into other products, like multi-currency bank accounts and investing. PricingWise is among the cheapest money transfer apps and it displays the fees clearly on the website and app, but it’s not the absolute cheapest. We found Atlantic Money offering GBP-USD transfers at the interbank rate plus £3. But I suspect that isn’t sustainable and it’s only one corridor, while Wise offers 21 currencies. If you want to know more about Atlantic Money, you can read my interview with the founders, Neeraj Baid and Patrick Kavanagh (who helped build Robinhood), and make up your own mind about the service. Research & AnalysisWise doesn’t really have any currency forecasts, which is fine because exchange rates are hard to predict. But it would be nice to have at least some commentary on the markets. We’ve given Wise a mid-ranking for research and analysis as it does provide lots of excellent guides online and has a good insight tab on the app which can help you see where your account money is being spent. If you want currency forecasts, you can read our regularly updated analysis of whether now’s a good time to buy USD or EUR. Is Wise a Bank?No. The company does not hold a UK banking licence and your balance is not protected by the FSCS. However, like a bank, Wise will pay you interest on your cash balances at arate of 3.32% on GBP, 1.72% on EUR and 3.51% on USD, Wise is primarily a low-cost international money transfer app that allows you to save money when sending money abroad. However, Wise provides some of the features that banks also provide, such as holding and exchanging multiple currencies, and sending and receiving payments. And you can have a multi-currency account with a pre-paid debit card. The firm is authorised as an “e-money” provider, which means your money has some protection but not as much as it would have with a bank. Money in bank accounts is protected by the FSCS guarantee, which covers balances up to £120,000 per eligible person, per bank. Wise lets customers send payments to more than 160 countries and spend internationally with the Wise card. Local bank details are provided for up to 9 currencies including US dollars, pounds sterling and euros. If you are looking for a bank account in the UK, you can see a list of current bank account switching offers here. Pros

Cons

Overall4.2 |

|||

|

Currencies 33 |

Min – Max $1 – $250k |

GMG Rating |

User Reviews 4.6

(Based on 511 reviews)

|

Account Types:

|

Revolut offers fast, affordable international money transfers to 160+ countries with competitive exchange rates and no hidden fees. Users can send via bank account, card, or Revolut-to-Revolut instantly, with clear in-app pricing. Transfers are often quicker than traditional banks, card transfers can arrive in seconds, and SEPA payments in minutes. Revolut also compares well against rivals like Wise and Western Union, often delivering more money to the recipient. However, fees may apply outside weekday fair usage limits, and intermediary banks can still charge. Premium plans offer higher limits and perks but come with monthly costs. |

|||

|

Currencies 75 |

Min – Max $1-$5k |

GMG Rating |

User Reviews 4.5

(Based on 26,022 reviews)

|

Account Types:

|

Remitly Review Provider: Remitly Verdict: Remitly is a low-cost money transfer app that was founded in 2011. Since then it has grown to service over 4.5 million active customers transferring money to 13 different countries. Remitly went public in 2021, and it’s shares are listed on the NASDAQ exchange valuing the company at around $4.9bn. Summary Remitly is a cheap and easy way to send small amounts of money abroad. Especially if you are a new customer, as you get better exchange rates on your first £1,000 sent abroad. Pros

Cons

Overall3.8 |

|||

|

Currencies 98 |

Min – Max $1 – $500k |

GMG Rating |

User Reviews 3.9

(Based on 117 reviews)

|

Account Types:

|

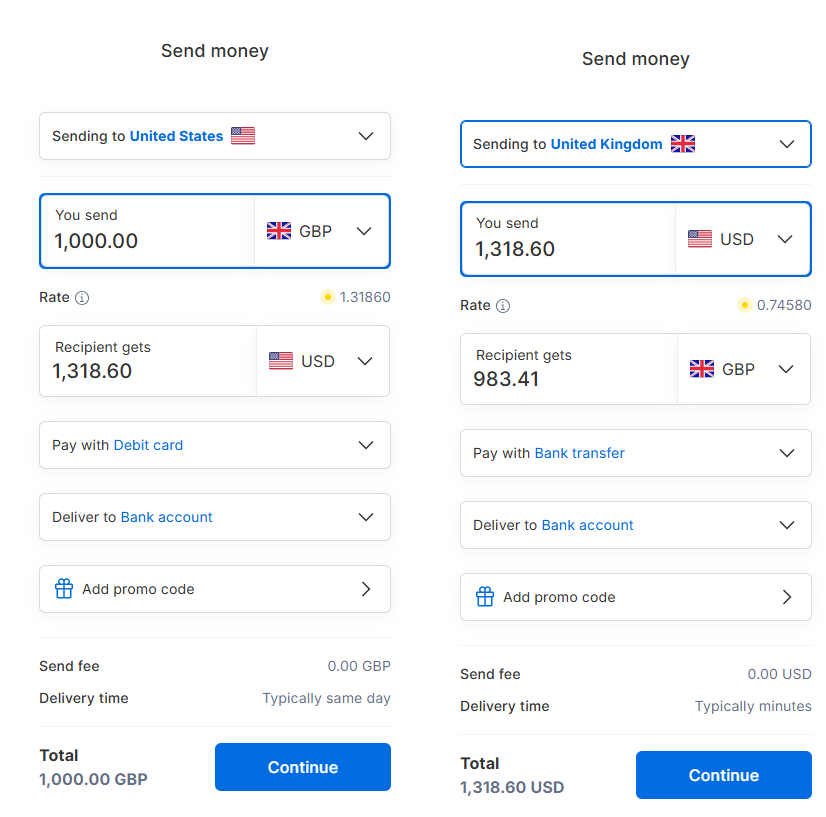

Xe Money Transfers Expert Review Provider: Xe Verdict: Xe started off life as an online currency conversion calculator, then started flogging the data to currency transfer providers, then in 2002 decided to compete with all it’s customers and offer online money transfers (which it provides through HiFX in the UK. At the time, HiFX was one of the largest money transfer providers in the UK, but as Xe.com is one of the largest currency conversion calculators in the world (in the top 500 websites by traffic) HiFX decided to rebrand to Xe. Is Xe a good international money transfer app? Xe is a good option if you are looking for cheap no no-frills, small to medium-sized currency transfers from a trusted and well-established brand. However, if you have a large amount of currency to transfer and need personal service, you are better off with a currency broker. I’ve always liked Xe.com, the website has always been an excellent resource for currency information. But ever since they were bought by Euronet under their HiFX brand in 2017 you can now use them for international currency transfers. They offer loads of currencies, a slick app, and the ability to send money by debit, credit card and bank transfer to other bank accounts, to be picked up as cash or to a mobile wallet. As international payments have grown in popularity you can also use them for business international payments. Is Xe cheap for international money transfers? I’m not sure Xe is as cheap as it used to be. When I was testing the app it looks like Xe exchange rates are around 1% from the midmarket. When I requested some quotes, the midmarket was 1.3294 for GBPUSD, and Xe quoted me 1.3186. Doing it the other way round, the USDGBP rate was 0.7522 and Xe quoted 0.7458 (about 0.85%) away from the mid-market. It’s a bit frustrating that money transfer apps are still hiding fees in the exchange rate market up (read my guide on how to compare exchange rates here). Especially when it says there is no send fee. Granted, “Send Fee” and “Exchange Rate Market Up” are two different things, but it still stinks.

Is Xe safe for money transfers? Yes, we rate Xe.com as a safe way to send money abroad as they have been established since 1995, owned by a larger parent company and are authorised by the Financial Conduct Authority under the Payment Services Regulations 2017, registration 462444, for the provision of payment services. Who owns Xe.com money transfers? Xe.com is ultimately owned by Euronet Worldwide Inc, which is a public company listed on the NASDAQ with the ticker code EEFT. Xe.com is managed by HiFX, which acquired XE.com in 2017. Prior to this HiFX only offered money transfer services for business, but the acquisition enabled them to offer individual currency transfers. You can see thier share price and how much they are worth below.

Pros

Cons

Overall3.8 |

|||

|

Currencies 130 |

Min – Max $1 – $50k |

GMG Rating |

User Reviews 3.8

(Based on 123 reviews)

|

Account Types:

|

Western Union Review Provider: Western Union Verdict: Western Union lets you send money to more than 200 countries around the world. It was founded in 1851 in Rochester, New York, and was named the Western Union Telegraph Company when the New York & Western Union Telegraph Company merged with the rival New York and Mississippi Valley Printing Telegraph Company in 1856. It was a pioneer in transmitting telegrams and in 1871 it introduced a money transfer service through its extensive telegraph network. It stopped sending telegrams in 2006 and now offers money transfers to almost every country in the world. Today it has 150 million retail and digital customers with its headquarters in Denver, Colorado. Summary Western Union has made a real effort recently to modernise it’s app and reduce exchange rates and fees to compete with new start-ups. Still, one of the best ways to send cash abroad and now very competitive for smaller electronic transfers. Pros

Cons

Overall4.1 |

❓ Methodology: The Good Money Guide review team brings you the best money transfer apps based on:

- Our 20 years in the foreign exchange industry

- Over 30,000 customer votes in the exclusive Good Money Guide awards

- Interviews with the money transfer CEOs and senior management

- Hands-on, thorough analysis and testing of the money transfer apps and pricing

Compare Money Transfer App Exchange Rates

Use our money transfer app exchange rate comparison tool to request quotes from multiple providers and see how you could save up to 4% on large USD currency transfers versus using your bank when you send money abroad.

Yes, Wise is one of the cheapest and easiest ways to send money abroad. Highly recommended. Wise also won Best Money Transfer App in the 2025 Good Money Guide Awards.

Yes, Wise is one of the cheapest and easiest ways to send money abroad. Highly recommended. Wise also won Best Money Transfer App in the 2025 Good Money Guide Awards.