Salik is the operator of toll gates across a growing number of Dubai’s highways. Using RFID technology, drivers are automatically charged a few dirhams every time they pass through one of its 10 gates. With no stopping or scrabbling for the right change, that goes a long way to explaining the name Salik, which means “clear” or “open” in Arabic.

DFM listing

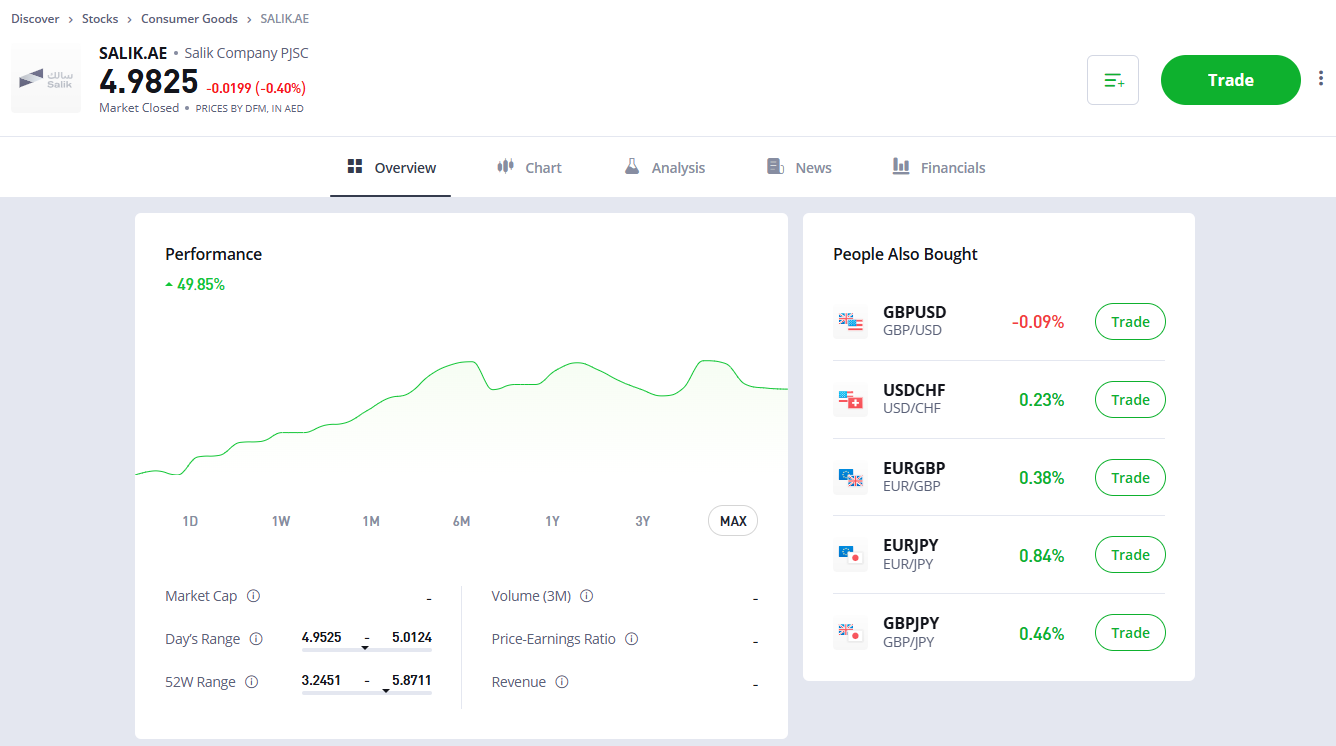

The company took a listing on the Dubai Financial Market in September 2022, with shares being priced at Dhs2 on their debut. After a first-day jump higher, the stock saw reasonably steady gains over the next two years, but with only a small number of key fundamental drivers – such as the number of gates in operation, the level of toll charged and the concession fee paid back to the state – adjustments to Salik’s profitability are inevitably well telegraphed.

With that in mind, it’s perhaps no surprise that gains for the share price began to accelerate in August 2024 with the announcement that two new toll gates would be added (they came on line in November 2024). A subsequent declaration of a shift to variable toll pricing – also announced in November 2024 and rolled out in January 2025 – meant that users would pay higher charges during rush hour, and nothing overnight.

A turbocharged quarter of returns

Salik pays a concession fee of between 15% and 25% of the toll revenue, with this charge having dropped to 22.5% in 2024. On the basis that Salik is charged with ensuring traffic in the emirate flows freely – and with an ever growing number of road users – there was clear justification behind the share price action last year. Between August and November 2024, the share price added more than 60% to reach a record high of Dhs5.53, but further progress has been muted. Is the change of pace warranted?

Notably, over the last four years, profit margins have been squeezed and with 100% of profit having been paid out in dividends in 2023 and 2024, some caution amongst investors, paired with questions from analysts, could be acting as a brake on performance.

A hugely popular stock

Salik is one of the most actively traded stocks in the UAE and plays a key part in the lives of the majority of those living in or visiting Dubai. In 2024, 4.3 million cars were registered on the Salik system, with almost 500 million revenue generating trips having been undertaken that year. And growing GDP – alongside a growing population – will inevitably feed into higher rates of urban mobility, fuelling demand for road usage.

So whilst Dubai continues to expand public transport infrastructure, the appeal of using a private vehicle in what for much of the year can be a very challenging climate isn’t going to disappear anywhere fast. With the transparency over the toll concession fees, an asset light operating model and a pricing structure that allows for tolls to increase or the concession fee to fall to offset inflationary pressures, this has the potential to be a classic utility stock that would only be knocked off track by a material collapse in demand – or a runaway increase in operating costs.

Analyst cynicism overblown?

Gulf News pointed out that analyst comments have been circulating recently to suggest how at current levels, using a simple P/E ratio, the stock looks overvalued. But given the tailwinds and the fact that success for Salik is vital if Dubai traffic is to remain as free-flowing as possible (as a frequent visitor myself, I can easily see the case for more tolls to be added and dynamic pricing to become significantly more sophisticated), the combination of an asset-lite model and strong forward revenues where there’s very limited scope for the concession fee to increase in the near term position the business as a proverbial cash cow. Are investors asleep at the wheel?

How do you buy shares in Salik?

To buy shares in Salik, you need an account with a UAE trading platform like eToro that offers access to companies on the DFM exchange.

Tony Cross is a seasoned market commentator with over 15 years of experience, delivering engaging and insightful content for both journalists and investors. Specializing in macroeconomics, UK blue-chip equities, and intermarket analysis, his commentary is highly valued for its clarity and its knack for eliminating unnecessary jargon.

You can contact Tony on tony@goodmoneyguide.com