Is Dubai Energy and Water Authority (DEWA) a good investment?

As the name suggests, this is a key utility provider for the Emirate of Dubai. DEWA is in short the public infrastructure company charged with keeping the lights on and the taps running. Founded in 1992, the company IPO’d onto the Dubai Financial Market in April 2022, with the government offering 18% of the equity to external investors, whilst the remainder is held by the Dubai Investment Fund

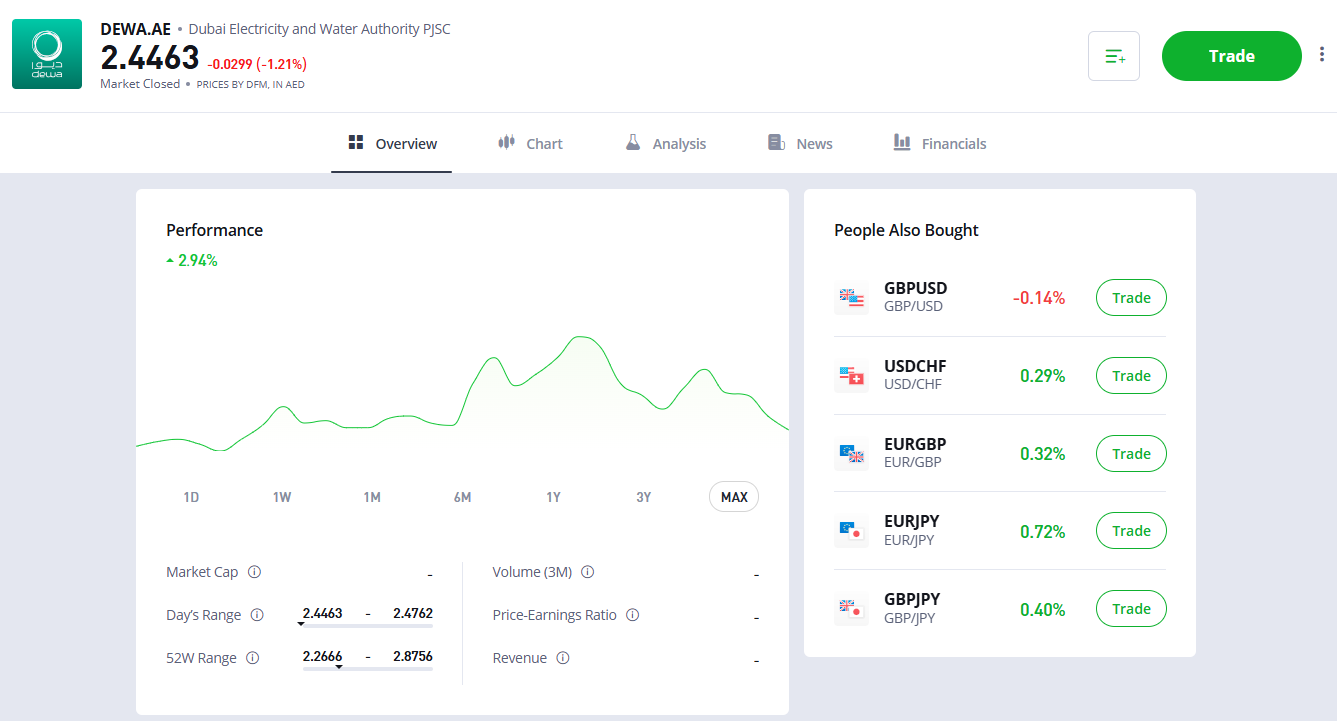

The share price history

The shares were priced at Dhs2.48 in an offering that was reported as being 37 times oversubscribed. A day one jump to just above Dhs3 followed, but those gains proved to be very short lived, with the shares trading within 10% of the Dhs2.5 level until late 2024. Global bull market enthusiasm then helped the valuation move towards those all time highs, but again this hasn’t been sustained, so capital growth is looking rather limited.

What about the dividends?

As with many companies in the region, there’s a heavy focus on the dividend payments which are being made. DEWA is no exception here and the company has committed to paying dividends twice a year. At IPO it was laid out to investors that they could expect to see an annual return of at least Dhs6.2 billion by way of a dividend, so against the current market cap of Dhs122 billion, that makes for a reasonable yield of just over 5%. The stock will next go ex-dividend on 28th March when a Dhs0.6 per share payment will be recorded.

Can the company grow from here?

As we have seen with many UAE listed, service-based businesses, growth is largely dependent on getting more customers, something that as a monopoly provider is made easier when the government is driving an agenda of population growth. In the latest set of earnings, published in February 2025, full year revenues grew by 6.1% whilst operating profits grew by 6.4% to reach a record high. Earnings per share stood at Dhs0.14, just a shade above the Dhs0.12 which was distributed to shareholders by way of a dividend, so the potential for capital accrual is limited, but so long as both the population and GDP continue to grow, there’s little cause for concern.

Sustainability at its core

Green agendas may be falling from favour right now, but DEWA has a clear commitment in using modern technology to create a sustainable company delivering sustainable growth. Investments in new facilities including the world’s largest single site solar park underline this ambition and the project is seen as “solidifying the UAE’s position as a global hub for renewable energy innovation”. DEWA appears to be an investment that it’s easy to make with a clean conscience.

A “buy and forget” stock, or one to trade in the short term?

Perhaps investing in DEWA is better considered as part of a balanced portfolio, rather than a moon-shot. The predictable dividend yield gives the investment a cash-like quality which has attracted so much interest in the UK’s utility firms. But with the government still owning a majority stake, directors do not need to be influenced by shareholder demands to load up on debt simply to boost cash returns in the short term. The utility sector is after all one that should act as a key pillar of a functioning society, something that in itself will be a fundamental driver in ensuring the longer term success of the Emirate as a whole.

As the investor relations pages of the website say, an investment in DEWA is seen as being an investment in the future of Dubai. Recent share price performance suggests that there may be some benefit in exploring medium-term swing trading strategies with the stock, but the company’s allure as a lower risk, defensive investment for the long term is difficult to ignore.

How to buy shares in Dubai Energy and Water Authority (DEWA)

To buy shares in Dubai Energy and Water Authority (DEWA), you need an account with a UAE trading platform like eToro that offers access to companies on the DFM exchange.

Tony Cross is a seasoned market commentator with over 15 years of experience, delivering engaging and insightful content for both journalists and investors. Specializing in macroeconomics, UK blue-chip equities, and intermarket analysis, his commentary is highly valued for its clarity and its knack for eliminating unnecessary jargon.

You can contact Tony on tony@goodmoneyguide.com