If you want to trade Crude Oil in the UAE you need a CFD broker like Capital.com, where you can trade contracts for difference on the price of crude oil. CFDs enable you to go long or short, so you can potentially profit from the crude oil price going up or down. As CFDs are an OTC product, you do not run the risk of taking delivery with a crude oil futures contract or being restricted by exchange minimums.

| Name | Logo | CFD Markets | Min Deposit | GMG Rating | Customer Reviews | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

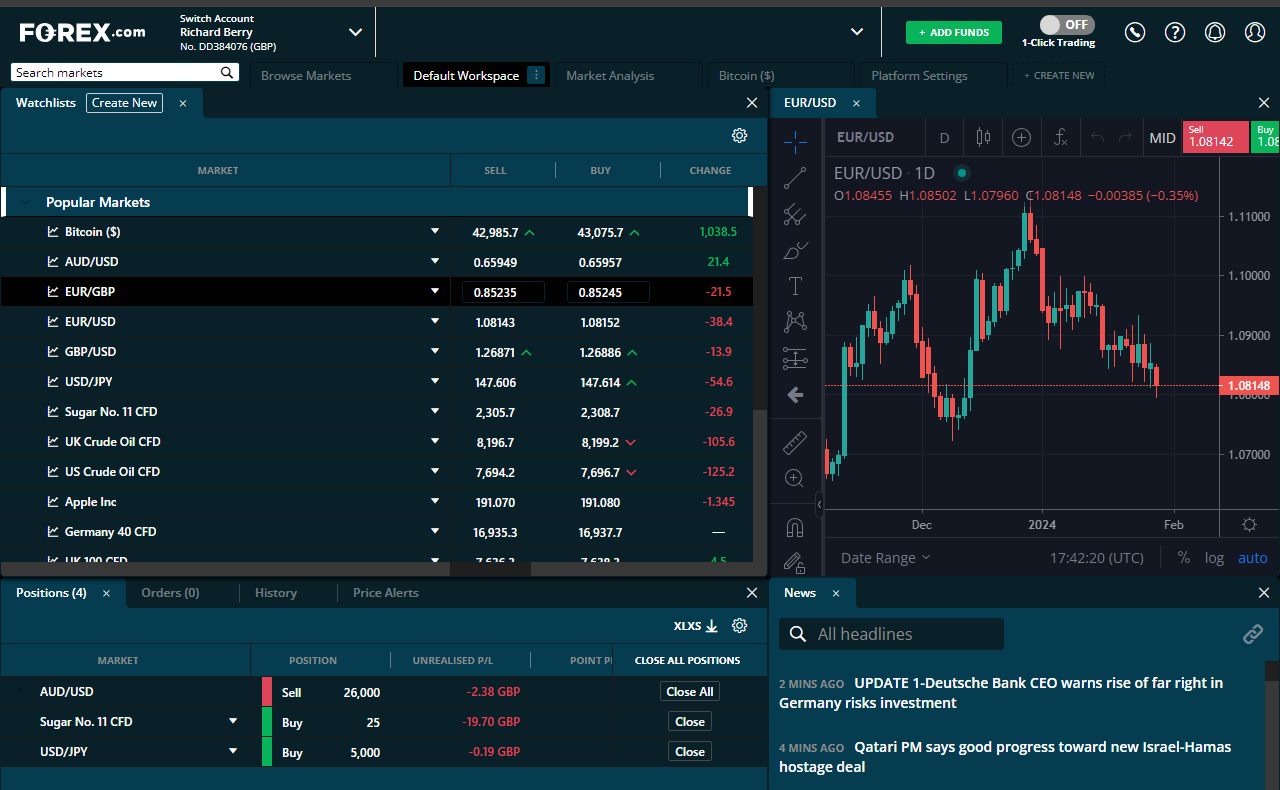

CFD Markets 5,000 |

Min Deposit $100 |

GMG Rating |

Customer Reviews |

Visit Platform 74% of retail CFD accounts lose money. |

Account Types:

|

|

||

|

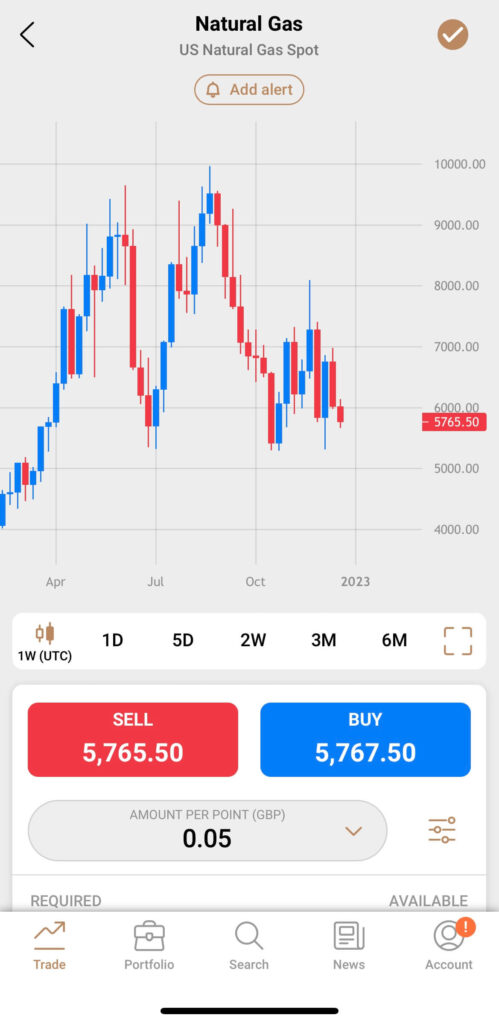

CFD Markets 1,200 |

Min Deposit $1 |

GMG Rating |

Customer Reviews |

Visit Platform 71.9% of retail investor accounts lose money |

Account Types:

|

|

||

|

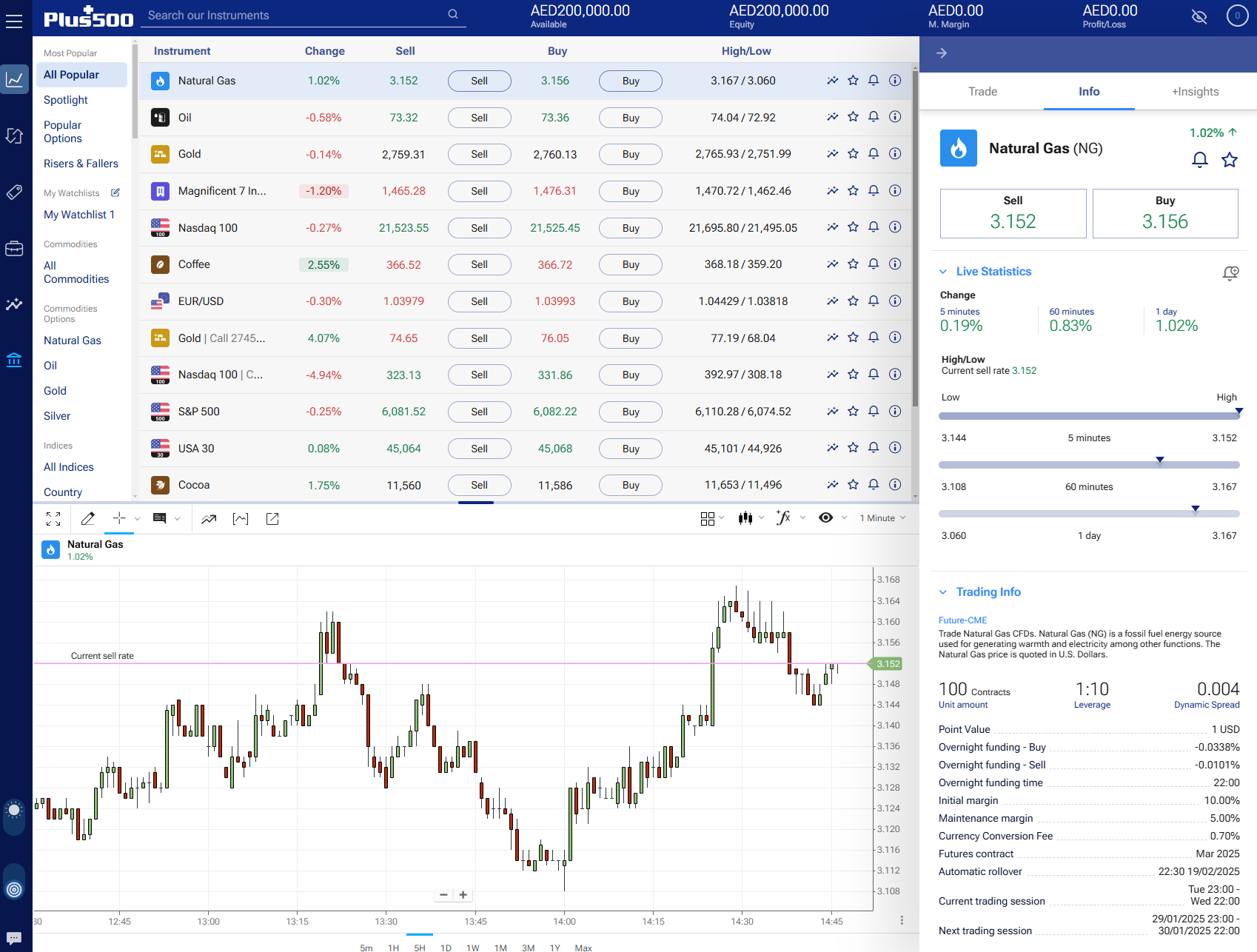

CFD Markets 4,500 |

Min Deposit $20 |

GMG Rating |

Customer Reviews |

Visit Platform CFD trading carries risk. Capital.com is regulated by the Capital Markets Authority (CMA).

|

Account Types:

|

|

||

|

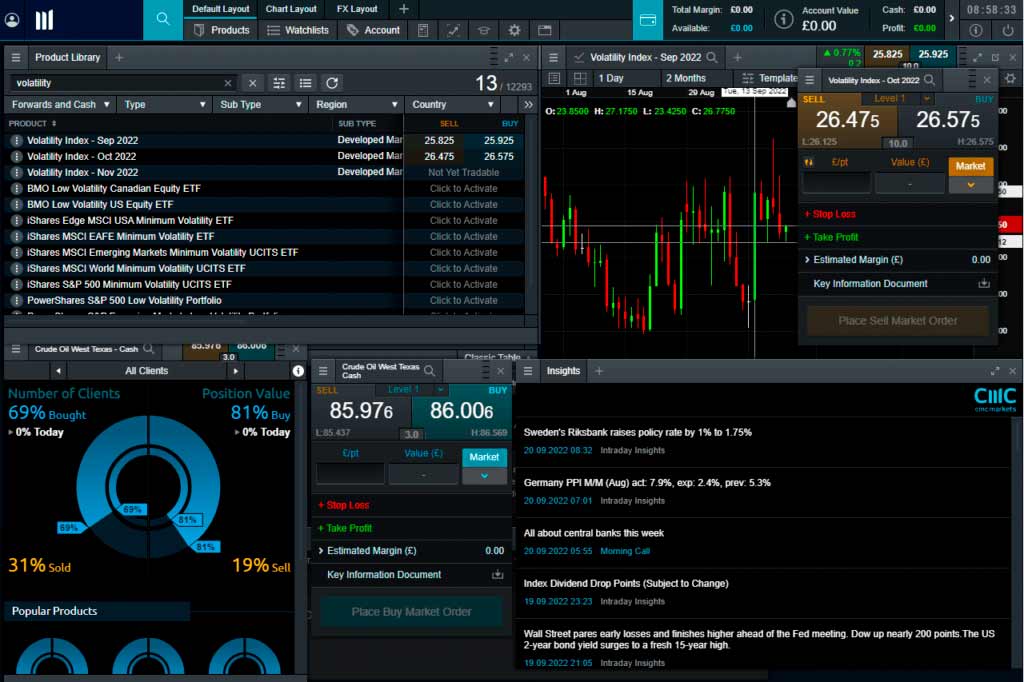

CFD Markets 2,000+ |

Min Deposit $50 |

GMG Rating |

Customer Reviews |

Visit Platform 76% of retail investor accounts lose money |

Account Types:

|

|

||

|

CFD Markets 12,000 |

Min Deposit $1 |

GMG Rating |

Customer Reviews |

Visit Platform 64% of retail investor accounts lose money |

Account Types:

|

|

||

|

CFD Markets 9,000 |

Min Deposit $1 |

GMG Rating |

Customer Reviews |

Visit Platform 62% of retail investor accounts lose money |

Account Types:

|

|

||

|

CFD Markets 17,000 |

Min Deposit $250 |

GMG Rating |

Customer Reviews |

Visit Platform 68% of retail investor accounts lose money |

Account Types:

|

|

Is now a good time to trade Crude Oil?

Michael Brown, Chief Market Strategist at Pepperstaone told us that participants have been pricing a substantially higher risk premium for some time now, given that US military intervention in the Middle East was looking likely, though said premium has ratcheted higher still since the weekend, after kinetic action begun.

Of course, many are now questioning whether we could trade to $100bbl in Brent, though such a view seems hyperbolic for now, barring a prolonged blockage of the Strait of Hormuz, or significant damage to energy infrastructure in the Gulf, neither of which have yet taken place.

From a macroeconomic perspective, key will be the length of any conflict, and subsequent rally in crude benchmarks, with a more prolonged military operation likely leading to Brent remaining north of $80bbl for the foreseeable, in turn bringing with it notable inflationary implications, which could delay central banks like the BoE from delivering rate cuts in the short-term.

Signals that both sides of the present conflict may be prepared to take ‘off ramps’ and de-escalate the situation would clearly be a positive signal, and see some degree of risk premium priced out.