eToro UAE Expert Review: Trade local and international stocks and markets

Provider: eToro UAE

Verdict: A good all round investing platform for traders in the UAE. In 2023 eToro was granted permission by the Abu Dhabi Financial Markets Authority or ADGM, to operate in the UAE as a broker in securities, derivatives and crypto assets.

Can you trade with eToro in the UAE?

Yes, eToro’s global community can now invest in over 30 companies listed on the ADX, gaining exposure to a diverse range of sectors, including energy, real estate, banking, finance, technology, and healthcare. The ADX-listed companies have a combined market capitalization exceeding USD 700 billion(1), reflecting the exchange’s significance as a growing financial hub.

ADX Stocks on eToro

eToro, recently added stocks listed on the Abu Dhabi Securities Exchange (ADX) to its platform. The launch follows an agreement signed last year between ADX and eToro, aimed at broadening investor access to the UAE’s stock market.

This is great for local investors as you can buy into and trade domestic stocks as well as access global markets. I think eToro will continue to improve access over the years, especially as the company grows and attracts more UAE investors.

The UAE is becoming an increasingly popular destination for margin trading and multi-asset brokerages, sitting as it does mid-way between European and Far Eastern markets. However, many firms have pursued licences in Dubai rather than in the neighbouring emirate of Abu Dhabi.

UAE PASS Integration

It’s now easier to open an account with eToro as UAE-based users can register using the UAE PASS app, which pulls verified Proof of Identity (POI) and Proof of Address (POA) directly from the government’s digital identity system. This is a great move for eToro and users becuase thee major barrier to entry and one of the pain points of trading and investing is actually getting the account open. Whenever I open a trading account, anything that stops me sighing or having to look for ID, makes my life easier and gets bonus points.

eToro’s history

Israeli-based eToro was founded in 2007 and has grown into one of the world’s biggest retail brokers with over 34 million registered users on its platform, and operations in more than 100 countries.

That’s largely thanks to its intuitive trading platforms, wide product and asset class offering, and a focus on retail customers of all sizes, with a particular emphasis on social trading, under which traders can follow and copy the trades of their more experienced peers.

eToro’s participation will add to its vibrant and trusted ecosystem of virtual asset trading venues, global exchanges and service providers, and reinforce the UAE’s strategic value to global finance.

Under its new license, eToro will be able to deal in investments as a matched principal, arrange deals in investments, and also provide custody services and manage client assets.

Copy trading

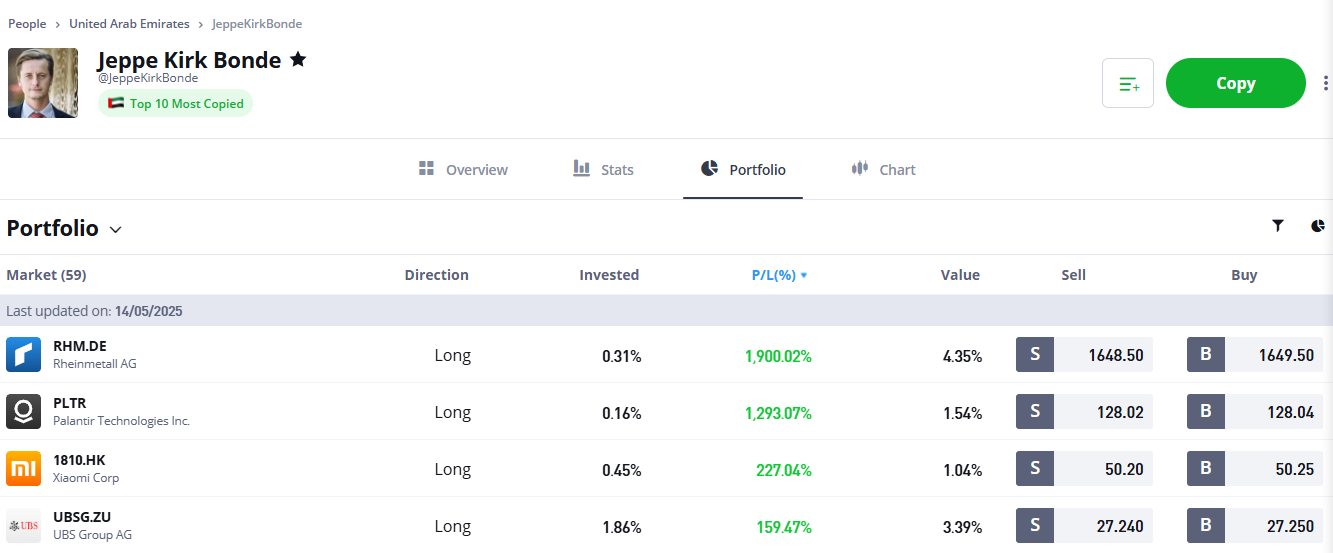

One of the key standout features of eToro is the ability to follow popular investors. One of the most copied is Jeppe Kirk Bonde who is based in the UAE with 30,000+ investors copy with over $100 million. Currently his most profitable positions are Rheinmetall (a European defence company), Palantir (AI) and Xiaomi (Chinese tech).

Pros

- Simple platform & app

- Local ADX stocks

- Access to global markets

Cons

- No DMA

-

Pricing

(4.5)

-

Market Access

(5)

-

App & Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(5)

Overall

4.9

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.