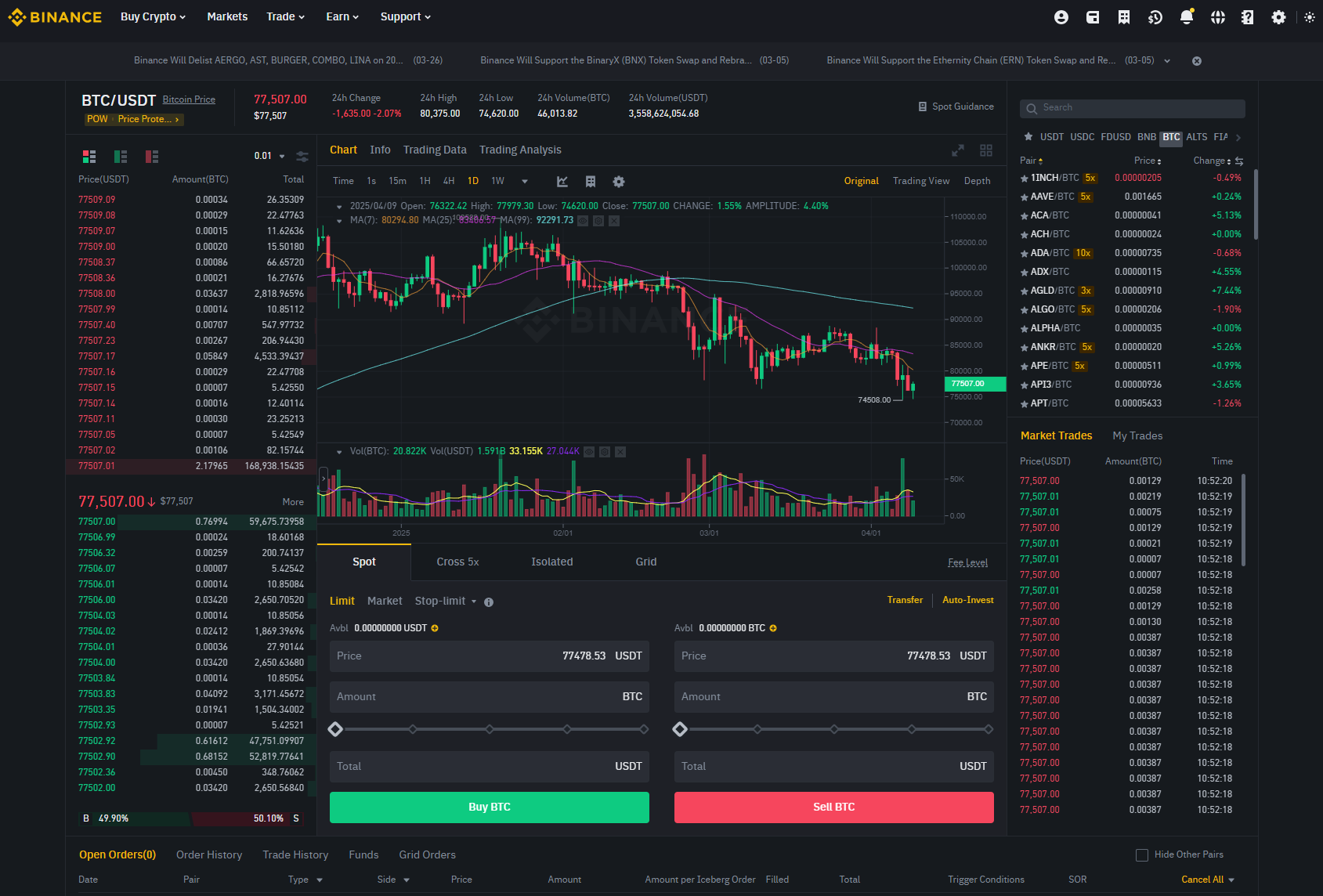

Binance lets you trade a huge range of cryptos in the UAE

Provider: Binance UAE

Verdict: UAE Binance users access to a vast array of cryptocurrencies, enabling trading on spot, margin, and futures markets. The platform supports peer-to-peer transactions and provides opportunities to earn interest through various crypto savings options.

Is Binance any good for UAE crypto traders?

When trading Bitcoin, Binance offers the lowest fees, charging a standard 0.10% per transaction. In contrast, Coinbase uses a tiered maker/taker model with fees ranging from 0.05% to 0.60%, depending on trading volume. eToro has the highest fees, applying a 1% charge on both buying and selling, with the fee embedded in the displayed price. This makes Binance the most cost-effective option for frequent traders, while Coinbase and eToro may appeal more to beginners due to their user-friendly interfaces and additional features.

Pros

- Extensive cryptocurrency selection

- Competitive fee structure

- Advanced trading features

Cons

- Complex interface for beginners

- Past regulatory issues

- Limited customer support

-

Pricing

(5)

-

Market Access

(4.5)

-

App & Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(3)

Overall

4.3

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.