GBPZAR Forecast highlights:

- GBPZAR surged to long-term highs in recent months

- ZAR remains on a structural decline, further downside risk remains

- Watch to buy GBPs at around 24

How has GBPZAR performed recently?

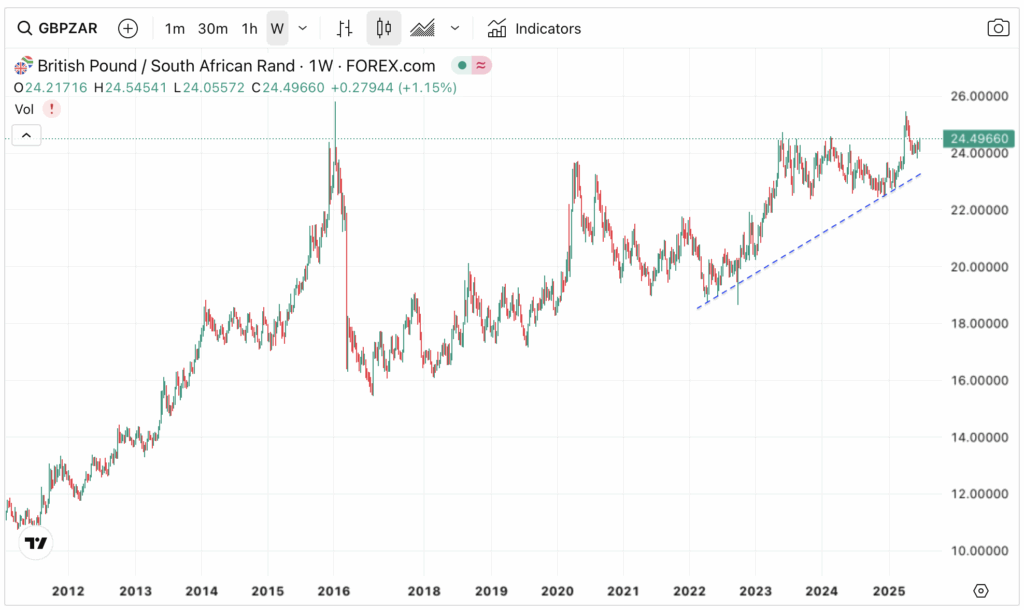

A quick glance at GBPZAR’s weekly chart tells you all need to know about the Rand’s long-term trend. It appears a one-way street for ZAR.

Down by more than 50 percent in a dozen years (14 rand/ £ in 2013 to 24 rand/£ now) is a hefty decline. And what’s more you have to take into account Sterling’s deep depreciation post Brexit. This tells us that ZAR is probably in a structural decline.

This year, prices spurted upwards when global risk aversion spiked back in April. The rate surged to 9-year highs and smashed through the resistance at 24.50 (see below). After a pullback the rate is still trading north of 24.0. This indicates support buying (of Sterling) at around this level.

Until the rate makes a decisive lurch south (ZAR stronger), the path of least resistance for GBPZAR still points up, towards the level at 26.0.

Is it a good time to buy GBP?

After a period of sustained weakness against Sterling, the Rand gained some ground in recent weeks. Prices returned near the level at 24.0

For those ZAR holders looking to buy Sterling, this level could be a good rate to start purchasing some.

Of course, many are wishing that the rate could return to 22.0. But we have to trade the price we’re given at any point, not the rate we wish we could get.

If you miss this level (24-24.5) to buy Sterling, you may find yourself chasing after the prices later on, unless the rate drops sharply from here.

Will GBP get stronger?

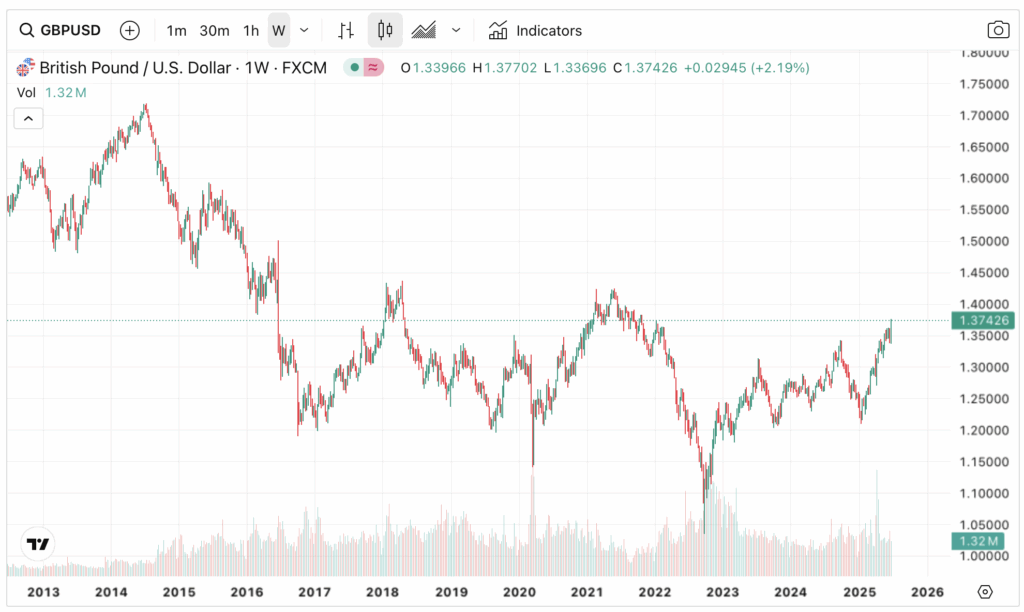

Pound Sterling is benefitting from the general retrenchment of risk from the US dollar.

Since April this year, investors have been selling out of the greenback due to a variety of reasons, from Trump tariffs to a potential weakening of the US economy. The unpredictability of the US fiscal path is pushing capital out of the USD into other currencies, such as GBP or EUR.

We already saw that the Euro has strengthened against a number of currencies in 2025. This marks a sustained change in its long-term price trend. For Pound Sterling, it too found itself back into favour after the disastrous ‘Mini Budget’ back in 2022.

Against the USD, for example, prices surged to the highest level since 2022. Just not so long ago, the rate was heading into 52-week lows near 1.200. The sudden rebound in GBPUSD, in other words, was driven by a turnaround in investor sentiment rather than macro indicators, since the latter have not shown marked improvement. For example, UK April GDP shrunk by 0.3 percent.

As the USD keeps depreciating, the near-term target here appears to be 1.400 (see below). General bullish sentiment is buoying many GBP-related pairs, including the Rand. The outlook for GBP is medium-term bullish and back this general positivity GBPZAR may retest its 2025 highs soon.

What is the GBPZAR forecast in weeks?

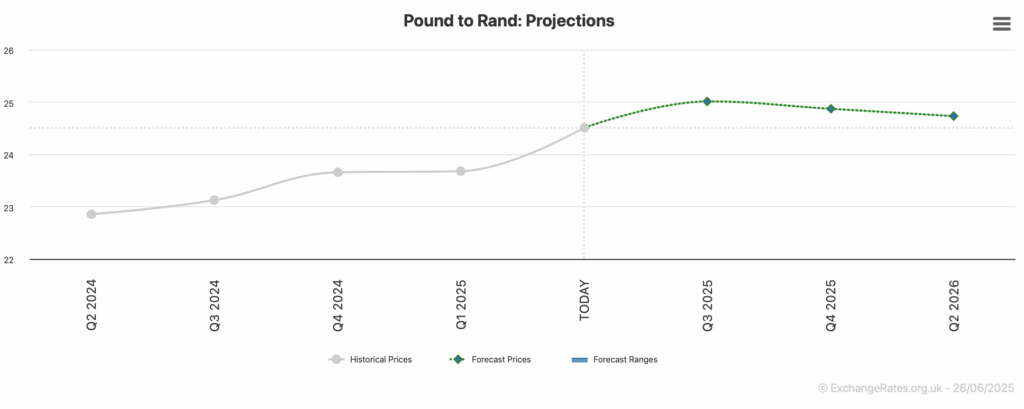

The general trend of GBPZAR’s forecasts are favourable to Sterling.

The exchange rate is expected, over the next few quarters, to rise above current levels. A potential peak is noted at 25.0 (see below).

Whether these predictions will materialise is not a certainty. But the long-term price trend here does favour an eventual resumption of the advance.

Source: exchangerates.org.uk

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.