USDAUD Forecast highlights:

- USD surged against AUD post US election; hit a high of 1.640

- 2022 high has continued to act as resistance to the recent advance

- Prices are consolidating around 1.600. Watch to buy USD below this level

How has USDAUD performed recently?

USDAUD was stuck in a sideways pattern until last October, when investors started to realise that Donald Trump was about to win the US presidential election.

One of the winners from the ‘Trump Trade’ was the US dollar. You can see this clearly in USDAUD.

The rate touched a low of 1.450 before surging above 1.600 in a matter of weeks. The rate briefly crossed above the 2022 peak before retracing the rally (see below).

The high from 2022 is continuing to act as resistance.

For now, the rate is consolidating above the prior resistance, now probably converted into support, at 1.580. If broken, the next area of support is noted at 1.550.

Is it a good time to buy US dollars?

Based on the chart, it really is hard to say whether one should buy USD now.

The reason is because USD has had a strong rally late last year. The rate is quite unfavourably to A$ holders. The overbought rally could retrace in the coming weeks.

On the other hand, the USD may become even stronger later this year. Yes, the rally above 1.630 was rejected recently. But this is hardly a conclusive development to say prices will not trade above 1.650.

Therefore if you need USD now, try to buy USD below 1.600. Of course, you may wait further for a further retracement. But there is risk in waiting as the rate may not correct to the desired level in time.

Will USD get stronger?

The key question is whether the Dollar will renew its strength later this year.

The US dollar has softened up in recent days after a hectic six-week rally. At the moment, it seems like USD is just consolidating its advance rather than reversing it.

US CPI inflation this week came in higher than expected (at 3 percent). This may sustain the current Fed Funds rate further, which, in turn, is buoying the USD.

At the same time, the Reserve Bank of Australia is expected to cut the policy rates as inflation soften and economic outlook dims.

In sum, the market is still trying to work if USDAUD will be able to return to its prior trading range at 1.550-1.450. Current macro currents are highly volatile.

Market expectations that not met can lead to massive swings in prices.

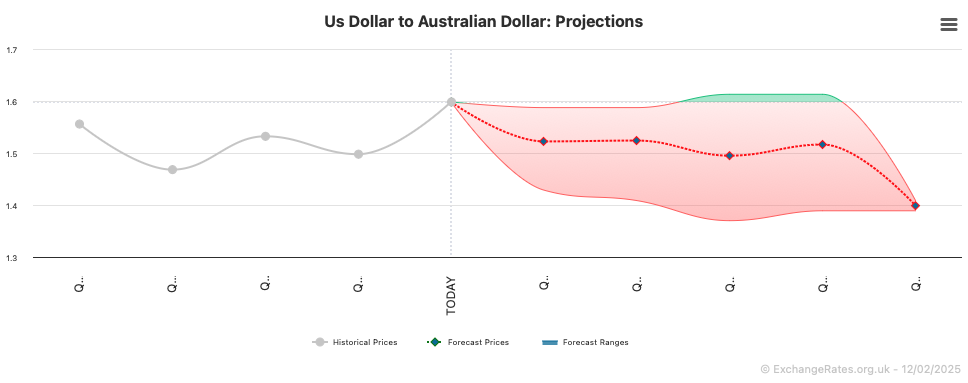

What is the USDAUD forecast in weeks?

Most of the brokers are fairly bearish on USDAUD. That it, they are expecting the rate to drop in the coming quarters, in favour of the AUD.

If we look the next 2-3 quarters ahead, the median forecasts show a correction to 1.520. At the end of the forecast range shows a big drop to 1.40.

The question is whether these forecasts are too bearish on the dollar. Perhaps. Spot rates can move quickly and render these predictions out of date. Therefore we need to keep our attention on the current pricing.

Source: ExchangeRates.org.uk

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com