-

Checked By

Richard Berry

Checked By

Richard Berry

- Updated

| Name | Logo | GMG Rating | Customer Reviews | Stocks Available | Stock Trading Costs | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews 4.5

(Based on 1,330 reviews)

|

Stocks Available 17,913 |

Stock Trading Costs 0.003% |

Features:

|

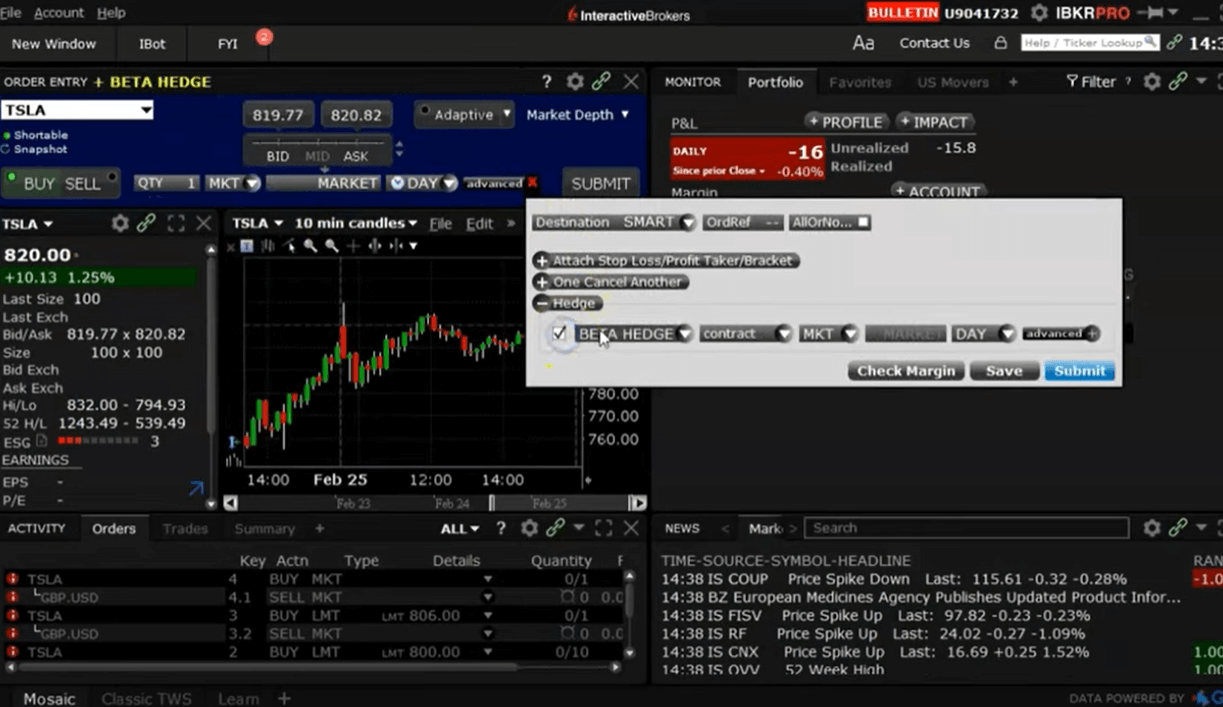

Interactive Brokers stock trading makes them one of the best US stock brokers Account: Interactive Brokers Stock Trading Description: Amazing technology, and always first to market with innovative trading tools. Interactive Brokers lets you trade stock on 90+ international exchanges, with $0 commission and some of the lowest financing rates in the industry. Is Interactive Brokers a good stock broker? Yes, IBKR is an excellent US stock broker, low costs, excellent market access and superb apps and platforms. Pricing: Interactive Brokers is very cheap for trading stocks, especially in the IBKR Lite account, where commissions are $0 on US-listed stocks and fractional stocks. For more advanced traders, IBKR Pro commissions are USD 0.0005 to USD 0.0035 per share, but you get significant price improvements from IB SmartRouting. If you are trading stocks on margin, Interactive Brokers have some of the lowest margin loan financing rates in the industry from USD 4.83% to USD 5.83%. You can also actually get IBKR to pay you by letting them borrow your fully paid up stocks and letting them lend them out to short sellers, through their stock yield enhancement program. Market Access: IBKR probably has the best market access of all the stock brokers we compare. You can trade a huge range of international stocks and IBKR has local access to over 90 stock exchanges. There are very few stocks you cannot trade on IBKR. Apps & Platforms: Interactive Brokers’ stock trading apps and platforms are seriously good. When I traded on the desktop workstation platform, I was able to pair trade two stocks against each other. IBKR is one of the few platforms that allows you to do this. Probably because when I interviewed IBKR founder Thomas Peterffy before testing the platforms, he told me that he thinks the most successful stock traders are ones that trade one company against another. Customer Service: Because Interactive Brokers is one of the largest stock brokers in the world, customer service is largely automated and they were even using automated chatbots before the AI revolution took over. This is a good example of how they are at the forefront of stock trading technology. However, it can be a bit of a pain trying to get through to someone on the phone if you are not a large customer with a personal stock broker. Research & Analysis: You get lots of research and analysis from Interactive Brokers, including the IBKR Campus, for beginners to improve their stock trading. For longer-term investors, there is fundamental data on 30,000 companies and over 5,000 analyst ratings to give you an indication of whether a stock is a buy or a sell.

Pros

Cons

Overall4.8 |

❓ Methodology: Here’s how we selected the US’s best stock brokers:

All US stockbrokers are different and the best way to figure out what broker is best for your investing goals is to compare the key account features and products on offer.

- Hands-on analysis: Our review team tests each stock broker using real money for a genuine trading experience

- Stand-out features: We compare what sets each stock trading platform apart to highlight their unique strengths

- Customer feedback: Over 30,000 votes from the Good Money Guide annual awards help shape our ratings

- Exclusive interviews: We speak directly with stock broker CEOs and senior management to get their insights

- Our process: Find out more about how we choose and rank providers on our How We Rate page

What trading platform offers the most fractional US stocks?

According to our research, Interactive Brokers has the widest range of fractional shares on the major US trading platforms.

Fractional shares are a great way of investing building a diverse portfolio if you only have a small amount to invest.

This is because if you only have $500 to start investing you can buy $100 of five stocks instead of having to buy whole shares.

Which is particularly important if you are trading popular stocks like Tesla, which can cost upwards of $200.

The downside, though is that you can’t trade with direct market access and get inside the bid offer price. But this only really makes a meaningful difference if you are trading in large amounts. When fractional shares would not be that appropriate anway.

US Stock Broker FAQs

Here are the answers to the most commonly asked questions by people searching for the best stock brokers in America.

If you looking to open your first brokerage account or need an additional broker for diversification there are a few key questions you need to ask yourself. You can read our full guide on how to open a brokerage account or use our US stock broker comparison tables to find your perfect broker.

- There are three different types of account

- Self-directed – you make your own investment decisions

- Managed portfolio – a professional manages your investments

- Robo-advisor – an automated investment account

If you want to buy US stocks you need a US stock broker to buy them on your behalf. This is by far the most efficient way of getting exposure to a companies share price.

These are the main things to compare when choosing a US stock broker:

- Commissions

- This is how much the broker charges your for each trade. Despite online stock trading being highly competitive there is actually quite a significant difference between broker commissions.

- Account fees

- One top of commission some brokers will also charge a fees for market access, live pricing, research, inactivity and administration.

- Trade frequency

- The more you trade the lower your costs. If you are a regular trade look out for brokers with frequent trade promotions.

- Support

- When something goes wrong you need to know that you can get through to the right person on the phone. In investing mistakes can be costly if not dealt with promptly.

- Minimums

- Some brokers will ask you to make a deposit when you open an account, whilst other will let you get an account in place before you are ready to make your first trade and deposit.

- Investment products

- Read our guide to brokerage accounts to see the difference between trading through stocks, futures, options and ETFs etc.

- Experience

- Some brokers are better for beginners and other brokers offer investment products that are only suitable to experienced traders with a high risk appetite. Make sure you choose a broker that is best for your level of investment experience.

As a rule you should think in percentages of your net worth. The higher the risk the lower the percentage of you net worth you should allocate to it. All investments (even the safest) come with risk so be prepared to lose money as well as profit from the stock market.

Always stay within your comfort zone and never invest money you cannot afford to lose.

Investing in two stocks for example is more risky that investing in twenty. This is because you are diluting your exposure to things going wrong. For example if you hold a stock which has a profit warning and loses 50% of it’s value. It will have a greater impact on your net worth if you have a portfolio of two stocks rather than twenty because you will hold a greater value of it.