Options trading is a powerful tool for South African traders and investors looking to leverage market movements, hedge risks, or generate income. While options are more complex than traditional investments like stocks or ETFs, they offer unparalleled flexibility and strategic opportunities. This guide will introduce you to the basics of options trading, its benefits, and the steps to get started.

| Name | Logo | Options Markets | Commission | GMG Rating | Customer Reviews | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

Options Markets 10,000 |

Commission $0.25-$1 |

GMG Rating |

Customer Reviews |

Visit Platform 59.7% of retail investor accounts lose money |

Account Types:

|

|

||

|

Options Markets 100 |

Commission Included |

GMG Rating |

Customer Reviews |

Visit Platform 80% of retail investor accounts lose money |

Account Types:

|

|

What Are Options?

An option is a financial derivative that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price (the strike price) on or before a specific date (the expiration date).

There are two main types of options:

- Call Options: Give the holder the right to buy the underlying asset at the strike price.

- Put Options: Give the holder the right to sell the underlying asset at the strike price.

Options are often used for speculation, hedging, or income generation through strategies like writing covered calls.

The key features of options trading are:

- Leverage: Options allow traders to control large positions with a smaller initial investment.

- Flexibility: Traders can profit in rising, falling, or sideways markets depending on the strategy used.

- Limited Risk for Buyers: The maximum loss for an options buyer is limited to the premium paid for the option.

- Complexity: Options require a deeper understanding of pricing factors, including volatility, time decay, and the Greeks (delta, gamma, theta, vega, and rho).

Why Trade Options in South Africa?

- Market Access: South African traders can access options on local indices (e.g., the FTSE/JSE Top 40) and international markets through regulated brokers.

- Hedging Opportunities: Options can be used to hedge against downside risk in an equity or commodity portfolio.

- Strategic Flexibility: Options enable traders to employ sophisticated strategies such as spreads, straddles, and iron condors.

- Income Generation: Selling options, such as covered calls, can provide a steady stream of income.

Regulation of Options Trading in South Africa

Options trading in South Africa is regulated by the Financial Sector Conduct Authority (FSCA) and the Johannesburg Stock Exchange (JSE). The JSE offers equity and index options, providing a secure platform for local traders.

When trading options, ensure that your broker is FSCA-regulated and offers access to the JSE Derivatives Market or international options markets.

How to Start Trading Options in South Africa

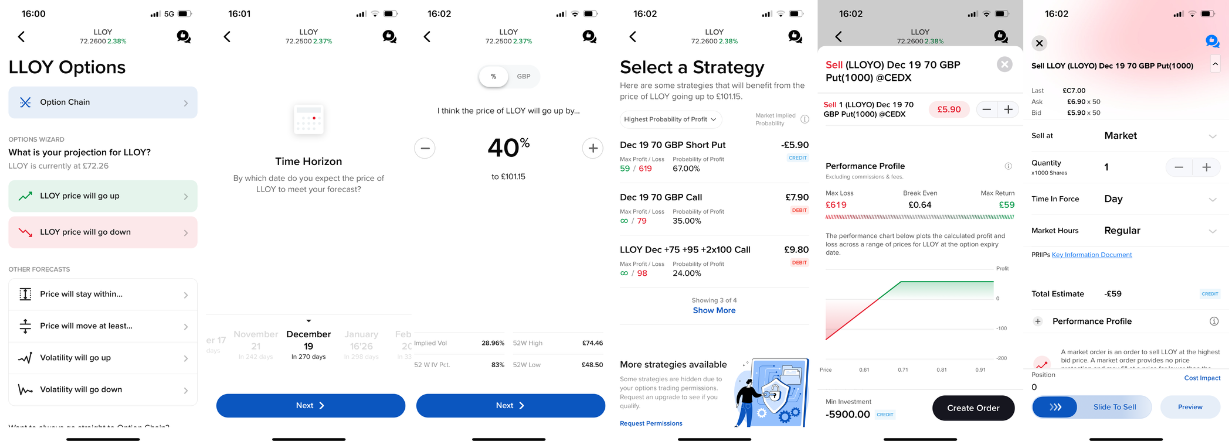

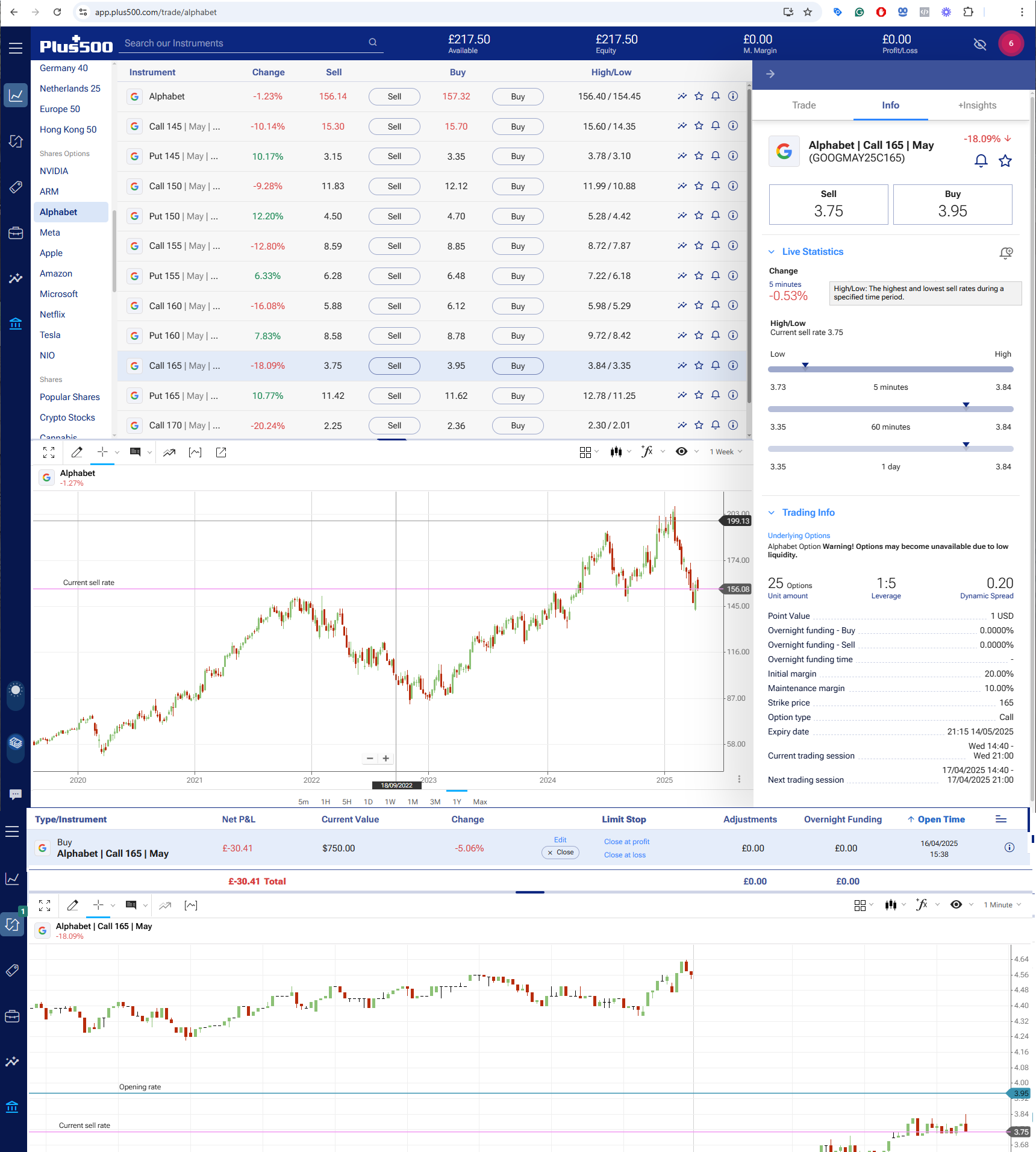

To trade options in South Africa you need to open an account with an options broker like Interactive Brokers or Plus500. Follow the below steps to get started:

- Choose a Broker:

- Select an FSCA-regulated broker that supports options trading.

- Open a Trading Account:

- Complete the account registration process. Some brokers may require additional documentation to approve options trading due to its complexity.

- Understand Options Pricing:

- Learn how options are priced using the Black-Scholes model or binomial model. Key factors influencing pricing include:

- Underlying Asset Price

- Strike Price

- Time to Expiration

- Implied Volatility

- Interest Rates

- Learn how options are priced using the Black-Scholes model or binomial model. Key factors influencing pricing include:

- Develop a Strategy:

- Determine your goals (e.g., speculation, hedging, income) and choose appropriate strategies. Beginners often start with basic strategies like buying calls or puts, while advanced traders explore spreads and combinations.

- Place Your Trade:

- Use your broker’s platform to enter orders. Ensure you understand the mechanics of the trade, including potential profit and loss scenarios.

- Monitor and Manage:

- Regularly review your positions and adjust as needed based on market conditions.

Popular Options Strategies

- Buying Calls and Puts:

- Straightforward strategies to profit from upward or downward price movements.

- Covered Calls:

- Writing call options against an existing stock position to generate income.

- Protective Puts:

- Buying a put option to hedge against potential losses in a long stock position.

- Spreads:

- Combining two or more options to limit risk and reduce cost (e.g., vertical spreads, calendar spreads).

- Straddles and Strangles:

- Strategies that profit from significant price movements in either direction, regardless of market direction.

Costs of Options Trading

- Premiums: The cost of buying an option.

- Brokerage Fees: Charged for executing trades; may vary based on contract size and market access.

- Margin Requirements: Selling options often requires a margin deposit to cover potential losses.

- Assignment Fees: Applied if an option is exercised and the underlying asset is delivered.

Risks of Options Trading

- Leverage Risk: While leverage amplifies gains, it also magnifies losses for sellers.

- Complexity: Options require a thorough understanding of pricing and risk factors.

- Expiration Risk: Options have a limited lifespan, which can lead to the total loss of the premium if the option expires worthless.

- Volatility Risk: Changes in market volatility can significantly affect options pricing.

Tips for Successful Options Trading in South Africa

- Start Small: Begin with simple strategies and gradually explore advanced techniques as you gain experience.

- Educate Yourself: Take advantage of resources like webinars, books, and online courses to deepen your understanding.

- Use Risk Management: Set stop-loss levels and avoid over-leveraging your account.

- Practice with a Demo Account: Many brokers offer demo accounts to help you learn without risking real money.

- Stay Informed: Monitor market news and trends that can impact your chosen options.

Options trading in South Africa provides traders with a versatile and powerful tool for hedging, speculation, and income generation. While the potential rewards are significant, it’s essential to understand the risks and complexities involved. By starting with a solid foundation of knowledge, choosing a reliable broker, and practicing sound risk management, you can harness the potential of options trading to achieve your financial goals.