FOREX.com is a highly rated US forex broker owned by NASDAQ listed StoneX and is also a registered FCM and RFED with the CFTC and a member of the National Futures Association (NFA # 0339826).

FOREX.com US Forex Trading Review: A dedicated US owned forex broker.

Account: FOREX.com US Forex Trading

Description: FOREX.com, is one of the largest forex brokers in the world and is now owned by NASDAQ listed institutional broker StoneX, Forex.com has been offering forex trading services to US residents since 2001, providing individuals and institutions with access to the foreign exchange market. Note: The products and services available to you at FOREX.com will depend on your location and on which of its regulated entities holds your account.

Is FOREX.com available in the USA?

Yes, you can trade with FOREX.com as a US resident in the USA. Forex.com are owned by NASDAQ-listed broker StoneX and are one of the few US forex brokers to be legally allowed to offer retail traders access to the forex markets.

FOREX.com is a good choice for forex traders in the US who want added value through trading signals and post-trade analysis. It’s worth noting that spread-only & RAW Pricing are the available account types for clients based in the USA. However, CFDs, Metals, Crypto CFDs & Stocks CFDs are not available for clients based in the USA.

One of the key features that make FOREX.com stand out above other forex brokers is Performance Analytics where you can see your post-trade history that helps traders improve their profitability.

Raw Forex pricing

FOREX.com has improved it’s Forex pricing and liquidity via what it calls a RAW pricing account which offers customers narrow or no bid-offer spreads.

Raw prices are effectively the prices that FOREX.com receives from the market via its liquidity providers, and rather than marking these prices up before distribution, the prices are sent to customers directly.

That means narrower spreads, with the typical bid-offer spread in EURUSD coming in at 0.00 pips and at 0.1 pips on AUDUSD.

The typical spread is defined as the median spread available.

Narrower spreads mean more trading opportunities and possibly many more profitable, and fewer loss-making trades.

Scratching a trade becomes more economical if you are paying little or no spread, and there is a far lower hurdle to overcome before a trade moves into profit, as well.

How do you get access to a RAW pricing account?

To access the new RAW spreads service clients will need to apply for a RAW pricing account with FOREX.com, however as the noted economist Milton Friedman famously said:

“There is no such thing as free lunch.”

The narrow spreads on the RAW pricing account are offset by a US$7.00 commission per $100k traded.

So if you trade 10 lots or $1.0 million worth of FX you pay $70.00 of commission, on both sides of the trade.

FOREX.com traders can further reduce their overall trading expenses if they sign up for the firm’s Active Trader program, under which they can earn rebates of up to $10.00 per million traded.

Is Raw forex pricing suitable for all traders?

RAW pricing accounts may well make sense for those traders who have an active trading strategy and high trading volumes, but they won’t always be beneficial for other traders.

So it’s important to crunch some numbers before you open one of these accounts.

One way to decide if it’s for you is to look back over a couple of quarters of trading, working out what your average monthly turnover was, and what your expenses were over a monthly time frame, which, will give you a basis on which to compare accounts and charges.

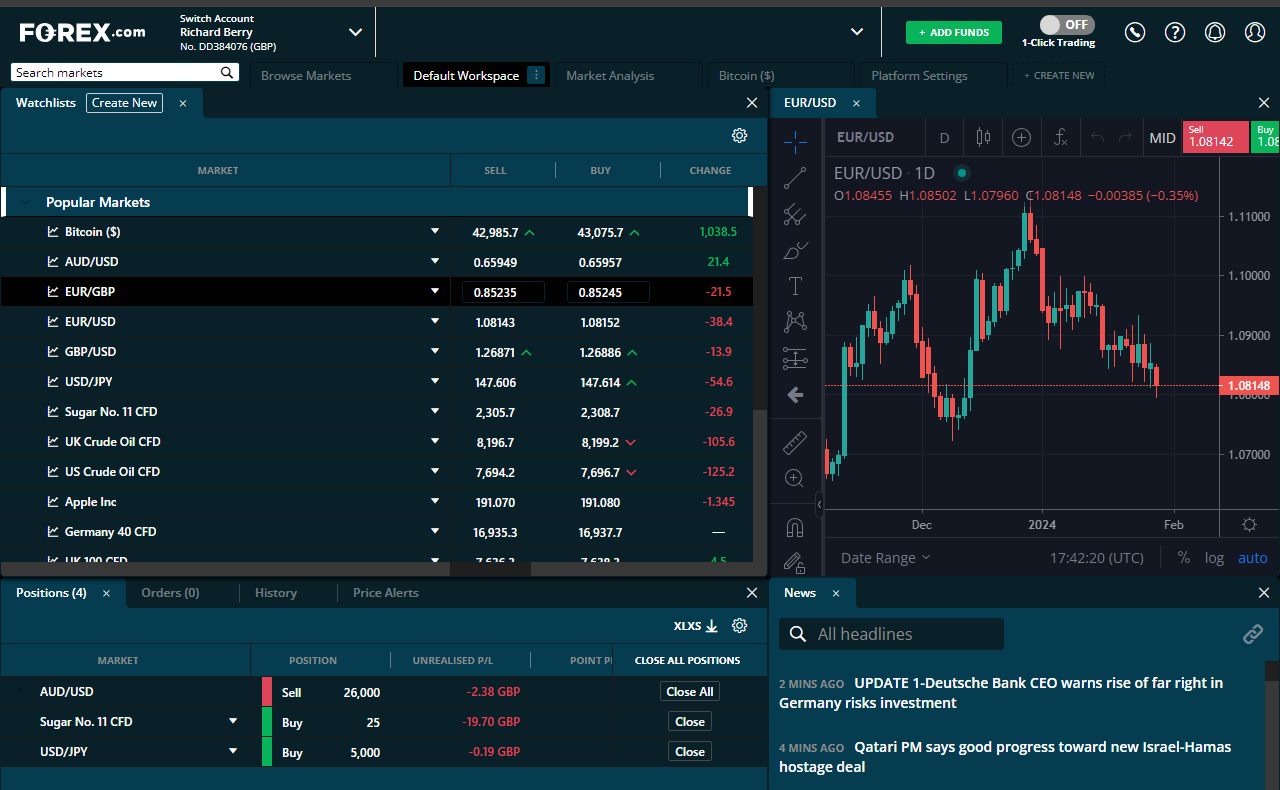

What’s the FOREX.com trading platform like?

I really like it, I’ve used it a lot over the years, and I’ve seen it improve significantly. You can see me testing the platform in our 24-hour FOREX.com live trading demo.

Pros

- Trading Signals

- Post Trade Analytics

- Forex Specialists

Cons

- Limited Market Range

- No DMA

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(5)

-

Customer Service

(5)

-

Research & Analysis

(5)

Overall

4.7

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.