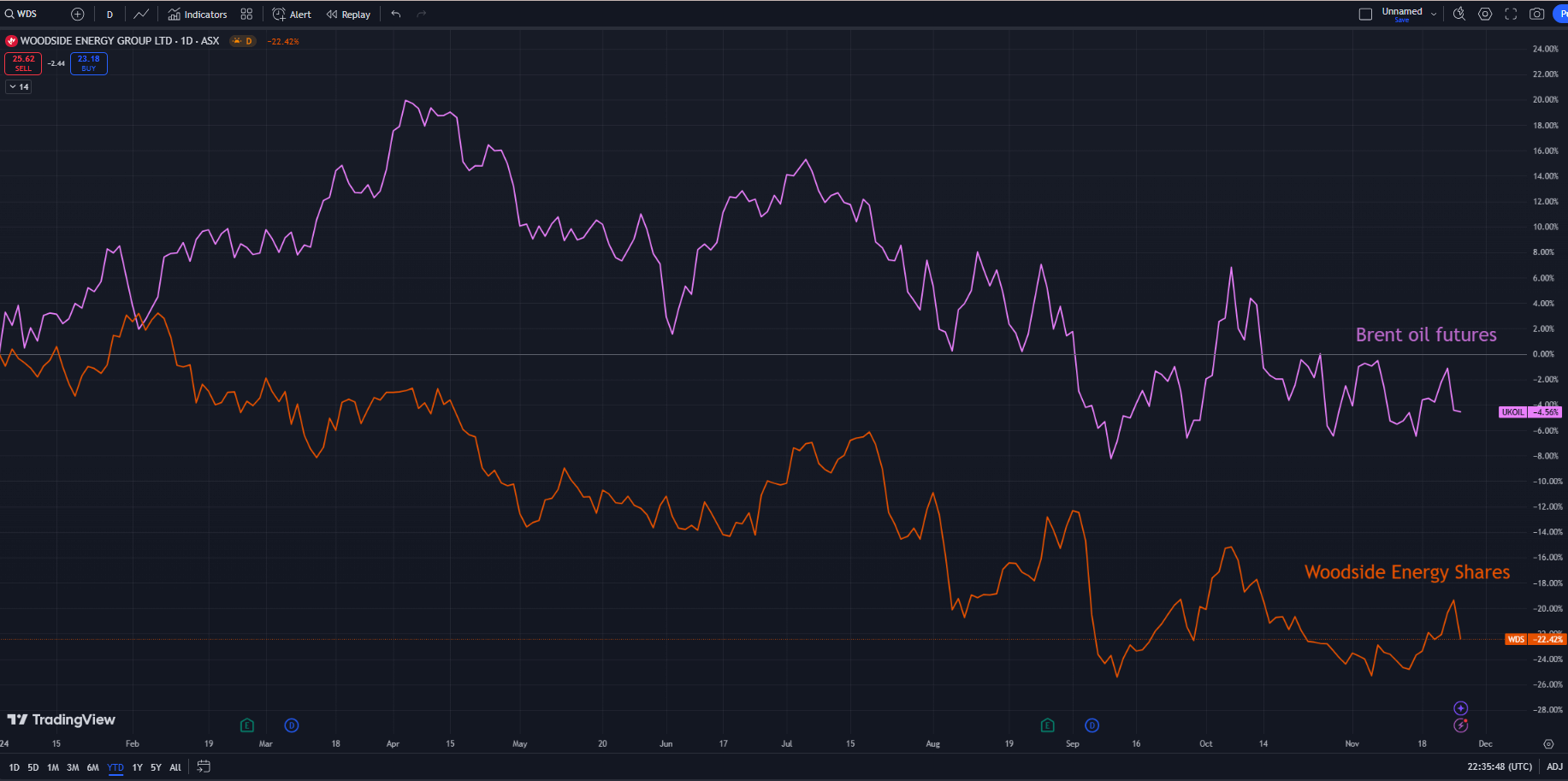

Woodside Energy’s (ASX: WDS) share price has been in a downtrend, sliding 21% due to slumping oil prices this year. The ASX 200 energy stock has a history of tracing the oil market movement, while also being influenced by the business growth prospects.

Since mid-November, Woodside shares rebounded from a near two-year low level due to the oil price surge amid war escalation between Russia and Ukraine.

So, is it a good time for investors to capitalise on their positions?

A growth slowdown is expected

Based in Perth, Woodside is Australia’s largest oil and gas producer with a market cap of US$30.87 billion. In 2023, the company reported a record year in production, driven by robust energy demand, high crude oil prices, and maintenance activities.

However, the momentum slowed down in the first half due to falling energy prices, coupled with maintenance activities and weather impacts. Additionally, its record quarterly production in Q3 did not give its share price a meaningful lift, as the company’s guidance implies a significant growth slowdown. In its latest production report, Woodside expects production of 189 and 195 million barrels of oil equivalent per day (MMboe) for 2024, representing a 4% annual growth this year, compared to a 19% increase in 2023.

Additionally, Woodside Energy has been investing heavily in expanding its oil drilling sites. Its capital expenditure increased by 32% year on year to $5.4 billion in the third quarter. However, the total revenue declined by 9%, implying a narrowing profit margin. The stock has a price-to-earnings ratio of 16.24, slightly higher than 13.53. Hence, the stock may not be significantly undervalued at such a growth pace.

Weak energy demand may continue pressuring Woodside shares

Woodside Energy’s growth trajectory relies on the macro force, which remains a key driver of its share price. Crude oil prices declined more than 10% in the past year due to weak global demands and surging US oil production. Energy markets will likely remain in the downtrend due to supply concerns.

Demand of the biggest oil importer China stays tepid due to its economic slowdown and renewable energy transition. Despite ongoing sweeping stimulus measures, a materialised economic recovery is yet to be seen. On the supply side, the United States has been ramping up its oil production to a record high. Meanwhile, Trump’s “drill, baby drill” policy stance may further increase US oil production, intensifying the oversupply issues.

Source: TradingView as of 27 November 2024

A high-yielding stock

However, for investors who seek long-term investments with high yields, Woodside could be a good pick. The company often gives a generous return to shareholders. In 2024, the oil producer has a fully franked interim dividend of 69 US cents per share, representing a half-year annualised dividend yield of 7.3% in 2024. It is expected to continue the trend with a 6% yield for 2025. The yields are much higher than earning interest rates by carrying cash in banks.

Opportunity & Risks

The opportunity here is that the ongoing military conflict in the Middle East and the Ukraine-Russia war remain bullish factors for energy stocks. Additionally, China’s demand outlook has been upgraded slightly, driven by increasing LNG demand.

However, risks are greater than opportunities. Firstly, any easing signs in the geopolitical tensions could trigger a new wave of selloffs in energy stocks. Secondly, Woodside Energy will likely face further macro headwinds and continue the trajectory of negative revenue growth.

Tina was a Market Analyst at CMC Markets from 2015 to 2024, providing client education, market commentary, and media presentations. She specializes in technical analysis and market fundamentals. Tina believes financial markets comprise a vast area reflecting economies, politics, history, psychology, and philosophy. As a result, her analysis is based on her interpretation of a specific country’s economic and historical background, alongside investor sentiment and behaviour.

Tina’s expertise has garnered recognition, with her commentary frequently quoted by reputable sources like Bloomberg, CNBC, Routers, WSJ, and AFR. Her insights span a diverse spectrum, covering various financial domains, including stock markets, foreign exchange, commodities, and cryptocurrencies. Previously, she also spent significant time with China Central Television. This experience allowed her to develop a deep understanding and insight into China’s economics and business.