-

Checked By

Richard Berry

Checked By

Richard Berry

- Updated

Forex trading is speculating on the price of two different currencies relative to each other. The foreign exchange market is the most heavily traded asset class in the world. Anyone can trade forex through a forex broker and forex trading falls into two categories, high-risk short-term speculation and physical currency exchange.

| Name | Logo | Forex Pairs | Minimum deposit | GMG Rating | Customer Reviews | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

Forex Pairs 80 |

Minimum deposit $1 |

GMG Rating |

Customer Reviews 3.6

(Based on 74 reviews)

|

Account Types:

|

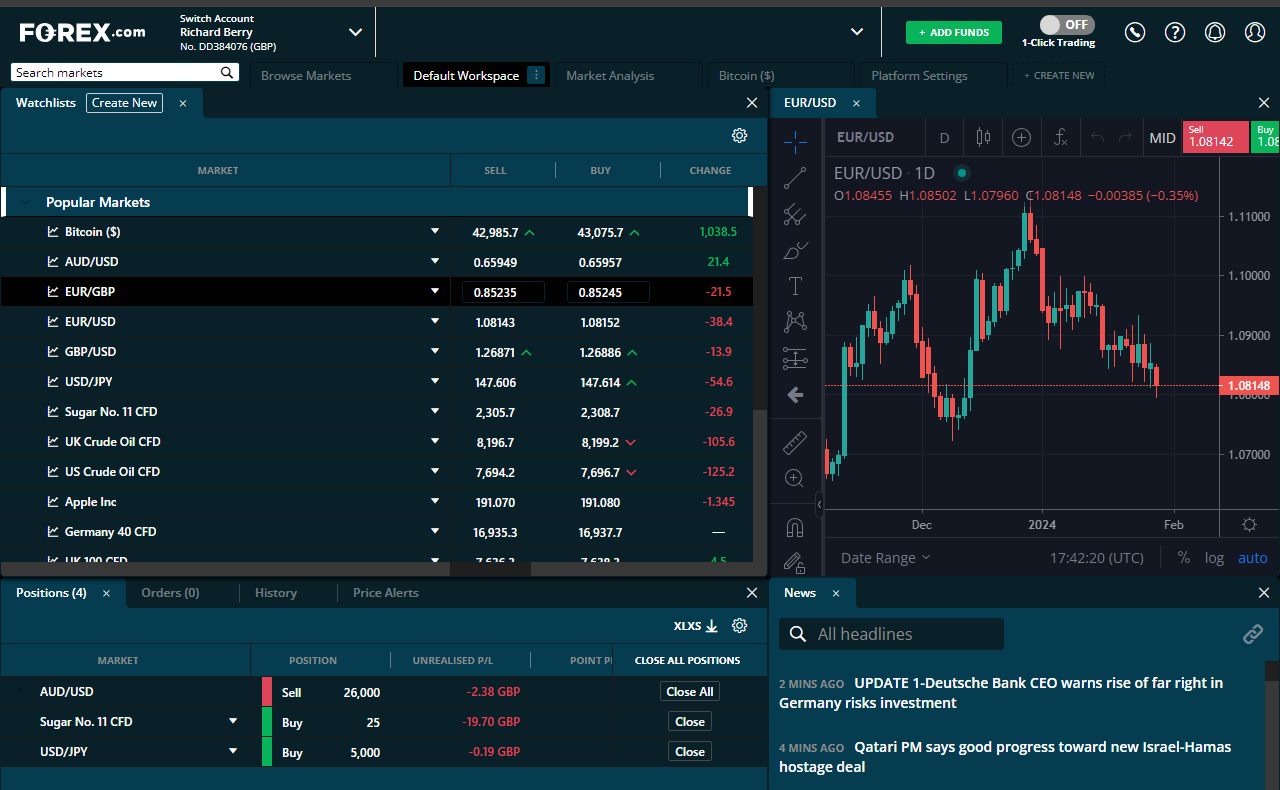

FOREX.com US Forex Trading Review: A dedicated US owned forex broker. Account: FOREX.com US Forex Trading Description: FOREX.com, is one of the largest forex brokers in the world and is now owned by NASDAQ listed institutional broker StoneX, Forex.com has been offering forex trading services to US residents since 2001, providing individuals and institutions with access to the foreign exchange market. Note: The products and services available to you at FOREX.com will depend on your location and on which of its regulated entities holds your account. Is FOREX.com available in the USA? Yes, you can trade with FOREX.com as a US resident in the USA. Forex.com are owned by NASDAQ-listed broker StoneX and are one of the few US forex brokers to be legally allowed to offer retail traders access to the forex markets. FOREX.com is a good choice for forex traders in the US who want added value through trading signals and post-trade analysis. It’s worth noting that spread-only & RAW Pricing are the available account types for clients based in the USA. However, CFDs, Metals, Crypto CFDs & Stocks CFDs are not available for clients based in the USA. One of the key features that make FOREX.com stand out above other forex brokers is Performance Analytics where you can see your post-trade history that helps traders improve their profitability. Raw Forex pricing FOREX.com has improved it’s Forex pricing and liquidity via what it calls a RAW pricing account which offers customers narrow or no bid-offer spreads. Raw prices are effectively the prices that FOREX.com receives from the market via its liquidity providers, and rather than marking these prices up before distribution, the prices are sent to customers directly. That means narrower spreads, with the typical bid-offer spread in EURUSD coming in at 0.00 pips and at 0.1 pips on AUDUSD. The typical spread is defined as the median spread available. Narrower spreads mean more trading opportunities and possibly many more profitable, and fewer loss-making trades. Scratching a trade becomes more economical if you are paying little or no spread, and there is a far lower hurdle to overcome before a trade moves into profit, as well. How do you get access to a RAW pricing account? To access the new RAW spreads service clients will need to apply for a RAW pricing account with FOREX.com, however as the noted economist Milton Friedman famously said: “There is no such thing as free lunch.” The narrow spreads on the RAW pricing account are offset by a US$7.00 commission per $100k traded. So if you trade 10 lots or $1.0 million worth of FX you pay $70.00 of commission, on both sides of the trade. FOREX.com traders can further reduce their overall trading expenses if they sign up for the firm’s Active Trader program, under which they can earn rebates of up to $10.00 per million traded. Is Raw forex pricing suitable for all traders? RAW pricing accounts may well make sense for those traders who have an active trading strategy and high trading volumes, but they won’t always be beneficial for other traders. So it’s important to crunch some numbers before you open one of these accounts. One way to decide if it’s for you is to look back over a couple of quarters of trading, working out what your average monthly turnover was, and what your expenses were over a monthly time frame, which, will give you a basis on which to compare accounts and charges. What’s the FOREX.com trading platform like? I really like it, I’ve used it a lot over the years, and I’ve seen it improve significantly. You can see me testing the platform in our 24-hour FOREX.com live trading demo.

Pros

Cons

Overall4.7 |

|||

|

Forex Pairs 100 |

Minimum deposit $2,000 |

GMG Rating |

Customer Reviews 4.5

(Based on 1,329 reviews)

|

Account Types: |

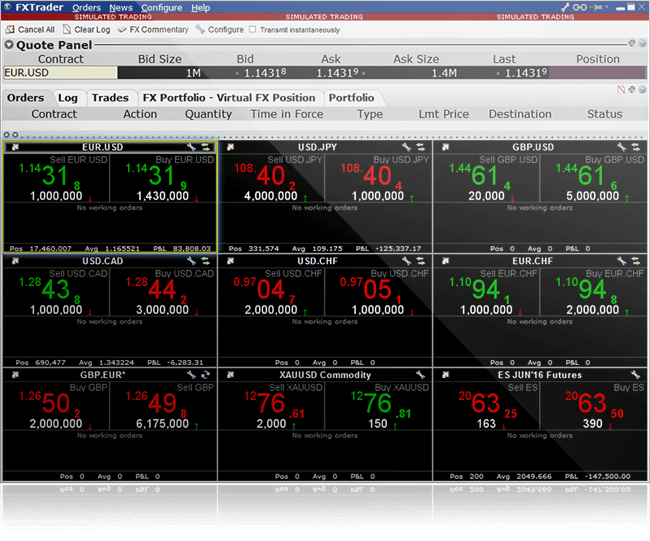

Interactive Brokers US Forex Trading Review: Seriously advanced trader tools for professionals Account: Interactive Brokers US Forex Trading Description: Interactive Brokers has been offering forex trading services in the US since their inception in 1978. As a pioneer in the industry, Interactive Brokers has established itself as a reputable and reliable broker for forex trading, offering competitive spreads, advanced trading platforms, and a wide range of currency pairs to trade. Over the years, Interactive Brokers has continued to enhance its forex trading offerings, incorporating advanced technology and features to meet the evolving needs of traders. Can you trade forex with Interactive Brokers in the US? Yes, you can trade currency futures with direct market access and currency options on the Interactive Brokers trading platforms. Interactive Brokers is a great forex broker for those who want to trade on exchange currency contracts rather than spot FX. Through IBKRs FXTrader you get interbank quality FX spreads, the ability to trade spot alongside on-exchange futures and over 20 forex order types like trailing stops to lock in profits if a position is going your way, OCO and scaled execution for large orders. IBKR US Address: Interactive Brokers LLC, One Pickwick Plaza, Greenwich, CT 06830, United

Pros

Cons

Overall4.8 |

|||

|

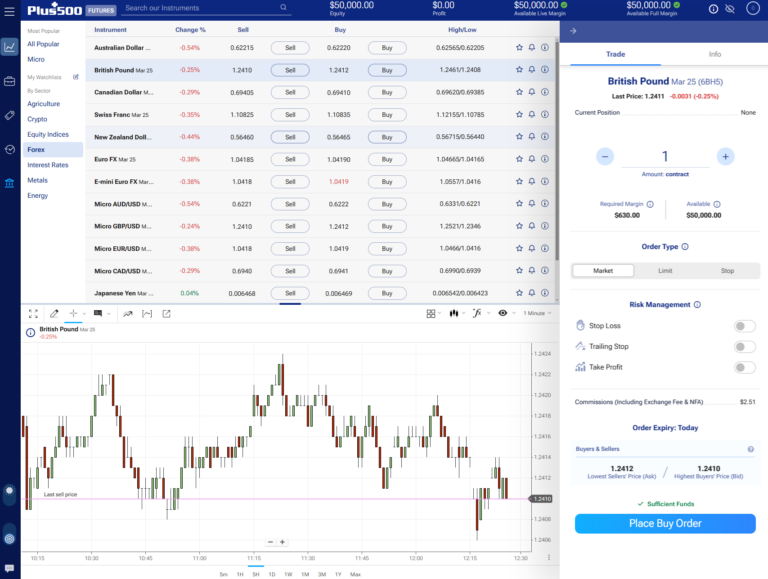

Forex Pairs |

Minimum deposit |

GMG Rating |

Customer Reviews |

Account Types:

|

Here’s how we selected the US’s best forex brokers:

- Hands-on analysis: Our review team tests each forex broker using real money for a genuine trading experience

- Stand-out features: We compare what sets each forex platform apart to highlight their unique strengths

- Customer feedback: Over 30,000 votes from the Good Money Guide annual awards help shape our ratings

- Exclusive interviews: We speak directly with forex broker CEOs and senior management to get their insights

- Our process: Find out more about how we choose and rank providers on our How We Rate page

How do you start forex trading in the US?

If you are based in the US, you need the following to start forex trading:

- An account with a forex broker that accepts US clients (see the comparison table on this page)

- Funds to trade with (forex trading is very high risk so only trade with money you can afford to lose)

- An understanding of what moves currency prices (everything from economic indicators to political events moves forex prices)

If you want to trade forex in the US, you must go through a regulated broker. Unlike equities, where you can buy directly through an exchange, forex is traded on a decentralised over-the-counter (OTC) market. Brokers act as the gateway, matching buyers and sellers or providing liquidity themselves.

The main benefits of using a forex broker are:

- Market access: Brokers provide the platforms, tools, and execution needed to trade currency pairs.

- Leverage: US brokers can offer margin trading (although capped at 50:1 by the CFTC).

- Protection: Regulated brokers must comply with strict rules, keeping client funds segregated and providing fair dealing.

What is forex trading in the US?

The foreign exchange market is the largest and most liquid market in the world, with daily turnover above $7 trillion. Trading takes place 24 hours a day, five days a week, across major financial centres such as London, New York, and Tokyo.

In forex, you trade currency pairs, for example, EUR/USD or USD/JPY where one currency is bought while the other is sold. Prices are influenced by economic data, interest rates, central bank policy, and global events.

For US traders, it’s particularly important to understand:

- Regulation: Only brokers overseen by the Commodity Futures Trading Commission (CFTC) and members of the National Futures Association (NFA) are allowed to operate.

- Restrictions: Leverage is capped at 50:1 for major pairs and 20:1 for minors and exotics.

- Costs: US brokers must quote transparent spreads and cannot offer the same promotions or bonuses seen overseas.

How do you choose the best US forex broker?

At Good Money Guide, we shortlist only trusted and established brokers that meet these criteria so you can compare them side by side with confidence.

When choosing a forex broker in the US, consider the following:

-

Regulation and safety

Ensure the broker is registered with the CFTC and is an NFA member. This protects you from scams and unregulated operators. Interactive Brokers is one of the most heavily regulated brokers around the world.

-

Trading costs

Look at spreads, commissions, and rollover (swap) rates. Even small differences can add up over time. When you are trade forex you will either be charged for spot trades where commission may be included in the spread. Or if you are trading US currency futures you will be charge commission on a per lot basis.

-

Platforms and tools

MetaTrader 4/5 are common, but some brokers offer proprietary platforms with advanced charting and execution speed. However, most established brokers will have their own proprietary trading platform. For instance IBKR has some of the best on exchange execution tools available to traders.

-

Currency pairs

If you want to trade more than just majors, check the broker’s product list. New and small brokers will only offer the most heavily traded FX pairs. The better US forex brokers will let you trade a greater range of markets.

-

Service and support

Reliable customer service and education resources are key, especially for beginners. You won't get any support from online brokers other than online guides when you start trading forex. But, if you are a large trader you may be assigned a personal broker to help with any issues.

Are US forex brokers safe?

Regulated and established US forex brokers are a safe place to trade. However, forex trading is not a safe form of investing. Forex trading is very high risk and many new traders are unsuccessful.

Here are 7 tips to help you with forex risk management:

- Use Stop-Loss Orders: A stop-loss order automatically closes your trade at a set level, preventing further losses. For example, if you buy EUR/USD at 1.1000, you might set a stop-loss at 1.0950 to limit downside to 50 pips.

- Limit Your Leverage: While US regulations already restrict leverage, traders should still avoid using maximum margin. Trading at lower leverage (e.g. 5:1 instead of 50:1) reduces the chance of a margin call.

- Position Sizing: Never risk more than a small percentage of your account on a single trade. Many traders use the “2% rule,” meaning no trade should risk more than 2% of your total account balance.

- Diversify Currency Pairs: Avoid concentrating on a single currency pair. Spreading trades across different pairs (e.g. EUR/USD, USD/JPY, GBP/USD) can reduce the impact of volatility in one market.

- Keep a Trading Journal: Recording every trade, entry, exit, reason, outcome, helps identify patterns in behaviour and improves discipline over time.

- Control Emotions: Set rules for when to trade and when to step away. Emotional discipline is as important as technical skill in managing risk.

- Use Demo Accounts Before Going Live: Practise strategies on a demo account first. This lets you test stop-loss placement, leverage levels, and position sizing without financial risk.

Are forex brokers legal in the US?

Forex regulation in the United States is some of the strictest in the world. Unlike regions such as Europe or Asia, where multiple regulators compete, the US has a centralised and highly enforced framework overseen by federal agencies. This makes the market safer for retail traders but also limits leverage, restricts products, and reduces the number of brokers who can operate.

Some of the most important US forex rules include:

- Leverage limits: 50:1 on major pairs; 20:1 on minors and exotics.

- Capital requirements: Brokers must hold significant net capital to ensure financial stability.

- No hedging rule: US traders cannot hold both long and short positions in the same pair simultaneously.

- FIFO (First In, First Out): Positions must be closed in the order they were opened.

- Advertising restrictions: Brokers cannot offer bonuses or misleading promotions.

You can check to see if a US forex broker is regulated on the NFA’s BASIC database: https://www.nfa.futures.org

Commodity Futures Trading Commission (CFTC)

The CFTC is the main federal agency regulating forex in the US. It oversees futures, options, and forex markets, ensuring transparency and stability while protecting traders from fraud and manipulation.

National Futures Association (NFA)

The NFA is an independent self-regulatory body. All US forex brokers must register with the NFA, which enforces compliance rules, audits firms, and provides a database where traders can check a broker’s regulatory status.

A brief history of how US forex brokers have been regulated

1974

1982

2000

2008

2010

Dodd–Frank Act enacted, capping leverage and banning certain practices (e.g. off-exchange retail forex options).

US Forex Broker FAQs:

Here are the answers to the most commonly asked questions by people searching for the best futures brokers in America.

Forex brokers make money from forex traders in three ways.

- Fees: This can either be the difference between the buy and sell price they offer their clients or commission on trade.

- Overnight financing: This is the amount forex brokers charge clients for holding positions overnight

- Unhedged positions: This is where a forex broker will not hedge a client trade in the underlying market

You can compare forex spreads and commissions that forex brokers charge in our US forex broker comparison table or click the button to view the specifics on the individual forex broker’s website. If you have a large forex trading account you should be able to negotiate lower fees.

The majority of forex brokers will offer (MT4 MetaTrader 4) as a trading platform alongside their own in-house developed platform or other third-party trading platforms.

Forex brokers like Interactive Brokers and Forex.com in the comparison table on this page accept clients from the US. US regulations mean that Forex brokers outside of the US cannot accept US clients so if you are a US resident you need a forex broker that is regulated to accept customers from the US.

Yes, if you are using a reputable and US-regulated forex broker, forex trading is a legitimate form of speculating on the financial markets.

Forex trading is legal in the United States. However, unlike in many other countries, it is heavily regulated. This means US traders can only use brokers that are licensed by the Commodity Futures Trading Commission (CFTC) and are members of the National Futures Association (NFA).

TD Ameritrade (now part of Charles Schwab) offers forex trading services through its thinkorswim® platform. They provide access to numerous currency pairs and advanced trading tools, catering to both beginner and experienced traders.

Charles Schwab Futures and Forex LLC provides forex trading services with a focus on delivering a comprehensive trading experience. With availability for 23 hours a day from Sunday to Friday, traders can access the forex market at their convenience. The thinkorswim® platform, offered by Charles Schwab, provides world-class technology and innovative tools to support forex trading. Investors can enjoy commission-free trading, with costs reflected in the bid/ask spread. The platform offers extensive product access and allows trading of over 70 currency pairs. In addition, knowledgeable support is available through the trade desk associates, providing assistance to forex traders around the clock.

ETRADE provides access to various futures contracts, including currency futures. Currency futures are standardized contracts that represent a specified amount of a particular currency to be exchanged on a future date at a predetermined price.

Through ETRADE’s trading platform, you can explore and trade currency futures contracts, such as those based on major currency pairs like EUR/USD, GBP/USD, USD/JPY, and more. ETRADE offers a range of tools and resources to assist with currency futures trading, including real-time market data, advanced charting, and order execution capabilities.

It’s important to note that trading currency futures involves risks, and traders should have a good understanding of futures contracts and currency markets before engaging in trading activities. Additionally, E*TRADE may have specific requirements and fees associated with currency futures trading, so it’s advisable to review their website or contact their customer support for detailed information on their futures trading services.

TastyTrade provide access to currency options, which are derivative contracts that give traders the right, but not the obligation, to buy or sell a specific currency at a predetermined price within a specified time period.

Through the tastytrade platform, you can explore and trade currency options on major currency pairs and potentially profit from changes in exchange rates. Tastytrade offers a range of options trading tools and resources to assist with currency options trading, including options analytics, risk management features, and educational content.

No, you should avoid copy trading in forex. It is possible but there is a high probability that you will lose your money. When dealing in high-risk products like currency futures, you should always do your own research and make your own trading decisions.