Forecast contracts are platforms where participants buy and sell contracts based on the outcome of future forecasts. These forecasts can be political, economic, sporting or anything that can be framed as a clear yes or no question. Prices move according to supply and demand, which means the market reflects the collective view of all participants about how likely a forecast is to occur.

| Name | Logo | Commission | Interest | GMG Rating | Customer Reviews | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

Commission $0-0.10 |

Interest 3.37% APY |

GMG Rating |

Customer Reviews |

Contract Venues:

|

|

|||

|

Commission $0.01 |

Interest 0% |

GMG Rating |

Customer Reviews |

Contract Venues:

|

|

|||

|

Commission $0 |

Interest 4% |

GMG Rating |

Customer Reviews |

Contract Venues:

|

|

What are forecast contracts?

In effect, forecast contracts turn opinions into tradable instruments. If a contract is trading at 70, the market is implying a 70 percent chance that the forecast will happen. If the outcome is confirmed, the contract settles at 100. If it does not, it settles at zero.

Forecast contracts are often used to gauge sentiment because they combine information from a wide range of participants and update continuously as expectations change.

What are the most popular forecast contracts?

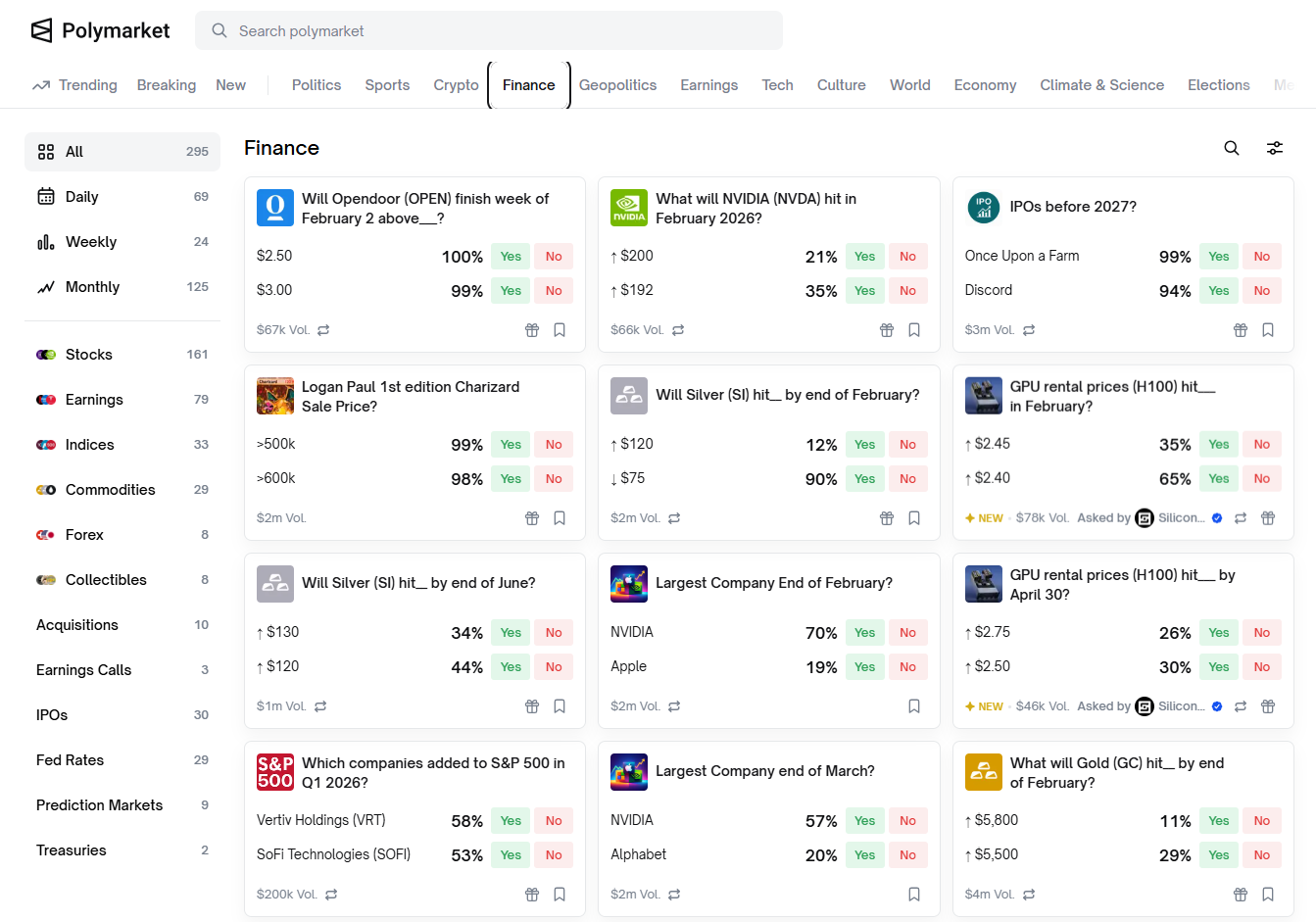

The best-known forecast contracts are global retail platforms that allow participants to trade opinions about politics, policy decisions and macro forecasts. Popular examples include markets on election winners, central bank decisions, inflation outcomes, interest rate cuts or hikes, and sporting or entertainment results.

Institutional versions also exist. Exchanges such as CME have explored forecast-style contracts in the past, and a number of academic and research bodies build internal forecast contracts to predict business outcomes, sales numbers or product success.

Which is an example of a forecast contract?

A widely cited example is PredictIt in the United States. Traders could buy or sell shares in outcomes such as who would win an election or whether a piece of legislation would pass. Each share costbetween 1 cent and 99 cents and settled at 1 dollar if the forecast occurred.

Another example is Kalshi, which operates regulated forecast contracts on subjects such as interest rate decisions, inflation releases or weather metrics. Although these are structured as forecast futures, they behave similarly to forecast contracts, with prices reflecting the probability of an outcome.

Many decentralised crypto platforms also run forecast contracts where settlements occur on-chain, although liquidity and regulatory certainty differ from traditional financial exchanges.

Are forecast contracts the same as gambling?

Not exactly, but the distinction depends heavily on regulation and jurisdiction.

Forecast contracts are designed to aggregate information and express probabilities, while gambling is primarily entertainment with no market pricing mechanism. However, when forecast contracts cover highly sensitive subjects such as elections, regulators often view them as too close to betting.

Some authorities classify political forecast contracts as gambling. Others permit them under strict conditions if they are used for research, education or hedging economic outcomes. This blurred line is one of the main challenges facing the industry.

Who regulates forecast contracts?

In the United States, forecast contracts that function like financial contracts fall under the oversight of the Commodity Futures Trading Commission (CFTC). The regulator has approved certain forecast-based markets and rejected others, particularly those involving political outcomes.

Elsewhere, regulation varies. Some countries do not permit real-money forecast contracts at all. Others classify them under gaming rules rather than derivatives regulation. Crypto-based markets often fall outside traditional frameworks entirely, which increases risk.

Because oversight is inconsistent, traders need to check whether a platform is licensed, supervised or operating under a no-action letter.

Forecast contracts versus futures and options

Forecast contracts resemble derivatives but operate more simply. A futures or options contract has complex pricing, margin requirements, time decay and exposure to underlying assets. Forecast contracts strip all that back to a single binary question: will this happen or not.

Key differences include:

Futures and options allow hedging real market positions. Forecast contracts are usually speculative.

Derivatives have well defined valuation models. Forecast contract pricing is driven entirely by trader sentiment.

Futures and options are standardised financial instruments. Forecast contracts are often bespoke and can include non-financial subjects such as elections or policy decisions.

Derivatives are tightly regulated globally. Forecast contract regulation is inconsistent and often contested.

Despite the simplicity, forecast contracts behave similarly to binary options, where the final settlement is 100 if the forecast occurs and zero if it does not.

Pros and cons of forecast contracts

Pros

- Simple to understand. Traders only need to decide whether a forecast will happen, and prices directly reflect probabilities.

- Low barriers to entry. Contract sizes are small and do not require margin, which makes the format accessible.

- Continuous sentiment gauge. Markets show real time collective expectations ahead of major forecasts.

- Useful for hedging uncertainty. Some institutional markets allow participants to hedge economic or policy outcomes.

Cons

- Risk of total loss. If the forecast does not occur, contracts typically expire worthless.

- Regulatory uncertainty. Many political or socially sensitive markets face restrictions or shutdowns.

- Information quality varies. Prices can be distorted by low liquidity or herd behaviour, reducing their reliability.

- Potential overlap with gambling laws. Some jurisdictions classify forecast contracts as gaming, which limits access and protections.