A Tax-Free Savings Account (TFSA) is a flexible, tax-advantaged investment account available to Canadian residents aged 18 and older. Introduced in 2009, the TFSA allows individuals to grow their savings tax-free and withdraw funds at any time without tax consequences.

| Name | Logo | GMG Rating | Customer Reviews | Account Fees | Dealing Commission | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews |

Account Fees $0 |

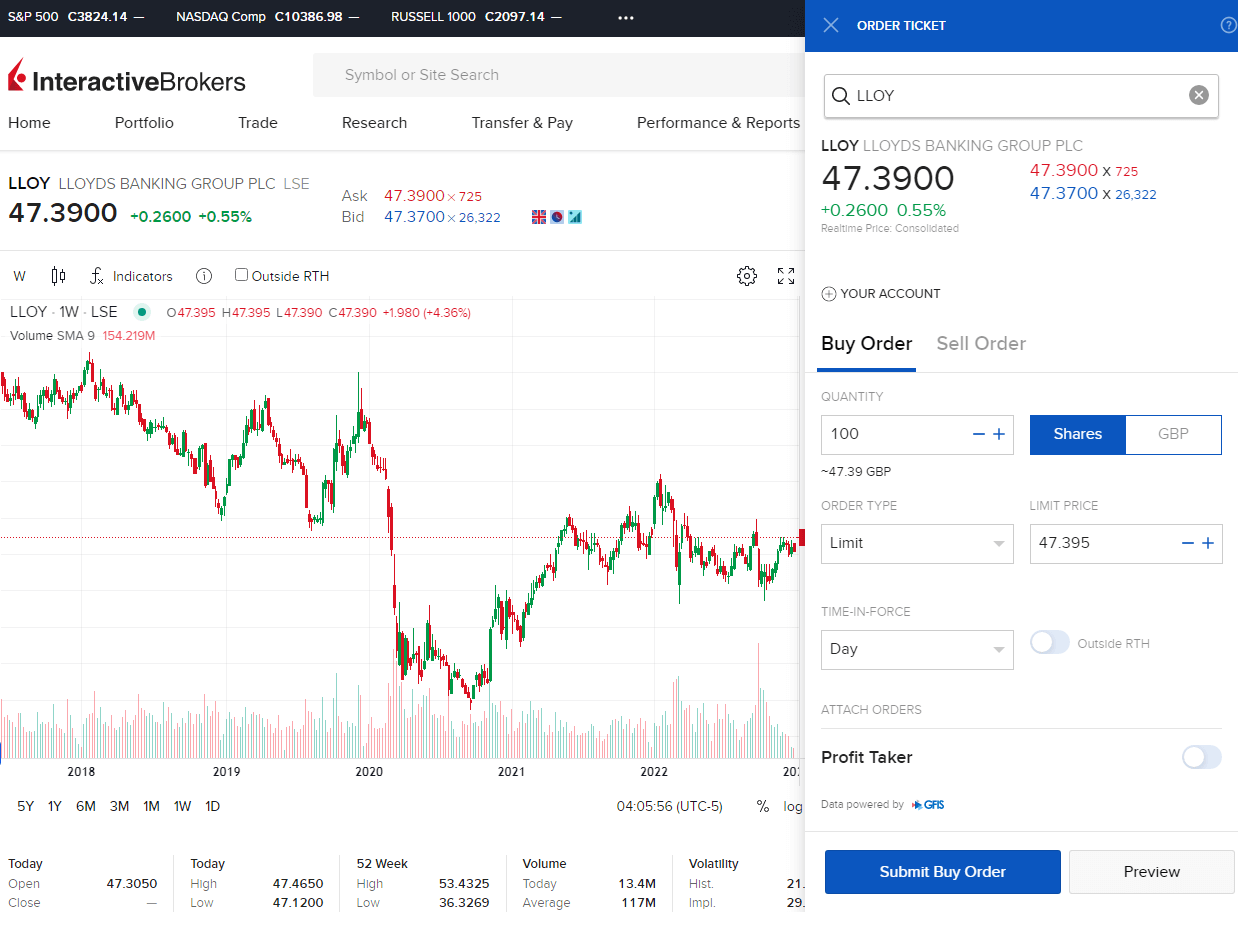

Dealing Commission 0.05% |

See Offer Capital at risk |

Features:

|

|

How a TFSA Works

Each year, the government sets a contribution limit, which accumulates if unused. As of 2024, the annual contribution limit is $7,000, with a total contribution room of $95,000 for those eligible since 2009. Contributions are made with after-tax income, meaning withdrawals are completely tax-free.

Investment Options

A TFSA is more than just a savings account—it can hold:

- Cash

- Stocks and ETFs

- Bonds and GICs

- Mutual funds

Investment income, including interest, dividends, and capital gains, is tax-free, making it a powerful tool for long-term growth.

Contribution Rules and Limits

- If you exceed your contribution limit, a penalty of 1% per month applies on the excess amount.

- Withdrawals do not reduce your contribution room but are added back the following year.

- Unused contribution room carries forward indefinitely.

TFSA vs. RRSP

While an RRSP (Registered Retirement Savings Plan) provides tax deductions on contributions but taxes withdrawals, a TFSA has no tax deduction upfront but allows tax-free withdrawals anytime—ideal for short-term savings and long-term investing.

Best Uses for a TFSA

- Emergency fund (tax-free access when needed)

- Short-term savings (e.g., vacation, car purchase)

- Retirement savings (tax-free growth and withdrawals)

- Investing in stocks and ETFs (capital gains remain untaxed)

A TFSA is a versatile savings tool for both short- and long-term financial goals.