The Canadian Dollar-to-US Dollar forecast is an indication of where technical and fundamental analysts think the CADUSD price may be in the future. You can use these exchange rate forecasts to help you decide if now is the right time to buy US Dollars with Canadian Dollars, or if you should wait until the price improves.

USDCAD forecast highlights

- USDCAD sinks below 1.40 to seven-month low

- Investors continue to rotate out of USD due to macro uncertainties

- C$ holders may buy some USD now on its recent weakness; watch to acquire more on a further decline

How has USDCAD performed recently?

The US dollar has suffered from continuous selling since February (around the time Trump 2.0 started). Against the Canadian Dollar, the rate peaked at 1.47 earlier this year and subsequently rolled back down, all the way below 1.400.

This up-and-down move cemented the January high as a peak of medium-term significance. Note this top was close to the 2020 high.

After piercing through the 1.400 support and foiling an attempt to retake this level, USDCAD, unsurprisingly, ventured deeper and deeper south. To the point where prices are threatening the multi-year uptrend from 1.200 (see below).

From here, we would not rule out the possibility of a rebound. The rate is oversold.

But for USDCAD to resuscitate the uptrend in a sustained way requires positive catalysts in favour of the USD. We await policy signals from the White House.

Is it a good time to buy US dollars from Canadian Dollars?

The past few months have been good for prospective USD buyers, as the Canadian dollar strengthened markedly. As 2025 started, more than C$1.45 was required to buy a single US dollar. Now, you only need C$1.36-37.

At C$ keeps strengthening into 1.360, it is presenting USD buyers with a good opportunity to lock in the lowest rate in months.

Of course, you may wish to wait a while longer to squeeze out better rates. A further decline from here to, say, 1.350 is possible. But this is not a given since FX rate volatility is high. The rate could easily rebound from this level.

I’m maintain the view that if you do need some USDs now, buy some and wait.

Will USD get stronger against CAD?

The entire FX market is adjusting to a new world – a world with higher tariffs, higher policy uncertainty, and higher market volatility.

The US dollar was cruising higher earlier this year. But its elevation was cut short by sudden policy adjustments emanating from the White House.

In the latest Bank of Canada economic assessment (6 June), the MPC pointed that:

the US administration has continued to increase and decrease various tariffs. China and the United States have stepped back from extremely high tariffs and bilateral trade negotiations have begun with a number of countries. However, the outcomes of these negotiations are highly uncertain, tariff rates are well above their levels at the beginning of 2025, and new trade actions are still being threatened.

As a result of these unpredictable factors, the central bank concluded: “Uncertainty remains high.”

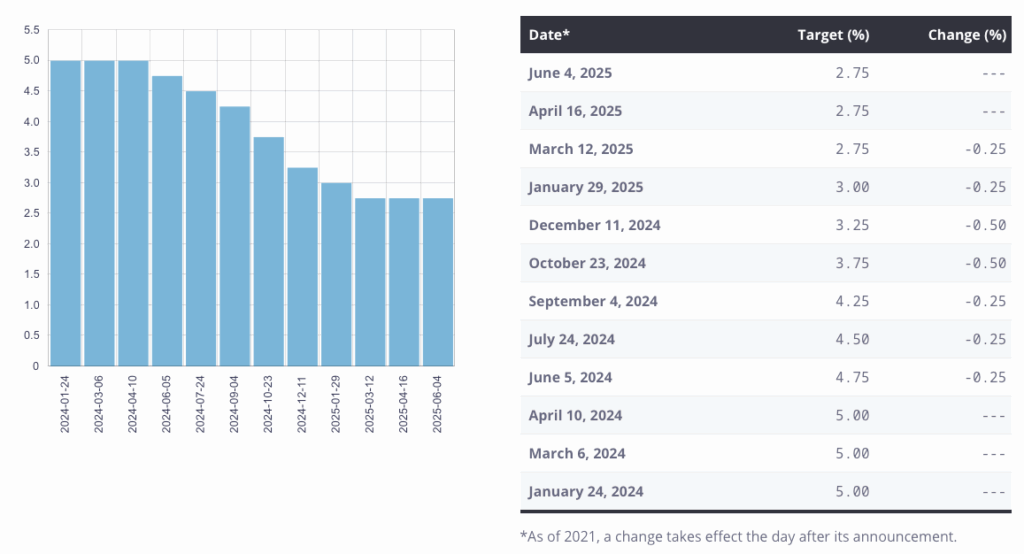

The upside, however, is that Canadian interest rates have dropped markedly since 2024. This brings some economic relief to indebted households and corporations.

Still, if macro uncertainty persists, a softening of the global economy is a distinct possibility.

Normally, high risk aversion leads to a strengthening of the US dollar. Not this time. Something has changed (for good?) in the calculus of international finance. A change that is directing haven-seeking money away from the dollar.

Perhaps it is the stratospheric US debt load that scares investors. Perhaps it is the uncertainty of Trump 2.0. Whatever the reason, the US dollar is behaving differently from the past.

Therefore, for USDCAD to regain its strength, investors need deep assurance that recent macro events are temporary. Until this happens, any rebound by USD against CAD may be sold into.

Source: Bank of Canada

What is the USDCAD forecast in weeks?

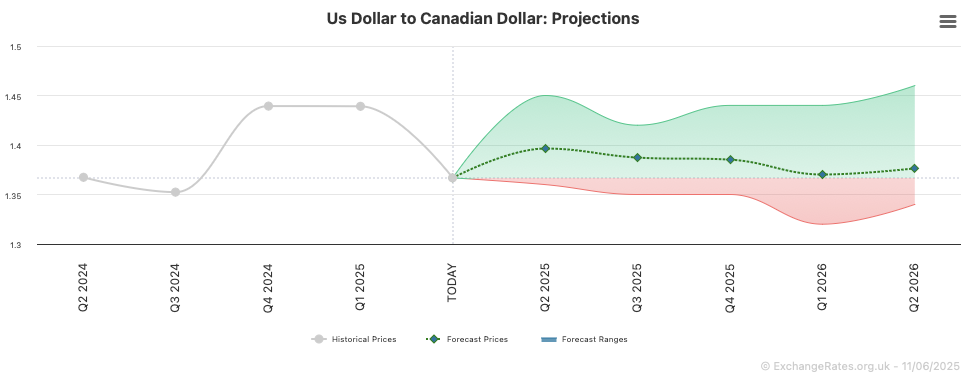

Most brokers are mostly expecting the USDCAD to fluctuate in between 1.350-1.40 over the medium term.

But, as you can observe below, the variability of the forecast range is high. Some anticipate the rate to drop near 1.300; some suggest a rebound above 1.45.

Whatever these forecasts are suggesting, I would always pay more attention to the actual prices. For now, the direction of USDCAD is pointing south (CAD stronger). Hence I assume a continuation of this trend. A large rebound is required to signal the end of the move.

Source: ExchangeRates.org.uk

Where is the best place for buying large amounts of USD from Canadian Dollars

There are two different ways people buy USD from Canadian dollars:

- Through a currency broker – when transferring money abroad

- Through a forex broker – when speculating on the price of currency

You can use this comparison table of Canadian currency transfer companies to see how many currencies they offer, what the minimum USD transfer is and if they offer forwards and currency options as well as when they were established. You can either visit each currency broker individually or use our currency quote comparison tool to request multiple exchange rates.

Or, if you are more interested in trading CADUSD you can compare Canadian forex brokers here.

How many USD does 1 Canadian Dollar get at the live exchange rate?

At the live current CADUSD exchange rate 1 CAD is worth 0.7217351 USD which is a change of 0% from the previous day’s closing price. Over a week CADUSD is 0%, compared to its change over a month of -0.73% and one year of -1.87%.

CADUSD exchange rate data is updated every 15 minutes.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please ask a question in our financial discussion forum.