US investing platform eToro has unveiled a suite of target-date investment portfolios in collaboration with global asset management giant Franklin Templeton. The new offerings aim to make long-term investing simpler and more accessible, especially for retail investors planning for specific financial goals like buying a home or saving for retirement.

These portfolios are designed to evolve over time. Starting with a diversified allocation heavily weighted toward equities, they gradually reduce exposure to riskier assets as the target year approaches, transitioning towards fixed income. The goal is to deliver capital growth early in the investment journey and then shift toward capital preservation, removing the need for manual rebalancing.

The launch includes four date-based strategies targeting 2028, 2030, 2033, and 2035, alongside two additional portfolios: FixedIncome-FT, a conservative mix with 90% bonds and 10% equities, and Equity-FT, a growth-oriented portfolio with 100% equity exposure that does not adjust over time.

Yoni Assia, eToro’s CEO and Co-founder, posted on LinkedIn: “Whether you’re investing to buy a house or to build a nest egg, target-date portfolios offer a hands-off way to help you stay on track with your financial goals. This is another step in our commitment to providing retail investors with long-term investment solutions.”

Jenny Johnson, President and CEO of Franklin Templeton, added: “We are excited to partner with eToro. By combining our deep expertise in target-date ETF portfolios with eToro’s cutting-edge social investing platform, we are able to offer outcome-based investment solutions to a broader audience, including digital-native younger investors.”

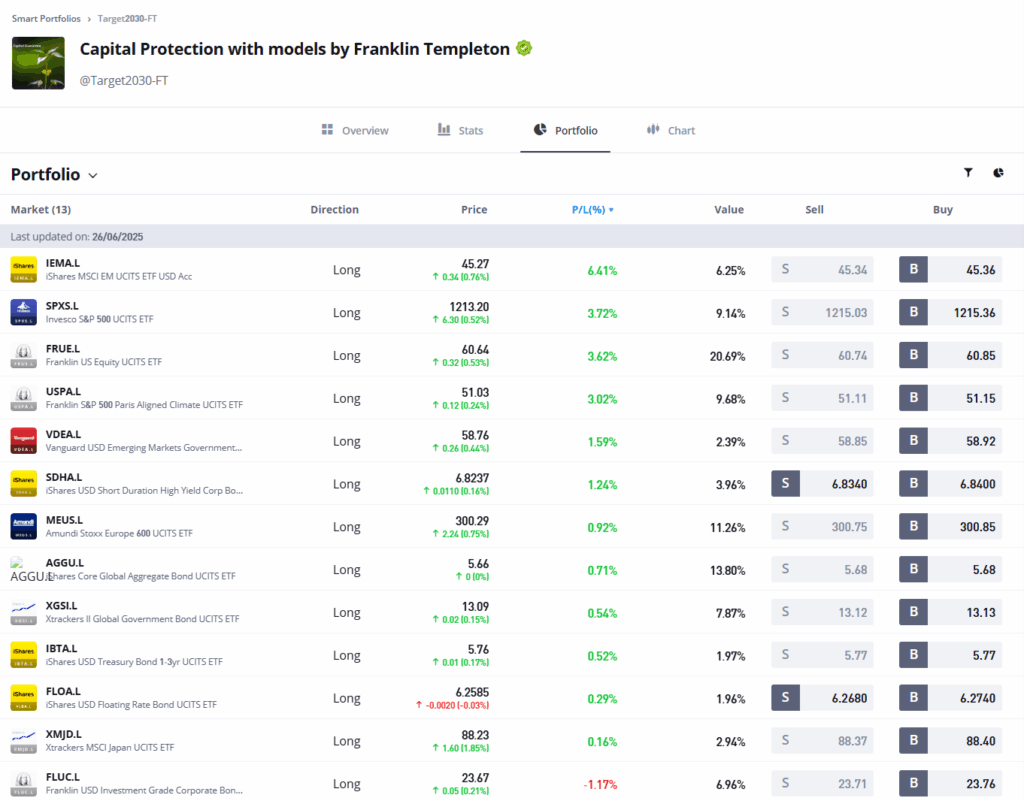

The Target2030-FT portfolio, for example, currently holds a globally diversified mix of 13 ETFs, including:

- iShares MSCI EM UCITS ETF (IEMAL) — up 6.41%

- Invesco S&P 500 ETF (SPXS.L) — up 3.72%

- Franklin US Equity UCITS (FRUE.L) — up 3.62%

- Amundi Stoxx Europe 600 (MEUS.L) — up 0.92%

- iShares USD Floating Rate Bond (FLOA.L) — up 0.29%

- Franklin USD Investment Grade Corporate Bond (FLUC.L) — down 1.17%

Initial investments start at $1,000. Notably, those who invest at least $2,000 in the Target2030-FT portfolio between 1 July and 31 December 2025 will receive full capital protection if held until 30 June 2030, subject to terms and conditions.

eToro’s target-date portfolios are currently unavailable to users based in the US.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.