For active traders the best way to trade commodities in Canda is through futures and CFDs platforms like Interactive Brokers which offer flexibility but require strong risk control. For long term investors, ETFs and commodity stocks provide accessible exposure with lower complexity. Physical metals can be part of a diversified portfolio. The best approach is the one that matches your experience, trading style and risk tolerance.

| Name | Logo | CFD Markets | Minimum Deposit | GMG Rating | Customer Reviews | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

CFD Markets 13,500 |

Minimum Deposit $1 |

GMG Rating |

Customer Reviews 4.2

(Based on 19 reviews)

|

Visit Platform 74% of retail CFD accounts lose money. |

Account Types:

|

FOREX.com Won Best Forex Broker in our 2025 Awards Provider: FOREX.com Verdict: FOREX.com is one of the largest forex brokers operating globally and owned by Nasdaq-listed institutional broker StoneX. Forex.com offers traders access to 7,000+ assets including 80+ currency pairs, thousands of stocks, popular commodities, indices and cryptocurrencies (pro accounts only in the UK & EU). Pricing is competitive, especially for those on the RAW spread account or active trader programmme.

Is FOREX.com a Good Trading Platform? FOREX.com won Best Forex Broker in the 2025 Good Money Guide Awards. 24-Hour FOREX.com Test I took FOREX.com out for a 24-hour test drive, to trade with real money and try out some of the key features on the streets of the City of London. Here’s what happened… “For FX sake”, I thought to myself when faced with writing a review about a forex broker. Firstly because all these brokers do is offer access to the forex market (or so I believed). Secondly, because I’ve never had much success with forex trading. I find the nuances of intra-day technical analysis too complicated. I’m an old-fashioned trader – I like to look at the market and think it’s either overvalued or undervalued and, in my mind anyway, that’s easier when looking at a company’s share price, an index or even a commodity. But for some reason, with forex trading, I’ve never really got the hang of it. Having said that, I have dealt currency for about 20 years now, but more as a broker rather than as a trader. For instance, I used to do some prime brokerage for institutions that would hedge their currency exposure when buying aeroplanes. But I was so frustrated with how opaque pricing was in currency trading, that I decided to start up my own currency brokerage specialising in high-value currency transfers (£250,000 upwards) and undercutting everyone. It was called Berry FX, you can still see the demo on YouTube. Basically, personal service with the best rates anywhere ever. But now I just let other currency brokers compete for clients by trying to offer the best exchange rates. But you want to know what I think of FOREX.com. 24 Hour Test I took FOREX.com out for a 24-hour test drive around the City of London, putting some real trades on whilst going about my business to see if I could make any money. I started out at the Bank of England with £10,000 on account at 11:30am. Lunch was a few minutes’ walk from the tube station, so I took the opportunity to put some trades on using FOREX.com’s trading signals. I’ve used these for years; back in 2018, they were known as GetGo and it was a standalone forex trading app. When I reviewed it then, I said these were the future of forex trading signals but are they still? There are a couple of things that make these signals better than the rest.

When I was walking down King William Street to L’Antipasto to meet some contacts for lunch, I put a few trades on. First, I looked at the traders that had a historic success rate of over 50% and followed them. Then I looked at trading signals that had a success rate of less than 50% and traded against them. It’s a pretty simple strategy that generally works (not always, though). I used the classic stop/limit risk/reward ratio, aiming for twice the potential loss as a potential win. Again, simple forex trading strategies. The market is not hard to call, but if you get a trade right, it often pays to let it run for longer, but if it’s wrong, close it sooner. Trading Central On the way to my next meeting, I took a few moments on London Bridge to look at some of the other signals on FOREX.com: Trading Central. Now, Trading Central has been providing technical analysis to brokers for decades and supplies a constant stream of manually and automatically updated trading ideas throughout the day to give traders an indication of where the markets may go. It’s not as fluid as the trading signals, as you have to put the trades in manually, but still gives you a bit of stimulus. This is great for someone like me because I generally have an idea of what I want to do from eyeballing a chart (I did, after all, run a technical analysis division for 5 years), but it’s nice to get confirmation of your thoughts one way or another. Execution When you are actually trading there are some great other features on the app:

Post-Trade Analytics Once you’ve done a bit of trading, you can review your trading history and see where you do well and where you can improve. This is a great feature as it can break down how well you trade by time of day, markets or volatility. You can also set up “Play Maker” if you have a trading strategy and want to stick to it. Obviously, you can’t get that sort of data in a 24-hour test drive, so I’ll have to revisit that another time. Demo Account FOREX.com has a pretty good demo account. In fact, it’s hard to tell the difference between the demo and live trading platform. You get the same functionality and as trades are OTC, the same prices. However, when I opened a demo account to test it, I already had a real account. So after I got my demo account login details, I clicked through to the “Webtrader” portal and (funny or alarming, depending on how you look at it) my live account details were auto-filled in by Google Chrome. Now, had I not been checking my email, to ensure that the platform had sent me through my credentials, I might not have noticed that I was logging into a live account. It could have been disastrous if I’d started trading away thinking it was paper money. Even more so as you get £10,000 in demo funds and I’d deposited £10,000 in my live account when I took FOREX.com on a 24-hour trading signal test drive. It reminded me of when a trader thought that he was trading on a demo account and put $1bn worth of orders through and then sued his broker because it voided his €10m profits. TradingView & MetaQuotes I had a good play about with TradingView, as it’s now the go-to destination for traders. TradingView is a sort of social network for traders where you can view charts (they are excellent) and post trading ideas (take with a pinch of salt). As TradingView has grown, it has also become an execution venue, so you can link your FOREX.com trading account and deal straight from the charts. This shouldn’t be too much of a stretch for most traders as the charts on the app and web-based platform are provided by TradingView (which, incidentally, is one of the largest financial-based websites in the world now). You can also trade on MT4 or MT5 (but only MT5 in the EU), if you are into that sort of thing… Am I a Forexpert? I did make money on day one, mainly thanks to putting on a GBP-USD trade that covered most of the losses from some of the other trades. When I used the trading signals 5 years ago, I also made money. Day 2 wasn’t so good. On my way to an investor show, I gave back a few pennies but still ended up on top. But I have to admit my traders were calculated guesses rather than heavily researched positions. I don’t like holding positions overnight, as day trading reduces not only your margin requirements but also increases the amount of sleep you get because you don’t wake up with cold sweats in the middle of the night worrying about Asian interest rates. Overall would I recommend forex.com? Yes, if you are going to trade forex and don’t know where to start, as it’s a massive brand with global reach and owned by a listed brokerage with an institutional pedigree. As far as box-ticking is concerned, it ticks the lot. Or should I say pips the lot… Pros

Cons

Overall4.6 |

||

|

CFD Markets 1,200 |

Minimum Deposit $1 |

GMG Rating |

Customer Reviews 4.6

(Based on 86 reviews)

|

Visit Platform 71.9% of retail investor accounts lose money |

Account Types:

|

Pepperstone is a great broker for automated trading and active traders Provider: Pepperstone Verdict: Pepperstone is a great all round broker for active traders looking for low costs. Especially for those that want to automate their trading as they are one of the biggest and best MT4 brokers with a very good set of EA packages. Pepperstone were founded in 2010 in Australia and have since then grown to be a global brokerage with international offices and around 400,000 active clients. They offer spread betting and CFDs on 1,200 major market instruments, which means they focus on the most heavily traded assets, mainly forex and indices trading. Of those 900 are shares on the major stocks on international exchanges. Is Pepperstone a good broker? Pepperstone is a great trading platform for traders who want low costs, wide market access and wide range of trading platforms, including one of the best MT4/MT5 packages available to retail traders worldwide. Pricing: Razor tight pricing (on their Razor account). Yes, I’ve used both trading platforms that Pepperstone offer, MT4/5 and cTrader, which include TradingView charting. cTrader is a more traditional trading platform with a basic layout, simple order execution and sentiment indicators. Whereas MT4 is one of the most popular and complex trading platforms available used by millions of traders and thousands of brokers. However, what makes Pepperstone’s MT4 offering stand out is the brokerage behind it. Pepperstone offers it’s MT4 clients experienced account executives based in London and other local offices around the world. Plus, Pepperstone have put together a package of expert indicators and trader tools that are available to download for free that can be plugged into MT4. To win business Pepperstone competes on price and compared to other trading platforms it is one of the cheaper options. For example, the Razor account can offer forex trading with zero pips, with the commission charged post-trade. Or traders can opt for the standard account, which adds a 1 pip markup, but is built into the spread. One of the interesting things about Pepperstone is that whilst they do the traditional digital advertising, they are not on football shirts (apart from the Tennis and now sponsoring Aston Martin) and as Tamas said in his interview, a lot of their business comes from referrals, which is always a good sign. They are a global brokerage so you can at the moment trade crypto, but only if you are a professional client in the UK or are in a jurisdiction that hasn’t banned crypto derivatives. Management: If you want to know more about the man currently running Pepperstone you can read my interview with Tamas Szabo, who has been Group CEO of Pepperstone since 2017, joining from IG where he started in 1996. So plenty of experience at the helm, Tamas, has been in the business for 25 years. One of the interesting things about Pepperstone is that whilst they do the traditional digital advertising, they are not on football shirts or anything like that and as Tamas said in his interview, a lot of their business comes from referrals, which is always a good sign. As I said Pepperstone offers CFD trading for international clients and spread betting for UK customers. Spread betting of course unique to the UK as trades are structured as bets so if you make money trading you don’t have to pay capital gains tax on your profits. Trading Platforms: Pepperstone doesn’t actually have its own proprietary trading platform instead they offer TradingView, MT4/5 and cTrader. MetaTrader is gradually pushing brokers and clients to MT5 because it’s faster and a bit more user friendly, however, there is a lot of resistance from traders, especially those that use EA’s or Electronic Advisors, as most have been written for MT4 and can’t be converted for MT5 without being re-written. Automated Trading: If you haven’t used one an EA, an Electronic Advisor enables you to trade automatically based on certain market criteria, usually based on technical analysis. So if the market does x, you buy, if the market does y you sell. The idea is that you set up a trading strategy and set it on autopilot to trade on your behalf. It’s not necessarily high-frequency trading that was featured in Flash Boys or Flash Crash, but it’s similar. If you want to know more about high-frequency trading those are two books well worth reading, Michael lewis has an excellent way of explaining complex derivatives and I particularly enjoyed Flash Crash because the chap it’s about was a client at the brokerage where I used to work and some people I know were mentioned in it, which is always quite amusing. A few things to note though about EAs, unless you have a VPS or VPN they won’t work if you turn your trading screen isn’t on and you can’t use them on the web version or mobile. However, Pepperstone will set you up with a free VPS connection if you want one and do a certain amount of business. MT5 versus MT4: MT5 is one of the most popular trading platforms on the planet and is used by millions of traders and hundreds of brokers. The key benefits are that it’s pretty simple to use and universally recognised, so if you used MT4 or 5 with one broker, switching accounts is fairly easy. Initially, it does have a clunky institutional feel to it, but once you get the hang of it it’s fairly simple to use. Pepperstone’s MT5 does have its advantages over other brokers though. Mainly the packages they offer, the spreads and the execution, but also the regulation. Pepperstone are regulated by the FCA, so if you are a UK client a certain amount of your funds are protected by the FSCS if Pepperstone was to go bust. You are not protected if you are using MT4 or 5 through an offshore broker, and to be honest, if you are based in the UK you should always be trading with an FCA regulated broker, or the FCA regulated entity of a broker. It is tempting to go offshore to get better margin rates since ESMA capped them but you can get them as a professional client and if you can’t qualify as a professional client you probably shouldn’t be trading with excessive leverage anyway. One of the main things that make Pepperstones MetaTrader offering stand out is market range, you get loads of forex pairs, the major indices and they are also increasing the number of shares they offer. They have the major FTSE 100 stocks and a few hundred US, European and Australian stocks, but that is growing. But, it is still nowhere near as many markets as someone like IG or Saxo offers. Also, Pepperstone is still only a trading platform so you can’t hold any of your long-term investments with them. Trading Tools: Pepperstone also has a unique package of MT5 downloads which they call Smart Trader Tools, which include plugins like Trade Terminal where you can set your preferences for assets. So for example if you always trade cable in 1 lot, and have a stop 10 pips away and a limit 20 pips that will be your default OCO when you trade. You also get things like a Pivot Points plugin where you can trade off previous highs and lows. Some other main features of MT4 are one-click trading, and the ability to trade off the charts. You can also move your entry and exit points automatically. If you trade four markets you can have four set up on screen and have your defaults for each one. cTrader: One of the major drawbacks about MT5 though is that it doesn’t show your margin when you trade, which to be honest isn’t great if you are a beginner because you have no idea what your exposure is or how much risk capital is going to be used up. It will tell you your overall margin position, but it won’t show you your individual margin rates. Which is daft. However, Pepperstone’s other platform cTrader does do this. To be honest, I actually prefer cTrader, I think it’s more user-friendly, it breaks down your margin. The disadvantage of course is that you can’t run net and hedged positions. You can’t trade with EAs but I don’t really like them anyway, I think the chances of clients making money with an off-the-rack automated trading strategy is pretty slim. It may work for a bit to nick a trade here and there but if you leave it running over a massive market correction you can get wiped out. You also can’t trade as many shares on cTrader as you can on MT5, which is a shame. I think it has a cleaner layout, with everything pre-installed and you can trade in a web browsers rather than having to download the software. If you are building your own EA then MT5 is for you but if you are just eyeballing the market and taking a view I prefer cTrader as you get news, calendars, plus Autotrachtists is on there as well and is linked to the pair you are looking at. Education & Analysis: One other thing to note as well is that when it comes to learning to trade or understanding the markets it is incredibly difficult. Pepperstone has partnered with The Corillian Academy, to provide some educational content. Corillian was set up by some fairly sophisticated traders with decent backgrounds. Richard Adcock for example has been on the board of the society of technical analysts for 30 years. Customer Service: Although probably the main benefit of Pepperstone over the majority of MT4 brokers is customer service. It’s a big risk trading the financial markets and there are often big sums of money involved. So being able to phone someone up who can execute trades for you and give you a full demo of the platform is almost more important, in my mind anyway, than pricing and market access. If you’re in the UK, you get to talk to your dealers in London, through direct dial. Pros

Cons

Overall4.1 |

||

|

CFD Markets 7,000 |

Minimum Deposit $2,000 |

GMG Rating |

Customer Reviews 4.5

(Based on 1,330 reviews)

|

Visit Platform 59.7% of retail investor accounts lose money |

Account Types:

|

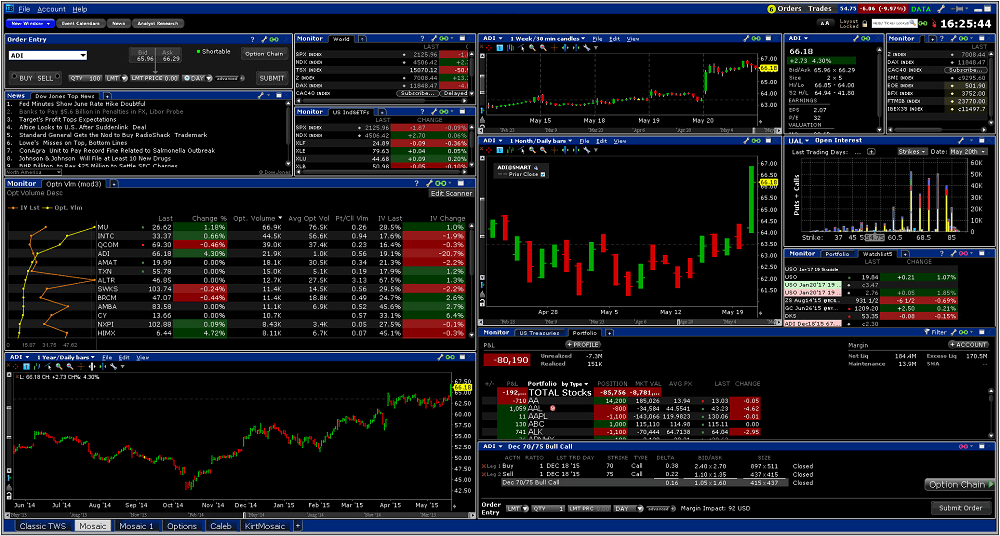

Interactive Brokers trading platform gives retail traders institutional grade features Account: Interactive Brokers Trading Platform Description: Overall, Interactive Brokers, as the pioneer of the online trading industry, remains one of the best all-round online trading platforms for sophisticated investors and traders. We rank Interactive Brokers as the best online trading platform as it is exceptionally good for sophisticated trading. It offers by far the most access to the most markets through DMA futures, options, physical shares and CFDs. it also has the most advanced execution tools for retail traders, including complex order types such as VWAP, pairs trading, iceberg, and algorithmic trading. Is Interactive Brokers trading platform any good? Interactive Brokers won “best trading platform” in our 2024 and 2023 awards as they offer an exceptionally advanced platform for advanced traders, but also a very simple interface for beginners. They also scored very highly in our annual survey for pricing and market range. We rank Interactive Brokers as the best online trading platform as it is exceptionally good for sophisticated trading. It offers by far the most access to the most markets through DMA futures, options, physical shares and CFDs. it also has the most advanced execution tools for retail traders, including complex order types such as VWAP, pairs trading, iceberg, and algorithmic trading. When I was testing the trading platform, one thing that is immediately obvious though is that the desktop version is almost too good for retail traders and most will only use a small percentage of its capabilities. However, new traders should not be put off by its institutional-grade offering. The heavy-duty Interactive Brokers Trader Workstation is available as a download on PC, but there is also a simplified web-based version that is very simple to use called Portal. On the web-based Portal trading platform, you can execute trades as physical deals, CFDs, futures and options (on the widest range of stocks). There are lots of webinars (with the founder Thomas Peterffy and his team) that cover trading strategy. You can also evaluate your portfolio based on how ethical your positions are. There are stock scanners, fund scanners, bond scanners, a fundamentals explorer for hunting out undervalued stocks and you can convert currency at some of the best exchange rates around. IBKR also gives you more control over your currency exposure. Most other trading platforms automatically convert currency when you trade instruments outside your base currency but IBKR lets you do it manually on a per-trade or ad hoc basis. What does Interactive Brokers trading platform look like?

Pros

Cons

Overall4.8 |

||

|

CFD Markets 2,000+ |

Minimum Deposit $50 |

GMG Rating |

Customer Reviews 3.7

(Based on 146 reviews)

|

Visit Platform 76% of retail investor accounts lose money |

Account Types:

|

Plus500 Expert Review 2026: A user-friendly platform with access to global markets Provider: Plus500 Verdict: Plus500 is one of the largest online trading platforms and operates in more than 50 countries worldwide. Founded in 2008, it has more than 26 million customers today.

Plus500 is headquartered in Israel, however, it’s listed in the UK on the London Stock Exchange (it’s a member of the FTSE 250 index). Here in Britain, its platform is operated by Plus500UK Ltd, which has offices in London.

In the UK, you can only trade CFDs with Plus500. CFDs are financial instruments that allow you to profit from the price movements of a security without owning the underlying security itself. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Is Plus500 a good broker? Yes, Plus500’s trading platform has evolved nicely over the years from a simple interface to an intuitive execution venue for CFDs on the major markets and stocks. Opening a Plus500 account is really simple:

Pricing: It’s dynamic so moves with the market for minimum spreads. Plus500 does not charge any trading commissions when you place a CFD trade. However, there are some fees you need to be aware of including:

Withdrawals are free of charge no matter how many you make per month. Deposits are also free of charge. Market Access: Very good, Plus500 are always first to try new asset classes With Plus500, you can trade CFDs on a range of assets and instruments including:

Overall, there are over 2,800 assets you can trade with CFDs. The maximum amount of leverage you can use with Plus500 varies depending on the asset class as shown in the table below. If you are trading forex, you can potentially borrow up to 30 times your own money. For shares, you can only borrow up to five times your own capital. Plus500 margin rates:

Platform & Apps: Basic execution, but it does the job well Plus500 trading apps and platform also offers several tools to help traders manage risk including:

Customer Service: Plus500 doesn’t have a phone option, but its live chat is sufficient Plus500’s customer service options are limited to online chat, email and WhatsApp. So, you can’t contact the company by telephone. However, don’t let that put you off. We contacted the company via online chat and were very impressed with the service and support offered. It’s worth noting that support is available 24/7. This is a big plus – some other CFD providers only provide support during the week. If you are a larger or professional trader you can get access to Plus500’s Premium Service Package which includes:

The premium service is invitation only. To become a premium customer, you must have a real-money trading account. However, if you want better margin rates but are not interested in the premium package you can upgrade to a professional account. The Plus500 professional account is an account designed for professional traders. With this account, you have access to higher levels of leverage (e.g. 1:20 for shares). To be eligible for a professional account, you must meet two of the following three criteria:

Research & Analysis: Some sentiment, but limited education and analysis. Plus500 offers a range of additional features designed to help traders make money, including:

Pros

Cons

Overall4.6 |

How to Trade Commodities in Canada

Trading commodities in Canada is accessible, well regulated and supported by a wide range of brokers. Whether you want exposure to energy markets, agricultural products or precious metals, there are several routes available. The right approach depends on your experience, risk appetite and whether you prefer physical delivery or financial speculation.

What commodity trading involves

Commodity trading allows you to speculate on or hedge against price movements in raw materials such as oil, natural gas, wheat, copper and gold. Prices are influenced by supply and demand, weather patterns, geopolitical risk and wider market sentiment. Canadian traders often focus on energy and metals because these sectors are closely linked to the national economy, but global markets are also easily accessible.

Where commodities are traded in Canada

Most Canadian commodity traders gain exposure through financial markets rather than taking physical delivery of goods. Futures and options contracts are primarily traded on exchanges such as the CME Group in the United States, which clears many global commodity markets. Canadian investors generally access these markets through domestic or international brokers that offer commodities as part of their product range.

Futures and options

Futures are one of the most common ways to trade commodities. A futures contract commits you to buy or sell a specific amount of a commodity at a set price on a future date. Canadian brokers that offer futures require margin accounts and minimum balances. Contracts can be volatile, and leverage means gains and losses are magnified. Options on futures provide more flexibility by giving the right, but not the obligation, to trade at a fixed price.

Futures and options are best suited to experienced traders who understand risk management and are comfortable with rapid price movements.

Commodity CFDs

Some international brokers accept Canadian residents and offer commodity CFDs. A contract for difference allows you to speculate on the price of a commodity without owning the underlying asset. CFDs allow leverage and short selling, which makes them attractive for short term traders. However, CFDs are not permitted by all Canadian provinces because they are considered high risk. Traders should check local regulations and ensure their broker is authorised to operate within their jurisdiction.

Commodity ETFs and stocks

For long term investors, commodity ETFs can be a straightforward option. These funds track the price of a commodity or a basket of commodities and trade like ordinary shares. They are available through most Canadian online brokers. Commodity focused stocks, such as mining and energy companies, also provide exposure, although performance can diverge from the commodity itself due to company specific factors.

Physical commodities

Some commodities such as gold and silver can be bought in physical form. Canadian investors can purchase bullion from authorised dealers or brokers offering secure storage. Physical ownership is useful for diversification but is less practical for active trading.

Regulation of commodities trading in Canada

Commodity trading in Canada is supervised at both federal and provincial levels. Brokers must be registered with the Investment Industry Regulatory Organization of Canada (IIROC) or follow local securities rules. Checking your broker’s regulatory status is essential for safety and investor protection.