Interactive Brokers Singapore is unbeatable if you want low trading fees and global market access

Provider: Interactive Brokers Singapore

Verdict: Interactive Brokers (IBKR) Singapore Pte. Ltd. is a branch of the global brokerage firm Interactive Brokers Group. The company entered Singapore in 2020 and is regulated by the Monetary Authority of Singapore (MAS). It provides trading access to a wide array of financial products, including stocks, ETFs, bonds, and derivatives.

Is Interactive Brokers good for investing and trading in Singapore?

Market Access

Compared to other brokers in Singapore, Interactive Brokers offers broader access to global markets and financial instruments. Clients can trade stocks, ETFs, Warrants & Certificates, options, futures, currencies, bonds, CFDs, and mutual funds on 160 global markets. It also provides Forecast Contracts trading via ForecastEx.

The company enables trading in 28 currencies, alongside FX conversion services in the trading accounts. You can also earn an annualized interest rate of 3.83% on the USD cash balances, although this is subject to a minimum balance requirement.

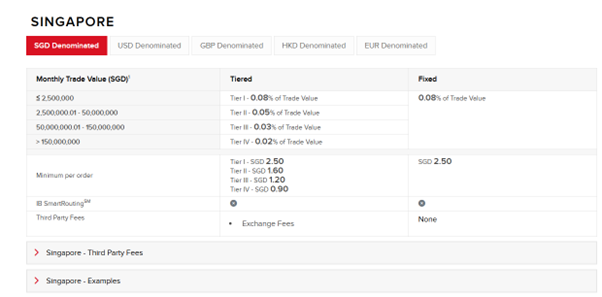

Pricing

IBKR is known for its competitive pricing. For US markets, commissions on shares and ETFs are charged either on a per-share basis between US$0.0005 and US$0.35 for tired volume, or a fixed rate of US$0.005 per unit. As for Singapore markets, the commission charge will be based on trade value in SGD, ranging from 0.08% to 0.02% for tiered volume or a fixed rate of 0.08%.

Commission charges for options range from US$0.25 to US$0.65 per contract based on tiered volume, with a minimum charge of US$1. For futures, commission charges are range from US$0.1 and US$0.25 per contract, or a fixed US$0.25 per contract.

Account types

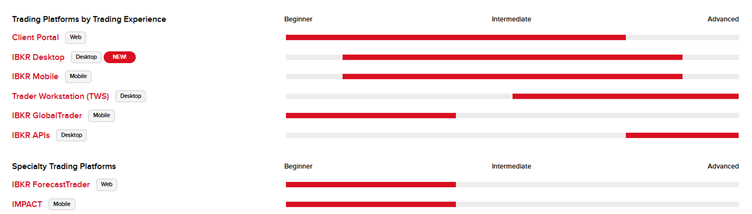

IBKR offers a variety of trading platforms in Singapore, tailored to clients’ trading experiences.

The Client Portal, a web-based platform integrated with TradingView charts, is well-suited to beginners and intermediate traders.

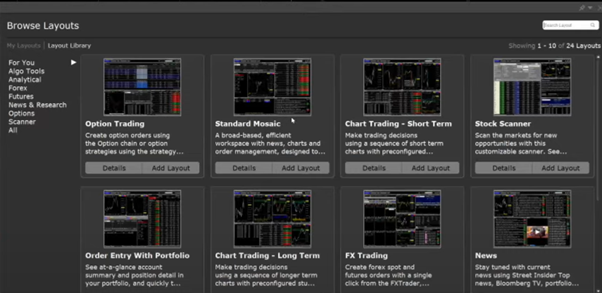

Trader Workstation (TWS) is a desktop application designed for more professional traders. The platform features a layout library, offering customised views for instrument categories and trading strategies. However, the platform’s complexity could be overwhelming for beginners.

For advanced users, the API platform enables automated trading through algorithmic strategies, more suitable for sophisticated traders.

Research & Education

IBKR provides extensive market analysis and client educational resources through IBKRCampus, an online hub for financial market knowledge. Particularly, the Traders’Academy offers a series of free online courses tailored to different skill levels . The in-house strategists and economists provide timely market news and analysis.

Customer Service

There are various ways to reach out to IBKR’s client services team, such as phone (24/5), email, or Chat Room. However, unlike some other countries with both toll-free and direct dial, Singapore has only one general customer service phone line in Singapore.

Pros

- Wide market access

- Excellent education resources

- Earning interest on cash balance

Cons

- Website interface can be overwhelming

- Minimum investment requirement applies

- Complex fee structure

-

Pricing

(5)

-

Market Access

(5)

-

App & Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.8

Tina was a Market Analyst at CMC Markets from 2015 to 2024, providing client education, market commentary, and media presentations. She specializes in technical analysis and market fundamentals. Tina believes financial markets comprise a vast area reflecting economies, politics, history, psychology, and philosophy. As a result, her analysis is based on her interpretation of a specific country’s economic and historical background, alongside investor sentiment and behaviour.

Tina’s expertise has garnered recognition, with her commentary frequently quoted by reputable sources like Bloomberg, CNBC, Routers, WSJ, and AFR. Her insights span a diverse spectrum, covering various financial domains, including stock markets, foreign exchange, commodities, and cryptocurrencies. Previously, she also spent significant time with China Central Television. This experience allowed her to develop a deep understanding and insight into China’s economics and business.