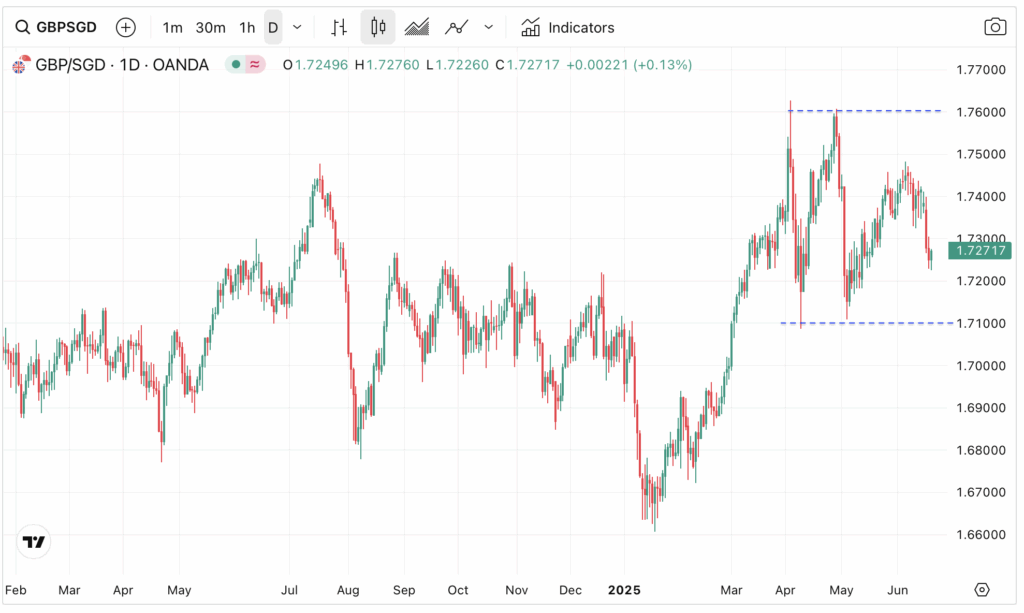

GBPSGD Forecast highlights:

- SGD depreciated against GBP into 1.710-1.760

- Deteriorating macro environment weighing on SGD

- Needs tariff deals and supportive global growth to improve SGD outlook

How has GBPSGD performed recently

Much has changed since the my February update on GBPSGD – economically and politically. The ascension of ‘Trumpism’ on the global trade framework has shattered previous working assumptions.

Higher tariff rates, higher economic uncertainty, and increased geopolitical tensions. It is this swing in macro backdrop that lifted Pound Sterling from its previous weakness.

Against SGD, the rate has rebounded sharply in the first four months of 2025. From 1.660 the rate surge to a multi-year high of 1.760. Much of the gain happened after the new US president took office.

Technically, the rate is now digesting the prior rally. Prices have been ricocheting between the ceiling at 1.760 and the floor at 1.710, suggesting that traders are now waiting to see where the macro winds are blowing in the next quarter.

Is it a good time to buy GBP?

As the rate is trading above 1.700, holders of Singapore Dollars may want to wait and see if price can return near this area (around 1.710).

Sterling is enjoying a bounce these days because institutional investors are keen to diversify away from the USD. This could be a long-term trend.

Therefore, any correction back into the low 1.700 should be bought into. In fact, buyers of GBP should start when prices dip into 1.720 as that area is the lower side of the recent trading range..

Will S’pore Dollar get stronger against GBP?

One of the key factors weakening SGD against GBP is the rise in reciprocal tariffs in goods. This may impact the economic performance of the city-state since it is situated in the heart of Asia.

According to a panel of experts on the Singapore economy, many are lowering their predictions on key indicators of the country.

For example, in the latest survey (June), Singapore’s GDP is lowered from 2.6 percent to 1.7 percent. The biggest drop is Manufacturing, which is expected to contract from 2.9 percent to a minus -0.3 percent (see below).

Tariffs are having a bigger impact on the trading volume of physical goods. Against this challenging backdrop, SGD has depreciated against Sterling in the first half of 2025.

Of course, these are just predictions and not actual numbers. Economic trends are not set in stone and may, in reality, outperform predictions.

For GBPSGD to move in SGD’s favour, a conclusive deal between China-US may be required. Lower geopolitical tensions will help to increase consumer confidence globally. And with it, Singapore’s economic performance.

Until all these bullish factors materialise, the rate is likely to stay within the horizontal trading band for the time being.

Source: MAS (June)

What is the GBPSGD forecast in weeks?

The local bank group OCBC has made some forecasts for GBPSGD. The rate is expected to trade around 1.74 for the next few quarters (see below).

This is essentially an extended projection of the horizontal trading band seen in GBPSGD’s chart.

If UK’s economic performance deteriorates or SGD improves better than expected, expect a test of the lower side of the band.

Source: OCBC (16 June 2025)

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com