A Registered Retirement Savings Plan (RRSP) is one of the most effective tools available to Canadians for retirement savings. Designed to encourage long-term financial security, RRSPs offer tax advantages that help individuals grow their wealth more efficiently. This guide explores how RRSPs work, their benefits, contribution limits, taxation, and strategies for maximizing their potential.

| Name | Logo | GMG Rating | Customer Reviews | Account Fees | Dealing Commission | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews 4.5

(Based on 1,330 reviews)

|

Account Fees $0 |

Dealing Commission 0.05% |

See Offer Capital at risk |

Features:

|

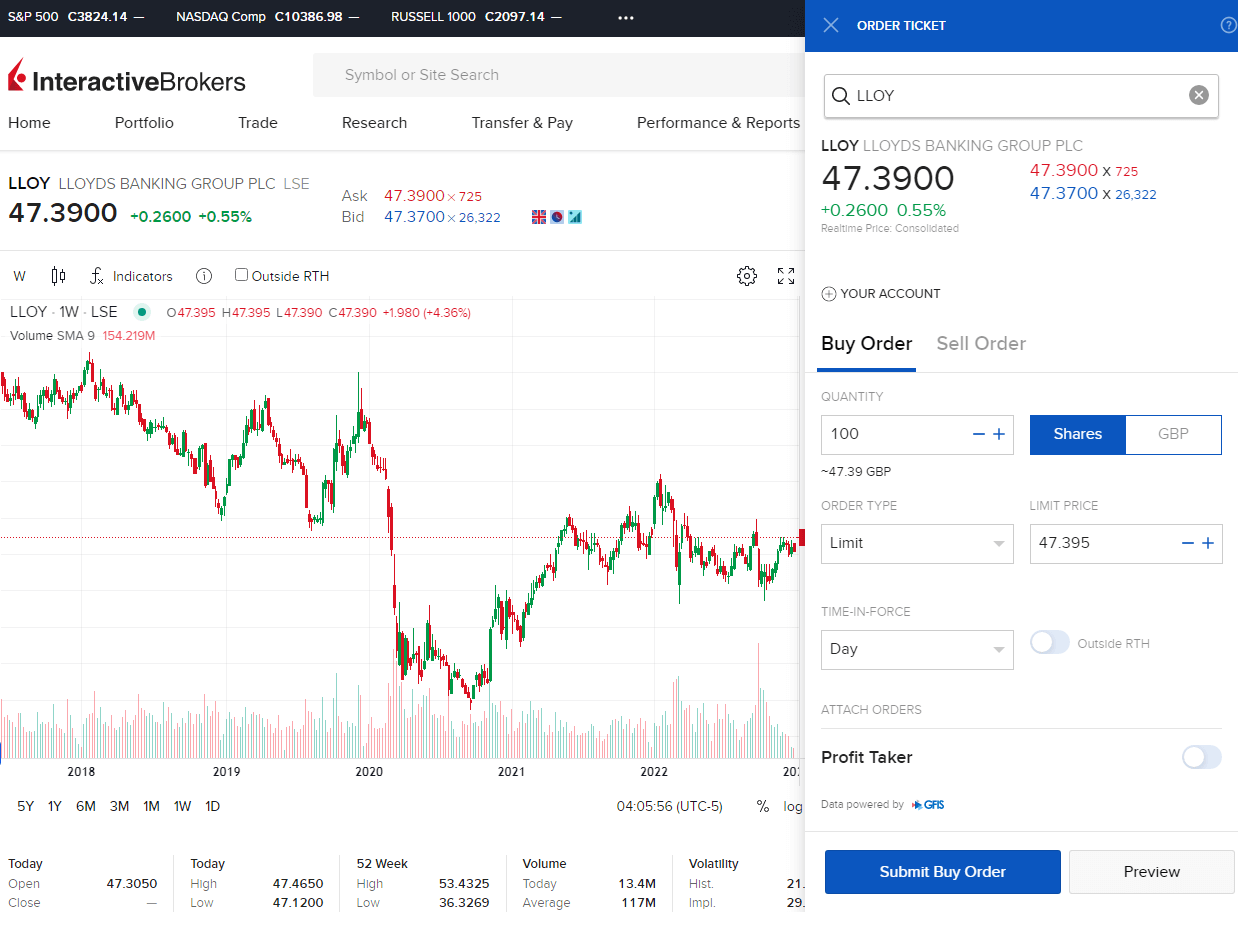

Interactive Brokers General Investment Account Review: Excellent low-cost investing and trading Account: Interactive Brokers General Investment Account Description: Interactive Brokers’ (IBKR’s) GIA is aimed at sophisticated investors, and offers access to derivatives, options, and futures. The platform is one of the cheapest across all asset classes. Capital is at risk. Is IBKR's GIA a Good Account? IBKR’s GIA is its “universal account” that lets you invest in all asset classes via shares, CFDs, futures, options or funds. The account is excellent for sophisticated investors who want to manage their own portfolios with complex order types. It’s ideal for active investors who need access to a wider range of investment products like derivatives, options, and futures. IBKR is also one of the cheapest investment platforms across all asset classes, as it was built on offering electronic discount brokerage. Fees There is no account charge for general investment accounts at IBKR. When you buy and sell shares minimum dealing commissions are £1 in the UK or 0.05% of the deal size. Special Offers IBKR clients can earn $200 for each qualified referral while giving their friend the opportunity to earn up to $1000 of IBKR stock. What is IBKR’s Platform Like to Use? The investment platform is a slimmed-down version of its exceptional desktop trader station. For investing it gives you a good overview of shares and funds.

Pros

Cons

Overall5 |

What Is an RRSP?

An RRSP is a government-registered investment account that allows Canadians to save for retirement while benefiting from tax-deferred growth. Contributions made to an RRSP are tax-deductible, reducing taxable income for the year in which they are made. Investment earnings within the RRSP grow tax-free until funds are withdrawn, typically during retirement when an individual may be in a lower tax bracket.

Benefits of an RRSP

- Tax Deductibility: Contributions to an RRSP can be deducted from taxable income, reducing the amount of income tax owed.

- Tax-Deferred Growth: Investments within the RRSP grow tax-free, allowing compounding returns to accumulate faster.

- Wide Range of Investments: RRSPs can hold various financial assets, including stocks, bonds, mutual funds, ETFs, and GICs.

- Spousal RRSPs: Individuals can contribute to a spouse’s RRSP to split income in retirement and reduce overall tax liability.

- Home Buyers’ Plan (HBP): First-time homebuyers can withdraw up to $35,000 tax-free from their RRSP to purchase a home, provided the amount is repaid within 15 years.

- Lifelong Learning Plan (LLP): Individuals can withdraw up to $20,000 tax-free to fund education expenses, with repayment required over ten years.

Contribution Limits and Rules

The annual RRSP contribution limit is determined by the lesser of:

- 18% of the previous year’s earned income, or

- The annual RRSP dollar limit set by the government (for 2024, the limit is $31,560).

Unused contribution room carries forward indefinitely, allowing individuals to contribute more in future years. Over-contributions are subject to a penalty of 1% per month if they exceed the $2,000 lifetime over-contribution buffer.

Taxation of RRSP Withdrawals

Withdrawals from an RRSP are fully taxable as income in the year they are withdrawn. To minimize tax liability, many individuals withdraw funds during retirement when they may be in a lower tax bracket.

Upon reaching the age of 71, an RRSP must be converted into one of the following:

- Registered Retirement Income Fund (RRIF): Provides scheduled withdrawals while continuing tax-deferred growth.

- Annuity: Provides guaranteed income for life or a fixed term.

- Lump Sum Withdrawal: Results in full taxation of the amount withdrawn, often leading to a higher tax burden.

Strategies to Maximize RRSP Benefits

- Maximize Contributions: Consistently contribute up to the annual limit to take full advantage of tax deductions and compound growth.

- Use a Spousal RRSP: Reduce household taxes by shifting income to a lower-earning spouse in retirement.

- Time Withdrawals Wisely: Plan RRSP withdrawals in years when taxable income is lower to minimize tax consequences.

- Reinvest Tax Refunds: Use the tax refund from RRSP contributions to reinvest in the RRSP or pay down debt.

- Diversify Investments: Maintain a mix of stocks, bonds, and ETFs to ensure a balanced and risk-adjusted portfolio.