Our trading expert Tina Teng test Moomoo Singapore and reviews pricing, platform features, market access, research tools, and customer service — based on real testing and expert analysis.

Moomoo Singapore gives traders discounted access to US and Asian markets

Provider: Moomoo Singapore

Verdict: Moomoo Financial Singapore Pte. Ltd. is a subsidiary of global brokerage firm Futu Holdings Ltd., founded in Hong Kong in 2012. The company positions itself as a financial technology provider, offering a digital brokerage platform. Moomoo is its brand name used in international markets, while Futubull is the name used for Hong Kong users. Moomoo Singapore was launched in 2021 and is regulated by the Monetary Authority of Singapore (MAS). It provides trading access to stocks, ETFs, bonds, and derivatives. The company also provides private wealth management advisory services to eligible clients.

Is Moomoo good for trading in Singapore?

Overall, we rate Moomoo as a strong choice for trading in Singapore, as it offers low fees, a feature-rich platform, and excellent customer support, with good market access to Asia and the US markets.

Market access

Compared to other brokers, Moomoo provides relatively limited access to international markets, with a stronger focus on more on the US and Asian markets. The platform provides trading access to a broad range of asset classes, including stocks, ETFs, REITs, cryptocurrencies, bonds, and derivatives- options, forex, warrants, and futures. The Singapore branch primarily offers market access to the US, Singapore, Hong Kong, and Japan, covering 37,000 + listed companies.

Pricing

Moomoo offers zero commission for most markets, although in some markets this is available for only a limited period. Platform fees and other trading-related charges still apply.

For US stocks and ETFs, Moomoo Singapore offers permanent zero commissions, but charges platform fees of US$0.99 per order, along with applicable SEC, settlement, and trading activity fees.

As for Singapore stocks, ETFs, and REITs, the company offers zero commission for 1 year. After that, a fee of 0.03% of transaction amount will apply, along with platform, trading, and clearing fees.

For Hong Kong and China A-shares, it offers a 30-day zero commission, after which standard charges apply. Japanese equities are charged at 0.08% per order, with a minimum of JPY80. Platform fees and other fees will also apply.

There is no commission or platform fees for Forex trading.

As for leveraged trading, the margin rates are 4.8% for the US dollar and Singapore dollar, and 6.8% for the Hong Kong dollar and the Chinese offshore Yuan.

Platforms

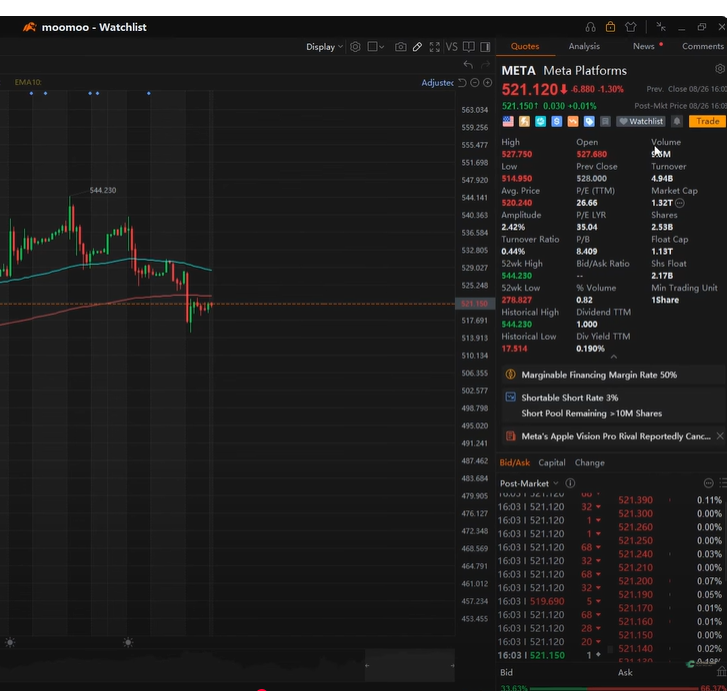

Moomoo’s next-gen is an all-in-one desktop platform that provides access to all asset classes. In my view, its intuitive design makes it particularly suitable for beginners and intermediate traders and investors.

What I particularly like about the platform is that you can access stock information by simply searching by name, and it comes with live market pricing, news, analysis, and company fundamentals.

The interface is sleek and user-friendly, with a dark background set by default. The “Market” tap provides a watchlist of stock performance, segmented by country and product category.

It supports 25 widgets, allowing users to access market data, watchlists, and market quotes from the home screen. The charting tool features 100+ technical indicators, 38 drawing tools, and 190 preset functions, making it a good choice for technical traders.

Research & Education

Moomoo Singapore offers a comprehensive ecosystem to support clients throughout their learning journey, including earnings season, economic news, educational videos, and an in-house economic calendar. It also has its own community forum, providing timely market news and keep clients informed.

Customer Service

Moomoo Singapore is one of the few brokers that provide customer services during weekends and holidays. Details are as below:

- Live chat: Trading day: 24 hours; Holiday or weekend: 09:30 AM – 09:30 PM SGT

- Customer service hotline: +65-6321 8888. Trading day: 24 hours; Holiday or weekend: 09:30 AM – 09:30 PM SGT)

- Email: clientservice@sg.moomoo.com

Pros

- User-friendly trading platform

- Excellent education resources

- Client services available on weekends and holidays

Cons

- Limited access to international markets

- Platform fees on most instruments

- No CFD trading available

-

Pricing

(4)

-

Market Access

(3)

-

App & Platform

(4)

-

Customer Service

(5)

-

Research & Analysis

(4)

Overall

4

Tina was a Market Analyst at CMC Markets from 2015 to 2024, providing client education, market commentary, and media presentations. She specializes in technical analysis and market fundamentals. Tina believes financial markets comprise a vast area reflecting economies, politics, history, psychology, and philosophy. As a result, her analysis is based on her interpretation of a specific country’s economic and historical background, alongside investor sentiment and behaviour.

Tina’s expertise has garnered recognition, with her commentary frequently quoted by reputable sources like Bloomberg, CNBC, Routers, WSJ, and AFR. Her insights span a diverse spectrum, covering various financial domains, including stock markets, foreign exchange, commodities, and cryptocurrencies. Previously, she also spent significant time with China Central Television. This experience allowed her to develop a deep understanding and insight into China’s economics and business.