Singapore’s position as a global financial hub makes it an attractive destination for traders seeking access to advanced platforms, diverse instruments, and strong regulatory oversight. Residents and international traders can participate in various markets through specialized trading accounts designed for different financial instruments such as CFDs, futures, options, and other derivatives. This guide outlines the main types of trading accounts available in Singapore, the regulatory framework, and the leading providers.

| Trading Platform | Markets | CFDs | Forex | Futures | Options | DMA | Customer Reviews | More Info |

|---|---|---|---|---|---|---|---|---|

| 5,000 | ✔️ | ✔️ | ❌ | ✔️ | ❌ | 4.1

(Based on 16 reviews)

| See Platform 76% of retail investor accounts lose money |

| 1,200 | ✔️ | ✔️ | ❌ | ❌ | ❌ | 4.6

(Based on 86 reviews)

| See Platform 75.3% of retail investor accounts lose money |

| 2,000 | ✔️ | ✔️ | ✔️ | ❌ | ❌ | 3.7

(Based on 144 reviews)

| See Platform* 80% of retail investor accounts lose money |

| 10,000 | ✔️ | ✔️ | ❌ | ✔️ | ❌ | 4.3

(Based on 257 reviews)

| See Platform 64% of retail investor accounts lose money |

| 17,000 | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | 3.9

(Based on 678 reviews)

| See Platform 71% of retail investor accounts lose money |

| 12,000 | ✔️ | ✔️ | ❌ | ✔️ | ❌ | 3.7

(Based on 148 reviews)

| See Platform 70% of retail investor accounts lose money |

| 9,000 | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | 3.6

(Based on 73 reviews)

| See Platform 65% of retail investor accounts lose money |

| 7,000 | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | 4.4

(Based on 934 reviews)

| See Platform 60% of retail investor accounts lose money |

| 2,967 | ✔️ | ✔️ | ❌ | ❌ | ❌ | 3.4

(Based on 277 reviews)

| See Platform 61% of retail investor accounts lose money |

| 2,100 | ✔️ | ❌ | ❌ | ❌ | ❌ | 4.6

(Based on 136 reviews)

| See Platform 75% of retail investor accounts lose money |

Best For Currency Trading – Forex.com

Forex.com Singapore Expert Review

Forex.com Launches in Singapore

The firm described the move into the Singaporean market as a key milestone in its expansion into APAC or Asia Pacific, and that it was committed to empowering traders in the city and surrounding environs.

Singapore is an attractive destination for margin trading businesses, not least because the city-state’s wealth has been built on a history of trading and mercantile commerce.

Singapore came 4th in a recent survey of the world’s 50 richest cities and was only eclipsed by New York, San Francisco and Tokyo.

The survey, conducted by Henley & Partners and New World Health, found that there were 242,000 millionaires in Singapore, a figure that has increased by +62.0% over the last decade.

There are also more than 300 Singaporean centi-millionaires and 30 billionaires.

Forex.com offers a range of CFDs on rolling spot FX, alongside stock indices, individual shares and commodities. Clients can choose from a web trader, a trading app and MT4 as their trading platform.

The site also provides regular analysis and market-related news, as well as an educational offering that covers trading basics to more advanced concepts and strategies.

Forex.com is one of three margin trading brands under the Stonex Group umbrella. The others are City Index and Gain Capital.

Has Stonex Group been expanding elsewhere?

Parent company Stonex is expanding in other directions too, most recently through the acquisition of rival futures broker RJ O’Brien & Associates, which will bring some 75,000 clients and 300 IBs to the table. Stonex has also recently acquired Paris-based fixed income broker Octo and investment banking business Benchmark.

Stonex is paying around $900.00 million for RJ O’Brien in a cash and shares transaction, which is expected to close in the second half of 2025.

Pros

- Forex specialist

- Trading signals

- Post trade analytics

Cons

- No DMA

- Limited market range

-

Pricing

(4.5)

-

Market Access

(4.5)

-

App & Platform

(4.5)

-

Customer Service

(5)

-

Research & Analysis

(5)

Overall

4.7Best For Active Traders – CMC Markets

CMC Markets provides CFD and forex trading with competitive spreads and a robust trading platform. The platform is suitable for beginner and advanced traders, with features like customizable dashboards and advanced charting tools.

CMC Markets Singapore Expert Review

Name: CMC Markets Singapore

Description: CMC Markets Singapore is a subsidiary of the UK-based brokerage house CMC Markets plc. and is regulated by the Monetary Authority of Singapore (MAS). The company has been long established in Singapore since 2007, offering CFD and FX trading. It launched a stock broking business in 2023, trading as the brand under CMC Invest, also regulated by the MAS. CMC Markets primarily refers to the firm’s derivatives trading services, which offer high leverage and both long and short positions. Meanwhile, CMC Invest is a stock broking trading account/platform, offering physical shares and ETFs trading without leverage.

Is CMC Markets good for CFD and FX trading in Singapore?

The CFD and FX trading accounts provide access to a broad range of asset classes, including Forex, Indices, Commodities, Shares, ETFs, and Cryptocurrencies, totalling 12,000+ instruments. Clients can choose from three trading platforms – CMC Markets Next Generation(NG) platform, TradingView, and MT4.

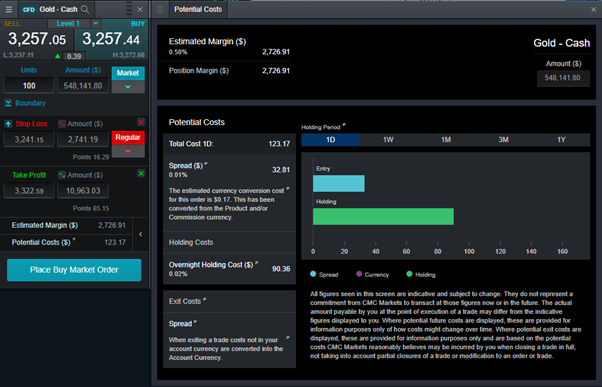

The NG platform is more suitable for professional traders due to its sophisticated functionalities. It enables customisable layouts, supporting up to 10 chart windows alongside live pricing for categorized asset classes. The designation can give traders a comprehensive view of the market trends, particularly suitable for those who employ tactical and technical trading strategies. One feature I quite like about this platform is the transparency of order tickets, clearly demonstrating trading amounts, associated costs, and fees upfront without hidden surprises.

The order ticket on the NG platform

TradingView is one of the most popular platforms for both technical and fundamental analysis. The platform offers more than 20 interactive chart types and over 110 drawing tools. For stock investors interested in company fundamentals, it provides access to key financial metrics such as Revenue, Earnings Per Share, and Income Statement.

MT4 is a more simplified trading platform, which may appeal to beginners. The platform offers much less access to instruments.

CMC Invest Singapore

The CMC Invest Singapore account enables clients to access over 45,000 stocks, REITs, and ETFs across 15 major markets, including more than 500 local companies’ stocks. The CMC Invest platform is developed in-house.

There are three types of trading accounts you can choose from – Invest, Platinum, and Diamond- the higher the tier, the lower the trading costs. In my view, premium accounts suit those who trade more regularly with less carrying time, while the standard Invest accounts are better suited to longer-term, buy-and-hold investors.

Compared to other brokers in Singapore, CMC Invest enables broader access to international markets without custody or settlement fees. Instead, you will be charged volume-based commission and FX conversion fees (FX conversion fees are often not transparently displayed by most brokers). CMC Invest offers a limited number of free trades per month before these charges apply.

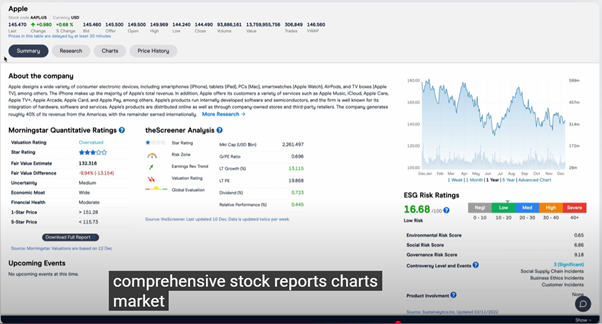

Research & Education

Both CMC Markets CFD and CMC Invest accounts include Morning Star analysis reports. The company offers education, market analysis, and platform training, though less frequently than in the past. The NG platform also includes a built-in economic calendar and live Reuters news for daily market updates.

The CMC Invest built-in Morning Star report

Customer Service

There are three ways to contact the client service team in Singapore – a 24/5 phone call service line, WhatsApp, and email, depending on the urgency of your enquiry.

Pros

- Wide market access

- Transparent fee structure

- Well-established and regulated brokerage

Cons

- High CFD slippage volatility

- Costly basic Invest account

- Limited analysis and education

-

Pricing

(4.5)

-

Market Access

(4.5)

-

App & Platform

(5)

-

Customer Service

(4.5)

-

Research & Analysis

(5)

Overall

4.7Best All-Rounder – Interactive Brokers

Known for its low commissions and extensive market access, Interactive Brokers offers trading in CFDs, options, futures, and other derivatives. It’s a popular choice for professional traders due to its advanced tools and algorithmic trading capabilities.

Interactive Brokers Singapore Expert Review

Name: Interactive Brokers Singapore

Description: Interactive Brokers (IBKR) Singapore Pte. Ltd. is a branch of the global brokerage firm Interactive Brokers Group. The company entered Singapore in 2020 and is regulated by the Monetary Authority of Singapore (MAS). It provides trading access to a wide array of financial products, including stocks, ETFs, bonds, and derivatives.

Is Interactive Brokers good for investing and trading in Singapore?

Market Access

Compared to other brokers in Singapore, Interactive Brokers offers broader access to global markets and financial instruments. Clients can trade stocks, ETFs, Warrants & Certificates, options, futures, currencies, bonds, CFDs, and mutual funds on 160 global markets. It also provides Forecast Contracts trading via ForecastEx.

The company enables trading in 28 currencies, alongside FX conversion services in the trading accounts. You can also earn an annualized interest rate of 3.83% on the USD cash balances, although this is subject to a minimum balance requirement.

Pricing

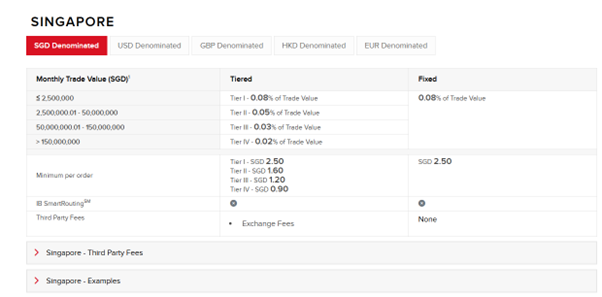

IBKR is known for its competitive pricing. For US markets, commissions on shares and ETFs are charged either on a per-share basis between US$0.0005 and US$0.35 for tired volume, or a fixed rate of US$0.005 per unit. As for Singapore markets, the commission charge will be based on trade value in SGD, ranging from 0.08% to 0.02% for tiered volume or a fixed rate of 0.08%.

Commission charges for options range from US$0.25 to US$0.65 per contract based on tiered volume, with a minimum charge of US$1. For futures, commission charges are range from US$0.1 and US$0.25 per contract, or a fixed US$0.25 per contract.

Account types

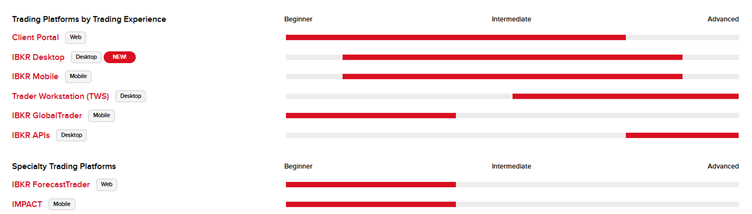

IBKR offers a variety of trading platforms in Singapore, tailored to clients’ trading experiences.

The Client Portal, a web-based platform integrated with TradingView charts, is well-suited to beginners and intermediate traders.

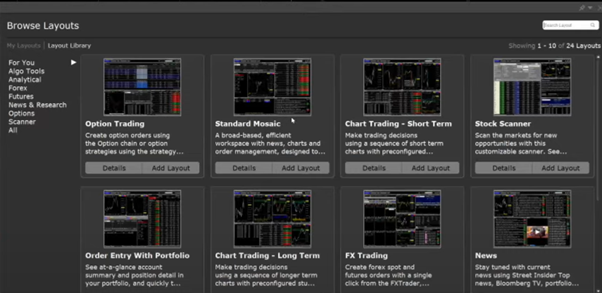

Trader Workstation (TWS) is a desktop application designed for more professional traders. The platform features a layout library, offering customised views for instrument categories and trading strategies. However, the platform’s complexity could be overwhelming for beginners.

For advanced users, the API platform enables automated trading through algorithmic strategies, more suitable for sophisticated traders.

Research & Education

IBKR provides extensive market analysis and client educational resources through IBKRCampus, an online hub for financial market knowledge. Particularly, the Traders’Academy offers a series of free online courses tailored to different skill levels . The in-house strategists and economists provide timely market news and analysis.

Customer Service

There are various ways to reach out to IBKR’s client services team, such as phone (24/5), email, or Chat Room. However, unlike some other countries with both toll-free and direct dial, Singapore has only one general customer service phone line in Singapore.

Pros

- Wide market access

- Excellent education resources

- Earning interest on cash balance

Cons

- Website interface can be overwhelming

- Minimum investment requirement applies

- Complex fee structure

-

Pricing

(5)

-

Market Access

(5)

-

App & Platform

(5)

-

Customer Service

(4)

-

Research & Analysis

(5)

Overall

4.8Other Trading Platforms In Singapore

IG Markets

One of the largest CFD providers globally, IG Markets is MAS-regulated and offers a wide range of CFDs, forex, and options. It is known for its user-friendly platform, advanced trading tools, and extensive educational resources.

Saxo Markets is a premier trading platform offering access to forex, CFDs, options, and futures. Known for its sophisticated tools and research capabilities, Saxo caters to both retail and institutional clients.

Phillip Futures

A subsidiary of PhillipCapital, Phillip Futures specializes in futures and options trading. It provides access to the SGX and other global exchanges, catering to traders looking for direct market access.

Tiger Brokers

Tiger Brokers provides access to global markets, including the SGX, with a focus on equities, ETFs, and derivatives. It’s gaining popularity among retail traders for its competitive fees and intuitive mobile app.

What types of trading accounts are there in Singapore?

- CFD Trading Accounts

Contracts for Difference (CFDs) allow traders to speculate on price movements of assets such as stocks, indices, forex, and commodities without owning the underlying asset. CFD trading is highly popular in Singapore due to its leverage, flexibility, and ability to trade both rising and falling markets. Leverage allows traders to control large positions with a small initial deposit, but it also amplifies risk. CFD trading is suitable for short-term speculative strategies and hedging.

- Futures Trading Accounts

Futures contracts involve agreeing to buy or sell an asset at a predetermined price on a specified future date. In Singapore, futures are traded on platforms like the Singapore Exchange (SGX), which offers a variety of contracts including equity index futures (e.g., MSCI Singapore Index) and commodity futures. Futures trading is well-suited for experienced traders due to the complexity and potential for significant profit or loss.

- Options Trading Accounts

Options give traders the right, but not the obligation, to buy or sell an underlying asset at a specified price before or on a specific date. Traders can use options to hedge risk, speculate on market direction, or generate income through strategies like writing covered calls. Options trading requires an in-depth understanding of market mechanics, pricing models, and risk management, making it more suitable for advanced traders.

- Forex Trading Accounts

Singapore’s traders have access to a wide range of forex trading platforms, offering currency pairs for speculation on exchange rate movements. Forex trading operates on high leverage, and the market’s 24-hour availability makes it a popular choice for those looking for flexibility. Commonly traded pairs include major pairs like EUR/USD and USD/SGD.

- Derivative Trading Accounts

Derivative accounts allow access to instruments such as swaps, forwards, and other structured products that derive their value from underlying assets. These accounts are often used by institutions or sophisticated traders seeking advanced hedging or speculative opportunities. Derivative trading typically involves higher complexity and risks compared to traditional investments.

How to choose a trading platform in Singapore?

When selecting a trading platform in Singapore, it’s essential to evaluate the associated costs and features. Common fees include spreads, commissions, and overnight financing charges for leveraged products like CFDs. Platforms may also charge for data subscriptions, withdrawals, or inactivity. Additionally, traders should consider factors like leverage limits, margin requirements, and the range of available instruments.

Singapore’s trading environment offers a diverse range of accounts for CFDs, futures, options, and other derivatives, catering to traders with varying levels of experience. Regulated by MAS, the industry ensures a high level of transparency and investor protection. Choosing the right trading account depends on your financial goals, risk tolerance, and trading experience. Whether you’re looking to speculate on forex, hedge with futures, or explore advanced derivatives, Singapore’s trading platforms provide the tools and security to navigate global markets effectively.