Singapore is one of Asia’s leading financial hubs, offering its residents a diverse range of investment accounts to grow their wealth. With robust regulatory oversight, tax advantages, and access to global markets, Singaporean residents have ample opportunities to invest in various asset classes. Whether you’re saving for retirement, growing wealth, or diversifying your portfolio, choosing the right type of investment account is essential. This guide explores the main types of investment accounts available in Singapore and how they cater to different financial goals.

| Name | Logo | Account Fee | Commission | GMG Rating | Customer Reviews | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

Account Fee 0.12% |

Commission 0.08% |

GMG Rating |

Customer Reviews 4.1

(Based on 125 reviews)

|

Visit Platform Capital at risk |

Account Types:

|

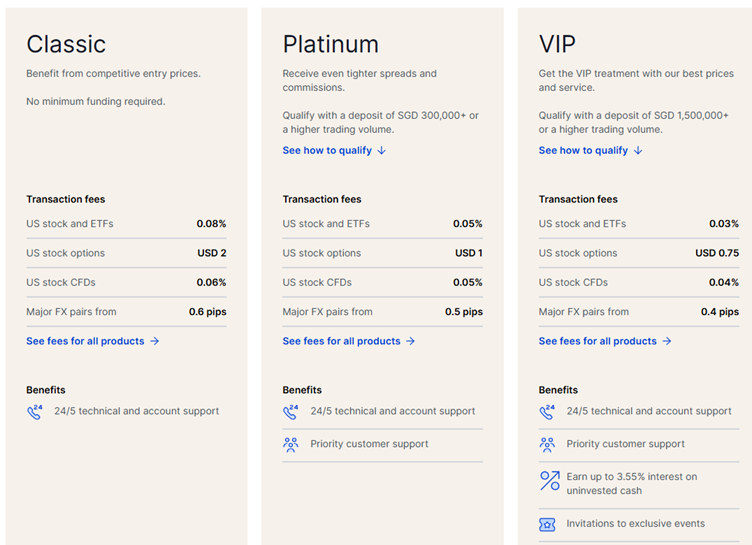

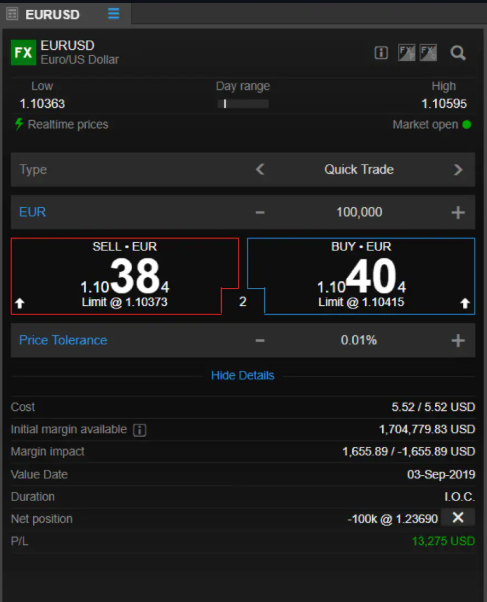

Saxo Singapore lets traders of all types access institutional grade trading platforms Provider: Saxo Singapore Verdict: Saxo Singapore is best suited for serious retail and professional traders who want institutional-grade tools, broad global access, and premium service, though some features remain reserved for high-net-worth clients. Saxo Markets Singapore is a subsidiary of Danish investment bank Saxo Bank, a global brokerage firm founded in 1992. The Singapore branch was established in 2006, serving as the APAC regional headquarter. The company is regulated by the Monetary Authority of Singapore (MAS). Who are Saxo, and what do they do in Singapore? Saxo positions itself as a leading capital markets service provider backed by its advanced financial technology. Its trading platform offers access to a wide range of asset classes, including stocks, ETFs, bonds, derivatives and more. Market access Compared to other brokers in Singapore, Saxo Markets offers broader market access, owing to its investment bank roots. Clients can trade across multiple asset classes, including stocks, ETFs, commodities, bonds, cryptocurrencies, bonds, and derivatives – such as options, forex, and CFDs, totalling more than 71,000 instruments. Pricing Saxo’s trading costs differ depending on account types- Classic, Platinum, and VIP accounts – the higher the account tier, the lower the fees. Spreads on major FX pairs can be as low as 0.4 pips for VIP accounts, compared to 0.6 pips for Classic accounts. Cash interests apply to the VIP accounts as well.

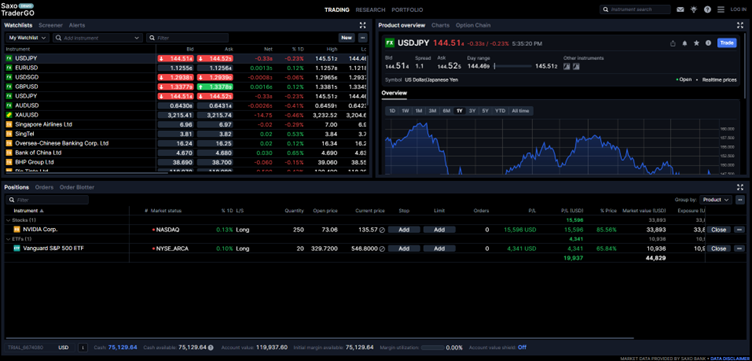

However, there is funding criteria to be qualified as a higher-tier account. If clients want to be in a higher tier account upon account open, a Platinum account requires funding of SGD 300,000, and SGD 1,500,000 for a VIP account. Alternatively, clients can also be upgraded based on trading volume, which accumulates points towards higher-tier status. Platforms There are three trading platforms available for retail clients – SaxoInvestor, SaxoTraderGO, and SaxoTraderPRO. The SaxoInvestor platform is a web platform with basic functionality. The most popular platform is the SaxoTraderGO, suitable for all levels of clients. The platform offers access to all asset classes, with product categories on top. It is clean, user-friendly interface with a default dark theme. It offers comprehensive charting tools, news & analysis section, an in-built economic calendar, dedicated client education content and access to live webinars. What is the SaxoTraderGo trading platform like?

For advanced traders, the SaxoTraderPro provides high-performance tools with in-depth market analysis features. This is particularly for full-time and professional traders who require fast execution, more real-time market data. The platform supports Algorithmic orders and allow editing orders on charts. It also offers one-click switching for options trading across FX and stocks. SaxoTraderPro’s order ticket

Research & Education Saxo Markets Singapore offers regular webinars featuring CFDs, FX, futures, commodities, ESG investing and more to clients. I have to say the educational support is among the most systematic and well-structured available in the brokerage industry. Additionally, there are timely market news and analysis, a podcast series for “Money Matters,” and basics for an investor/trader, such as platform guide, margin and leverage, and risk management. Customer Service Client services are available 24/5 on its trading platforms through live chat, a phone call or messages. However, most common queries can be also resolved quickly using the search function within the platform, which offers self-help options. No wealth management services Saxo Singapore has discontinued its SaxoWealthCare and SaxoSelect wealth management products for clients in the country. The bank and trading platform will no longer offer its SaxoWealthCare and SaxoSelect solutions in Singapore from 10 December onwards. Following the discontinuation of the products, Saxo Singapore has also extended different alternatives to clients. These include both options within and outside of Saxo’s offerings. “Saxo Singapore regularly reviews our product offering and has come to the difficult but necessary decision to discontinue our wealth management offering,” the statement added. “In this transitional period, our top priority is to ensure clients receive the support they require.” The update comes as Saxo Bank has reportedly attracted acquisition bids from investors and rival platforms, including Interactive Brokers. Denmark-headquartered Saxo has seen interest from bidders such as Interactive Brokers Group, Bloomberg reported earlier this month. Other parties interested in acquiring the firm include a consortium of Altor Equity Partners and Centerbridge Partners, which have submitted a non-binding bid. On 2 October the bank rolled out its SaxoInvestor service for UK clients, providing access to more than 70,000 global instruments including stocks, ETFs, bonds and mutual funds. Saxo also launched a US election trading hub in October, providing new clients access to commission-free trading of the most 100 popular US stocks. Saxo Bank currently oversees around $120 billion of client assets globally, with its UK branch growing assets to around £2 billion last year. Pros

Cons

Overall4.6 |

||

|

Account Fee $0 |

Commission 0.05% |

GMG Rating |

Customer Reviews 4.5

(Based on 1,347 reviews)

|

Visit Platform Capital at risk |

Account Types:

|

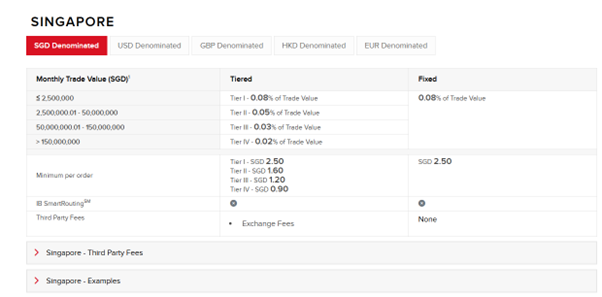

Interactive Brokers Singapore is unbeatable if you want low trading fees and global market access Provider: Interactive Brokers Singapore Verdict: Interactive Brokers (IBKR) Singapore Pte. Ltd. is a branch of the global brokerage firm Interactive Brokers Group. The company entered Singapore in 2020 and is regulated by the Monetary Authority of Singapore (MAS). It provides trading access to a wide array of financial products, including stocks, ETFs, bonds, and derivatives. Is Interactive Brokers good for investing and trading in Singapore? Market Access Compared to other brokers in Singapore, Interactive Brokers offers broader access to global markets and financial instruments. Clients can trade stocks, ETFs, Warrants & Certificates, options, futures, currencies, bonds, CFDs, and mutual funds on 160 global markets. It also provides Forecast Contracts trading via ForecastEx. The company enables trading in 28 currencies, alongside FX conversion services in the trading accounts. You can also earn an annualized interest rate of 3.83% on the USD cash balances, although this is subject to a minimum balance requirement. Pricing IBKR is known for its competitive pricing. For US markets, commissions on shares and ETFs are charged either on a per-share basis between US$0.0005 and US$0.35 for tired volume, or a fixed rate of US$0.005 per unit. As for Singapore markets, the commission charge will be based on trade value in SGD, ranging from 0.08% to 0.02% for tiered volume or a fixed rate of 0.08%.

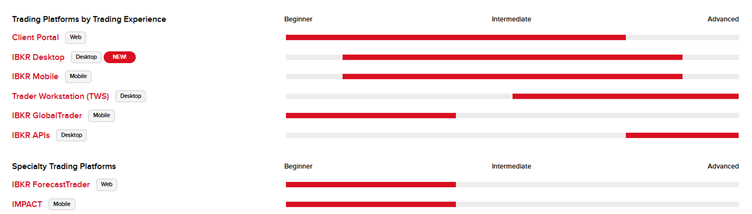

Commission charges for options range from US$0.25 to US$0.65 per contract based on tiered volume, with a minimum charge of US$1. For futures, commission charges are range from US$0.1 and US$0.25 per contract, or a fixed US$0.25 per contract. Account types IBKR offers a variety of trading platforms in Singapore, tailored to clients’ trading experiences. The Client Portal, a web-based platform integrated with TradingView charts, is well-suited to beginners and intermediate traders.

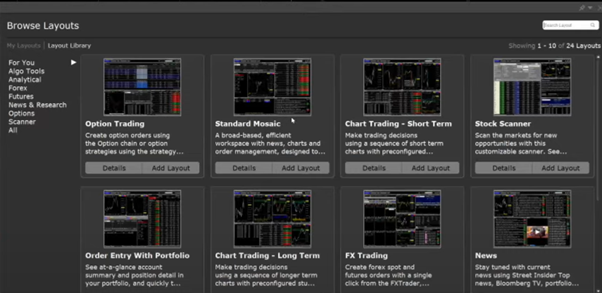

Trader Workstation (TWS) is a desktop application designed for more professional traders. The platform features a layout library, offering customised views for instrument categories and trading strategies. However, the platform’s complexity could be overwhelming for beginners.

For advanced users, the API platform enables automated trading through algorithmic strategies, more suitable for sophisticated traders. Research & Education IBKR provides extensive market analysis and client educational resources through IBKRCampus, an online hub for financial market knowledge. Particularly, the Traders’Academy offers a series of free online courses tailored to different skill levels . The in-house strategists and economists provide timely market news and analysis. Customer Service There are various ways to reach out to IBKR’s client services team, such as phone (24/5), email, or Chat Room. However, unlike some other countries with both toll-free and direct dial, Singapore has only one general customer service phone line in Singapore. Pros

Cons

Overall4.8 |

Methodology: Our experts have tested and ranked Singapore’s best investing platforms and accounts that are regulated by MAS and hand-picked the best investment accounts based on:

- User feedback. We analysed over 30,000 votes and reviews in the prestigious Good Money Guide annual awards

- Unbiased, real-world testing. Our team tests each investing account provider with real money to ensure you have a seamless experience

- In-depth feature comparison. We thoroughly compare features, highlighting those that make a platform stand out

- Exclusive insights from the top. Our exclusive interviews with the investing company CEOs give you insider perspectives to help you make the best decisions.

Central Provident Fund Investment Scheme (CPFIS)

The CPF Investment Scheme (CPFIS) allows Singaporeans and Permanent Residents to invest a portion of their Central Provident Fund (CPF) savings in approved products to enhance their retirement savings. Under CPFIS, CPF Ordinary Account (OA) funds and Special Account (SA) funds can be used to invest in a range of instruments, including unit trusts, exchange-traded funds (ETFs), and bonds. While CPFIS offers the potential for higher returns compared to the default CPF interest rates, it comes with risks. Investors must evaluate their risk tolerance and long-term objectives before participating in CPFIS, as poorly chosen investments can lead to lower overall savings.

Supplementary Retirement Scheme (SRS)

The Supplementary Retirement Scheme (SRS) is a voluntary savings scheme that complements the CPF system. SRS contributions are eligible for tax relief, making it an attractive option for individuals looking to reduce their taxable income while investing for retirement. Funds in an SRS account can be invested in a variety of financial instruments, including stocks, ETFs, bonds, unit trusts, and even insurance-linked products. Withdrawals are subject to a 50% tax concession after the statutory retirement age, making SRS a tax-efficient way to grow long-term wealth. Unlike CPF savings, SRS contributions and investments are voluntary, providing flexibility for individuals with varying financial goals.

Regular Brokerage Accounts

Singaporeans can open regular brokerage accounts to invest directly in stocks, ETFs, bonds, and other securities. These accounts are provided by local and international brokerages, offering access to the Singapore Exchange (SGX) as well as global markets. Popular brokers in Singapore include DBS Vickers, OCBC Securities, Saxo Markets, and Tiger Brokers. Brokerage accounts offer flexibility, allowing investors to trade independently and choose their investments. However, fees such as commissions, custody fees, and currency conversion charges can add up, so comparing brokers’ pricing structures is crucial before opening an account.

Robo-Advisory Platforms

For those seeking a hands-off approach to investing, robo-advisory platforms are an excellent option. Platforms like StashAway, Syfe, and Endowus offer algorithm-driven investment portfolios tailored to individual risk profiles and financial goals. These platforms typically invest in ETFs and low-cost index funds, providing diversification and cost efficiency. Robo-advisors are particularly suited for beginner investors or those with limited time to manage their portfolios actively. While fees for robo-advisory services are lower than traditional financial advisors, they may still exceed those of direct investments in ETFs or stocks.

Savings and Investment-Linked Policies (ILPs)

Investment-linked policies (ILPs) combine insurance coverage with investment opportunities. A portion of the premiums is used for insurance, while the remainder is invested in sub-funds chosen by the policyholder. ILPs provide a dual benefit of protection and wealth accumulation, but they often come with higher fees compared to standalone investments. They are ideal for individuals seeking life coverage while growing their wealth over the long term. However, it is essential to understand the fee structures and the performance of the underlying funds before committing to an ILP.

Unit Trust Investment Accounts

Unit trusts, also known as mutual funds, are a popular choice for investors seeking professional fund management and diversification. By pooling money with other investors, unit trusts allow individuals to access a broader range of asset classes, including equities, bonds, and real estate. Unit trust investment accounts can be opened through banks, brokers, or fund management companies. While unit trusts provide the benefit of active management, they often come with higher management fees compared to passive investment vehicles like ETFs. For investors with a longer time horizon and moderate risk tolerance, unit trusts offer a balanced approach to portfolio growth.

Investment-Linked Savings Accounts (ILSA)

Investment-linked savings accounts provide a structured way to invest regularly while earning interest or returns. Offered by banks and financial institutions, these accounts often include options to invest in funds or structured products. They are suitable for individuals looking to automate their savings and gradually build their investment portfolio. However, returns may be lower compared to direct investments in higher-yield assets like stocks or ETFs.