CMC Markets Singapore is great for active investors trading major markets

Provider: CMC Markets Singapore

Verdict: CMC Markets Singapore is a subsidiary of the UK-based brokerage house CMC Markets plc. and is regulated by the Monetary Authority of Singapore (MAS). The company has been long established in Singapore since 2007, offering CFD and FX trading. It launched a stock broking business in 2023, trading as the brand under CMC Invest, also regulated by the MAS. CMC Markets primarily refers to the firm’s derivatives trading services, which offer high leverage and both long and short positions. Meanwhile, CMC Invest is a stock broking trading account/platform, offering physical shares and ETFs trading without leverage.

Is CMC Markets good for CFD and FX trading in Singapore?

The CFD and FX trading accounts provide access to a broad range of asset classes, including Forex, Indices, Commodities, Shares, ETFs, and Cryptocurrencies, totalling 12,000+ instruments. Clients can choose from three trading platforms – CMC Markets Next Generation(NG) platform, TradingView, and MT4.

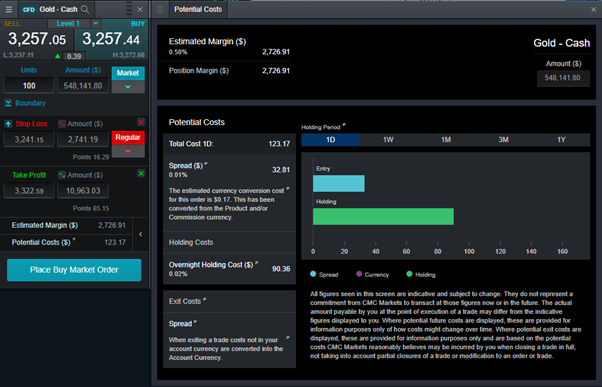

The NG platform is more suitable for professional traders due to its sophisticated functionalities. It enables customisable layouts, supporting up to 10 chart windows alongside live pricing for categorized asset classes. The designation can give traders a comprehensive view of the market trends, particularly suitable for those who employ tactical and technical trading strategies. One feature I quite like about this platform is the transparency of order tickets, clearly demonstrating trading amounts, associated costs, and fees upfront without hidden surprises.

The order ticket on the NG platform

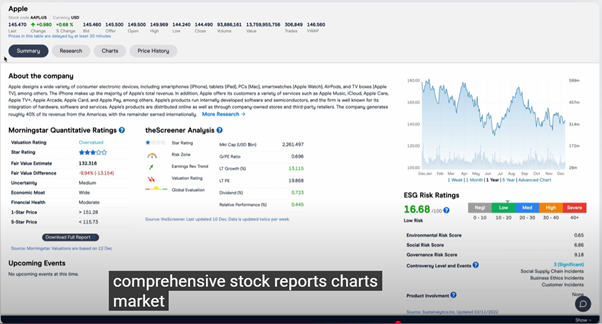

TradingView is one of the most popular platforms for both technical and fundamental analysis. The platform offers more than 20 interactive chart types and over 110 drawing tools. For stock investors interested in company fundamentals, it provides access to key financial metrics such as Revenue, Earnings Per Share, and Income Statement.

MT4 is a more simplified trading platform, which may appeal to beginners. The platform offers much less access to instruments.

CMC Invest Singapore

The CMC Invest Singapore account enables clients to access over 45,000 stocks, REITs, and ETFs across 15 major markets, including more than 500 local companies’ stocks. The CMC Invest platform is developed in-house.

There are three types of trading accounts you can choose from – Invest, Platinum, and Diamond- the higher the tier, the lower the trading costs. In my view, premium accounts suit those who trade more regularly with less carrying time, while the standard Invest accounts are better suited to longer-term, buy-and-hold investors.

Compared to other brokers in Singapore, CMC Invest enables broader access to international markets without custody or settlement fees. Instead, you will be charged volume-based commission and FX conversion fees (FX conversion fees are often not transparently displayed by most brokers). CMC Invest offers a limited number of free trades per month before these charges apply.

Research & Education

Both CMC Markets CFD and CMC Invest accounts include Morning Star analysis reports. The company offers education, market analysis, and platform training, though less frequently than in the past. The NG platform also includes a built-in economic calendar and live Reuters news for daily market updates.

The CMC Invest built-in Morning Star report

Customer Service

There are three ways to contact the client service team in Singapore – a 24/5 phone call service line, WhatsApp, and email, depending on the urgency of your enquiry.

Pros

- Wide market access

- Transparent fee structure

- Well-established and regulated brokerage

Cons

- High CFD slippage volatility

- Costly basic Invest account

- Limited analysis and education

-

Pricing

(4.5)

-

Market Access

(4.5)

-

App & Platform

(5)

-

Customer Service

(4.5)

-

Research & Analysis

(5)

Overall

4.7

Tina was a Market Analyst at CMC Markets from 2015 to 2024, providing client education, market commentary, and media presentations. She specializes in technical analysis and market fundamentals. Tina believes financial markets comprise a vast area reflecting economies, politics, history, psychology, and philosophy. As a result, her analysis is based on her interpretation of a specific country’s economic and historical background, alongside investor sentiment and behaviour.

Tina’s expertise has garnered recognition, with her commentary frequently quoted by reputable sources like Bloomberg, CNBC, Routers, WSJ, and AFR. Her insights span a diverse spectrum, covering various financial domains, including stock markets, foreign exchange, commodities, and cryptocurrencies. Previously, she also spent significant time with China Central Television. This experience allowed her to develop a deep understanding and insight into China’s economics and business.