OANDA Singapore Lets You Trade Forex with Solid Tools and Tight Spreads

Provider: Oanda Singapore

Verdict: OANDA Singapore is a solid, MAS-regulated CFD broker with strong platforms and education, making it ideal for forex-focused beginners to intermediate traders. However, its limited asset coverage and inactivity fees may deter long-term investors.

Who are Oanda, and what do they do?

OANDA Singapore is a subsidiary of the global brokerage firm OANDA Corporation, headquartered in Toronto, Canada. The company launched operations in Singapore in 2007, expanding into the Asia-Pacific region for the first time after receiving US$100 million in investment from venture capitalists. It is regulated by the Monetary Authority of Singapore (MAS) and offers market access to financial instruments covering multiple asset classes.

Market access

OANDA Singapore offers CFD trading in broad asset classes, including currencies, indices, commodities, cryptocurrencies, and bonds. CFD represents Contract for Difference (CFD), a financial derivative that allows traders to speculate on the price movement of the underlying assets without owning them. CFDs typically offer higher leverage, also known as margin trading.

The margin rates on OANDA’s instruments are mostly 20:1 for FX, 5:1 for commodities and bonds, and a much higher rate of 2:1 for Cryptocurrencies.

Pricing

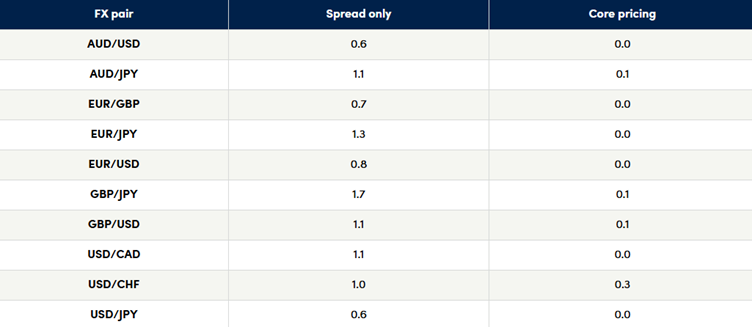

OANDA offers competitive pricing with floating spreads. Clients can choose from two fee structures: Spread-only pricing and commission + core spread pricing. The latter offers reduced spreads plus a fixed commission charge per trade, more suitable for active traders in my view.

The trading cost on currency pairs starts from 0.6 pips for the spread-only model. As for the commission structure, the spread can be as low as zero, with a commission of SGD 30 per 1 million in notional value traded.

Source: OANDA

Overnight funding charges apply for positions held past 5 pm ET. Additionally, a monthly inactivity fee will be charged if there has been no trading activity for 12 months.

Platforms

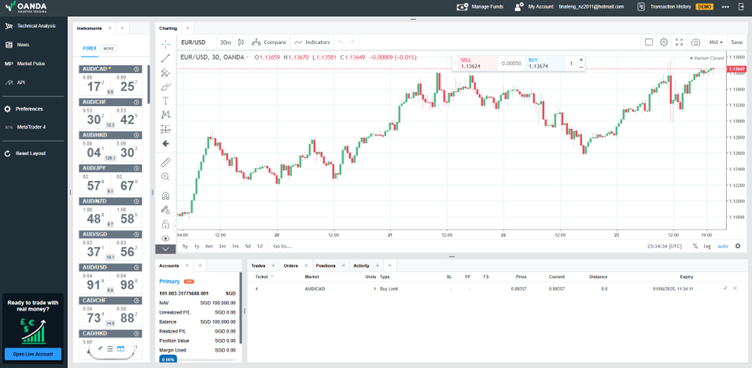

OANDA Singapore offers clients four trading platforms: a mobile app, OANDA web, TradingView, and Meta Trader 4.

OANDA web is the most popular platform for its clients, integrated with the TradingView chart tools. Its clean and intuitive interface is more favourable to beginners and intermediate traders. The platform includes access to analyst insights for technical analysis and live news feeds from Dow Jones.

A feature I like about OANDA web is the Guaranteed stop-loss (GSLOs) order, which ensures that your trades are exited at the exact price you specify, avoiding wide slippage during volatile period in the markets. However, a charge occurs if it gets triggered.

OANDA demo account

Research & Education

Singapore provides a Masterclass education video series for beginners and advanced traders. Clients can also attend trading workshops featuring live market analysis from in-house analysts, alongside a premium webinar series.

Additionally, its Daily Dose of Market Insights provides timely daily market updates on macro & intraday technical analysis. Meanwhile, the OANDA Trade Tap Blog is a text-based content, including “Chart of the Week” and “Monthly Tactical Views”.

Customer Service

You can reach the client service support team in Singapore via phone, email, live chat, or SMS. The service team is available from Monday at 4 am SGT to Saturday at 6 am SGT.

Pros

- User-friendly trading platform

- GSLOs available

- Strong technical analysis and educational resources

Cons

- Limited to CFD trading – individual stocks are not available

- A monthly inactivity fee applies after 12 months of no activity

-

Pricing

(4)

-

Market Access

(3)

-

App & Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

3.8

Tina was a Market Analyst at CMC Markets from 2015 to 2024, providing client education, market commentary, and media presentations. She specializes in technical analysis and market fundamentals. Tina believes financial markets comprise a vast area reflecting economies, politics, history, psychology, and philosophy. As a result, her analysis is based on her interpretation of a specific country’s economic and historical background, alongside investor sentiment and behaviour.

Tina’s expertise has garnered recognition, with her commentary frequently quoted by reputable sources like Bloomberg, CNBC, Routers, WSJ, and AFR. Her insights span a diverse spectrum, covering various financial domains, including stock markets, foreign exchange, commodities, and cryptocurrencies. Previously, she also spent significant time with China Central Television. This experience allowed her to develop a deep understanding and insight into China’s economics and business.