I once tweeted about asking who would win in a fight, XTB’s Conor McGregor or Plus500’s Jack Bauer. I don’t know why brokers choose the celebrities they do to endorse them, but they must have their reasons. But this isn’t about UFC vs 24. It’s about whether or not XTB is a decent broker. I’ve been trading on their platform for years now and here I highlight what features I like, what they are lacking and what sort of trader XTB is suitable for.

- Overview

- Richard's Review

- Facts & Figures

- Customer Reviews

XTB Ratings

Name: XTB

Description: XTB is a CFD and forex broker headquartered in Poland and listed on the Warsaw Stock Exchange (WSE:XTB) valued at over $1bn. XTB was founded in 2003 and offers forex, indices, commodities, ETF and stock CFD trading. XTB has historically used celebrity endorsements to promote it’s brand including Jose Mourinho, Conor McGregor, Joanna Jędrzejczyk and Jiří Procházka.

77% of retail investor accounts lose money when trading CFDs with this provider

Summary

XTB, are a decent all-round trading platform and a good choice for most small-to-medium sized CFD traders. They are publically listed in Poland and offer, competitive spreads on a fairly wide range of markets.

Pros

- Publically listed

- Mulitple platform choices

- Innovative order types

Cons

- Not UK based

- No DMA

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4Ratings Explained

- Pricing: Industry standard and inline with tight spreads.

- Market Access: Getting better all the time as XTB embrace pong-term investing.

- Platform & Apps: Very good, with some really innovative features and integrations.

- Customer Service: Industry standard.

- Research & Analysis: Lots of educational “masterclasses” built in.

Richard’s XTB Review

I’ve used XTB on and off now for around 5 years, and one thing to note is that they are a reactionary broker. In that, they keep adding and removing features based heavily on client demand. One feature they used to have which I thought was brilliant, was the option to build your own baskets of assets. Which is essentially building your own ETF to trade multiple currency pairs, stocks of indices in one go. You could even assign your own custom weighting to which assets were included. Unfortunately, no-one used it so they discontinued the feature. Which is a shame, but on the plus side, they do keep adding features to the platform as and when customers need them.

When we do CFD broker reviews, we talk to the people at the brokerages themselves, trade live with real money and highlight some key features that make them stand-out. So we also spoke to Josh Raymond, one of the directors who over the course of a 15-minute video chat took us through some of the key features on the platform. I would have suggested we meet in person for an update on what’s new but, last time I was due to meet Josh for a coffee in Canary Wharf, he forgot and didn’t turn up. I can, however, recommend Notes for a bit of people watching.

Highlights

The key things to focus on when considering trading with XTB are:

- They have their own proprietary trading platform. When I interviewed Omar Arnaout, the XTB CEO Omar Arnout he said “I’m really proud of our platform and honestly believe it’s one of the best in the market.” Rightly so.

- They really push client education, XTB won “Best Trading Platform Education” in our 2023 awards (although they didn’t show up to collect the trophy, they never do). You can read their Q&A on forex education here.

- Customer service is paramount. Omar said that “first and foremost is the customer service”. I really agree with this as I think it’s important to have a few different trading accounts (diversify, diversify, diversify) and you’ll trade more with the broker that treats you best.

Awards

In our annual awards, XTB has won:

- Best Trading Platform Education – 2023

- Best Forex Broker – 2021

- Best Crypto Broker – 2019 & 2018

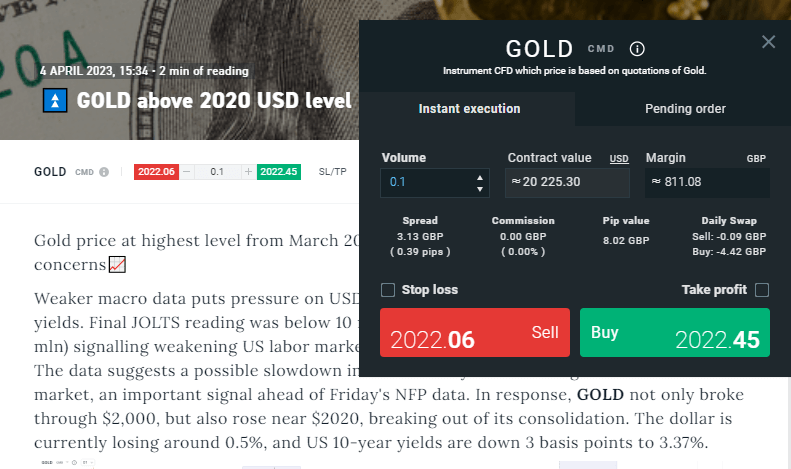

News, analysis and trading ideas

All brokers have news, technical analysis, economic announcements and fundamental data. Most even have RanSquark (where your computer shouts at you every time there is a market figure), but XTB also has an integrated dealing ticket so you can trade quickly from the analysis. You can see below in their recent Gold analysis. You can either place a market order to go long or short at your saved standard lot size or bring up a dealing ticket to work a limit.

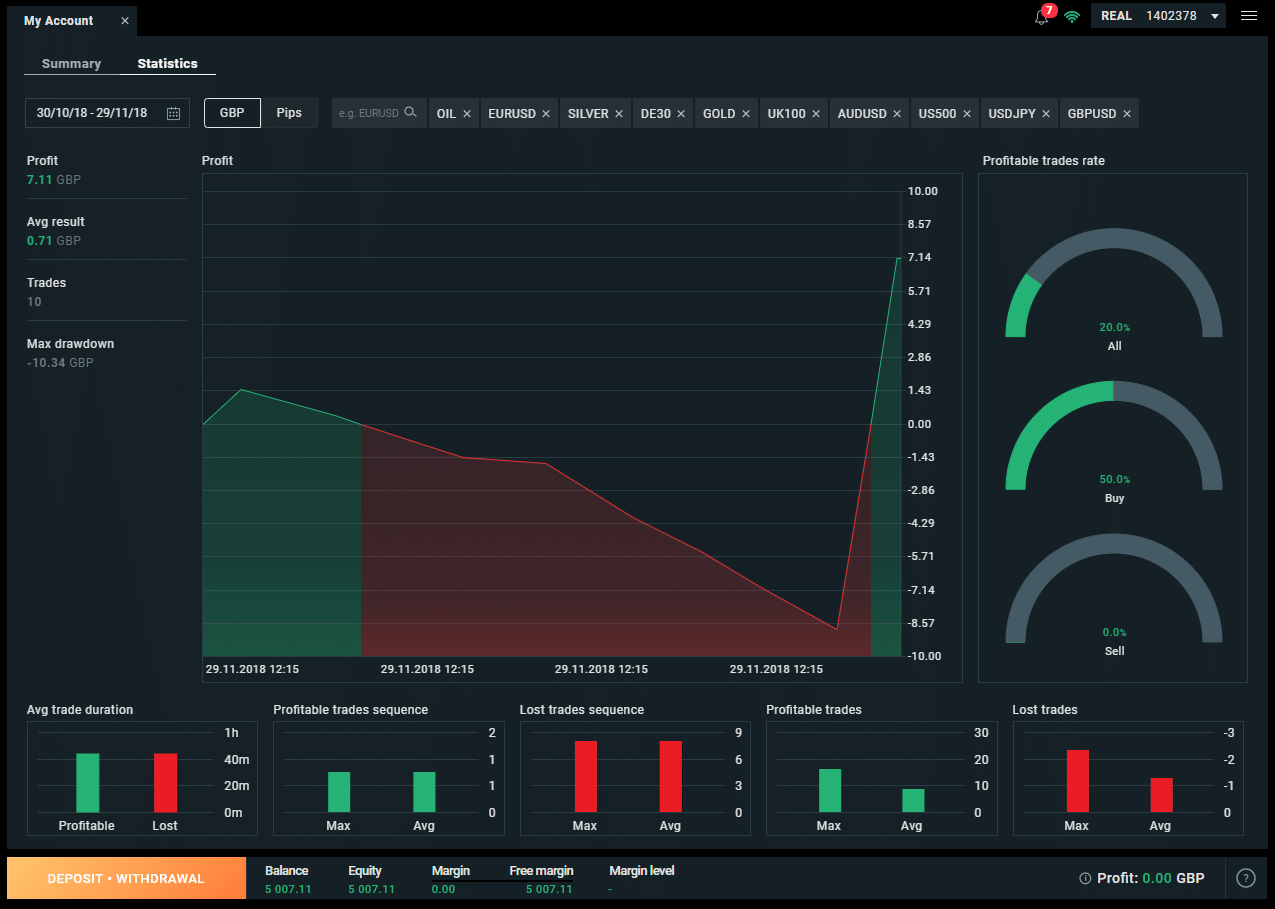

Post-trade analysis

See a breakdown of what markets and trades you make or lose money.

XTB was one of the first brokers to introduce post-trade analysis, and this sits nicely alongside their ethos of trading to educate their clients rather than churn and burn them. You can see a recap of your previous trades in your account settings. This gives a very visual representation of which trades you make and lose money on. This is a really interesting feature because, as we all know, it’s hard to make money trading. But oddly enough it’s not that hard to pick winners.

Picking on Josh again, we highlighted an article he wrote (The truth about whether trading is actually winnable) way back in 2014, showing that the profitable trades were around 60%. It’s just that the losses were larger than the profits. This suggests that it is a post-trading strategy that is the issue. Not picking trades. So, by using this section to evaluate which trades you most frequently win on you should be able to improve your overall trading strategy.

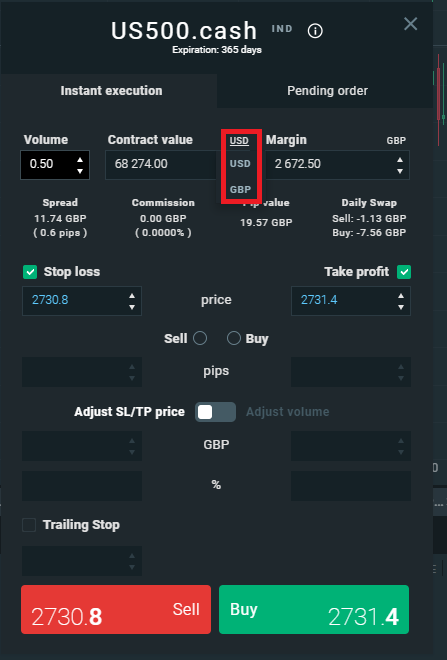

Account base currencies

You can change your base currency by setting up different sub accounts.

This may not seem like a big deal on the surface, but it’s actually a really nice feature. One thing traders never really take into account when trading international markets is currency exposure.

Even when trading Forex, traders tend to just look at what is happening on the chart and not the overall economic climate. Trading profits are hugely affected by currency exposure and in some cases can wipe out profits. Also, as tight as deliverable foreign exchange rates are becoming they are still always never below 0.5%.

So if you are in the UK with GBP on account and trading US products your P&L will be in USD. This will then have to be converted into GBP before you can withdraw (unless you want to be at the mercy of your banks tourists rates (which you don’t)). But, if you go to your “My Accounts” page you can open up sub accounts in GBP, USD, or EUR. So, if you have a strategy that mainly relies on non-local currencies you can reduce your FX fees and currency exposure.

You can also change the currency in the dealing ticket, between local and base currency, which can give you more control over your position exposure. This is particularly helpful, when fx markets are volatile.

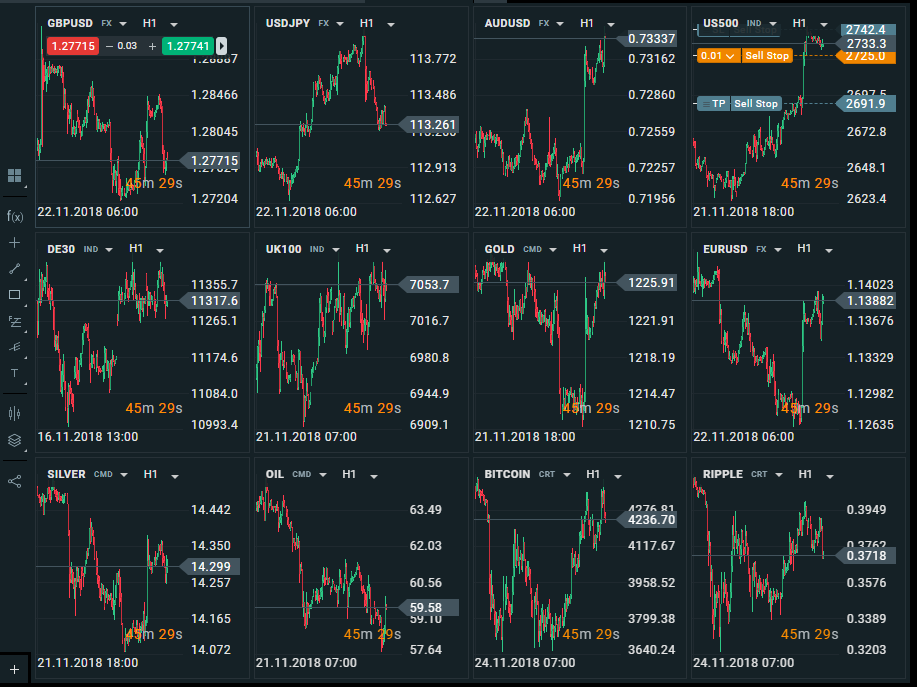

Chart grids

You can get an instant macro market overview with grid charts.

When I first started off as a stockbroker many decades ago we used this pricing system called QTS. It’s long gone now, but it had this great feature where you could get a grid view of a market with a single click. It was a great default view so you can instantly see what was going up or down without having to have multiple screens up.

I know you can set this up manually on most other brokers, but other than CMC, I don’t think it’s that easy anywhere else. XTB, have a really nice feature where you can see all your open charts as a grid. A very handy visual overview of what is going on.

Plus, if you’ve got a pending order you can see the levels on the chart. When I took the below screenshot I had a working stop entry in US500 (top right).

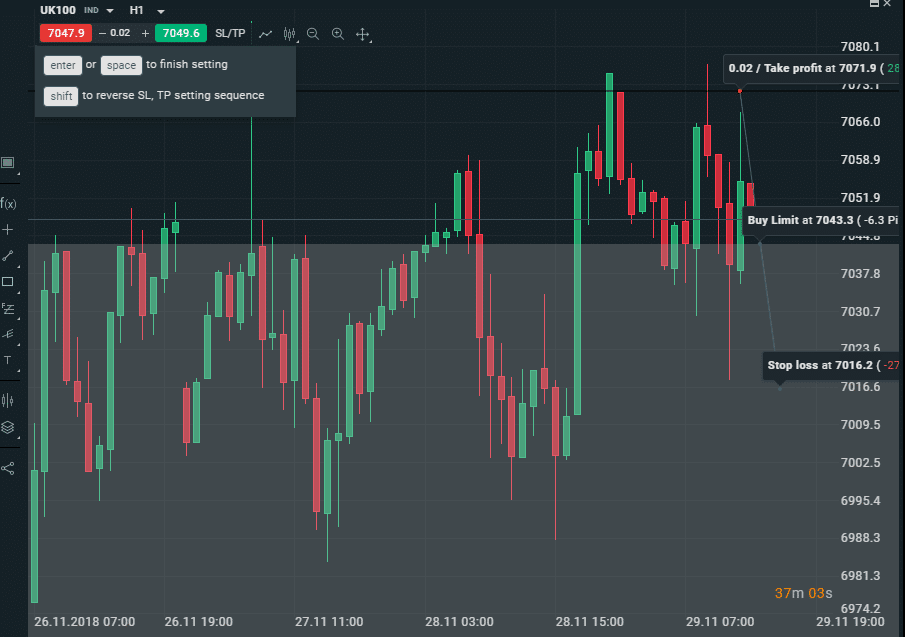

Trade from the charts

Add market orders, stops entries, limits and stop losses by clicking directly on the charts.

A lot of other brokers let you trade from the charts. In fact, last week when we did a video demo of Spreadex’s platform where we highlighted that you can move your stops from the chart.

Which is an almost essential feature. Because let’s face it you either place stops at support and resistance levels or base them on how much you want to win or lose. So it’s quite nice to set your P&L limits then move your orders based on what the chart looks like.

However, what is unique to XTB (as far as I know) is the ability to place stop entries, stop losses and limits straight onto the chart.

The first click is where you want to buy, second your stop loss and third your limit. You basically draw your trade on the chart and it is created in the dealing ticket.

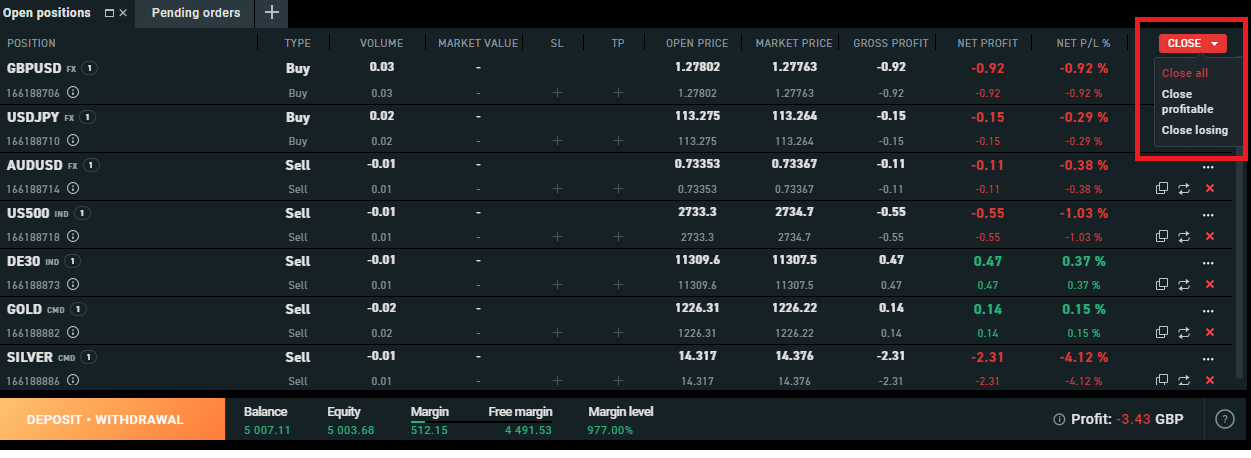

Closing off positions

You can close all, profitable or losing trades in one go

This is a nice feature to end off our XTB review. When you are done for the day, or popping off to the shops, you can select what trades you want to close.

It’s really annoying when you have to click on twenty different trades to close them out when you want to be flat. So on the XTB “Open Positions” tab you can choose to close either all your trades or just the duds that are losing. Or, you can bank your profits by closing all the winners and leave your losers to either get stopped or reverse. But I shall leave it to you to decide if that is a sensible trading strategy.

XTB Facts & Figures

| Total Markets | 2,100 |

| ➡️Forex Pairs | 57 |

| ➡️Commodities | 22 |

| ➡️Indices | 25 |

| ➡️UK Stocks | 230 |

| ➡️US Stocks | 1080 |

| ➡️ETFs | 138 |

| Broker specifics | |

| 👉Active Clients | Over 447,000 |

| 💰Minimum Deposit | 0 |

| ❔Inactivity Fee | 10EUR per month |

| 📅Founded | 2002 |

| ℹ️Public Company | ✔️ |

| Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ❌ |

| ➡️DMA (Direct Market Access) | ❌ |

| ➡️Futures Trading | ❌ |

| ➡️Options Trading | ❌ |

| ➡️Investing Account | ❌ |

| Average Costs | |

| ➡️FTSE 100 | 1.7 |

| ➡️DAX 30 | 1 |

| ➡️DJIA | 3 |

| ➡️NASDAQ | 1 |

| ➡️S&P 500 | 0.5 |

| ➡️EURUSD | 0.9 |

| ➡️GBPUSD | 1.4 |

| ➡️USDJPY | 1.4 |

| ➡️Gold | 0.35 |

| ➡️Crude Oil | 3 |

| ➡️UK Stocks | 0.08% |

| ➡️US Stocks | 0.08% |

XTB Customer Reviews

Tell us what you think:

77% of retail investor accounts lose money when trading CFDs with this provider

XTB FAQs:

Yes, we rate XTB as a good broker and can recommend it based on their pricing, reputation, customer service, regulator status and platform features.

Yes. If you are trading through the FCA regulated entity of XTB your funds are protected by the FSCS. However, it’s important to note that XTB offers CFDs which are a high-risk and volatile way to invest and trade the market.

There is no minimum deposit required to open an account. However, you will need enough funds on account to cover the initial and variation margin of the positions you open.

XTB say it takes one business day to withdraw funds from your account. However, this process may be delayed if you use a different withdrawal/deposit method due to AML regulations.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.