The markets are steady as COVID cases rise, but for how long if there is a looming second wave?

The dominating news for those investing these days is all about the looming ‘Second Wave’.

Following a summer retrenchment, the coronavirus pandemic has returned in a vengeance, especially in Europe. The past few weeks saw France, Spain, and many other Eastern European countries report a growing number of new COVID cases. Some nations have even surpassed their March-April peaks. France and Spain, for example, both detected more than 10,000 new cases per day just recently. The trend is unmistakably growing in the UK too, with more than 3,000 new cases registered in the past 24 hours.

Inevitably, governments have tightened personal freedoms and economic activities. Local lockdowns are reimposed in many areas; gatherings are limited. In the UK, the Johnson administration has limited groupings to no more than six. Should new cases continue to rise, further restrictions are on the table.

How will lockdowns impact the stock market?

As new cases rise, is a market correction all but certain? To answer this we have to look at two factors: The health of companies and the general macroeconomic liquidity.

First, on companies. When the first wave struck in March/April, it hit companies hard on several fronts: drastically lower revenue, dwindling financial liquidity, and a highly unstable outlook. The economic ‘Sudden Stop’ was unprecedented in modern times. It created a vicious downward spiral and investors were genuinely frightened.

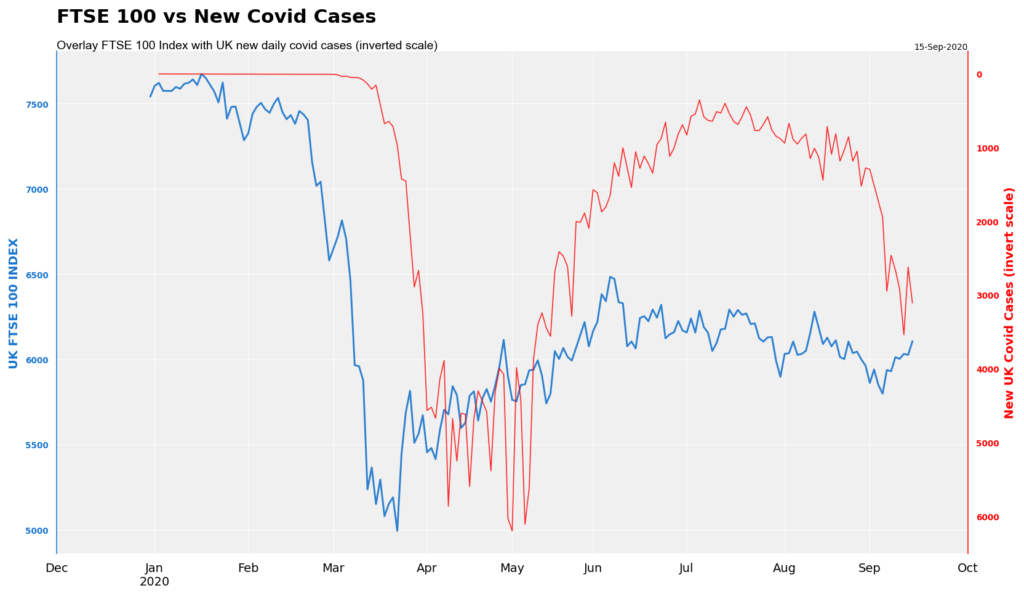

Look at the FTSE 100 Index in March (see below, blue line). Prices plunged from 7,500 to 5,000 in a matter of weeks. Many stocks suffered corrections in excess of 40 percent. If the lockdown persists and tightens into the critical pre-Christmas trading season, many High Street names will suffer. But will poor corporate results lead to lower stock prices? It depends on investor expectations.

Source: UK gov covid dashboard

Should investors bet on central banks being rescued?

This brings us to the second factor: General movement of stock prices. This is driven by many macro factors, including quantitative easing (QE), inflation rate, exchange rate, and investor behaviour etc. On this, the dominant factor these days is QE.

During March-June, the US Federal Reserve doubled its reserves by US$3 trillion to combat the covid-led market selloff and economic contraction. This amount is as much as QE1-QE3 combined (2008 to 2015). Other central banks also injected high doses of monetary morphine. The Bank of Japan, for example, pledged in April to buy an ‘unlimited’ amount of government bonds. Thanks to this massive surge in liquidity, stock markets especially tech stocks skyrocketed. Gradually, Dow, S&P 500 and several other stock indices have recovered much of the March/April losses.

- Related Guide: How to invest in tech shares

As the March bear market turned into a four-month bull run, many investors would have regretted selling stocks during the correction. Given this recent experience, investors logically conclude: Should a second wave happen, central banks are likely to step in (again).

- Expert guide – How to invest in a bear market

With this in mind, look at the above chart again. Even as the number of new covid cases in the UK rises (right hand scale, red), the UK blue-chip index remains fairly firm. Investors are not in a panic selling mode yet. Yes, corporate results are not great but this is somewhat priced-in. Unlike the market back in January, investor expectations are currently moderately low.

The next question is, what should we do when a Coronavirus correction happens?

Related Guide: How to predict a market crash and what you can do about it

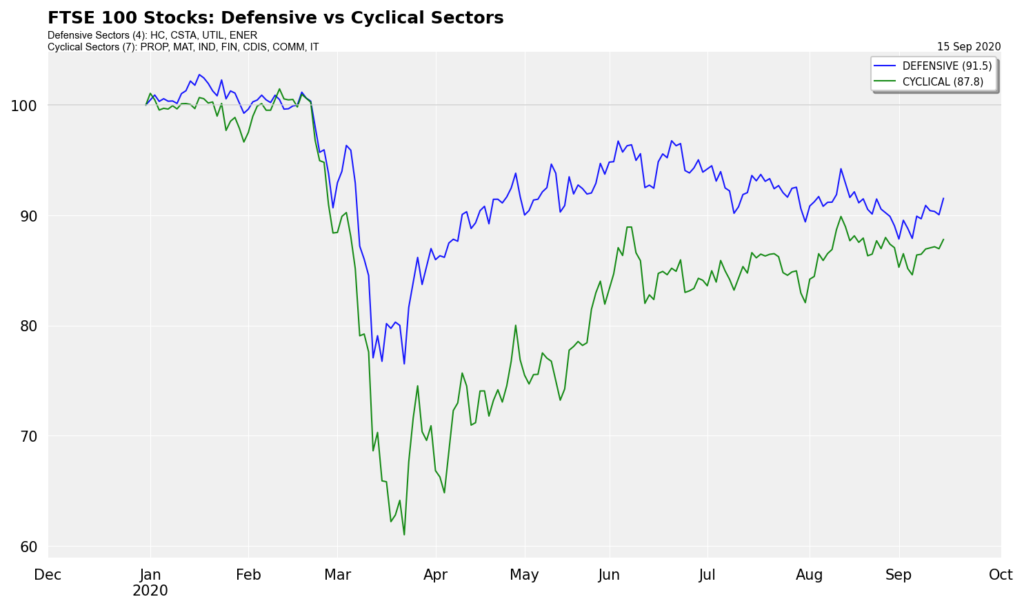

During the March selloff, cyclical sectors were hammered. (Cyclical sectors are Property, Materials, Industrials, Financials, Discretionary, Communications and IT, as defined by MSCI.) Meanwhile, defensive sectors did relatively better (see chart below). But during the April-July rally, cyclical sectors rebounded much higher from their March lows.

Therefore it is likely that defensive stocks will outperform again should markets decline on the covid second wave; while cyclicals will lead on the subsequent recovery rally.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.