Spread betting brokers let you speculate on the price of shares, indices, commodities, forex and fixed-income markets going up or down through financial spread betting. Financial spread betting platforms are unique to the UK as trades are structured as bets on a value-per-point movement basis and there is no capital gains tax due on profits. We have tested, ranked, compared and reviewed some of the best spread betting brokers in the UK to help you choose the most appropriate account for your trading strategy.

City Index: Best spread betting broker for trading signals and post-trade analysis

🏆Award Winner🏆

- Spread betting markets available: 12,000

- Minimum deposit: £100

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.08%, FTSE 1, GBPUSD 0.9

- GMG rating: (4.3)

- Customer rating: 3.6/5 (86 reviews)

69% of retail investor accounts lose money when trading CFDs with this provider

City Index Spread Betting Review

Name: City Index Spread Betting

Description: City Index is one of the best spread betting brokers and is suitable for all types of traders looking for a tax-efficient way to speculate on the financial markets. City Index also won our “best trader tools” award in 2023.

70% of retail investor accounts lose money when trading CFDs with this provider.

Summary

Overall City Index’s spread betting platform is one of the best around with competitive pricing, a wide range of markets to trade, and some very good added value tools to help traders seek out opportunities and improve their trading strategy.

- Spread betting markets available: 12,000

- Minimum deposit: £100

- Account types: CFDs & spread betting

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.08%, FTSE 1, GBPUSD 0.9

Spread bets at City Index are available on 12,000 markets including, 23 equity indices, thousands of UK and international stocks and ETFs, 19 commodities, bonds, and interest rates, and an industry-leading 182 FX pars. City Index also has an options desk for spread betting on index and populare stock options.

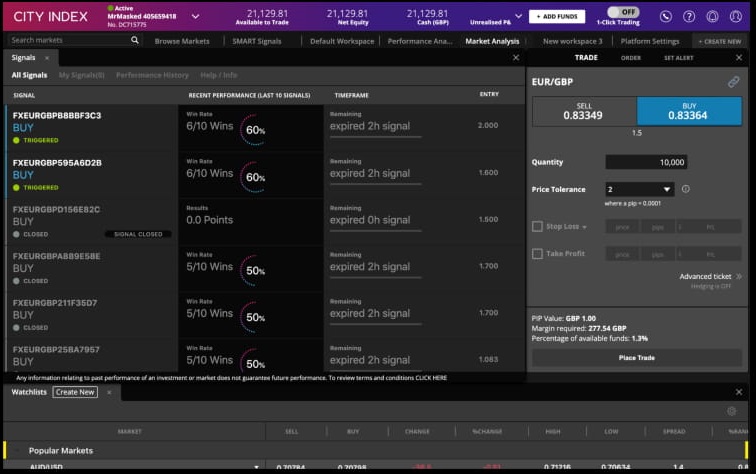

When I tested City Index’s spread betting account there were two things that made it stand out, SMART Signals and Performance Analytics.

SMART Signals, is one of the best trading signal services out there and is developed in-house by City Index. The idea is that the algorithm scans the market for price patterns and highlights upcoming trading opportunities. It differs from the standard offerings from Autochartist and Trading Central, by being fully integrated giving you the ability to trade via a single click, as well as being fully transparent by displaying the previous P&L per asset.

The other spread betting tool, that is unique to City Index is Performance Analytics. Whilst other brokers provide post-trade analysis, When StoneX (City Index’s parent company) acquired Chasing Returns, they were able to exclusively provide a huge amount of data to help their customers stick to a trading plan and provide insights into what can make them a better spread bettor.

As with most spread betting brokers, City Index clients trade via two-way bid-offer prices the difference between the bid and offer representing the spread. These vary by product and contract but in the FTSE 100 index City charges a minimum spread of 1 index point and on the Germany 30 or Dax it charges 1.20 points. You can trade Spread Bets on leading equity indices up to 24 hours per day. For stock trading, spreads of 0.8% for UK and 1.8 cents per share are built into the price.

Pros

- Wide range of spread betting markets

- Trading signals

- Post-trade analysis

Cons

- No DMA spread betting

- No investing account

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

4.3Pepperstone: Best for spread betting on MT4/MT5

- Spread betting markets available: 1,200

- Minimum deposit: £1

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.9

- GMG rating: (4.1)

- Customer rating: 4.6/5 (61 reviews)

75.3% of retail investor accounts lose money when trading CFDs with this provider

Pepperstone Spread Betting Review

Name: Pepperstone Spread Betting

Description: Pepperstone introduced spread betting in early 2021 with a focus on tight pricing for major instruments and automated trading on through trading platforms.

75.6% of retail investor accounts lose money when trading CFDs with this provider.

Summary

Overall, Pepperstone is a good choice for clients that want to spread bet on MetaQuotes as it’s MT4 & MT5 package is one of the best around. Plus Pepperstone are one of only two brokers that offers spread betting through TradingView.

- Spread betting markets available: 1,200

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.9

Pepperstone operates a tiered approach to spread betting accounts. Newer clients typically joined Pepperstone’s standard accounts; more experienced traders can elect to join the firm’s Razor account. The latter is used mainly for scalping and algorithmic trading. As seen below, Razor accounts have lower spreads than standard accounts in the FX markets but they also incur some commissions.

Pepperstone does not charge an inactivity fee, which is excellent for low-latency traders. The firm has no regular maintenance fee like some investment accounts. There is no minimum deposit either.

In the UK, Pepperstone offers protection on negative balance for retail clients only. This means that should the market swing violently against you and wipe out your risk capital, your account will not go below zero. Professional accounts, however, will be required to post additional equity and can go into negative equity.

For funding, Pepperstone accepts Visa, MasterCard, Paypal or bank transfers.

Most withdrawals are free, although international Telegraphic Transfer (TT) may incur fees by the banks which will be passed on to clients.

Pros

- Good MT4 spread betting broker

- Low minimum deposit

- Excellent package of indicators

- Spread betting on TradingView

Cons

- Limited market range

- No options spread betting

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.1CMC Markets: Best spread betting trading platform sentiment indicators

- Spread betting markets available: 12,000

- Minimum deposit: £1

- Equity overnight financing: 2.9% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.59

- GMG rating: (4.3)

- Customer rating: 3.6/5 (107 reviews)

74% of retail investor accounts lose money when trading CFDs with this provider

CMC Markets Spread Betting Review

Name: CMC Markets Spread Betting

Description: CMC Markets pioneered electronic trading in the UK during the early 1990’s and introduce financial spread betting to complement its CFD and forex trading in 2001. Since then the Market Maker spread betting platform has evolved into the “Next Generation” platform and is one of the best proprietary trading platforms for active traders in the industry.

74% of retail investor accounts lose money when trading CFDs with this provider.

Summary

Overall, CMC Markets is an exceptional spread betting platform with innovative features suitable to frequent traders wanting to trade on tight spreads.

- Spread betting markets available: 12,000

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: 2.9% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.59

CMC Market’s spread betting offering has always won business by producing great technology that reduces the cost of trading. By focussing on mobile and online trading, they now see over 70% of spread bets go through on mobile versus online.

I found that CMC Market’s spread betting prices were always tight and hail from the original online platform name (Deal4Free, and slogan “compare the spread”). CMC Markets also invented the concept of the daily cash rolling spread bet so traders no longer need to trade the futures price, reducing trading costs further.

Whilst CMC Markets focus on the major markets, they do actually offer access to quite a large amount of assets, over 12,00 including an industry-leading 338 fx crosses (CMC did start as a forex platform), 124 commodities, 28 indices and hundreds of UK and international stocks.

Two of CMC Market’s very innovative spread betting features are how they break down client sentiment and their share baskets. It’s commonplace for spread betting brokers to display client sentiment, but CMC Markets let you filter that sentiment down to profitable clients so it can become more valuable. They also provide a wide range of weighted share baskets so you can spread bets on sectors like driverless cars, big tech, cyber security and China tech, where ETFs have not yet been created.

Pros

- Excellent spread betting technology

- Client sentiment indicators

- Good for active traders

Cons

- Limited spread betting on smaller markets

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.3Spreadex: Best spread betting platform for customer service and small caps

- Spread betting markets available: 10,000

- Minimum deposit: £1

- Equity overnight financing: 3% +/- SONIA

- Pricing: Shares 0.2%, FTSE 1, GBPUSD 0.9

- GMG rating: (4.2)

- Customer rating: 4.2/5 (177 reviews)

72% of retail investor accounts lose money when trading CFDs with this provider

Spreadex Spread Betting Review

Name: Spreadex Spread Betting

Description: Spreadex is one of the last spread betting brokers to offer a mixture of financial and sports spread betting, for those who want to trade the FTSE during the week and the Footie on the weekend. I’ve used both services for nearly 20 years and have seen them mature along with the industry.

72% of retail investor accounts lose money when trading CFDs with this provider.

Summary

Overall, Spreadex is an excellent spread betting broker for those who want personal service and the ability to speculate on financial as well as sports markets.

- Spread betting markets available: 10,000

- Minimum deposit: £1

- Account types: CFDs, spread betting

- Equity overnight financing: 3% +/- SONIA

- Pricing: Shares 0.2%, FTSE 1, GBPUSD 0.9

Based in St Albans, just outside of London Spreadex offers a simple but innovative spread betting platform for trading a wide range of assets. Spreadex has always focused on customer service, winning business from referrals and maintaining long-term relationships with their clients.

It’s a testament to the business that they build their own technology in-house and are reserved with marketing campaigns.

They offer access to over 10,000 markets and recently Spreadex has reduced spreads across the major assets and still offers access to smaller-cap stocks compared to some of the other providers.

The spread betting platform does have some good charting options, such as adding pro trading tools like WVAP and pro trend lines, as well as the usual obligatory technical indicators like Bollinger Bands and Moving Averages. You can see what percentage of clients are long on watchlists and you can quickly go to a specific time point on a chart.

There is also a wide range of ETFs, ETCs and Trackers to spread bet on for sector speculation, and you also have the option to trade political markets.

Pros

- Excellent customer service

- Smaller cap stock spread betting

- Proprietory spread betting platform

Cons

- Limited spread betting on options

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(5)

-

Research & Analysis

(3.5)

Overall

4.2IG: Best overall spread betting broker

- Spread betting markets available: 17,000

- Minimum deposit: £250

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.6

- GMG rating: (4.3)

- Customer rating: 3.9/5 (523 reviews)

69% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

IG Spread Betting Review

Name: IG Spread Betting

Description: IG won “best spread betting broker” in our 2023 and 2022 awards as it continues to be the best spread betting platform. As well as inventing the concept of financial spread betting in 1974, IG also offers access to the most markets, with the most liquidity and are, (by market cap as of April ’22) the biggest spread betting broker valued at over £3.5bn.

70% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Summary

Overall, IG is the best spread betting broker is suitable for beginners through to professional high volume and high-frequency traders.

- Spread betting markets available: 17,000

- Minimum deposit: £250

- Account types: CFDs, spread betting, DMA, investing

- Equity overnight financing: 2.5% +/- SONIA

- Pricing: Shares 0.1%, FTSE 1, GBPUSD 0.6

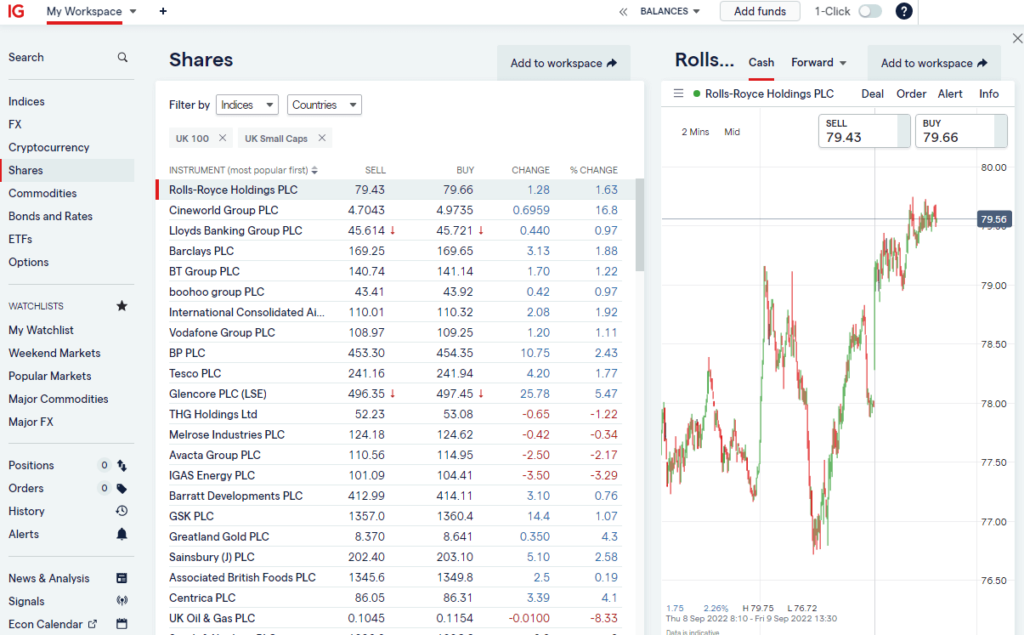

With IG you can spread bet on over 17,000 markets (an industry-leading amount) including 51 forex pairs, 38 commodities, 34 indices and over 10,000 UK and international stocks.

A few key features that make IG’s spread betting platform stand out are the ability to bet on smaller-cap shares, trade IPOs pre-market via their “grey market” and their liquidity. IG’s liquidity can actually be better than the underlying exchange, so you can place and get filled in large orders using IG’s internal liquidity when there might not be the volume on the exchange order book.

Even though IG internalises order flow they do not profit from client losses instead hedging or matching order flow and operating symmetrical tolerance levels. This means that you also benefit from positive slippage, so if you place a spread bet limit order and the market moves in your favour before it is executed you get a better fill.

When I compared pricing against other spread betting brokers IG spreads are always competitive and often market-leading, especially in the major instruments, but where IG wins business is its ability to continually innovate and add value to its spread betting platform. There are trading signals from Autochartist and PIAfirst, but IG takes it a step further by making executing these signals easier and integrating dealing tickets. IG has a good post-trade analytics feature that can show you where you are profitable or not and they create a huge amount of analysis and research around what their clients are trading based on platform analytics.

Pros

- Huge range of markets to spread bet on

- Good liquidity for large spread bet positions

- Spread betting on smaller-cap stocks

Cons

- £250 minimum deposit

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

4.3ThinkMarkets: Good for backtesting spread betting strategies

- Spread betting markets available: 3,981

- Minimum deposit: £10

- Equity overnight financing: n/a

- Pricing: n/a

- GMG rating: (4)

- Customer rating: 0.0/5 (0 reviews)

66.95% of retail investor accounts lose money when trading CFDs with this provider

❓Methodology: We have chosen what we think are the best spread betting brokers based on:

- over 17,000 votes in our annual awards

- our own experiences testing the spread bet trading platforms with real money

- an in-depth comparison of the features that make them stand out compared to alternatives.

- interviews with the spread betting brokers CEOs and senior management.

Compare Spread Betting Brokers

To find your best account use our comparison tables of what we think are the best spread betting brokers to compare how many markets they offer, how much it costs to trade major instruments, minimum deposit amounts and what the overnight financing costs are for holding longer-term positions.

| Spread Betting Broker | Markets Available | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 12,000 | £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 1,200 | £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 17,000 | £250 | See Platform | 69% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 10,000 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 12,000 | £1 | See Platform | 67% of retail investor accounts lose money when trading CFDs with this provider | |

| 3,981 | £10 | See Platform | 66.95% of retail investor accounts lose money when trading CFDs with this provider |

Best overall

IG won best spread betting broker in our 2023 awards. They were the pioneers of the industry and have remained at the forefront of its innovation since its inception. IG offers a huge selection of markets to trade, with deep liquidity and competitive pricing.

Previous winners have been:

- 2022: IG

- 2021: CMC Markets

- 2020: IG

- 2019: Spreadex

- 2018: IG

Beginners

We have ranked City Index as the best spread betting broker for beginners as they offer a simple trading platform with lots of analysis and news. You also get trading signals from their unique Smart Signals feature and you can use the Performance Analytics feature to see which particular markets you are trading most profitably.

This comparison table shows which spread betting platforms have tools that are helpful for new traders.

| Account Types: |  |  |  |  |  |

|---|---|---|---|---|---|

| Trading Signals | ✔️ | ❌ | ✔️ | ✔️ | ✔️ |

| Webinars | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Seminars | ✔️ | ✔️ | ❌ | ❌ | ✔️ |

| Leverage Control | ❌ | ❌ | ❌ | ❌ | ❌ |

| Low Risk Products | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Investment Account | ❌ | ❌ | ❌ | ❌ | ✔️ |

Experienced traders

IG is the best spread betting broker for experienced traders as their liquidity and market range are unparalleled. IG’s internal matching means that there can be better liquidity on their order book than on the underlying exchange, which is particularly good for working larger orders above the NMS (normal market size). IG also have a specialist desk for high-net-worth traders with personal dealers assigned to your account.

If you are an advanced trader with plenty of experience spread betting, this comparison table shows the features commonly used by professional traders.

| Advanced Features: |  |  |  |  |  |

|---|---|---|---|---|---|

| Voice Brokerage | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| Corporate Accounts | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Level-2 | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Algo Trading | ❌ | ❌ | ❌ | ✔️ | ✔️ |

| Prime Brokerage | ❌ | ✔️ | ❌ | ❌ | ✔️ |

Forex trading

City Index offers the most forex pairs for spread betting on foreign exchange, as well as intra-day trading signals, news, analysis and tight FX pricing.

Spread betting on Forex is all about tight prices, speed and market timing. It is one of the most actively traded markets in the world. Positions are generally turned over much faster than any other asset class, and traders aim to take quick profits. Finding a spread betting broker with really tight FX spreads can make a big difference to your profit and loss at the end of the trading day.

We’ve ranked the best spread betting brokers by how many forex pairs they offer:

- CMC Markets: 338

- City Index: 182

- Pepperstone: 62

- Spreadex: 60

- IG: 51

Stocks & shares

IG currently offer the largest amount of UK, US and international shares to spread bet on. As well as a huge range of stocks to trade they also provide technical and fundamental trading signals through autochartist and PIAfirst. There is also excellent integrated news coverage and analysis, economic diaries so you can see which companies are reporting and for larger traders excellent liquidity for working orders outside the usual normal market size (NMS).

We’ve ranked the best spread betting brokers by how many shares you can trade:

| Broker | UK Shares | US Shares | Total Equities |

| IG: | 3,925 | 6,352 | 10,277 |

| City Index: | 5,000 | 2,000 | 7,000 |

| CMC Markets: | 745 | 4,968 | 5,713 |

| Spreadex: | 1,575 | 2,110 | 3,685 |

| Pepperstone: | 192 | 880 | 1,072 |

Commodities

CMC Markets currency offers the most commodities for spread betting on. They offer over 100 commodities as cash best or forwards, and you can also trade a wide range of commodity ETFs on individual commodities or sections such as agriculture, energy or precious metals.

We’ve ranked the best spread betting brokers by how many commodities you can trade:

- CMC Markets: 100+

- IG: 35

- Pepperstone: 32

- City Index: 20

- Spreadex: 20

MT4 & MT5

Pepperstone is the best MT4 spread betting broker as they offer one of the widest ranges of markets to trade and have a pre-built package of indicators exclusively for their traders.

MT4 is one of the most popular ways to trade the financial markets, and many spread betting brokers now offer MT4 as a platform. If you are interested in spread betting on MT4, you can review the best MT4 spread betting accounts here. Spread betting companies that provide MT4 give clients the ability to upload and purchase custom indicators, and then run automated trading strategies based on pre-set technical perimeters. Traders can also follow “Expert Advisors” and trade based on established FX strategies without the need to execute trades manually.

We’ve ranked the best spread betting brokers by how many markets you can trade on MT4:

- Pepperstone: 1,200

- CMC Markets: 200+

- IG: 91

- City Index: 84+

Cheapest fees

CMC Markets often have the cheapest spreads of all the spread betting brokers. You can compare how much spread betting platforms charge for the most popular markets in our spreads comparison table.

| Trading Costs |  |  |  |  |  |  |

|---|---|---|---|---|---|---|

| FTSE 100 | 1 | 1 | 1 | 1 | 1 | 1 |

| DAX 30 | 1.2 | 1.2 | 1 | 0.9 | 1.2 | 1.8 |

| DJIA | 3.5 | 2.4 | 2 | 2.4 | 4 | 5 |

| NASDAQ | 1 | 1 | 1 | 1 | 2 | 1.9 |

| S&P 500 | 0.4 | 0.4 | 0.5 | 0.4 | 0.6 | 0.7 |

| EURUSD | 0.5 | 0.6 | 0.7 | 0.09 | 0.6 | 0.8 |

| GBPUSD | 0.9 | 0.9 | 0.9 | 0.28 | 0.9 | 1.3 |

| USDJPY | 0.6 | 0.7 | 0.7 | 0.14 | 0.7 | 0.8 |

| Gold | 0.8 | 0.3 | 0.3 | 0.05 | 0.4 | 0.28 |

| Crude Oil | 0.3 | 0.28 | 3 | 2 | 3 | 0.4 |

| UK Stocks | 0.008 | 0.001 | 0.001 | 0.001 | 0.002 | 0.30% |

Tight spreads are important when choosing a spread betting broker

Make sure your broker offers tight spreads. The spreads and how tight they are is an important part of trading through a spread betting broker, as spreads impact how quickly you can make money.

However, there are other important considerations to take into account as well. For example, a broker may try to win your business by marketing ultra-tight spreads on a couple of the main products, but then increase spreads on the more exotic asset classes.

You also need to make sure when you pick a broker that they offer consistently tight spreads, and not just during normal trading hours. Securing tight spreads when you want to trade is more important to your profits than choosing a broker that offers the cheapest spreads.

Spreads can also vary on the asset class. In some circumstances, it may be best to go with a broker that has consistently tight spreads throughout their entire asset class range rather than just on a few key products.

That being said, it ultimately depends upon what and how you trade. For example, if you only trade two or three indices and FX pairs, then a broker that will give you the lowest trading costs on these assets will likely make the most sense; then use alternative accounts for other instruments.

Market access

IG currently offers the most markets for spread betting, around 17,000 financial instruments including UK and international stocks, commodities, forex pairs and indices.

Use this comparison table to see which spread betting broker offer the most tradable assets.

| Market Access: |  |  |  |  |  |  |

|---|---|---|---|---|---|---|

| Total Markets | 12000 | 17000 | 11000 | 1200 | 10000 | 3700 |

| Forex Pairs | 84 | 51 | 338 | 62 | 54 | 138 |

| Commodities | 25 | 38 | 124 | 32 | 20 | 28 |

| Indices | 21 | 34 | 82 | 28 | 17 | 23 |

| UK Stocks | 3500 | 3925 | 745 | 192 | 1575 | 450 |

| US Stocks | 1000 | 6352 | 4968 | 880 | 2110 | 1575 |

| ETFs | n/a | 2000 | 1084 | 107 | 160 | 0 |

Choose a spread betting broker with the best range of offered markets

Some spread betting companies focus on tight spreads on a few key markets. Others focus on providing a good overall value and service. When opening a new account, have in mind what asset classes and individual instruments you want to trade.

If you have AIM and small-cap shares, you will need a spread betting broker that specialises in them, like Spreadex, or IG.

You may need to consider separate accounts if you have a favourite broker for one market but want to trade on a market they don’t offer. However, remember that all brokers will offer the major index, commodities and FX pairs though.

Leverage & margin rates

The FCA and ESMA regulators have put caps on how much leverage spread betting companies can offer retail traders so margin rates are standardised across spread betting platforms at:

- Indices: 20%

- Major Forex pairs: 3.33%

- Commodities: 10%

- UK & US shares: 20%

This means if you want to trade shares you have to put down 20% of the value of the trade as a deposit for the initial margin, the equivalent of leveraging your money 5 times. This was in part to protect spread betting clients from over-trading but also to protect the brokers for having to cover client losses. Since the CHF cap was removed and many clients went into negative equity (owing the broker money by losing more than their account balances) the regulators have forced spread betting companies to guarantee that retail client accounts will not go into negative equity.

If a broker is unable to close client positions, they must cover the client losses that exceed their account balance. The margin caps were put in place also to protect the regulator as if a broker cannot cover client losses and defaults, client funds are protected by the FSCS which the regulator is responsible for. So by increasing the amount of margin required for trading, there is less likely hood of larger client losses which the broker, and ultimately the regulator would have to cover.

However, if you are an experienced trader you may be able to upgrade your account to a “professional trading account” and reduce your margin rates. To do so you will need to demonstrate that you have a large investment portfolio, have worked in relevant financial services and are a regular trader.

Trading as a retail or professional spread betting client

If you are new to spread betting, you will be classified as a “retail trader”, which means you get more protection from the regulator, restricted margin rates and standard fees. However, if you are a more experienced trader and can prove it, you may be eligible to upgrade to a “professional trader”. Being a professional trader means you get lower fees and more leverage, but less protection against losses.

Margins can change, here’s why margin increases aren’t always a negative prospect for traders.

Account types

IG offers the most account types in addition to spread betting. You can also trade CFDs, DMA equities and invest for long term capital growth through a general investment account or ISA. Use our comparison table of account types offered by spread betting brokers to see how else you can trade through them.

| Account Types: |  |  |  |  |  |

|---|---|---|---|---|---|

| Spread Betting | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| CFD Trading | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| DMA | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Pro Accounts | ✔️ | ✔️ | ✔️ | ❌ | ✔️ |

| Investments | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Futures & Options | ❌ | ❌ | ❌ | ❌ | ❌ |

Added value, research and tools

City Index has some of the best trading signals to give you some indication of where potential markets may move as well as some great tools for analysing your past traders to see where you get it right and wrong. CMC Markets is one of the most established spread betting brokers and offers a wide variety of webinars, trading tools and indicators on their online platform. IG has lots of sentiment, data and analysis tools, whilst Spreadex have a great reputation for customer service.

| Added Value: |  |  |  |  |  |

|---|---|---|---|---|---|

| Trading Ideas | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| Client Sentiment | ❌ | ✔️ | ❌ | ❌ | ✔️ |

| Post Trade Analytics | ✔️ | ❌ | ❌ | ❌ | ✔️ |

| News & Analysis | ✔️ | ✔️ | ❌ | ❌ | ✔️ |

| Web Based Platform | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

Spread betting companies cannot give advice, but they can provide research and analysis to help you find potential trading opportunities. However, one thing to look out for if you are after value (other than tight spreads) is what else you get as part of the spread betting trading platform. Some spread betting accounts provide access to third-party research and analysis services such as autochartist, PIAfirst, trading central and Tipranks.

Voice brokerage

City Index, IG and CMC Markets provide dedicated support if you have a large account where as smaller spread betting brokers like Spreadex tend to provide dealer access to all clients. Spreadex is one of those brokers that people like doing business with. They don’t offer the tightest spreads or even the widest range of markets. But, they do offer a slightly more personal service. It’s their small brokerage attitude that makes them worth trading through.

Being able to get help when you need it and have the ability to trade over the phone is a vital part of spread betting. Whilst over 95% of trades go through online and trading apps ensure you are connected to the market all the time, there still may be occasions when you need the help of experienced dealers.

A few occasions when you will need customer support include corporate actions on stock positions, working large orders, fixing errors, help with margin information, getting new markets added and general questions about how the products work.

All spread betting brokers we feature in our comparison tables have experienced dealers you can talk to should you need it. As spread betting is unique to the UK, spread betting companies have offices in and around London and provide direct lines to dealing staff.

⚠️ FCA Regulation

All spread betting brokers that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority and is responsible for ensuring that UK spread betting brokers are properly capitalised, treat customers fairly and have sufficient compliance systems in place. We only feature spread betting brokers that are regulated by the FCA, where your funds are protected by the FSCS.

Spread Betting Broker FAQ:

When choosing a spread betting broker, you need to compare more than just costs. The main things to consider when choosing a trading platform:

- Market access – how many instruments can you spread bet on? (IG offers the most markets)

- Minimum deposit – can you test the platform with a small amount when you start? (Spreadex, CMC & Pepperstone all have £1 minimum deposits)

- Account types – do they offer DMA spread betting as well as OTC (over-the-counter)? (IG offers the most account types)

- Inactivity fee – is there a charge if you do not use your account? (CMC, Pepperstone and Spreadex do not charge inactivity fees)

- Founded – how well established is the spread betting platform? (IG is the oldest spread betting broker)

- PLC – public spread bet firms that are listed on stock exchanges have to report their financial health on a more regular basis. (IG and CMC are listed on the LSE, CIty Index is owned by StoneX which is listed on the NASDAQ)

Financial spread betting is a tax-free type of trading in the UK because the trades are structured as bets. As there is no capital gains tax due on gambling in the UK profits can be tax-free. For more information read our guide on why financial spread betting is tax free.

Spread betting is a way to bet on the rise and fall of the prices of a financial instrument. You do not own the underlying asset but make money by predicting correctly if the value of your chosen asset will rise or fall in a given timescale. You can spread bet on anything, from shares to gold and crude, FX or house prices.

For example, if you wanted to speculate on the price of Lloyds shares going up and wanted to bet the equivalent of buying 1,000 shares you would bet £10 per point (pence) that the Lloyds share price goes up.

There are a few key differences between traditional investing. Firstly, you can profit from markets going down as well as up. Secondly, you trade on margin as you bet on a per-point basis, so you can make or lose much more than your stake – which makes spread betting a high-risk or high-reward product.

Commonly, only around 20% of retail clients make money with spread betting brokers. If you are a complete beginner or new to trading altogether, then the sensible thing to do is to read around the subject, define a strategy and practice spread betting using a free demo account before you commit any real money.

See our guide on how to make money spread betting.

Stuart Wheeler the founder of IG, is generally credited with inventing and popularising the concept of betting on financial markets in 1974.

The most popular markets for spread betting are in order:

- Indices

- Stocks & shares

- Forex

- Commodities

You can read more about why these markets are so popular in our guide to the best markets for financial trading.

The B book has a pretty bad reputation, rather unjustly. It’s a little unfair as the industry wouldn’t exist without it. Some ask how can the B Book model in spread betting still exists in the current financial climate? The answer is simple; without it, all the brokers would go out of business.

Essentially, the B book means that the broker will take the other side of a trade for some time. By doing so, the broker accumulates asset value on the opposite side of your trade, meaning that when another client bets the opposite way, they only have one transaction to facilitate over two, as an A book broker might. This efficiency essentially allows brokers to pass on cheaper trading costs to their clients.

Yes if you have a professional spread betting account, but not if you are classified as a retail trader. The FCA has banned trading on cryptocurrencies. However, you can buy and sell cryptocurrencies through crypto exchanges.

Various indicators will show you how volatile the market is. In most cases, a moving market is easier to trade than a stagnant one. You can spread bet on market volatility using the VIX, a futures contract based in Chicago. It’s not the easiest indicator to follow or understand but once mastered, it can be an invaluable tool.

Yes, spread betting brokers are regulated by the FCA and client funds protected up to a certain amount by the FSCS.

However, over that amount your funds are not protected and as spread betting is an OTC product your risk is with the broker rather than the exchange. The best way to ensure your funds are protected is to always use a well capitalised broker.

An easy way to keep an eye on a company’s financials is to go with brokers that have traded themselves on the London Stock Exchange. Being a public company means that you have to submit financial reports regularly. The share price and market cap are also good indicators of whether or not a company is heading for trouble.

IG, CMC Markets and CIty Index are publicly listed spread betting brokers.

Our tips and strategies explaining how to spread bet can help you effectively navigate the world of spread betting.

The financial markets are difficult to profit from, and spread betting is a high-risk, leveraged way of speculating that can result in significant wins and losses. Make sure you fully understand the risks involved by familiarising yourself with how it works.

Spreadex and IG are two spread betting brokers that offer AIM stocks. There are pros and cons to spread betting on the smaller stocks. A pro is that if they skyrocket, you don’t have to pay tax on your winnings. The cons are that they are illiquid and as such can be very volatile.

The best way to spread bet on the AIM market is through a spread betting broker you have a good relationship with, who talks to the market directly. Even if you are a big client, you may find the dealers get frustrated. But if you hold the positions long enough, you’ll also end up paying a lot in interest overnight funding.

Most spread traders use technical analysis as it can provide a good visual representation of the market and is generally more relevant to short-term movements. However, it is based on historic events.

Fundamental analysis instead looks at what a company could be worth in the future.

Technical analysis vs fundamental analysis in spread betting is a debate that will probably go on forever, but for the most part, there is value in doing both, and it is largely down to personal preference as to what you rely on more.

It is possible to profit when stocks fall in the market by betting on a company underperforming. This is known as shorting a stock. They say profit warnings come in threes, so there are many bear traders out there stalking the market for potential victims. Shorting stocks is how you use spread betting to bet on a downward market, and this can be profitable, but beware as losses are unlimited. You can only make as much as your stake goes to zero, but in theory, a stock price can go on up forever. Compare spread betting brokers for shorting a stock.

CFDs are for professional traders who use them for direct market access and anonymity (to an extent). Outside the UK, CFDs are used by private clients as there are no tax benefits. Read what the difference is between spread betting and CFDs for more information.

Yes, there are pros and cons to hedging with spread betting. Using spread betting as a hedging tool can be an efficient way to manage a profitable position for tax purposes.

Spread betting in the UK is only possible because there is no capital gains tax on spread betting profits. This does of course mean that you cannot offset spread betting losses, and tax laws can and always will change. Spread betting outside the UK does not exist, as UK spread betters are the only traders that benefit from the tax breaks.

Punters have been trying to beat the man for centuries and spread betting is no different. In the case of spread betting, brokerage arbitrage appears that the scales are against the customer. There are countless cases of punters finding loopholes in the dealing systems of various stock and spread betting brokers, and (quite innocently) trading to take advantage of them. After all, arbitrage between markets is a legitimate trading strategy.

However, the brokers will always win when it comes down to it. Don’t bother, as this sort of behaviour can be seen as market manipulation and may result in fines from the FCA. Stick to the basic principles of buying low and selling high. It’s the facts.

It is possible to spread bet on the UK property market but only through a small number of brokers. Spreads will be wide and the market does not move much. If you manage to track down a price, check how long it will be honoured for and what size you can bet. It may be a good hedge against a property portfolio, but check the funding rates for short positions if that is your intention.

No, spread betting brokers are regulated by the FCA and are not allowed to offer welcome bonuses anymore. If a broker does offer you a cash bonus for signing up, it may be a scam. You can check that a broker is regulated by the FCA on the FCA register.

If you think that an unauthorised broker is trying to scam you, you can report them to the FCA.

Spread-betting brokers prefer you to make money. Spread betting is not an evil industry and it offers some of the best customer service and retention rates around. One of the most important aspects of business for brokers is client retention, and clients who make money with a broker are far more likely to stay loyal than those who lose. This is one of the reasons why spread betting brokers like to see clients making money and why many profitable clients might choose to stay loyal to the same broker for decades.

Further reading:

In short, the answer is a simple one, which involves spread betting brokers not having enough experience. Amateur or beginner traders are often guilty of over trading, over leveraging and not cutting their losses or running their profits. However, spread betting is not an easy way to make money, and should not be marketed or promoted as such.

It is a facility to bet on the financial markets to be used appropriately. Most brokers do a good job of ensuring that clients have some investment experience before allowing them an account.

Further reading:

Most of the trading courses you will have seen advertised are run by people with little or no knowledge of the actual market, and for the most part, if they were good traders, they certainly wouldn’t be teaching.

We have put together some reliable online resources to help you learn to spread bet. We can also recommend these spread betting books as valuable resources for traders of all experience levels.

Yes, plus you do not have to pay tax on forex trading if you are spread betting, however you do if you are trading spot or CFDs.

As an alternative to trading CFDs on forex, individuals and UK taxpayers can spread bets on foreign exchange.

Spread betting, as the name suggests, are wagers on the performance of an instrument or market rather than a trade, and though the methodology and pricing of these two types of transactions can look very similar, the tax treatment of any profits made in them is very different.

Profits made from trading are subject to UK capital gains tax, whilst under current legislation, profits generated through spread betting are tax-free. By the same token, losses made in trading can be offset against capital gains made elsewhere, whilst spread betting losses cannot.

For more information on forex trading tax, read our Q&A: Do you have to pay tax on forex trading?

The tax treatment is the principal difference between the two forms of speculation, however, some spread bets may be priced in a similar way to futures contracts; that is with the cost of carry or financing included in the quote at the outset, rather than being charged daily, as is the case in forex trade. Spread bets are also likely to have a fixed expiry, whether daily, weekly or quarterly. While FX trades, which are effectively CFD trades, have no fixed expiry unless you are trading a currency future or option, rather than the rolling spot contract.

The mechanics of spread betting on FX are very similar to those of trading FX. Of course, you will need to open a spread betting account to spread bet rather than a trading account. You will also want to familiarise yourself with the bets that spread betting providers offer and the contract lifetimes, and the way that they are priced that could be very different for say a rolling daily bet, a weekly bet or indeed a monthly or quarterly bet.

One obvious thing to try to do is to match the contract you are going to be betting on with your time horizons, and style of speculation daily bets won’t be much use to you if you have a two- or three-week-time horizon. Equally, a quarterly contract may not be your best choice if you are an intraday bettor.

This article contains affiliate links which may earn us some form of income if you go on to open an account. However, if you would rather visit the spread betting brokers via a non-affiliate link, you can view their financial spread betting pages directly here: