What is social media sentiment trading?

Day traders are making a comeback in 2021. The explosive combination of ample liquidity, a bullish mentality, and social media created havoc for professional investors.

Reddit traders on r/WallStreetBets co-ordinated a short squeeze on GameStop (GME) in January and sent its share price rocketing from $50 to $450 in a matter of days. A short squeeze happens because traders who shorted a stock aggressively have to buy back the shares.

So powerful was GME’s rally that the $12 billion Melvin Capital was nearly destroyed by it. Only a massive capital infusion from its competitors saved the fund from going under.

While the event is shocking, you can’t say the squeeze came out of nowhere. Clues were there for anyone who read the social media forums such as Reddit. WallSreetBets has been in existence for years. Keith Gill, a key reddit commentator with personas Roaring Kitty and DeepF**kingValue, has been liking GME for some time, saying the stock is ‘undervalued‘.

When we talked about social platforms, we often refer to Facebook, Twitter, LinkedIn et cetera. Reddit was, until now, ignored. Not any more. After GameStop, professional funds will likely scout these forums for ideas and gauge the sentiment of a stock. Funds do not want to be caught in a downward spiral like Melvin Capital.

- Related guide: 50 rules for successful trading

The power of social media and its influence on stock prices is now so strong and pervasive that funds are being created just to capitalise on it. The most recent ETF to do that last week is the VanEck Vectors Social Sentiment ETF – with a very apt ticker: BUZZ.

Scouting social media forums for ideas

Before BUZZ, there were only few choices to trade stocks based on sentiment.

We did mentioned about JP Morgan‘s ‘Volfefe Index’ some time back, but it was only based on the then President Trump’s twitter messages. It was not easy to trade his twitter messages because a lot of them were simply ‘noise’ and unpredictable. And towards the end his presidency, Twitter simply banned Trump.

Professionally-run stock chat platforms, however, are easier to gauge the market sentiment. And perhaps easier to act upon because messages are flowing constantly, especially on ‘hot’ stocks.

Computers these days are powerful enough to keep loading and analysing messages 24/7. Softwares can also aggregate messages from multiple platforms.

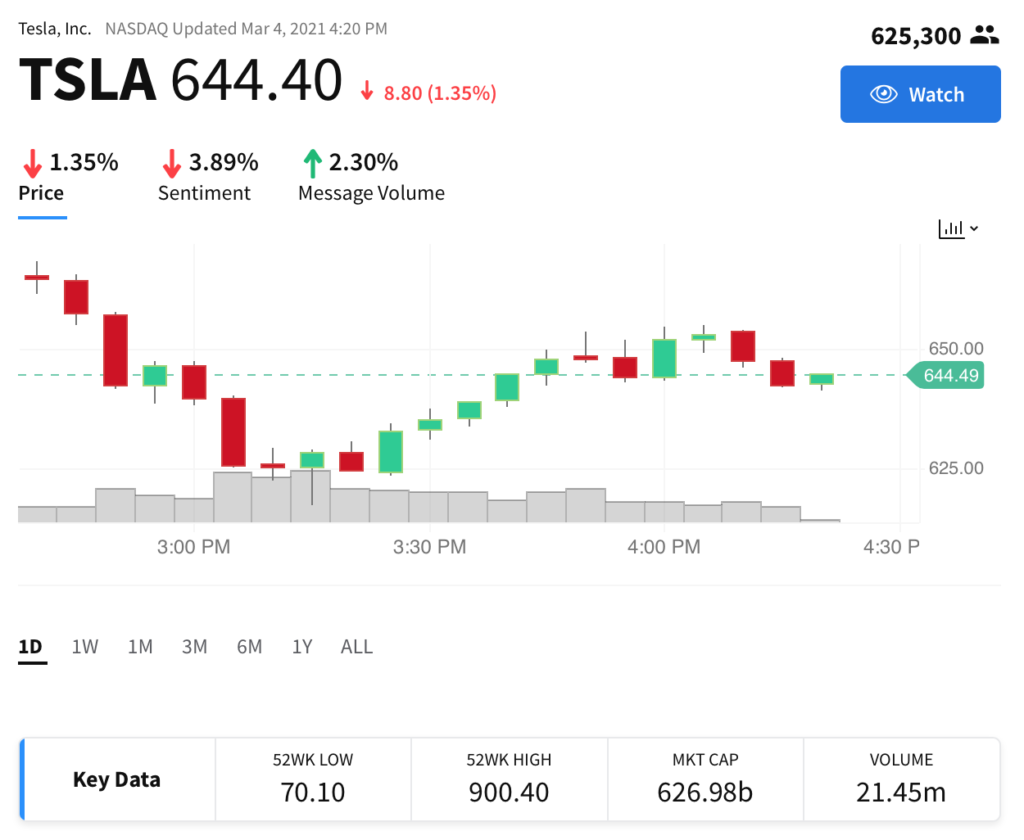

For example Stocktwits.com is used by many traders and investors to express their views on stocks. Tesla (TSLA) is a hugely popular stock on the platform and has more than 600,000 followers (see below) while Amazon (AMZN) has 400,000 followers.

Once in the forum, it can become addictive once a stock is ‘on the move’ and making money. Traders will keep commenting on these forums and searching out other views and tips. The same pattern is found in Twitter and Reddit.

In fact, you can sure that if a stock suddenly explodes upwards, it will generate lots of attention. This, in turn, will attract more followers. Momentum begets momentum.

Source: Stocktwit.com

Where’s the Buzz?

Turning to the BUZZ ETF, the fund’s factsheet says that it follows the BUZZ NextGen AI US Sentiment Leaders Index.

Portfoliowise, the $1.2 million fund (a small fund since it just started last week) follows about 75 US large-cap stocks which “exhibit the highest degree of positive investor sentiment and bullish perception based on content aggregated from online sources including social media, news articles, blog posts and other alternative datasets.”

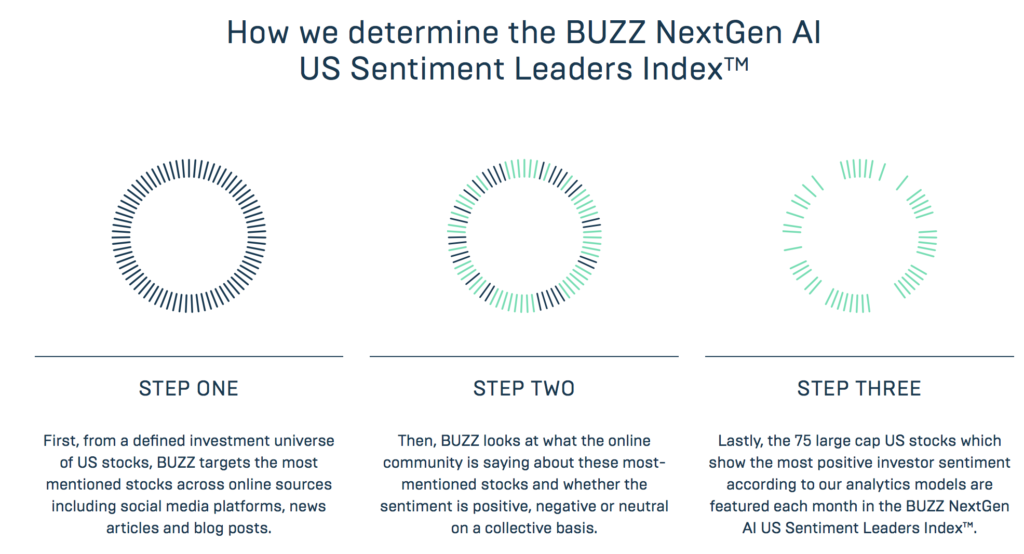

According to BUZZ’s website, the index provider look at a fixed set of universe, run an algorithm across datasets to search for key words, and perhaps attach a scoring mechanism to the phrases found. It uses artificial intelligence and machine learning to detect patterns and tradeable outcomes based on a stock index (see below).

Source: investwithbuzz.com

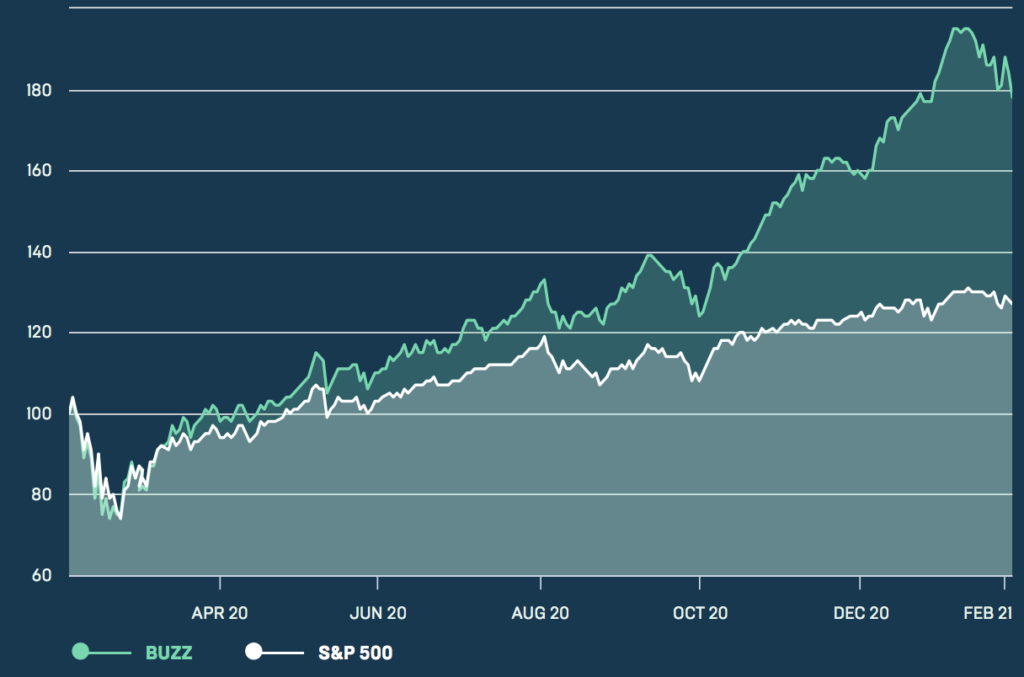

According to the index provider’s backtest result, its one-year return is 79%, a result that certainly outperforms the S&P 500 Index (see below). Details about the index can be seen here.

At the moment, the index’s biggest holdings are Draftkings (DKNG), Twitter (TWTR), Ford (F), American Airlines (AAL) and Facebook (FB). Hot tech stocks made up a good chunk of the index.

Should you trade based on sentiment?

While all these sentiment-based stock selection strategies appear modern, they are not.

Social media is just the latest tools used by many promoters to ‘hype up’ certain stocks. Once the stock is widely talked about with a strong price trend, insiders sell out. Prices then collapse. This is a classic ‘pump and dump’. Many are left with worthless stocks. They Johny-come-lately are called #bagholders these days.

Using social media to pick stocks – without doing serious homework – will make investors jump in and out of stocks they know little about. Will investors benefit from such activity? Perhaps, but only for a short time. But eventually the fundamentals of a stock will prevail.

Of course, a lot investing activities these are ‘faith based’ rather than fact based. MEME stocks – see Reddit’s take on this – are just a collection of hot stocks with a large following and a positive price trend. It’s like the Nifty-Fifty of yesteryears. They did good for a while until the next bear market.

So the question this year is whether you should trade based on sentiment. Well, if I am interested in the BUZZ ETF, I will only buy a very small portion to test the waters. But given how new this ETF is, I will wait for it to gain some traction before jumping in. I want to see real money following the buzz.

Using Twitter Messages To Predict Stock Markets?

JP Morgan’s ‘Volfefe Index’, idea is not a new one. In fact, researchers have been testing on this idea for years, ie, using Twitter as a proxy for market and public sentiment and its predictability on markets.

In fact, CMC Markets produced a handy infographic on market movements caused by Twitter sentiment.

As early as 2010, Bollen et al from Indiana University used 9 million+ Twitter feeds as a proxy for public mood. They tested changes in these messages against the subsequent movements in DJIA and found some association. It was the first time that a connection was scientifically made between Twitter massages and market movements.

Later, two Stanford researchers also affirmed Bollen’s study when they use Twitter feeds to predict DJIA. Their study used neural network. Since then, many other studies have been published.

These results caught the eye of some practitioners. Derwent Capital Markets, in 2010, was launched with this concept. Their edge was to employ Twitter feeds as the raw material. After some statistical analyses, these results are used to bet on market movements.

But their efforts did not translate into marketing and financial success.Why? Presumably, I suspect the Twitter space is far too noisy.

Remember, Twitter is a crowd-sourced messaging service. Some messages are genuine; some are not (fake news, they call it). Segregating them is hard work. Even then, with all the results the ‘edge’ may be too small to earn above-market returns in reality. Friction costs money.

How To Use Twitter Effectively For Trading

As of March 21, 2019 this year, Twitter has officially became a teenager. A mature social media platform used by millions. It has become a go-to place for many investors, traders, and financiers. Financial twitter is now a very active place for all sorts of market banters. You can benefit from using the platform too. Here are some tips to use them effectively for forex speculation, financial spread betting and CFD trading:

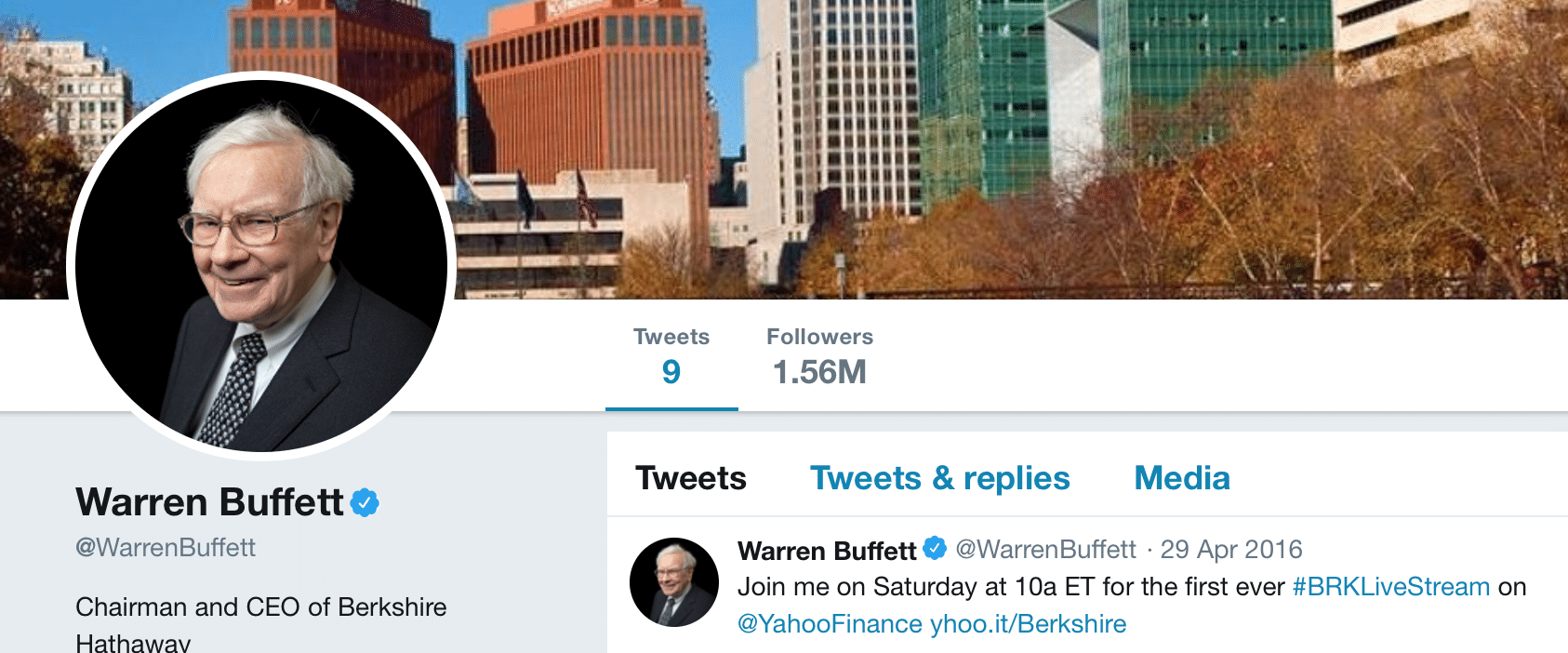

- Follow selectively. Some CEOs and heavy hitters actively use Twitter to promote their views and products. Some don’t. For example, you can learn a lot from Mohamed El Elrian and Ray Dalio’s tweets. But not Warren Buffet. As of 2019, the third richest man in the world had a grand total of 9 tweets – but 1.5 million followers.

- Use Twitter for stock research – Check out if the CEO of a listed firm has a habit of posting disruptive tweets. Some do – like Elon Musk of Tesla inc (TSLA). If you own this stock, following Musk’s tweet is almost essential. Also, Twitter space can produced heated arguments, say, between bullish and bearish camp of Tesla. You can listen to both sides for your portfolio.

- Subscribe to news feed. These feeds may give you some market-moving ideas:

- @breakoutstocks — technically strong or weak prices

- @cnbc— good source of finance news and real-time business updates

- @WSJDealJournal— coverage of M&A

- @benzinga— info on analysts’ upgrades/downgrades

- Use data mining tools. Twitter is a voluminous source of info. These tools can help you analyse and aggregate the impact of tweets, summarise collective information, and backtest some ideas. Some useful tools include:

- Interact and network. If you interact more, you may get more ideas.

Lastly, I attach Fintwit’s Fantastic List of twitter accounts (webpage here) to get you started:

FinTwit List (work in progress)

- @IvanTheK

- @BrattleStCap

- @BarbarianCap

- @The_Real_Fly

- @ReformedBroker

- @TheStalwart

- @firstadopter

- @modestproposal1

- @LongShortTrader

- @JacobWolinsky

- @LadyFOHF

- @conorsen

- @BluegrassCap

- @millennial_inv

- @foswi

- @John_Hempton

- @Nonrelatedsense

- @RussianBear

- @ritholtz

- @dasan

- @SconnieTrader

- @FCFYield

- @ArbCowboy

- @JayBWood

- @mark_dow

- @special_sits

- @VolSlinger

- @Find_Me_Value

- @catamounnt_cap

- @Valuetrap13

- @georgepearkes

- @activiststocks

- @stockthoughts81

- @TheCreditBubble

- @gatorcapital

- @quantian1

- @Alphal_pha

- @ElliotTurn

- @DonutShorts

- @schaudenfraud

- @EquityNYC

- @groditi

- @BobBrinker

- @footnoted

- @zerohedge

- @EddyElfenbein

- @EventDrivenMgr

- @The_Analyst

- @pmarca

- @cablecarcapital

- @mbusigin

- @stevenplace

- @tradingpoints

- @PlanMaestro

- @ToddSullivan

- @SIRF_Report

- @darth

- @JeffCNYC

- @WastedCapital

- @Fritz_100

- @tangentstyle

- @CapCube

- @biggercapital

- @fakehfm

- @VincePagano

- @oknotsomuch

- @_oldmangloom

- @Liberty8988

- @MicroFundy

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.