Vanguard’s VUSA ETF (LON:VUSA) is an exchange-traded fund whose share price mimics the movement the widely-followed blue-chip US S&P 500 Stock Index. This equity index, as its name implies, is comprised of 500 largest stocks in the US (factsheet) and is one of the best performing and heavily traded markets in the World.

What is the live Vanguard VUSA ETF share price?

The current LON:VUSA share price is 77.09p which is a change of -1.07 or -1.37% from the last closing price of 77.09 with 296,019 shares traded. The most recent daily high has been 77.55 and daily low 76.52. The LON:VUSA share price 52 week high has been 80.17 and the 52 week low 60.95. Based on the most recent LON:VUSA share price opening of 77.09.

Pricing data automatically updates every 15 minutes

Is Vanguard’s VUSA ETF a good investment in the long term?

By and large, US stocks tend to advance upwards. Not only that, when the US market runs, no market comes close.

For one, the USA is the largest economy in the world. It is dynamic, innovative and vibrant. Moreover, few countries match the depth of the American capital market. The combined market capitalisations of the Nasdaq and NY Stock Exchange are in the trillions. And the US Dollar is used by most countries in the world to settle cross-border transactions. Most commodities are priced in the dollar.

- Related guide: How to invest in the S&P 500 from the UK.

Many funds around the world track this index because it gains exposure to the US market. According to the index company Standard & Poor’s, an “estimated $15 trillion is indexed or benchmarked to this index.” Historically, the S&P 500 Index progressed in cycles (90-year chart):

Occasionally, faith in the US market was tested to the full. For example, during the 2008 financial crisis. But the country pulled together and the US stock market soared to new highs soon after. In the words of investment guru Warren Buffett (entitled “Buy American. I am”, 2008):

Over the long term, the stock market news will be good. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.

Therefore, VUSA is indeed a good vehicle to gain exposure to dynamic US stocks.

Not to forget, the UK currency has been falling over the past 10-15 years due to macro underperformance. This means foreign assets become more valuable in Sterling terms. For instance, look at the GBPUSD exchange since 2005. It is not exactly a vote of confidence on the British economy.

When is the best time to buy VUSA shares?

The best time to buy US stocks is when the outlook is very negative or uncertain.

When the outlook is negative, it means investors are expecting the economy to contract, which leads to poorer earnings at the corporate level. This reduces the valuation of the stock market.

However, when is the best time to buy VUSA? There are several rules that people have come up with:

- Regular buying of the ETF – this ensures that we average out the entry price over a cycle

- Buy when the index moves into its long-term uptrend – ie above its 200-day moving average and sell when it drops below it (so-called ‘IVY Portfolio’ – a good book on the strategy).

The key here is diversification – since VUSA is a broad-market ETF.

What are the top ten biggest stocks in Vanguard’s VUSA ETF?

As of November 2022, LON:VUSA largest US stock positions are:

- Apple: 7.12%

- Microsoft Corp: 5.32%

- Amazon.com: 2.79%

- Tesla: 1.86%

- Alphabet Inc: 1.72%

- Berkshire Hathaway Inc: 1.64%

- Unitedhealth Group Incorporated: 1.60%

- Alphabet Inc: 1.58%

- Exxon Mobil Corp: 1.42%

- Johnson & Johnson: 1.41%

Is the VUSA share price overvalued or undervalued at the moment?

This is like asking if the US market is over or undervalued now. Simply, we can’t say for certain.

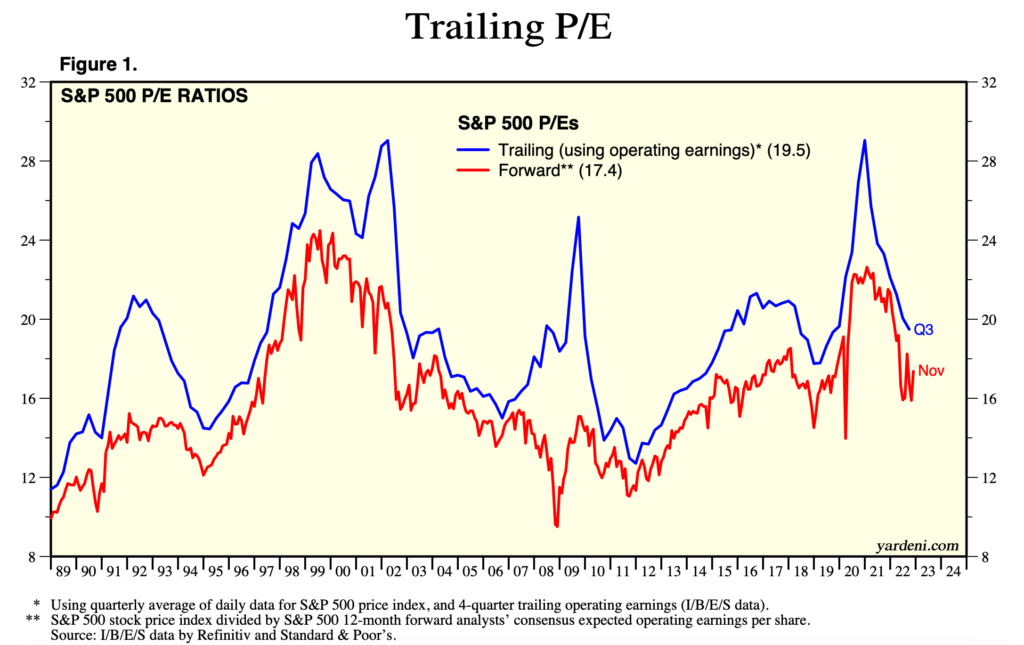

Valuation-wise, the S&P is currently back to levels attained in 2017/18 (see below). This means two things:

- The market is still not very ‘cheap’ compared to its bear market lows.

- Some overvaluation froth has been wiped away by the recent price falls.

Source: Yardeni.com

So the bulls and bears have valid arguments on their side. The market has yet to fall to its pandemic lows but the index valuation shows that the stock market is no longer as highly valued as before. Prices could stay range bound for the time being.

Why has VUSA’s share price dropped recently?

The S&P 500 Index has been falling in a progression of lower highs due to several macro reasons:

- Interest rate hikes – this quantitative tightening is still ongoing and may prolong into early parts of 2023

- A deterioration of corporate earnings – for example even a defensive stock like Walmart (WMT) had an earnings shock earlier this year. Investors are gradually bracing for more profit warnings in 2023.

- A fall in tech stocks – due to a regression in valuation. Many tech stocks have stopped going ‘to the moon’ and are being repriced in a more sensible manner.

However, when looking at VUSA’s chart, bear in mind that this is GBP-denominated. Hence it is doing better than those USD-denominated equivalent ETFs because of the fall in GBP.

What is VUSA’s earnings prediction?

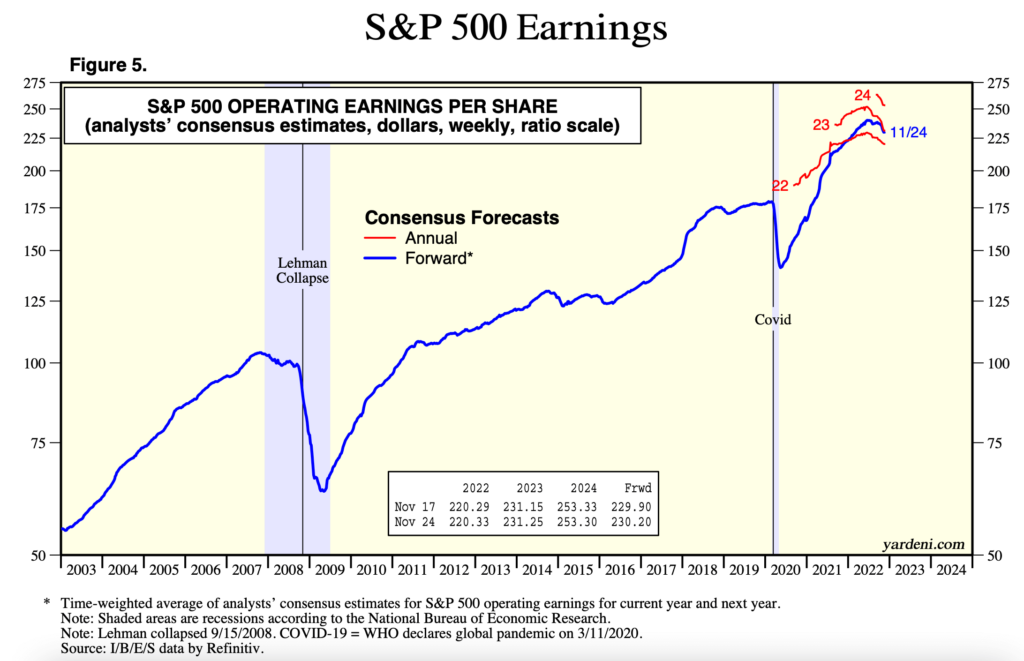

Wall Street is now becoming more cautious about the S&P.

According to some aggregators, analysts are expecting a dip in S&P earnings next year (see below). The question now is whether the macro conditions will derail these predictions. The level and pace of rate hikes is a major concern; so is the price of energy and food (inflation).

Therefore, these predictions should be taken with a grain of salt due to a rise in macro uncertainties.

Source: Yardeni.com

How do you buy Vanguard VUSA S&P 500 UCITS ETF (LON:VUSA) shares:

To buy shares in Vanguard VUSA S&P 500 UCITS ETF (LON:VUSA), you need a trading or share dealing account. Follow these three steps if you want to buy shares in Vanguard VUSA S&P 500 UCITS ETF:

- Decide if you want to buy Vanguard VUSA S&P 500 UCITS ETF shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

How much does it cost to buy Vanguard VUSA S&P 500 UCITS ETF shares (LON:VUSA)?

Buying one LON:VUSA share costs 77.09p. However, as well as the 77.09p cost of buying the shares you will also have to pay stamp duty, dealing and custody account fees for holding your shares with a broker. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker. You can compare the different costs associated with the different types of trading and investing accounts in our comparison tables below.

Pricing data automatically updates every 15 minutes

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.