If you are new to UK Real Estate Investment Trusts (REITs), throughout this guide, we will go through the basics of REITs and how they can serve your investment needs. By the end of this guide, you will be confident enough to buy your first REIT.

What is a REIT?

A Real Estate Investment Trust (REIT) is a corporate vehicle that owns and manages rental properties on behalf of shareholders.

This type of investment trust was popularised in the UK about a decade ago, many listed property firms have sought – and converted – into REIT-status. Firms such as Land Securities, British Land and SEGRO (formerly Slough Estates) belong to the growing REITs club.

To become a Real Estate Investment Trust is fairly straightforward. Simply, the firm’s rental income must be its major source of profits, and the bulk of this income – 90% – must be distributed to shareholders (see government’s guidance here). This untaxed cash flow to investors will be treated as property income. A further condition for a REIT is a listing in a recognised exchange, such as the London Stock Exchange.

- Related data: List of UK REITs on the LSE

How to invest in REITs

To invest in REITs you need a stock broker like Hargreaves Lansdown, Interactive Investor or AJ Bell. You can use our comparison of what we think are the best accounts for investing in REITs to compare how much it costs to buy and sell REITs, the costs of holding the REIT as an investment and in what type of account you can hold the RIET. As well as also buying REITs in general investment accounts you can also hold them in a wide range of tax efficient investment accounts like stocks and shares ISAs and SIPPs.

Compare the best UK accounts for buying and investing in REITs here:

| Share Dealing Platform | Share Dealing Fee | Account Fee | Min Deposit | GMG Rating | More Info |

|---|---|---|---|---|---|

| £5.95 | Shares: £0 Funds: 0.45% | £1 | Visit Platform Capital at risk |

|

| £3-£8 | £24 per quarter | £250 | Visit Platform Capital at risk |

|

| 0.10% (min. GBP 8) | €10 per month or 0.12% | £1 | Visit Platform Capital at risk |

|

| £1 (or 0.05%) | £0 | £1 | Visit Platform Capital at risk |

|

| £3.99 – £5.99 | From £4.99 a month | £1 | Visit Platform Capital at risk |

|

| £4.95 – £9.95 | 0.25% (capped at £3.50 pm) | £500 | Visit Platform Capital at risk |

|

| £4.95 | 0.2% to 0.4% | £1 | Visit Platform Capital at risk |

|

| £0 | 0.15% | £1 | Visit Platform Capital at risk |

You can even leverage up with financial spread betting and CFD trading. The harder bit, however, is knowing when to do so.

How does a REIT work?

A UK Real Estate Investment Trust (REIT) is just like any other company listed on the London Stock Exchange. This means you can:

- Buy and sell a REIT like a stock

- A REIT’s equity price will fluctuate just like a stock, depending on supply and demand

The biggest difference between a Real Estate Investment Trust and other companies is what they do with the rental income.

According to the UK government, REIT rules and LSE notes:

- 90% of property rental business must be paid to shareholders each year

- 75% of the company’s profits must derive from property rental business

- 75% of the company’s gross assets must comprise assets or cash involved in the property rental business.

In the past, companies were taxed on their rental income. On receiving dividends, investors were taxed again.

With the introduction of REITs (around 2007), savings are passed on to shareholders directly. This eliminates the ‘double taxation’.

Why Invest in REITs?

The structure of a Real Estate Investment Trust is efficient.

- First, REITs offer investors access to a wide portfolio of properties at a corporate level. A REIT save investors the hassle of direct property ownership.

- Second, profits and gains within the REIT are tax-exempt.

- Third, you can buy and sell major REITs throughout a trading session, like any other stock. Investing £1,000 or £1 million in a REIT will earn a proportional amount of income. Unsurprisingly, many pensions and large investors are increasingly dependent on REITs for their yield.

Advantages of REITs?

REITs offer several advantages for ordinary investors.

- Real Estate Investment Trustoffer investors access to a wide portfolio of commercial and residential properties at a corporate level. REITs offer access to an experience team to manage these properties professionally on your behalf – and save investors the hassle of direct property ownership.

- Real Estate Investment Trusts offer the prospect of a stable income, due to the nature of UK commercial leases.

- You can buy and sell major REITs throughout a trading session, like any other stock. Investing £1,000 or £1 million in a REIT will earn a proportional amount of income. Liquidity is good on a FTSE 100 REIT.

More critically, unlike some property funds, investors are seldom ‘gated’ in REITs. Over the past 12 months, an estimated £3 billion were pulled from property funds, which led to a halt in redemptions in some property funds.

Unsurprisingly, many pensions and large investors are increasingly reaching to REITs for their dividend yields.

Types of Real Estate Investment Trust

In the UK, most REITs belong to the ‘equity’ type. An equity-REIT may own, among others, offices, shopping complexes, apartments, student accommodation et cetera, to produce the required income for shareholders. The other major type is a mortgage-REIT, which derived its income from mortgage-related activities.

A REIT may specialise. For example, SEGRO concentrates on industrial properties and warehousing – a sector on the rise due to the popularity of online delivery.

How to Profit from REITs?

Investors can benefit from REITs in two ways. The first is through share price appreciation. Remember, REITs trade like stocks and their prices can go up (or down) significantly.

For example, you bought British Land on Dec 31, 2018 at 533p. A year later, prices rose to 638.8p. You gained about 19.8% excluding dividends.

Secondly, you can benefit from a rise in rental income. This means higher income distribution via dividends.

In practical, however, be aware that REITs is not a one-way street for investors. Companies that pay the rent can – and do – go bust. For example, over the past 18 months some retail REITs had been slammed by a ‘perfect retail storm’. This led to a persistent drop in rental income from their property portfolios. In turn, this led to lower dividends and share prices.

What to Look For in UK REITs?

Before you invest in any REITs, you need to know a few things specific about them. Not all REITs are equal.

- What are their properties? The ability to generate rental income is dependent on the quality of property assets.

- What is the geographical tilt of the REIT?

- Is the REIT trading at a premium or discount to their property value?

- Is the REIT profitable?

- What is the REIT’s current dividend yield?

Some REITs are only operating in a niche sector or area. Shaftesbury (SHB), for instance, is a REIT focussed mainly in London West End. British Land (BLND), on the other hand, straddles commercial and retail in a variety of locations. For Segro (SGRO), it is about warehousing, a high-growth sector due to the expansion of on-line shopping.

Where Do You Start Investing in REITs?

For any investor looking to invest in REITs, perhaps the first thing to look at is size. The three largest REITs in the FTSE 100 are:

- Segro (SGRO) MCap £9.56bn and Dividend yield 2.24%

- Land Securities (LAND) £7.15bn and 4.79%

- British Land (BLND) £5.49 and 5.31%

The next level down are mid-cap REITs trading within the FTSE 250 space. Below I give a partial list of REITs trading on the London Stock Exchange.

- Related Guide: Compare the best investment platforms in the UK here

How to choose which UK REITs to buy?

Once you have done some basic research about REITs, you should then stick with these principles:

- Be selective.

- Ride with long-term uptrends.

- Include stops in all your dealings.

- You can’t buy all the REITs. So you have to choose, according to some conditions. Either the property sector/area you know best, or REITs with prices that are performing the best, ie, 52-week highs. Be consistent with these filters.

- Once you have narrowed a list of REITs, look at their long-term trends. Buy the ones that are doing well, or have seen a change in their long-term trends. For example, I use the 200-day moving average as a simple yardstick to tell me their long-term trends. If a REIT’s trend is bullish, prices should trade above this trend line.

Look at Segro’s long term trend. Bullish and above the 200-day moving average most of the time (see below).

Point three. Property is cyclical. Prices go up a lot and then crash. So using stops to protect yourself if immensely helpful. Investing without stop losses is like driving without seat belts.

When investing in REITs bear in mind three points:

- The fortune of REITs is dependent on the property and economic cycles. Property values, like stock prices, can go up and down. Boom and bust is a recurring feature of the property market.

- Some property sectors are more popular than others.

- Timing is an important factor too.

Look at the long-term chart of Land Securities (LAND, yield – 5.2% ). Up – down – up – down. A REIT since 2007.

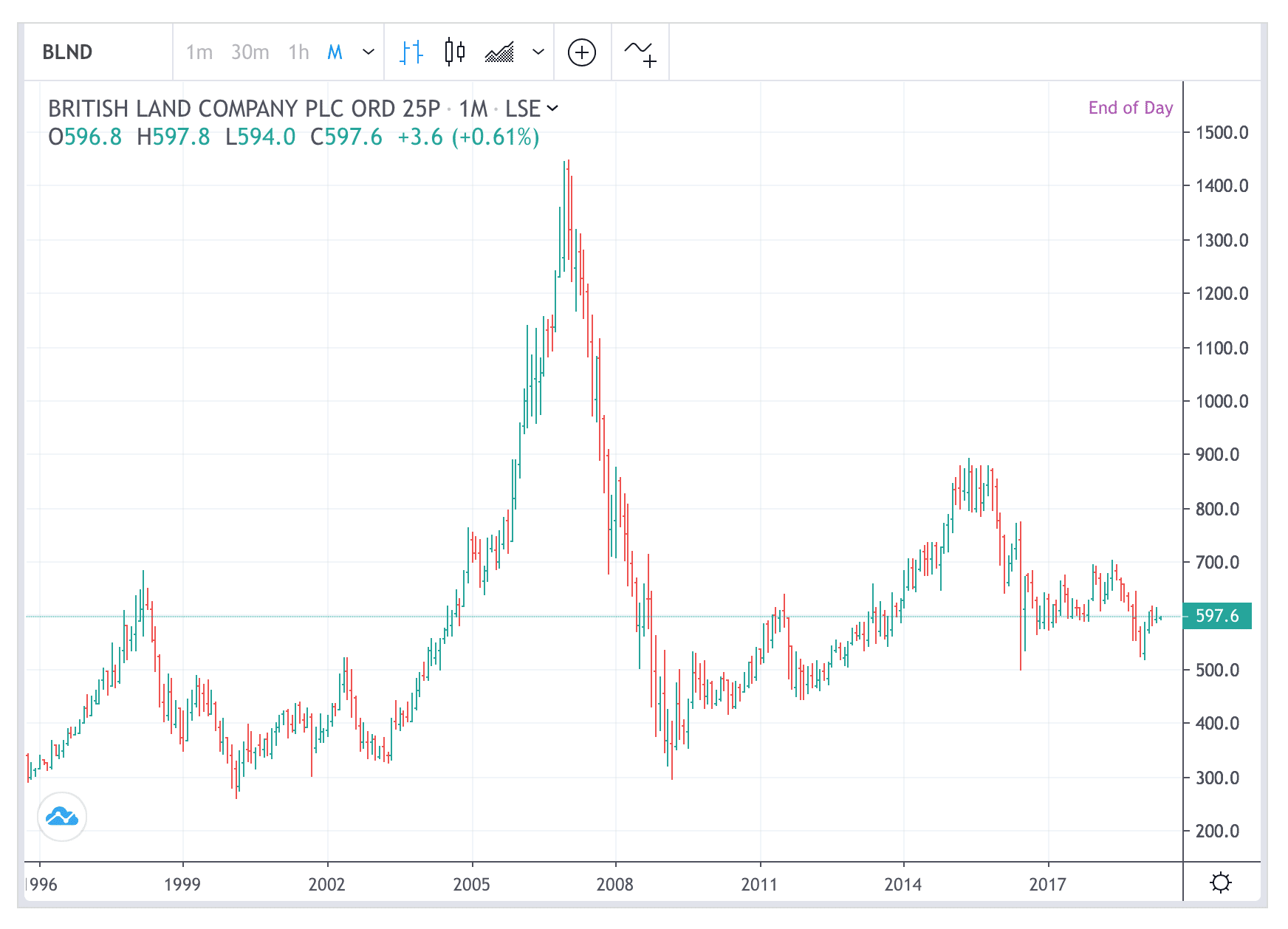

What about British Land (BLND, yield – 5.2%)? Has a roller-coaster chart pattern too. At 600p, prices are still a long long way below its 2007 peak. In fact, prices have made no significant progress since 2004, about 15 years ago. A REIT since 2007.

For retail-oriented REITs, their share prices are faring even worse. Hammerson (HMSO), for example, is crashing into new 52-week lows on bearish projections into their rental portfolio (see below). Obtained REIT status in 2007.

Should you invest in REITs?

Being a listed vehicle gives investors liquidity, but this has a cost: Amplified price swings. REITs are subjected to the ebb and flow of the stock market. So as a general rule of thumb, REITs must only be part of one’s diversified portfolio. Buying is recommended after a cyclical downturn. Use technical tools to time entry; stoploss orders are required, unless you can withstand a 50% drawdown.

If picking a successful REITs seems impossible, one should try for a REIT ETF such as iShares UK REIT (IUKP) (see ETF guide). Acquiring this ETF immediately gives investors a diversified basket of 39 REITs according to IUKP’s Factsheet.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.