Interactive Brokers the US-based online trading business with operations in Europe and Asia has announced the launch of new features designed to improve their US option execution prices.

What is IBUSOPT?

IBUSOPT as the new feature is known is actually a new order-routing destination or execution venue, that will enable option order executions at prices, that are inside the US National Best Bid/Offer, or NBBO, for both US equity and equity index options.

Interactive Brokers has utilised its existing smart order routing network to allow clients to peg an options order to the NBBO midpoint, thus avoiding the bid-offer spread, if that order is executed.

Clients can also use a “peg to best” order type that will allow them to directly compete with NBBO bid-offer prices, with their order set to remain a tick inside the bid or offer price.

IBUSOPT will be made available via the firm’s Trader Workstation platform

Thomas Peterffy, Founder and Chairman of Interactive Brokers said:

“We are excited to be launching IBUSOPT, which is the latest addition to our cutting-edge trading technology,”

He added that:

“With the dramatic increase in retail options trading, we believe that this new order destination will help our clients achieve better execution prices on their US options trades, and we are confident that it will be a valuable tool for both retail traders and institutional investors.”

Options remain extremely popular with traders in the US

Research by JP Morgan, published in December highlighted how well options trading volumes had held up in 2022. And showed that despite a slowdown in overall retail trading activity, the use of short-term and daily options was booming, and had at times accounted for as much as 40% of all S&P options trades.

Some of that growth is led by retail traders, but a large chunk of the increased activity likely comes about because of option dealer (market maker) hedging and the use of systematic trading strategies.

It’s also worth noting that there are very different attitudes towards options trading among US, UK and European regulators.

In the UK and Europe, options are viewed as complex instruments and retail traders are effectively discouraged from trading them.

However, in the US, there are few such qualms or barriers to opening an options trading account. That’s perhaps one of the reasons that IG Group spent US$1.0 billion on options broker and educator Tastytrade, a couple of years ago.

Interactive Brokers also added options trading to IBKR GlobalTrader & IMPACT Apps

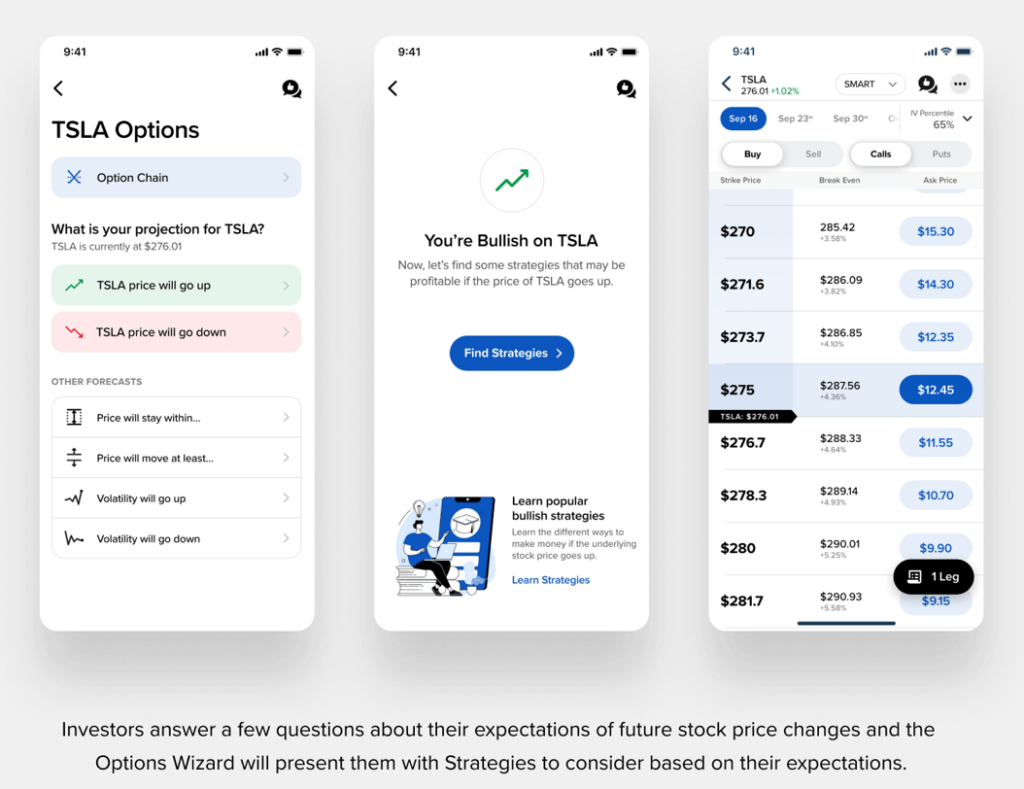

The new tools are designed to help retail traders negotiate the world of options and include an Options wizard and Option chain tools, which will help them to understand how options work and are priced.

Options are a derivative product, invented to spread risk and facilitate hedging, however, they also allow traders to speculate o. the rise and fall of a securities price.

Options come in two forms Puts and Call.

Put options give the buyer the right but not the obligation to sell a fixed amount of a security at a given price, within a specific time frame.

Whilst a Call option gives the buyer the right but not the obligation to buy a fixed amount of a security at a given price, within a specific time frame.

Options trade in what are known as series, for example, weekly, monthly or quarterly and each series will contain a number of strike prices, these are simply the levels at which the owner of an option has the right to buy or sell the security, which the option is over.

Option prices are calculated using a number of factors that include the option’s strike price relative to the price of the underlying security, the time left to an option’s expiry date and the level of market volatility.

Why have Interactive Brokers launched these new options trading tools?

Options have proved to be increasingly popular with retail traders since lockdown and this is particularly true in the USA, not least because there are far fewer regulatory hurdles for private clients to overcome in the US before they can trade what UK regulators consider a complex product.

The are numerous strategies that investors and traders can deploy using options and both the Interactive Brokers Options Wizard and Options Chain tools can help retail traders to identify strategies and strike prices that best meet their needs.

Users are asked to answer a few questions about their view on a security to establish whether they are bullish or bearish, and once that’s ascertained they are shown a selection of potential trades and strategies, together with indications of the likely cost of that trade or strategy. As well as the breakeven point for the trade, based on the price of the underlying security.

Should you use the new tools from Interactive Brokers to trade options?

These new tools from Interactive Brokers look to be a good starting point for those that are interested in learning to trade options. However, there is no substitute for doing one’s own research, not least because there are asymmetric risks in options trading.

Buyers of options have a limited risk position with losses confined to the purchase price or premium of the option, however, short sellers of options face potentially open-ended risks.

With that in mind, we would suggest that you get a good understanding of exactly how options work and are priced before you attempt to trade them.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.