- In 2022, losses in US stocks and bond totalled over $15 trillion, on top of the crypto loss of $2 trillion. This is an unprecedented loss of wealth.

- Market is anticipating a recession. Interest rates are soaring; economic growth is slowing.

- Stay disciplined to navigate through the choppy market

In this guide, we look at recessions and bear markets, why they happen and how best to invest when the markets take a turn for the worst.

How to invest in a recession

The global economy is cyclical. Booms and busts drive the economy forward. That is undisputed. What is controversial is the timing and the severity of the cycle. As things stand, 2023 is going to be far trickier for investors because of three macro factors:

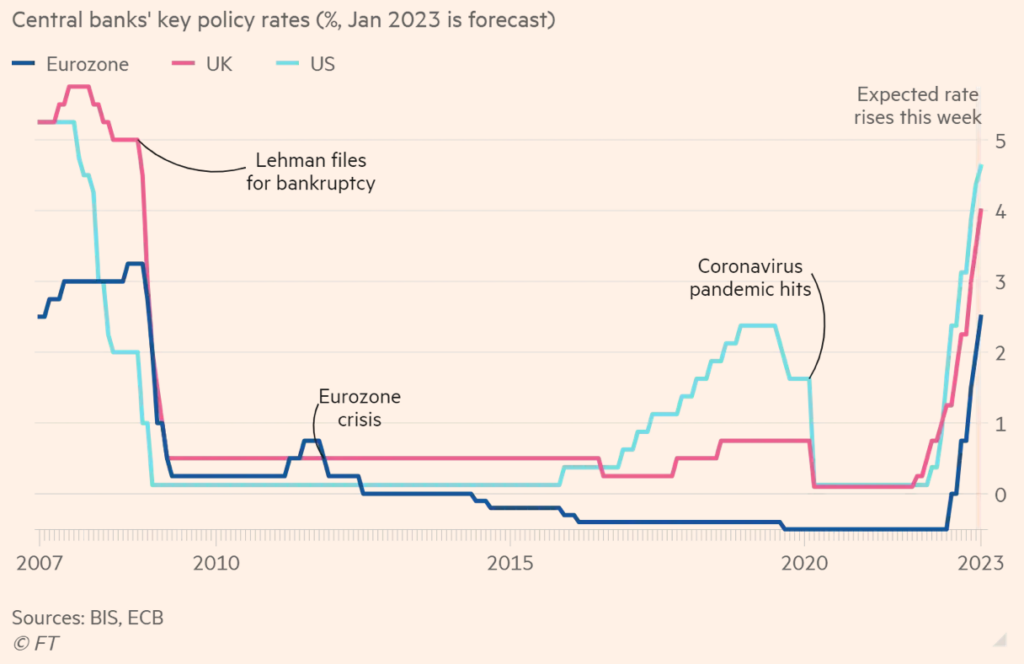

- Interest rates – will the rate at which they are going up now decelerate? Where will central bank stops hiking? Which central bank will blink first?

- Unemployment/PMI – current low unemployment is masking the weak PMIs across many countries. Is a slowdown looming?

- China – will the sudden reopening going to rescue the global economy?

One certain thing about the macro outlook is uncertainty. Investors look at this interest rate chart (FT) and wonder: How can the economy withstand the furious pace of rate hikes like this? Fearing the worst, many are now bracing for a deep economic recession.

How, then, should investors prepare for a recession? Is there any particular industry that capital will favour?

First, a recession is nothing to be afraid of. In fact, for long-term investors you should welcome it. In Warren Buffett’s words:

“Bad news is an investor’s best friend. It lets you buy a slice of America’s future at a marked-down price.”

The key here is preparedness. You need to know a few things about the stock market and one of them is which stocks will likely survive – and eventually prosper – during a period of economic slowdown. Write down a list of good companies you would like to buy (and own) for the long term.

Second, have patience. A recession can last for years. The market will not rally if the economic outlook is dire or the crushing weight of the borrowing costs is continuing to hammer the economy. Equity holders need to ride out the fluctuations.

Third, do not use leverage to buy as there is a financial cost associated with borrowed money (namely, interest rates). Leverage makes investing riskier, especially when we do not know when the recession will end. Yes, returns will be higher – but only if you get the timing right.

Fourth, diversify across different assets if possible. Cash is favoured in the earlier phase of the economic slowdown as the severity of the slowdown is unknown. Assets to focus on include: Stocks, bonds, emerging markets, developed markets, commodities, and sectors. Good quality stocks and bonds ensure the portfolio has cash flow coming in. Single-country stock markets help to diversify risk.

Fifth, as the cycle progresses and share prices become cheaper, cash should then be funnelled into buying assets at good prices. Gradually, of course. Forget about buying at the “absolute low” – because chances are you will not get it. Instead, focus on ‘margin of safety’. If assets are selling at a good prices, buy and hold.

What about small-cap stocks that are selling cheaply? Well, these stocks can potentially yield 10-50x returns for investors – only if you get two things right: One, stock selection. Investors need to know which companies will survive and rebound mightily. Second, prices. You need to buy at the appropriate price to get the rewards.

This is not as easy as it sounds. In 2009, for instance, not many investors bought stocks because the fear was overwhelming. But it was the classic buy signal. Investors need to overcome the sentimental bias and look through the fog to ascertain values.

Simply put:

Be fearful when others are greedy and be greedy when others are fearful.

What to invest in during a recession

In a recession, economic activities slow and corporate profits sink. Losses are a norm. Overleveraged companies go to the wall. To survive, some companies raise money via rights issues, increased borrowings, or engage in mergers to tackle the unfavourable climate.

What to invest in this situation?

First, look towards quality, large-cap, defensive stocks.

Companies like Coca-cola (KO), McDonald’s (US:MCD), or in the UK, Unilever (ULVR) or Diageo (DGE). Why? One reason: Cash flow.

These large companies have enough liquid resources (namely, cash) to weather the recession. Their business models are consumption-based – and human consumption is unlikely to go out of fashion even during a recession. A quick look at McDonald’s long-term chart tells you the advantages of buying a powerful consumer staple stock.

- Related guide: What is the Big Mac Index?

Some far-sighted companies may even take advantage of a slower market to gobble up competitors at favourable prices. Acquisitive companies that enhance their market share at a good price are likely to rebound the fastest when the economy recovers.

In 2008, for example, Warren Buffett bought General Electric (GE), Goldman Sachs (GS), Bank of America (NYSE:BAC), and Wrigley – large companies that were encountering temporary liquidity problems.

Second, look at bonds instead of stocks

You can buy the bonds of these quality companies that are selling at a discount to their par value.

Bonds are financial instruments that pay a certain income at regular intervals. When interest rate rises, these bond prices normally drop. But good companies usually continue to pay interest on bonds. You can pick up these bonds with high yields during market dislocation. ‘Dividend aristocrats’ we called them.

Third, be wary of bubble stocks.

In a recession, speculative bubble stocks fall the hardest – because capital flees asset bubble into safe haven assets. In the end, these bubble stocks may look cheap after a 70-90% fall. But many of them are speculative companies with shaky financials and immature operations. They may easily tip into financial hardship as market liquidity dries up. Just look at the crypto sector and the associated crypto stocks. Avoid these ‘meme’ stocks unless you know these companies extremely well.

Fourth, consider ETFs

If you do not have any knowledge about individual stocks, perhaps buying a wide-coverage exchange-traded fund (ETF) may be better.

Equity ETFs like the S&P 500 (SPY), Nasdaq 100 (QQQ) or FTSE 100 (LSE:ISF) or corporate ETFs like High-Quality Bonds (LQD).

Five, look at emerging markets

There are many stock markets around the world. Not all of them will suffer that same fate at the same time.

Some countries will continue to do well even as European countries struggle. Therefore, watch to buy into emerging markets or Asian countries should they prove to be better at weathering the global slowdown. Again, use ETFs to do this. For example, Japan ETF (EWJ), Mexico (EWW), India (INDA) or Indonesia (EIDO) – are just some of the single-country ETFs.

Remember, a recession does not last forever. Eventually, the economy will grow out of the economic torpor.

The three principles of protecting against a recession are:

- Cash is king during a recession

- Economic performance does not rhyme exactly with the stock market performance

- Quality matters

The plan should start now. You should be prepared as the Brexit-wounded economy moves into an uncharted territory. But to enact a plan as crucial as this requires some thinking. How should you navigate?

To get to the gist of the plan, I show you three principles that underpin it. These principles are very important because they create mini-plans which you can follow easily.

Principle 1: Cash is king during a recession

In a recession, nothing beats cash (or cash-generating assets). Why? Because it gives you two important strategic edges. One is the ability to survive the downturn without having to sell assets at fire-sale levels and two, resources to buy assets at attractive prices.

Survival for the long term is what counts. Remember Warren Buffett’s advice: ‘In order to finish first, you must first finish.’ Cash give you the ability to do that.

The second edge of cash – buy assets at attractive prices – gives you outstanding performances over the long term. As Shelby Davis pointed out: “You make most of your money in a bear market, you just don’t realize it at the time.”

- Related guide: How to invest in a bear market

Remember what Warren Buffett did in 2008? He went in big and loaded up. Even before the recession had ended, his paper profits were in the millions. How was he able to do that? Because he had cash. Lots of it.

So take a look at your portfolio now and see if some stock sales may be warranted. The current bull market is already ten-year old. Accumulate a strategic amount for bargain buying.

Principle 2: Economic Performance is not the same as Stock Performance

An economic recession, especially if it is a shallow one, may not lead to a sustained bear market.

Economic and stock performances are two different things. Sometimes they move together; sometime they are out of sync with one another. For example, while UK economic performance fared poorly this year, the FTSE 100 Index did better.

In the seventies, for example, the US economy was performing but the stock market did not.

Based on this principle, how do you translate it into a working tactic? For one, avoid major market timing exercise. Second, be patient on the sale and purchase of stocks.

The stock market is not going to tell you when the bull market has ended. Neither does it warn you that a bear market has started. Very few bought at the exact lows; or sold at the very peak. So market timing in this sense will be futile.

Thus, if you wish to implement some stock sales, do so on a regularly basis. Spread out your purchases over time and avoid cramming all the buying and selling at a single point.

Principle 3: Quality Matters

The last principle is about quality. If you have a portfolio of stocks, how should you determine which one to hold and which one to sell?

In a downturn, go for quality. For two reasons. First, quality corporations are far more likely to survive a downturn than weak ones. Two, quality stocks generally exhibit better relative strength during a bear market.

Relative strength is about its performance measured against the general market. You typically want to hold a stock that is outperforming the general market.

Another factor to consider is dividend. Dividend is very important because it will provide you with some financial cushion when prices are falling – returns that allow you buy more of that stock at better prices.

And quality firms tend to pay a dividend during a recession because they have lower leverage, higher profitability, and good cash flow.

But which companies will pay a dividend during a recession? Take a look at the last recession. One sector that is generally defensive and quality are large-cap pharmaceutical stocks.

During a bear market, small-cap stocks are generally undercapitalised and may be hit harder by the recession. For example, according to Financial Times, only one-fifth of smaller firms are prepared for a no-deal Brexit. I suspect this is due to inadequate resources. If you hold small-cap stocks, make sure these stocks have sound balance sheets.

Other quality assets that you may go for include:

- Gold – which hold up relatively well during a downturn

- Government Bonds – haven asset during a crisis

- Quality Corporate Bonds

- Quality Emerging Stocks – Some EM stocks are high quality that are worth buying when prices decline

However, a lot of these assets have already rallied significantly this year. Therefore, even if I were buy these assets, I would use Principle 2 – buying a portion of these assets over time.

Does a recession mean a bear market?

The answer, in short, is no.

This is because the economy and the stock market are two different systems. They beat to different rhythms. Investors always assume that they move together. Sometimes they do; sometimes they don’t. It is a mistake to think a good economy equals to a strong market. Or a bad economy means a bad market.

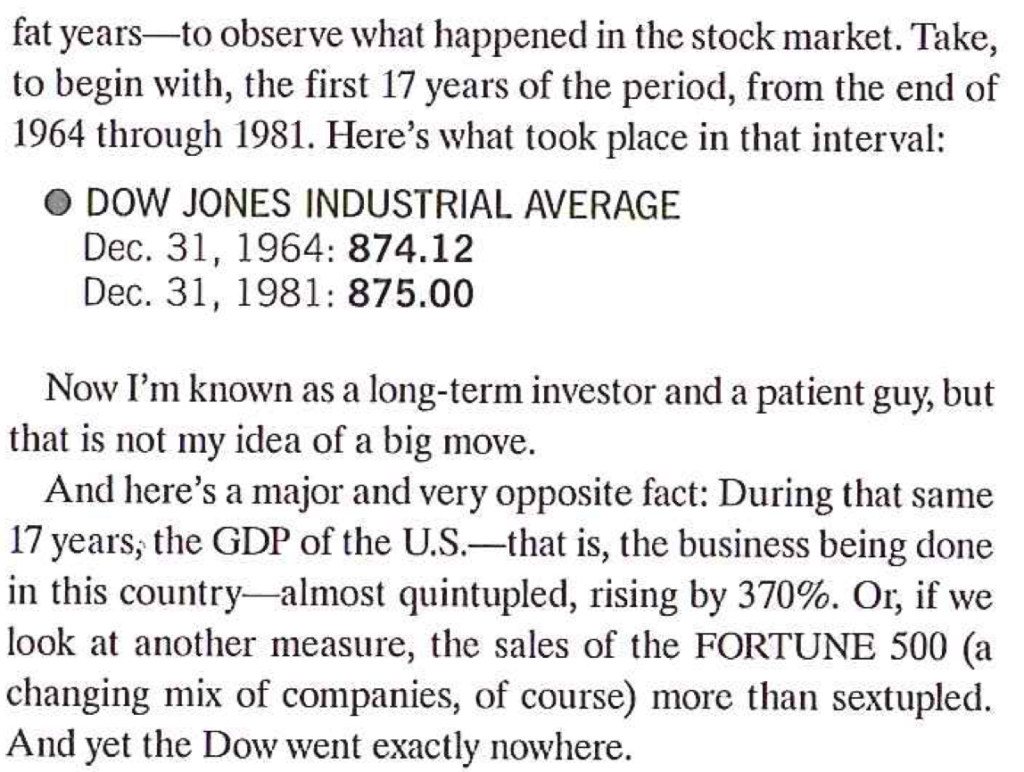

Warren Buffett pointed out this non-synchronised characteristic in an article back in 1999:

In other words, a stock market can stay subdued despite an improving economy.

One main macro variable that may pin stock markets to the floor is the skyrocketing interest rates. A high-interest rate discounts future cash flows at too high a rate; leading to lower present values.

As a matter of fact, this is what happened last year in the UK when gilt yields soared. Immediately, UK stock prices crashed. A fall in the yield then led to a recovery in stock prices.

So does a recession lead to a bear market? More often than not. This is because corporate earnings are lower and the valuation multiples on stocks contract. We saw these episodes during a severe bear market in 2008, 2000, and 1991.

But a stock market also anticipates. It discounts economic scenarios that may or may not happen. The joke that is that economists have “successfully predicted nine of the last five recessions”. The market does so too.

The point about this market-economy disconnect is this: stock prices carry much more volatility. Prices can plunge due to extreme fear or rally hard once this fear subsides – regardless of the economic trends.

Therefore, investors need to dispel the narrative that the market and economy ‘move together’. As an investor, I would pay more attention to stock prices and seek to get a good bargain on assets which I think will return to their fundamental values in the future.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.