Many investors seek to build a portfolio which generates a stream of steady income. To this end, income-bearing assets such as dividend shares, rental property, and more recently peer to peer lending have been popular with investors. In this guide we explain how it is possible to earn income and make money from bonds.

Earning income from bonds

However, the opportunity to earn income from individual bonds, such as those issued by Netflix, Virgin Media or Vodafone has long been the preserve of the financial elite, with prohibitive minimum trade sizes of £100,000 barring all but the wealthiest investors. As of end-2018, the global corporate bond market is $13trn in size and dominated by global banks, hedge funds, and pension funds.

Looking forward, innovation is opening up the bond market to retail investors. The introduction of fractional bonds is reducing minimum trading sizes, such that a company’s bonds are becoming as easy to trade as it’s shares. With the future of investing already distributed in small pockets of the present, Investors should consider the opportunity to diversify into corporate bonds through a bond broker. An established asset class, popular with institutional investors, and sporting income rates of 3-11%.

Bond coupons versus dividends

Many readers will have experience of investing in individual stocks but may be new to the bond market. So, what are bonds, and how do they differ from shares?

A corporate bond is a contract detailing a loan between an investor and a company – an IOU. The investor agrees to lend an amount of money in exchange for regular interest payments and the expectation that the company will repay the loan at a pre-agreed date.

Shares, on the other hand, represent ownership stakes in the business. Shares pay dividends, however, unlike coupons which are contractual, dividends only occur if a company’s management has decided to declare one.

So, if you buy a share in Netflix, you are becoming a partial owner of the company. If you purchase one of Netflix’s bonds instead, you become a creditor (a lender).

This is important. Let’s paint a melancholy picture of Netflix’s future. In this reality the wider world has come to its senses, concluding that Black Mirror is not ‘deep’ and is instead a shallow, vapid and universally dumb TV series. Several of Netflix’s other shows tank, subscriptions fall off a cliff, and the company’s financial health deteriorates materially leading to its bankruptcy.

Now, in this wildly speculative scenario, what would happen to Netflix’s shareholders & bondholders? Owners of the business are liable to a company’s creditors. As such, when administrators liquidate Netflix’s assets (e.g., the rights to its films & Tv series), shareholders will not receive the proceeds until bondholders have been repaid.

With bonds providing a greater chance of recuperating capital in the event of bankruptcy and having contractual coupons rather than uncertain dividends, investing in a companies bonds is less risky than investing in it’s shares. On the flip side equities are expected to compensate investors with high returns, notably in the form of capital appreciation.

Can you lose money in bonds?

Compared to Peer to peer loans – which are often made to SMEs, the opportunity to earn similar rates from large, visible, corporates is appealing. Especially with many P2P investors peering over their investments for a second look after several high profile P2P platforms went belly up.

As noted, investing in companies bonds is less risky than investing in it’s shares. With persistently low rates, many investors have become reliant on shares for dividend income. It is worth looking back at the last financial crisis, which caused shares to fall sharply. Suddenly investors, especially those looking forward to retirement, found it more difficult to recoup their capital losses, and this wasn’t helped by a doubtful dividend outlook.

The reader should also note that the market for corporate bonds is well established. In fact, the global market is worth over €13trn, and is dominated by global banks, hedge funds, and pension funds. Procedures for recovering value in bankruptcies are well established and put into place by some of the world’s largest accounting firms. Furthermore, risk is priced by a multi-trillion dollar marketplace. This stands in stark contrast to alternative assets such as P2P, where underwriting standards, risk pricing, and recovery procedures are relatively backward when compared to the multi-trillion dollar marketplace, and corporate bond underwriting standards enacted by investment banks such as Goldman Sachs or high profile recoveries undertaken by administrators such as KPMG.

Investors looking for guidance on assessing individual bonds may wish to turn to the ratings agencies – Moodys, Fitch, and Standard & Poors who offer opinions on the creditworthiness of specific debts. Ratings are given in grade from AAA – D (D for imminent default), akin to school grades.

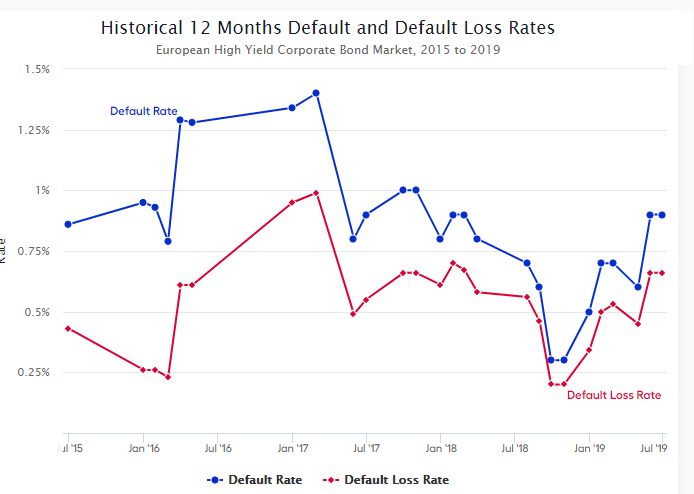

For the more adventurous subset of European bonds dubbed ‘high yield’ the proportion of bonds that failed to repay over the previous 12 months ranged from 0.3% to 1.4% between July 2015 and July 2019.

However, as bonds are paid out before shareholders even when defaults did occur, bondholders were often able to recoup some of their investment from the sale of the companies assets. When taking into account recoveries, corporate bondholders lost between 0.23% and 1% due to defaults over the period.

Source: Wise Alpha/Credit Suisse. Data as of 15 July 2019

Fractional bonds

The recent development of fractional bonds, is opening up the world of corporate bonds to savvy retail investors looking for income, consistency, and steady returns. The rise of the corporate bond is being fuelled by those focused on the real numbers: attractive risk-adjusted returns and lower volatility than the stock market. Investing in companies such as Netflix also provides you with more transparency over the performance of your investments and greater confidence in the recovery/underwriting process compared with SME or Consumer Credit Peer to Peer loans.

In fact, the past decade has seen corporate bonds issuance double in the 10 years since the financial crisis. A remarkable statistic that points to the importance of these instruments to the global economy and the huge amount of pension fund money entering the asset class.

The sheer scale and diversity of the multi-trillion corporate bond market is now open to retail investors. In the context of high profile minibond scandals and P2P shipwrecks, greater access to established, premium fixed income products is a positive development.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.