Over the last 15 years I’ve traded with Saxo Markets as a retail client, I’ve been a competitor as a broker at Man Financial, and I’ve been an institutional customer when I had a white label of their trading platform when I was at Investors Intelligence. I’ve also interviewed two of their UK CEOs and been to their offices a few times, so I know a fair bit about them. In this review, I tell you what I think of Saxo from a trader’s perspective and what sort of client will get the most from their brokerage services.

- Overview

- Richard's Review

- Awards

- Video Demo

- CEO Interview

- Facts & Figures

- Customer Reviews

Saxo Markets Review

Name: Saxo Markets

Description: Saxo Markets is one of the largest CFD brokers worldwide and provides direct market access to equities, bonds, forex, futures and options as well as being a major liquidity and infrastructure provider to wealth managers, banks and smaller brokers.

64% of retail investor accounts lose money when trading CFDs with this provider

Is Saxo Markets a good broker?

Yes, Saxo Markets is a good choice for more sophisticated traders. The platform, analysis, and direct market access may be too complicated for beginners. But, for experienced traders its coverage, commissions and research are unrivalled.

Pros

- Direct market access

- Low commissions

- Robust trading platform

Cons

- Seen as a trading platform for professionals

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(5)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.6Ratings Explained

- Pricing: Commissions have just been reduced further making Saxo one of the cheapest brokers.

- Market Access: Huge range of markets for both derivatives trading and physical investing.

- Platform & Apps: Industry-leading robust workhorse of a platform.

- Customer Service: Experienced dealers for active larger customers.

- Research & Analysis: Some of the best opinions on the markets around.

Richard’s Saxo Review

The thing about trading is that it is completely misunderstood. People still think they can beat the market with little or no knowledge about how global macroeconomics or a company’s balance sheet works. Trading is no different to any other skill, hobby or career, it requires experience.

There are some great quotes in a book called Reminiscences of a Stock Operator, it’s a ripping yarn and was written 100 years ago, but some of the lines are still particularly relevant. One, for example, is, “If it takes 5 years to get a bachelor’s and master’s in a subject and 10,000 hours in other skills, why should it be different for stocks?”

I bring it up because when I interviewed the UK CEO of Saxo Markets, Charlie White-Thomson before writing this review, he said that was one of his favourite books on investing.

It’s true, trading is hard, you have to know what you are doing, study, learn, and develop. It’s not for everyone. People think it’s easy, it’s not, it’s very high risk.

If you are going to trade you have to understand it. What it is, why you’re doing it and what the risks are.

My point here is that there are many different trading platforms and brokers to choose from, and all cater to slightly different audiences. Some cater to absolute beginners, some are more focussed on FX, others on stocks, some on automated trading strategies, and some for people that just want to tap away during the day scalping the markets.

But Saxo Markets, in my view anyway, has always catered to the more experienced traders, ones who may have already spent five years cutting their teeth as a risk warning statistic.

Saxo were in fact one of the earliest brokers to offer multi-asset trading from a single platform with direct market access, which puts them at the most sophisticated end of the spectrum.

Experienced Traders

For more experienced traders Saxo Markets offers CFD trading with direct market access. This means that instead of trading at prices set by the broker (usually slightly widened from the underlying bid/offer) you trade at the price you see on the exchange. By trading DMA CFDs your orders are placed directly on the order book letting you work limits inside the best bid/offer, meaning if you don’t want to deal at the market you’ll get better pricing than anywhere else if filled. Because you are trading DMA, your commission is charged afterwards and not included in the spread. This type of trading is particularly suited to larger and more professional traders, which is Saxo Markets ideal customer.

Futures, Options & DMA

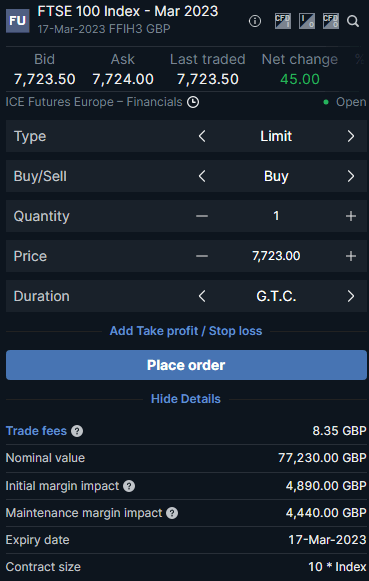

They are also one of the few trading platforms in the UK that offer retail traders (private clients) access to futures and options. Again an indication that Saxo goes after and caters to more experienced customers, because trading futures is for higher value accounts. FTSE futures for example are traded on ICE, and 1 lot is valued at £10 per index point. So, if for example the FTSE is trading at 7723 (as they are today) the smallest trade you can put on gives you £77,230 of exposure to the 100 biggest companies in on the LSE. Which is an initial margin of £4,890.

Other brokers like IG who (as well as looking after larger customers and funds) cater to smaller more inexperienced traders we let you trade the FTSE at 50p a point (£3,861.50 exposure).

Limiting Risk

Saxo are also quite risk averse for a margin trading business, as they do not offer excessive margins. Compared to Interactive Brokers (probably their closest competitor for product range and accounts types in the UK) their margin rates are quite high, for CFDs as they don’t want their customer blowing up. Instead they’ve told me on many occasions, they are more interested in building long-term mutually beneficial and profitable relationships with their customers.

Robust Trading Platform

As far as the trading platform is concerned, it’s excellent, well laid out, markets are easy to find and you get the choice with each asset if you want to trade is as a future or CFD if it’s an index, commodity or currency pair. If you’re trading stocks you can either deal as a CFD or a physical equity for longer-term investing.

You can drag and drop instruments from watchlist to the charting screen, then bring up options boards, and product overviews which give you all the pertinent details and market depth with level-2 pricing. Some markets though (like FTSE futures) you need a subscription to see live exchange data.

Research & Analysis

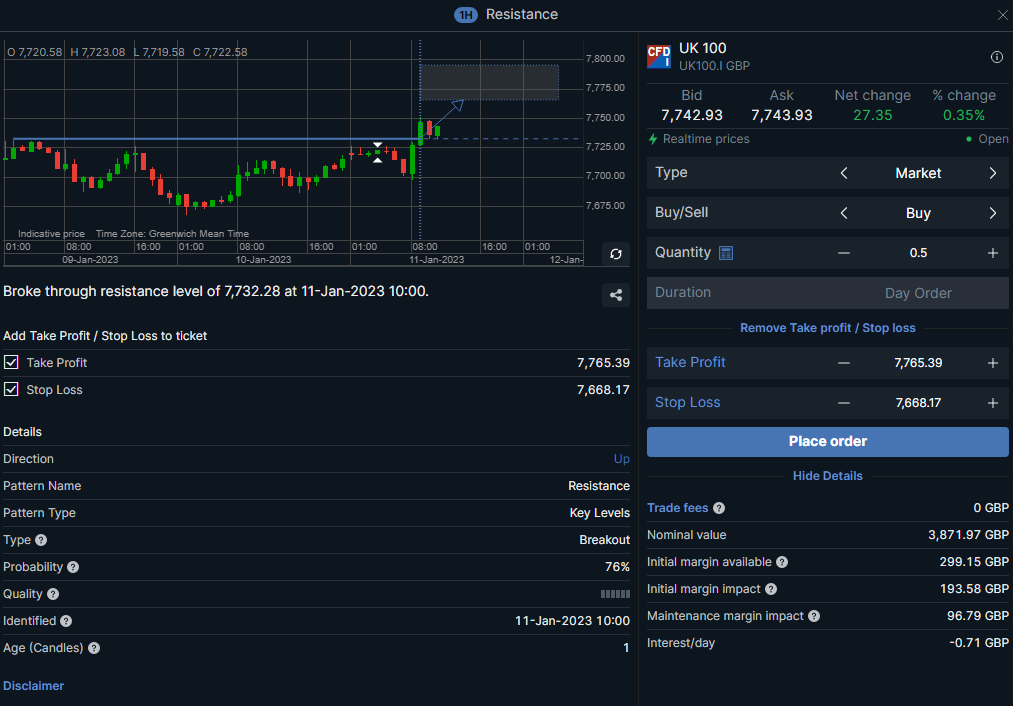

In the research tab you get access to trading signals from autochartist, which is probably worth taking with a pinch of salt because most platforms have this. But, there are really well integrated into the platform where you can deal straight from the signal and add pre-determined stops and limits.

There is also a high selection of curated webinars, educational articles, news feeds which you can filter by instrument, and an overview of which markets are trending by asset class. No client sentiment though, but that’s to be expected because they have some very large accounts which would skew the data and hedgies are notoriously secretive about their positions.

Conclusion

Overall, I’ve always enjoyed trading on the Saxo Market’s platform, but then I’ve been doing this for twenty years. For new traders, it might be a bit much, but if you want to get started with a platform you can continue to use as you become more experienced, you can also invest in ETFs, bonds and shares instead of trading. However, if you’ve got the experience and treat trading with the respect and dedication it deserves, then Saxo Markets could be the broker for you.

Saxo Awards

In our 2023 awards, Saxo won “Best CFD Broker”, and “Best DMA & Professional Trading Account. In 2022 Saxo also scooped “Best Bond Broker”. You can see Saxo collecting their award at our ceremony at Plaisterers’ Hall in the City of London in the video below.

Saxo Video Demo

In this video we live trade on the SaxoTraderGo platform. We buy some physical BP shares, then demonstrate hedging the position with put options and CFDs.

Saxo CEO Interview

We interview Charlie White-Thompson the CEO of Saxo Markets UK so that you can see straight from the top if they are the right broker for you.

Saxo Facts & Figures

Saxo Markets Total Markets | 60,000+ |

| ➡️Forex Pairs | 190 |

| ➡️Commodities | 20+ |

| ➡️Indices | 29 |

| ➡️UK Stocks | Over 5,000 |

| ➡️US Stocks | 2,000+ |

| ➡️ETFs | Over 6,400 |

Saxo Markets Key Info | |

| 👉Number Active Clients | 850,000 |

| 💰Minimum Deposit | £1 |

| ❔Inactivity Fee | ❌ |

| 📅 Founded | 1992 |

| ℹ️ Public Company | ❌ |

Saxo Markets Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ❌ |

| ➡️DMA (Direct Market Access) | ✔️ |

| ➡️Futures Trading | ✔️ |

| ➡️Options Trading | ✔️ |

| ➡️Investing Account | ✔️ |

Saxo Markets Average Fees | |

| ➡️FTSE 100 | 1 |

| ➡️DAX 30 | 1 |

| ➡️DJIA | 3 |

| ➡️NASDAQ | 1 |

| ➡️S&P 500 | 0.5 |

| ➡️EURUSD | 0.7 |

| ➡️GBPUSD | 0.8 |

| ➡️USDJPY | 0.7 |

| ➡️Gold | 0.5 |

| ➡️Crude Oil | 0.3 |

| ➡️UK Stocks | 0.0005 |

| ➡️US Stocks | $0.01 per share |

Saxo Customer Reviews

Tell us what you think:

64% of retail investor accounts lose money when trading CFDs with this provider

Saxo Markets FAQ:

Yes, Saxo Markets does act as a market maker for OTC products like CFDs. But, Saxo Markets does not act as a market maker if you are dealing in exchange products like listed options, futures or DMA stocks and shares.

No. Saxo used to offer a spread betting service through a partnership with London Capital Group. However, Saxo announced back in 2015 that it would be shutting down it’s spread betting service. Clients of Saxo Spread Betting migrated to deal with Capital Spreads directly.

The Saxo spread betting services was a white label of the London Capital Group platform, whose own brand is Capital Spreads.

The news came after there were significant changes at London Capital Group with a reported 75% staff turnover since Charles-Henri Sabet took the reigns and focusses on building the spread betting and forex broker back to profitability.

There is was also a significant amount more competition in the spread betting industry than in 2009 when Saxo launched the service. Increased competition and a decline in active spread betting clients may lead to more consolidation in the sector. This may include more white-label contracts being cancelled (like City Spreads, another LCG white label) or acquisitions (like City Index by Gain Capital or Cantor Index to Spreadex).

It is free to have an account with Saxo Markets. But there are some monthly fees for accessing live data on certain markets. There is also £50 quarterly fee if you only hold cash on your account.

For a classic account the minimum deposit is £500. For Platinum accounts the minimum deposit is £200,000 and for VIP accounts the minimum is £1,000,000.

Beginners may find Saxo Markets a bit complex as they are more suited to experienced traders. However, beginners can still open an account and invest in the stock market without trading derivatives.

No. There is no fee to withdraw funds. However, to avoid delays with requesting funds back make sure your account information is completely up to date as Saxo Markets will have to comply with AML regulations before returning money.

Yes, to switch from limit order to market order on Saxo Trader GO follow these steps:

- Go to the “Orders” tab at the bottom of the trading screen.

- Find the order you want to change

- Click the three dots on the right-hand side that look like this “…”.

- Select “change to market order”

- Approve the change on the confirmation screen.

Your order will be executed at the currency market price and your limit cancelled.

64% of retail investor accounts lose money when trading CFDs with this provider

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.